Hudson Pacific Properties, Inc. (HPP): Price and Financial Metrics

HPP Price/Volume Stats

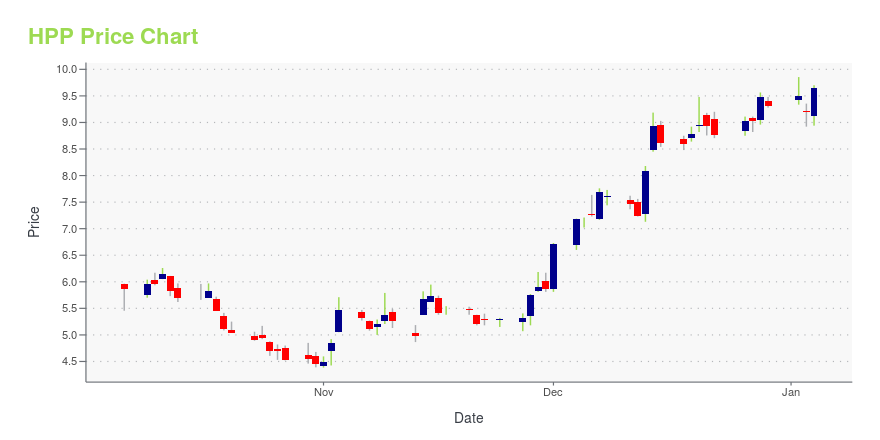

| Current price | $5.74 | 52-week high | $9.85 |

| Prev. close | $5.32 | 52-week low | $4.26 |

| Day low | $5.38 | Volume | 1,741,803 |

| Day high | $5.77 | Avg. volume | 2,427,499 |

| 50-day MA | $5.03 | Dividend yield | 3.62% |

| 200-day MA | $6.30 | Market Cap | 810.17M |

HPP Stock Price Chart Interactive Chart >

Hudson Pacific Properties, Inc. (HPP) Company Bio

Hudson Pacific Properties is focused on acquiring, repositioning, developing and operating high-quality office and state-of-the-art media and entertainment properties in select West Coast markets. The company was founded in 2006 and is based in Los Angeles, California.

Latest HPP News From Around the Web

Below are the latest news stories about HUDSON PACIFIC PROPERTIES INC that investors may wish to consider to help them evaluate HPP as an investment opportunity.

Hudson Pacific Announces Completion of Credit Facility AmendmentLOS ANGELES, December 27, 2023--Hudson Pacific Properties, Inc. (NYSE: HPP), a unique provider of end-to-end real estate solutions for tech and media tenants, today announced the company has closed on an amendment to its unsecured revolving credit facility to refine certain definitions and adjust certain covenant calculations, with key changes including: |

Small Stocks Are On A Tear — Investors Race To Buy These 10Small stocks are blasting past the S&P 500 — and investors are loading up on a handful of them fast. |

Fed Talks Three Cuts, REITs Go Ballistic — What To Do Now?It's often said that staying in the market beats trying to time the market and when Wall Street has a day like Wednesday when the Federal Reserve said it may cut interest rates three times in 2024, it proves that point. Real estate investment trust (REIT) investors were especially celebrating Wednesday after the Federal Open Market Committee (FOMC) meeting announcement because REITs, which had been bouncing back since late October, exploded with huge share price gains. One question is whether RE |

Hudson Pacific Properties Declares Fourth Quarter 2023 Preferred Stock DividendLOS ANGELES, December 08, 2023--Hudson Pacific Properties, Inc. (NYSE: HPP) (the "Company"), a unique provider of end-to-end real estate solutions for tech and media tenants, today announced that its Board of Directors has declared a dividend for the fourth quarter of 2023 on its 4.750% Series C cumulative preferred stock of $0.296875 per share, equivalent to an annual rate of $1.18750 per share, which will be paid on December 28, 2023 to preferred stockholders of record on December 18, 2023. |

Best Value Stocks? 15 Stocks Dr Michael Burry Bought and SoldIn this piece, we will take a look at 15 stocks Dr Michael Burry recently bought and sold. If you want to skip our introduction to the institutional investor, then take a look at 5 Stocks Dr Michael Burry Bought and Sold. Years after accurately predicting the 2008 financial crisis and making a fortune out […] |

HPP Price Returns

| 1-mo | 21.35% |

| 3-mo | 1.37% |

| 6-mo | -33.20% |

| 1-year | 2.72% |

| 3-year | -75.28% |

| 5-year | -79.21% |

| YTD | -37.22% |

| 2023 | 1.86% |

| 2022 | -57.88% |

| 2021 | 6.79% |

| 2020 | -33.40% |

| 2019 | 33.35% |

HPP Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching HPP

Here are a few links from around the web to help you further your research on Hudson Pacific Properties Inc's stock as an investment opportunity:Hudson Pacific Properties Inc (HPP) Stock Price | Nasdaq

Hudson Pacific Properties Inc (HPP) Stock Quote, History and News - Yahoo Finance

Hudson Pacific Properties Inc (HPP) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...