Kimberly-Clark Corp. (KMB): Price and Financial Metrics

KMB Price/Volume Stats

| Current price | $141.81 | 52-week high | $145.62 |

| Prev. close | $141.07 | 52-week low | $116.32 |

| Day low | $141.04 | Volume | 2,064,500 |

| Day high | $142.51 | Avg. volume | 2,167,548 |

| 50-day MA | $137.65 | Dividend yield | 3.59% |

| 200-day MA | $127.37 | Market Cap | 47.75B |

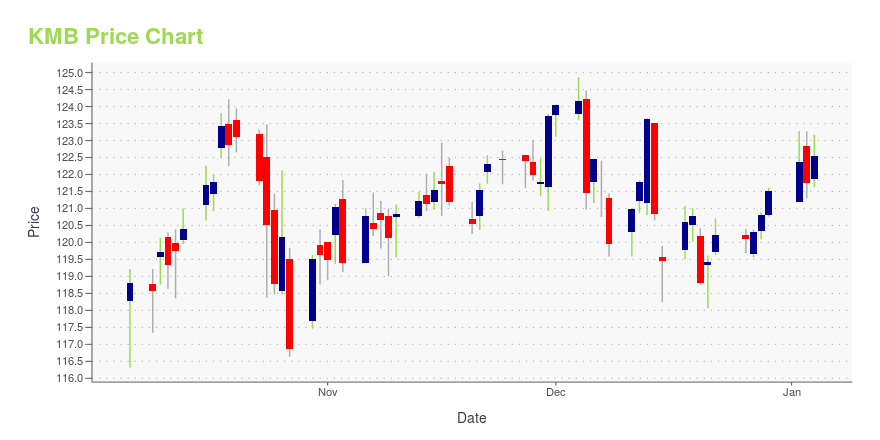

KMB Stock Price Chart Interactive Chart >

Kimberly-Clark Corp. (KMB) Company Bio

Kimberly-Clark Corporation is an American multinational personal care corporation that produces mostly paper-based consumer products. The company manufactures sanitary paper products and surgical & medical instruments. Kimberly-Clark brand name products include Kleenex facial tissue, Kotex feminine hygiene products, Cottonelle, Scott and Andrex toilet paper, Wypall utility wipes, KimWipes scientific cleaning wipes and Huggies disposable diapers and baby wipes. (Source:Wikipedia)

Latest KMB News From Around the Web

Below are the latest news stories about KIMBERLY CLARK CORP that investors may wish to consider to help them evaluate KMB as an investment opportunity.

Income Investing: 7 Stocks to Buy for a Steady ‘Pay Check’ in 2024One of the easiest ways for investors to get paid consistently is with income investing heading into New Year 2024. |

3 Dividend Kings Yielding Over 3%These Dividend Kings will provide royal returns and are perfect for income investors or those hoping for security. |

3 Stalwart Stocks to Protect Your Portfolio From a Coming CrashPreparing for the worst by buying stocks for a market crash means dividend stocks will be an integral component of the portfolio. |

Kimberly-Clark Corporation (KMB) is Attracting Investor Attention: Here is What You Should KnowKimberly-Clark (KMB) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects. |

Early Retirement Portfolio: 16 Stocks to Live Off Dividends RevisitedIn this article, we discuss the best dividend stocks for an early retirement portfolio. You can skip our detailed analysis of dividend stocks and their performance in the past, and go directly to read Early Retirement Portfolio: 5 Stocks to Live Off Dividends Revisited. As investors approach the threshold of retirement, the quest for financial […] |

KMB Price Returns

| 1-mo | 1.77% |

| 3-mo | 5.80% |

| 6-mo | 19.15% |

| 1-year | 12.92% |

| 3-year | 17.14% |

| 5-year | 21.57% |

| YTD | 18.92% |

| 2023 | -7.08% |

| 2022 | -1.58% |

| 2021 | 9.66% |

| 2020 | 0.95% |

| 2019 | 24.57% |

KMB Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching KMB

Here are a few links from around the web to help you further your research on Kimberly Clark Corp's stock as an investment opportunity:Kimberly Clark Corp (KMB) Stock Price | Nasdaq

Kimberly Clark Corp (KMB) Stock Quote, History and News - Yahoo Finance

Kimberly Clark Corp (KMB) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...