Global Indemnity Limited - Class A Common Shares (GBLI): Price and Financial Metrics

GBLI Price/Volume Stats

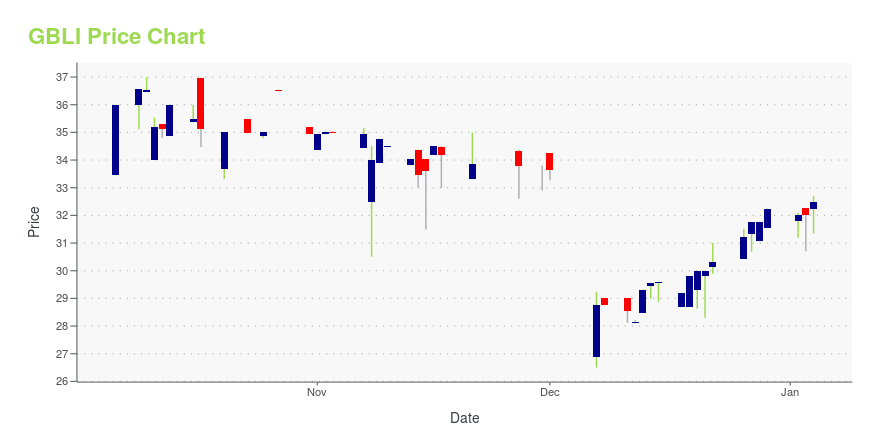

| Current price | $30.75 | 52-week high | $37.00 |

| Prev. close | $30.75 | 52-week low | $26.50 |

| Day low | $30.75 | Volume | 3,532 |

| Day high | $31.00 | Avg. volume | 4,949 |

| 50-day MA | $31.10 | Dividend yield | 4.52% |

| 200-day MA | $31.68 | Market Cap | 418.32M |

GBLI Stock Price Chart Interactive Chart >

Global Indemnity Limited - Class A Common Shares (GBLI) Company Bio

Global Indemnity Public Limited Company, through its subsidiaries, operates as a specialty property and casualty insurer. It operates through two segments, Insurance Operations and Reinsurance Operations. The company was founded in 1970 and is based in Dublin, Ireland.

Latest GBLI News From Around the Web

Below are the latest news stories about GLOBAL INDEMNITY GROUP LLC that investors may wish to consider to help them evaluate GBLI as an investment opportunity.

Global Indemnity Group (NYSE:GBLI) Has Affirmed Its Dividend Of $0.25Global Indemnity Group, LLC ( NYSE:GBLI ) has announced that it will pay a dividend of $0.25 per share on the 29th of... |

Global Indemnity Group, LLC Announces Quarterly DistributionWILMINGTON, Del., December 07, 2023--Global Indemnity Group, LLC Announces Quarterly Distribution |

Global Indemnity Group, LLC Suspends the Exploration of the Sale or Merger of Penn-America and Global IndemnityWILMINGTON, Del., December 07, 2023--Global Indemnity Group, LLC No Longer Pursuing the Sale or Merger of the Company |

GBLI: Global Indemnity Group reported 3rd quarter 2023 earnings which showed solid growth in the Package Specialty E&S lines of business.By Thomas Kerr, CFA NASDAQ:GBLI READ THE FULL GBLI RESEARCH REPORT Global Indemnity Group (NASDAQ:GBLI) reported 3rd quarter 2023 financial and operating results on November 8th which showed mixed results. Net Written Premiums declined 33.1% to $95.6 million, which was primarily driven by the planned non-renewal of a large Reinsurance casualty treaty as well as the roll off of premiums from |

Global Indemnity Group, LLC (NYSE:GBLI) Q3 2023 Earnings Call TranscriptGlobal Indemnity Group, LLC (NYSE:GBLI) Q3 2023 Earnings Call Transcript November 11, 2023 Operator: Thank you for standing by. My name is Danica, and I’ll be your conference operator today. At this time, I would like to welcome everyone to the GBLI Third Quarter 2023 Earnings Call. All lines have been placed on mute to […] |

GBLI Price Returns

| 1-mo | 0.75% |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | N/A |

| 3-year | 31.57% |

| 5-year | 38.49% |

| YTD | -2.40% |

| 2023 | 42.84% |

| 2022 | -3.35% |

| 2021 | -8.88% |

| 2020 | 0.67% |

| 2019 | -15.37% |

GBLI Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching GBLI

Want to do more research on Global Indemnity Ltd's stock and its price? Try the links below:Global Indemnity Ltd (GBLI) Stock Price | Nasdaq

Global Indemnity Ltd (GBLI) Stock Quote, History and News - Yahoo Finance

Global Indemnity Ltd (GBLI) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...