Ingles Markets Inc. Cl A (IMKTA): Price and Financial Metrics

IMKTA Price/Volume Stats

| Current price | $79.73 | 52-week high | $89.59 |

| Prev. close | $78.97 | 52-week low | $67.10 |

| Day low | $78.90 | Volume | 49,659 |

| Day high | $80.00 | Avg. volume | 85,230 |

| 50-day MA | $72.00 | Dividend yield | 0.85% |

| 200-day MA | $77.46 | Market Cap | 1.51B |

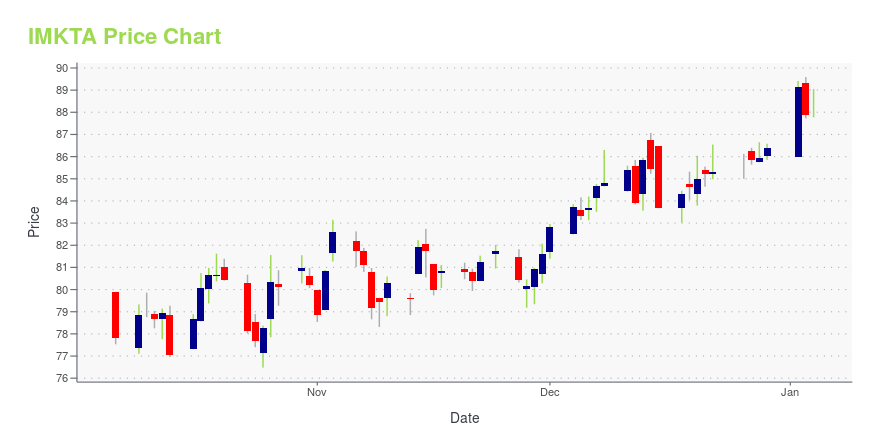

IMKTA Stock Price Chart Interactive Chart >

Ingles Markets Inc. Cl A (IMKTA) Company Bio

Ingles Markets operates various supermarkets in the southeast United States. The company was founded in 1963 and is based in Black Mountain, North Carolina.

Latest IMKTA News From Around the Web

Below are the latest news stories about INGLES MARKETS INC that investors may wish to consider to help them evaluate IMKTA as an investment opportunity.

15 Quality Undervalued Non-Cyclical Stocks to Buy NowIn this article, we discuss the 15 quality undervalued non-cyclical stocks to buy now. If you want to read about some more non-cyclical undervalued stocks, go directly to 5 Quality Undervalued Non-Cyclical Stocks to Buy Now. The United States stock market has been on a roller coaster ride over the past few years. The pandemic […] |

A Look At The Fair Value Of Ingles Markets, Incorporated (NASDAQ:IMKT.A)Key Insights Using the 2 Stage Free Cash Flow to Equity, Ingles Markets fair value estimate is US$86.62 With US$81.62... |

Ingles Markets Inc (IMKTA) Reports Mixed Fiscal Year 2023 ResultsNet Sales Rise While Net Income Declines Year-Over-Year |

Ingles Markets, Incorporated Reports Results for Fourth Quarter and Fiscal Year 2023ASHEVILLE, N.C., November 29, 2023--Ingles Markets, Incorporated (NASDAQ: IMKTA) today reported results for the three and twelve months ended September 30, 2023. |

Those who invested in Ingles Markets (NASDAQ:IMKT.A) five years ago are up 167%When you buy a stock there is always a possibility that it could drop 100%. But on a lighter note, a good company can... |

IMKTA Price Returns

| 1-mo | 16.75% |

| 3-mo | 9.91% |

| 6-mo | -5.38% |

| 1-year | -3.41% |

| 3-year | 37.86% |

| 5-year | 164.86% |

| YTD | -7.09% |

| 2023 | -9.77% |

| 2022 | 12.58% |

| 2021 | 104.79% |

| 2020 | -8.75% |

| 2019 | 78.27% |

IMKTA Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching IMKTA

Here are a few links from around the web to help you further your research on Ingles Markets Inc's stock as an investment opportunity:Ingles Markets Inc (IMKTA) Stock Price | Nasdaq

Ingles Markets Inc (IMKTA) Stock Quote, History and News - Yahoo Finance

Ingles Markets Inc (IMKTA) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...