Main Street Capital Corporation (MAIN): Price and Financial Metrics

MAIN Price/Volume Stats

| Current price | $60.92 | 52-week high | $63.31 |

| Prev. close | $60.98 | 52-week low | $45.00 |

| Day low | $60.50 | Volume | 545,000 |

| Day high | $61.30 | Avg. volume | 563,891 |

| 50-day MA | $56.51 | Dividend yield | 4.91% |

| 200-day MA | $55.79 | Market Cap | 5.42B |

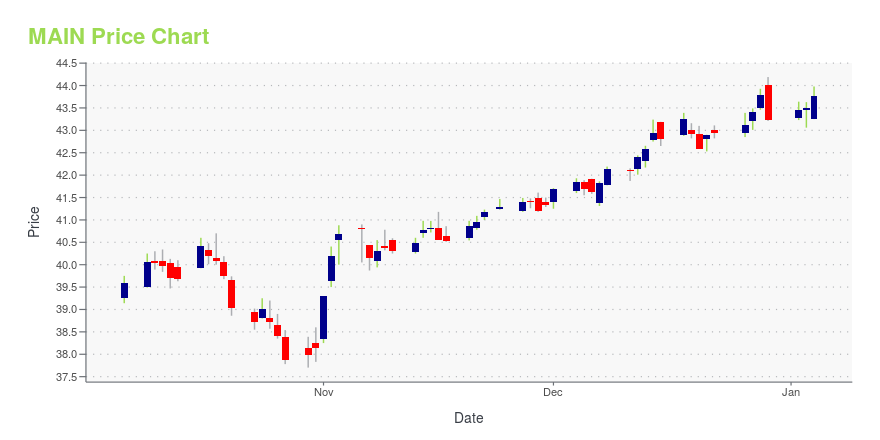

MAIN Stock Price Chart Interactive Chart >

Main Street Capital Corporation (MAIN) Company Bio

Main Street Capital is a principal investment firm that provides long-term debt and equity capital to lower middle market companies and debt capital to middle market companies. Main Street's portfolio investments are typically made to support management buyouts, recapitalizations, growth financings, refinancings and acquisitions of companies that operate in diverse industry sectors. The company was founded in 1997 and is based at Houston, Texas.

MAIN Price Returns

| 1-mo | 5.46% |

| 3-mo | 20.54% |

| 6-mo | 9.53% |

| 1-year | 28.27% |

| 3-year | 93.10% |

| 5-year | 205.16% |

| YTD | 8.39% |

| 2024 | 47.30% |

| 2023 | 28.22% |

| 2022 | -11.79% |

| 2021 | 48.31% |

| 2020 | -19.54% |

MAIN Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching MAIN

Want to see what other sources are saying about Main Street Capital CORP's financials and stock price? Try the links below:Main Street Capital CORP (MAIN) Stock Price | Nasdaq

Main Street Capital CORP (MAIN) Stock Quote, History and News - Yahoo Finance

Main Street Capital CORP (MAIN) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...