InterContinental Hotels Group PLC AD (IHG): Price and Financial Metrics

IHG Price/Volume Stats

| Current price | $103.54 | 52-week high | $112.08 |

| Prev. close | $102.73 | 52-week low | $70.06 |

| Day low | $102.20 | Volume | 244,900 |

| Day high | $103.77 | Avg. volume | 173,584 |

| 50-day MA | $103.90 | Dividend yield | 1.88% |

| 200-day MA | $95.16 | Market Cap | 16.73B |

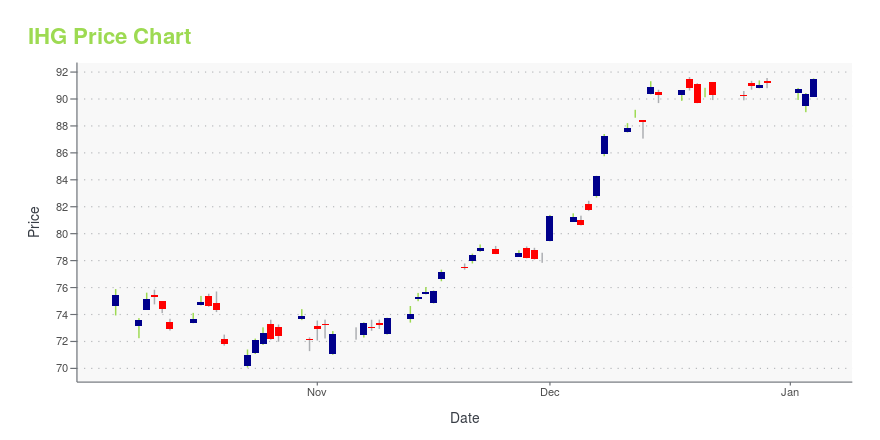

IHG Stock Price Chart Interactive Chart >

InterContinental Hotels Group PLC AD (IHG) Company Bio

InterContinental Hotels Group (IHG), marketed as IHG Hotels & Resorts, is a British multinational hospitality company headquartered in Denham, Buckinghamshire, England. It is listed on the London Stock Exchange and is a constituent of the FTSE 100 Index. (Source:Wikipedia)

Latest IHG News From Around the Web

Below are the latest news stories about INTERCONTINENTAL HOTELS GROUP PLC that investors may wish to consider to help them evaluate IHG as an investment opportunity.

IHG Hotels & Resorts expands Staybridge Suites portfolio in Asia PacificStaybridge Suites, part of IHG Hotels & Resorts is expanding its international presence with its second hotel opening in Asia Pacific. |

Is Intercontinental Hotels Group (IHG) Stock Outpacing Its Consumer Discretionary Peers This Year?Here is how InterContinental Hotels (IHG) and Jakks Pacific (JAKK) have performed compared to their sector so far this year. |

InterContinental Hotels Group PLC Announces Transaction in Own Shares - Dec 11Purchase of own sharesLONDON, UK / ACCESSWIRE / December 11, 2023 / The Company announces that on 08 December 2023 it purchased the following number of its ordinary shares of 20340/399 pence each through Goldman Sachs International ("GSI") on the ... |

From Unrefined Salt and Tinned Fish to Umami Cocktails: Kimpton Brings New Food and Beverage Trends and Classics to the Table in 2024Kimpton Hotels & Restaurants, part of IHG Hotels & Resorts' luxury & lifestyle portfolio, is returning with its annual Culinary + Cocktail Trend Forecast, highlighting predictions from its vast team of global culinary and beverage experts that will be featured on plates and bar menus in 2024. From global salts and seacuterie to textured cocktails and umami flavors, Kimpton is forecasting both new and evolving trends that will further enhance the dining experience. |

Top 5 Consumer Discretionary Stocks for DecemberWe have narrowed our search to five consumer discretionary stocks that have strong growth potential for December. These are: LYV, RCL, IHG, NKE, WMG. |

IHG Price Returns

| 1-mo | -1.45% |

| 3-mo | 2.59% |

| 6-mo | 9.13% |

| 1-year | 42.57% |

| 3-year | 64.61% |

| 5-year | 59.78% |

| YTD | 14.67% |

| 2023 | 59.59% |

| 2022 | -8.70% |

| 2021 | 0.14% |

| 2020 | -3.02% |

| 2019 | 34.44% |

IHG Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching IHG

Want to see what other sources are saying about Intercontinental Hotels Group Plc's financials and stock price? Try the links below:Intercontinental Hotels Group Plc (IHG) Stock Price | Nasdaq

Intercontinental Hotels Group Plc (IHG) Stock Quote, History and News - Yahoo Finance

Intercontinental Hotels Group Plc (IHG) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...