Luxfer Holdings PLC Ordinary Shares (LXFR): Price and Financial Metrics

LXFR Price/Volume Stats

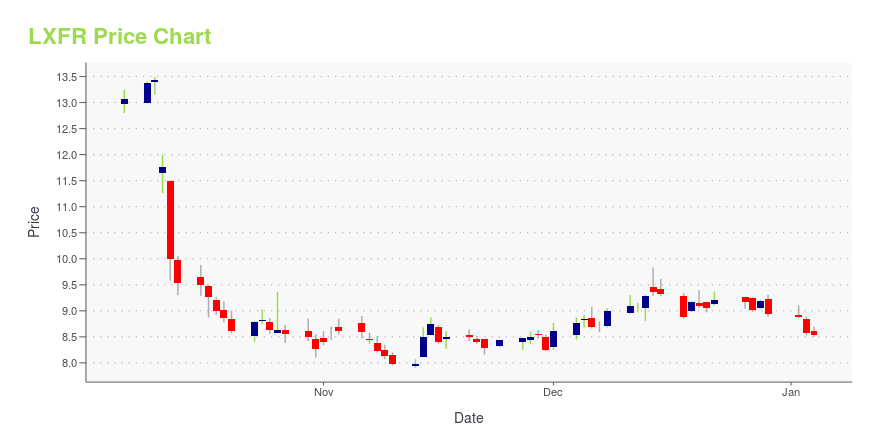

| Current price | $13.23 | 52-week high | $13.49 |

| Prev. close | $13.03 | 52-week low | $7.55 |

| Day low | $13.09 | Volume | 135,816 |

| Day high | $13.45 | Avg. volume | 166,245 |

| 50-day MA | $11.92 | Dividend yield | 4.08% |

| 200-day MA | $9.92 | Market Cap | 362.69M |

LXFR Stock Price Chart Interactive Chart >

Luxfer Holdings PLC Ordinary Shares (LXFR) Company Bio

Luxfer Holdings PLC designs, manufactures, and supplies materials, components, and high-pressure gas-containment devices for environmental, healthcare, protection, and specialty end-markets in Europe, North America, and internationally. The company was founded in 1898 and is based in Salford, England.

Latest LXFR News From Around the Web

Below are the latest news stories about LUXFER HOLDINGS PLC that investors may wish to consider to help them evaluate LXFR as an investment opportunity.

Luxfer Holdings PLC's (NYSE:LXFR) Fundamentals Look Pretty Strong: Could The Market Be Wrong About The Stock?With its stock down 28% over the past three months, it is easy to disregard Luxfer Holdings (NYSE:LXFR). But if you pay... |

Investors in Luxfer Holdings (NYSE:LXFR) have unfortunately lost 59% over the last five yearsWe think intelligent long term investing is the way to go. But no-one is immune from buying too high. For example... |

Insider Spends US$98k Buying More Shares In Luxfer HoldingsEven if it's not a huge purchase, we think it was good to see that Patrick Mullen, the Independent Chairman of the... |

Luxfer Holdings PLC (NYSE:LXFR) Q3 2023 Earnings Call TranscriptLuxfer Holdings PLC (NYSE:LXFR) Q3 2023 Earnings Call Transcript October 26, 2023 Operator: Good morning. My name is Angela, and I will be your conference coordinator today. Welcome to the Luxfer’s Third Quarter 2023 Earnings Conference Call. All lines have been placed on mute. [Operator Instructions] Now, I will turn the call over to Kevin […] |

Luxfer Announces Third Quarter 2023 Financial Results; Initiates Strategic ReviewMILWAUKEE, October 25, 2023--Luxfer Holdings PLC (NYSE: LXFR) ("Luxfer" or the "Company"), a global industrial company innovating niche applications in materials engineering, today announced financial results for the third quarter 2023, ended October 1, 2023. |

LXFR Price Returns

| 1-mo | 16.69% |

| 3-mo | 37.43% |

| 6-mo | 64.62% |

| 1-year | 10.17% |

| 3-year | -25.33% |

| 5-year | -25.21% |

| YTD | 54.05% |

| 2023 | -32.32% |

| 2022 | -26.63% |

| 2021 | 20.57% |

| 2020 | -8.79% |

| 2019 | 4.99% |

LXFR Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Loading social stream, please wait...