Kimco Realty Corp. (KIM): Price and Financial Metrics

KIM Price/Volume Stats

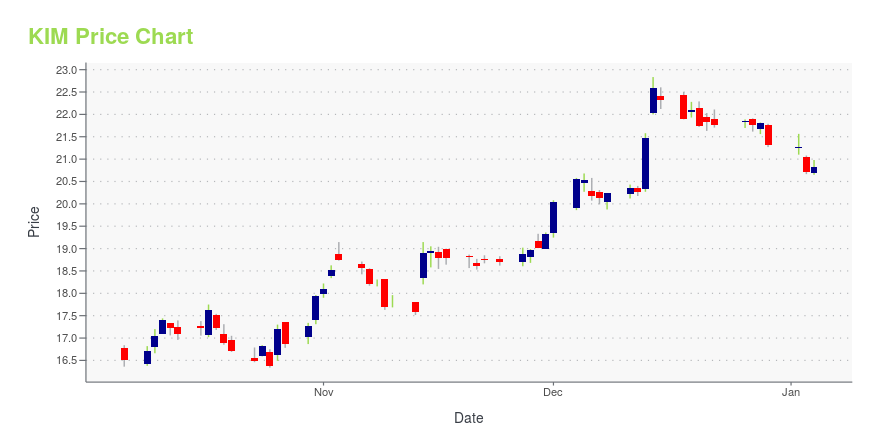

| Current price | $21.19 | 52-week high | $22.83 |

| Prev. close | $20.74 | 52-week low | $16.34 |

| Day low | $20.76 | Volume | 3,309,100 |

| Day high | $21.26 | Avg. volume | 4,859,351 |

| 50-day MA | $19.48 | Dividend yield | 4.5% |

| 200-day MA | $19.35 | Market Cap | 14.28B |

KIM Stock Price Chart Interactive Chart >

Kimco Realty Corp. (KIM) Company Bio

Kimco Realty Corporation is a real estate investment trust that invests in shopping centers. As of March 31, 2022, the company owned interests in 537 U.S. shopping centers and mixed-use assets comprising 93 million square feet of gross leasable space. (Source:Wikipedia)

Latest KIM News From Around the Web

Below are the latest news stories about KIMCO REALTY CORP that investors may wish to consider to help them evaluate KIM as an investment opportunity.

Livent Set to Join S&P MidCap 400; NCR Voyix and Rush Enterprises to Join S&P SmallCap 600S&P Dow Jones Indices will make the following changes to the S&P MidCap 400 and S&P SmallCap 600 effective prior to the open of trading on Tuesday, January 2: |

November’s Surprising Sector WinnerReal estate investment trusts (REITs), which have been beaten down by surging interest rates and economic uncertainty, are now showing signs of strength. |

Kimco Realty® Invites You to Join Its Fourth Quarter Earnings Conference CallJERICHO, N.Y., December 11, 2023--Kimco Realty® (NYSE: KIM) will announce its fourth quarter 2023 earnings on Thursday, February 8, 2024, before market open. You are invited to listen to our quarterly earnings conference call, which will be webcast on Thursday, February 8, 2024, at 8:30 AM ET. |

Black Friday Winners: 7 Retail Stocks Set for Post-Holiday GainsGiven so much talk about stubbornly elevated inflation and soaring borrowing costs, it’s not surprising that retail stocks incurred much skepticism throughout this year. |

Kimco Realty Corp's Dividend AnalysisKimco Realty Corp (NYSE:KIM) recently announced a dividend of $0.09 per share, payable on 2023-12-21, with the ex-dividend date set for 2023-12-06. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into Kimco Realty Corp's dividend performance and assess its sustainability. |

KIM Price Returns

| 1-mo | 11.00% |

| 3-mo | 16.74% |

| 6-mo | 5.81% |

| 1-year | 10.77% |

| 3-year | 16.18% |

| 5-year | 39.72% |

| YTD | 1.93% |

| 2023 | 6.05% |

| 2022 | -10.80% |

| 2021 | 69.48% |

| 2020 | -23.94% |

| 2019 | 49.75% |

KIM Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching KIM

Want to see what other sources are saying about Kimco Realty Corp's financials and stock price? Try the links below:Kimco Realty Corp (KIM) Stock Price | Nasdaq

Kimco Realty Corp (KIM) Stock Quote, History and News - Yahoo Finance

Kimco Realty Corp (KIM) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...