HDFC Bank Limited (HDB): Price and Financial Metrics

HDB Price/Volume Stats

| Current price | $60.64 | 52-week high | $70.54 |

| Prev. close | $60.20 | 52-week low | $52.16 |

| Day low | $60.25 | Volume | 1,139,175 |

| Day high | $60.77 | Avg. volume | 3,150,809 |

| 50-day MA | $60.29 | Dividend yield | 0.99% |

| 200-day MA | $58.82 | Market Cap | 112.79B |

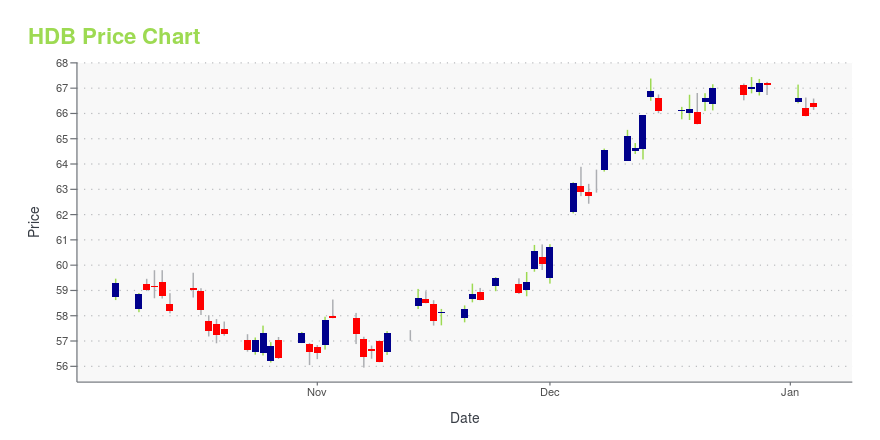

HDB Stock Price Chart Interactive Chart >

HDFC Bank Limited (HDB) Company Bio

HDFC Bank provides a range of banking and financial services to individuals and businesses in India, Bahrain, Hong Kong, and Dubai. The company was founded in 1994 and is based in Mumbai, India.

Latest HDB News From Around the Web

Below are the latest news stories about HDFC BANK LTD that investors may wish to consider to help them evaluate HDB as an investment opportunity.

Quant Ratings Updated on 65 StocksThe stock market kicked December off on a positive note, with the major indices closing higher on Friday. |

Steer Clear of These 10 Dividend StocksSo, in today’s Market 360, I’ll reveal 10 stocks with weak fundamentals that you should avoid. |

My 5 Tips to Set Your Portfolio Up for the Long HaulIn the spirit of Thanksgiving, I’d like to share my most important investing tips to prime your portfolio to flourish in the coming months. |

20 Most Valuable Asian Companies Heading into 2024In this article, we will look into the 20 most valuable Asian companies heading into 2024. If you want to skip our detailed analysis, you can go directly to the 5 Most Valuable Asian Companies Heading into 2024. Asia is the world’s largest and most populous continent, with a rich culture and heritage. The region […] |

Top 20 Most Valuable Indian CompaniesIn this article, we will look into the top 20 most valuable Indian companies. If you want to skip our detailed analysis, you can go directly to the Top 5 Most Valuable Indian Companies. An Outlook of the Indian Economy According to Deloitte’s Indian Economic Outlook 2023, The Indian economy is poised to emerge as […] |

HDB Price Returns

| 1-mo | -6.71% |

| 3-mo | 5.05% |

| 6-mo | 8.26% |

| 1-year | -9.44% |

| 3-year | -8.99% |

| 5-year | 11.04% |

| YTD | -8.68% |

| 2023 | -0.15% |

| 2022 | 7.03% |

| 2021 | -9.42% |

| 2020 | 14.03% |

| 2019 | 23.06% |

HDB Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching HDB

Want to see what other sources are saying about Hdfc Bank Ltd's financials and stock price? Try the links below:Hdfc Bank Ltd (HDB) Stock Price | Nasdaq

Hdfc Bank Ltd (HDB) Stock Quote, History and News - Yahoo Finance

Hdfc Bank Ltd (HDB) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...