Coca-Cola Company (KO): Price and Financial Metrics

KO Price/Volume Stats

| Current price | $67.05 | 52-week high | $67.11 |

| Prev. close | $66.07 | 52-week low | $51.55 |

| Day low | $66.01 | Volume | 13,530,071 |

| Day high | $67.11 | Avg. volume | 12,896,540 |

| 50-day MA | $63.51 | Dividend yield | 2.99% |

| 200-day MA | $60.20 | Market Cap | 288.85B |

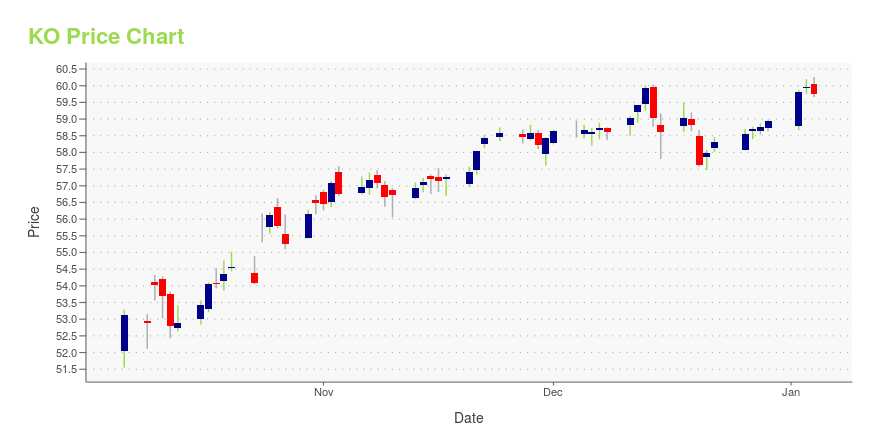

KO Stock Price Chart Interactive Chart >

Coca-Cola Company (KO) Company Bio

Coca-Cola is the world's largest beverage company, refreshing consumers with more than 500 sparkling and still brands. The Coca-Cola Company was founded in 1886 and is based in Atlanta, Georgia.

Latest KO News From Around the Web

Below are the latest news stories about COCA COLA CO that investors may wish to consider to help them evaluate KO as an investment opportunity.

The Top 7 Stocks to Buy Before They Take Off Next YearThese seven blue-chip stocks to buy can form a robust core portfolio for the next leg higher in 2024 and beyond. |

Top 3 Large-Cap Growth Stock Picks for the New YearCrisis is creating opportunity for investors with some of these large-cap growth stocks for New Year 2024. |

Disaster-Proof Dividends: 3 Stocks with Resilient Payouts in Tough TimesEnjoy steady passive income and capital growth in your portfolio through these three dividend stocks with steady payouts. |

The Zacks Analyst Blog Highlights Molson Coors Beverage, The Procter & Gamble, The Coca-Cola and The Kraft HeinzMolson Coors Beverage, The Procter & Gamble, The Coca-Cola and The Kraft Heinz are part of the Zacks top Analyst Blog. |

3 Incredibly Cheap Dividend StocksHere are dividend-paying stocks that are trading at a discount and merit a look from income investors. |

KO Price Returns

| 1-mo | 4.68% |

| 3-mo | 9.44% |

| 6-mo | 14.72% |

| 1-year | 10.82% |

| 3-year | 28.27% |

| 5-year | 44.58% |

| YTD | 15.58% |

| 2023 | -4.43% |

| 2022 | 10.61% |

| 2021 | 11.37% |

| 2020 | 2.47% |

| 2019 | 20.60% |

KO Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching KO

Want to do more research on Coca Cola Co's stock and its price? Try the links below:Coca Cola Co (KO) Stock Price | Nasdaq

Coca Cola Co (KO) Stock Quote, History and News - Yahoo Finance

Coca Cola Co (KO) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...