Infosys Ltd. ADR (INFY): Price and Financial Metrics

INFY Price/Volume Stats

| Current price | $22.79 | 52-week high | $22.94 |

| Prev. close | $22.01 | 52-week low | $16.04 |

| Day low | $22.44 | Volume | 15,980,200 |

| Day high | $22.94 | Avg. volume | 9,846,637 |

| 50-day MA | $18.73 | Dividend yield | 1.31% |

| 200-day MA | $18.32 | Market Cap | 94.35B |

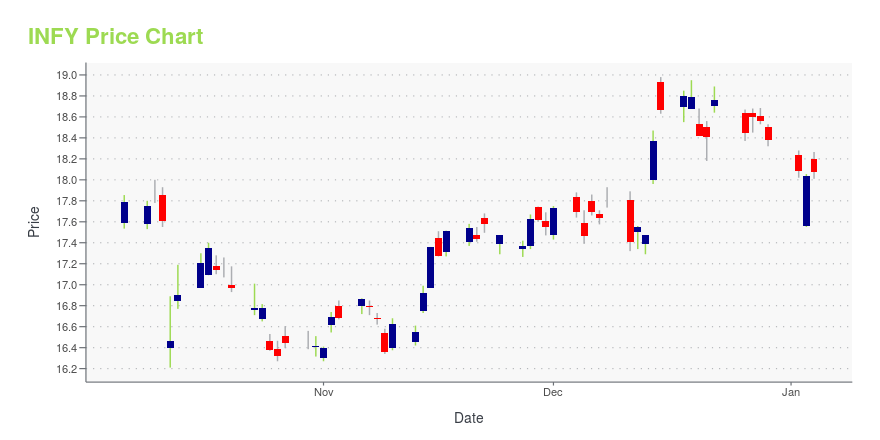

INFY Stock Price Chart Interactive Chart >

Infosys Ltd. ADR (INFY) Company Bio

Infosys Limited is an Indian multinational information technology company that provides business consulting, information technology and outsourcing services. The company was founded in Pune and is headquartered in Bangalore. Infosys is the second-largest Indian IT company, after Tata Consultancy Services, by 2020 revenue figures, and the 602nd largest public company in the world, according to the Forbes Global 2000 ranking. (Source:Wikipedia)

Latest INFY News From Around the Web

Below are the latest news stories about INFOSYS LTD that investors may wish to consider to help them evaluate INFY as an investment opportunity.

Infosys (INFY) Falls After $1.5B Global AI Deal TerminationInfosys (INFY) loses a multi-year mega contract worth $1.5 billion, which required it to provide an array of upgraded digital experiences and operational services based on its platforms and AI solutions. |

India's Infosys falls after $1.5 billion AI deal terminationShares of Infosys fell as much as 2.6% on Tuesday after the company said that an unnamed global company, which had signed a $1.5 billion deal focused on artificial intelligence solutions, decided to terminate its Memorandum of Understanding (MoU) with the IT giant. Infosys said it had plans to enhance digital experiences and provide business operation services, utilizing the company's platforms and artificial intelligence (AI) solutions. |

Infosys (INFY) to Lead LKQ Europe's System TransformationInfosys (INFY) partners with LKQ Europe, aiming to support the latter's business transformation related to information technology over the next five years. |

Infosys to Harmonize the Systems of LKQ EuropeInfosys (NSE: INFY), (BSE: INFY), (NYSE: INFY), a global leader in next-generation digital services and consulting, today announced a 5-year collaboration with LKQ Europe, one of the leading distributors of automotive aftermarket parts for cars, commercial vans, and industrial vehicles in Europe. Following multiple strategic acquisitions, LKQ has envisioned a corporate program that entails harmonizing business processes, improving product availability, and enabling faster delivery to end custome |

India's $245 billion IT sector swallows tougher terms amid scramble for contractsIndia's information technology firms are accepting tougher contract terms to win large deals from clients as they compete for fewer orders in an uncertain global economy, industry insiders and analysts say. The $245-billion sector, which gained immensely from the pandemic-induced boom in digital services, has struggled in recent quarters as clients slashed spending on discretionary projects amid inflationary pressures and recession fears. That is forcing companies including Tata Consultancy Services, Infosys and HCLTech to accept contract conditions such as guaranteeing minimum cost savings, billing the client only if certain goals are achieved and reviewing cost overruns. |

INFY Price Returns

| 1-mo | 25.08% |

| 3-mo | 36.87% |

| 6-mo | 14.67% |

| 1-year | 40.95% |

| 3-year | 12.02% |

| 5-year | 120.48% |

| YTD | 26.15% |

| 2023 | 4.35% |

| 2022 | -27.54% |

| 2021 | 51.76% |

| 2020 | 67.56% |

| 2019 | 11.65% |

INFY Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching INFY

Want to do more research on Infosys Ltd's stock and its price? Try the links below:Infosys Ltd (INFY) Stock Price | Nasdaq

Infosys Ltd (INFY) Stock Quote, History and News - Yahoo Finance

Infosys Ltd (INFY) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...