Industrias Bachoco, S.A.B. de C.V. (IBA): Price and Financial Metrics

IBA Price/Volume Stats

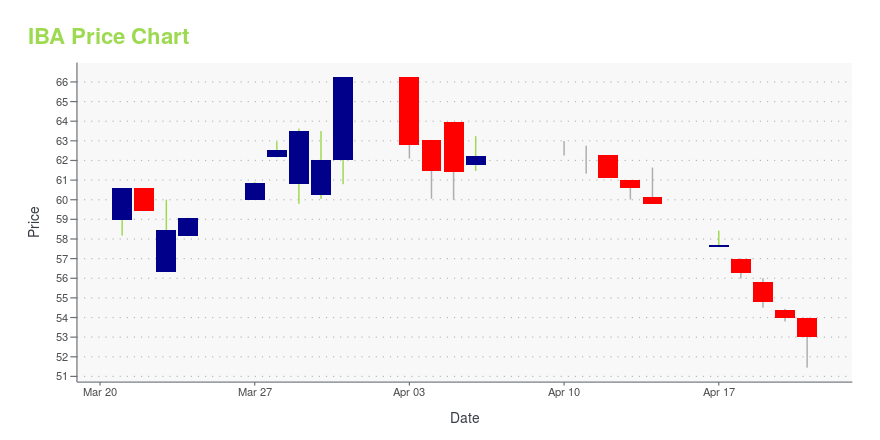

| Current price | $53.00 | 52-week high | $66.25 |

| Prev. close | $53.98 | 52-week low | $38.04 |

| Day low | $51.45 | Volume | 6,700 |

| Day high | $53.99 | Avg. volume | 6,513 |

| 50-day MA | $57.33 | Dividend yield | 0.87% |

| 200-day MA | $50.78 | Market Cap | 2.65B |

IBA Stock Price Chart Interactive Chart >

Industrias Bachoco, S.A.B. de C.V. (IBA) Company Bio

Industrias Bachoco S.A.B operates as a poultry producer in Mexico and the United States. The company primarily engages in breeding, processing, and marketing of chicken, eggs, swine, and balanced animal feed. The company was founded in 1952 and is based in Celaya, Mexico.

Latest IBA News From Around the Web

Below are the latest news stories about INDUSTRIAS BACHOCO SAB DE CV that investors may wish to consider to help them evaluate IBA as an investment opportunity.

Bachoco Informs About Delisting in the United StatesCELAYA, Guanajuato, Mexico, April 24, 2023--Industrias Bachoco, S.A.B. de C.V. ("Bachoco") (NYSE: IBA; BMV: BACHOCO). A national leader in the production and marketing of poultry products and other food products, informs, following previous announcements, that it has delisted its American Depositary Receipts ("ADRs"), from the New York Stock Exchange ("NYSE"), and is in the process of terminating its ADR program, and deregistering and terminating its obligations to prepare and file reports under |

Are Investors Undervaluing Industrias Bachoco (IBA) Right Now?Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks. |

Industrias Bachoco (IBA) Surges 6.9%: Is This an Indication of Further Gains?Industrias Bachoco (IBA) was a big mover last session on higher-than-average trading volume. The latest trend in earnings estimate revisions might not help the stock continue moving higher in the near term. |

Bachoco Informs About NYSE Delisting ApplicationCELAYA, Mexico & GUANAJUATO, Mexico, March 28, 2023--Industrias Bachoco, S.A.B. de C.V. ("Bachoco") (NYSE: IBA; BMV: BACHOCO). A national leader in the production and marketing of poultry products and other food products, today announced that its Board of Directors, considering, among other things: the results of the tender offer concluded on November 2022, by Edificio del Noroeste, S.A. de C.V., a vehicle controlled by the Robinson Bours Family, which together with its affiliates and related pa |

Is Industrias Bachoco (IBA) Stock Undervalued Right Now?Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks. |

IBA Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | N/A |

| 3-year | 17.87% |

| 5-year | 7.27% |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | 22.44% |

| 2021 | -4.08% |

| 2020 | -11.50% |

| 2019 | 33.71% |

IBA Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching IBA

Want to do more research on Industrias Bachoco SAB de CV's stock and its price? Try the links below:Industrias Bachoco SAB de CV (IBA) Stock Price | Nasdaq

Industrias Bachoco SAB de CV (IBA) Stock Quote, History and News - Yahoo Finance

Industrias Bachoco SAB de CV (IBA) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...