3M Company (MMM): Price and Financial Metrics

MMM Price/Volume Stats

| Current price | $124.75 | 52-week high | $141.34 |

| Prev. close | $126.47 | 52-week low | $72.47 |

| Day low | $124.50 | Volume | 3,774,800 |

| Day high | $127.04 | Avg. volume | 4,949,361 |

| 50-day MA | $132.85 | Dividend yield | 2.21% |

| 200-day MA | $104.61 | Market Cap | 69.03B |

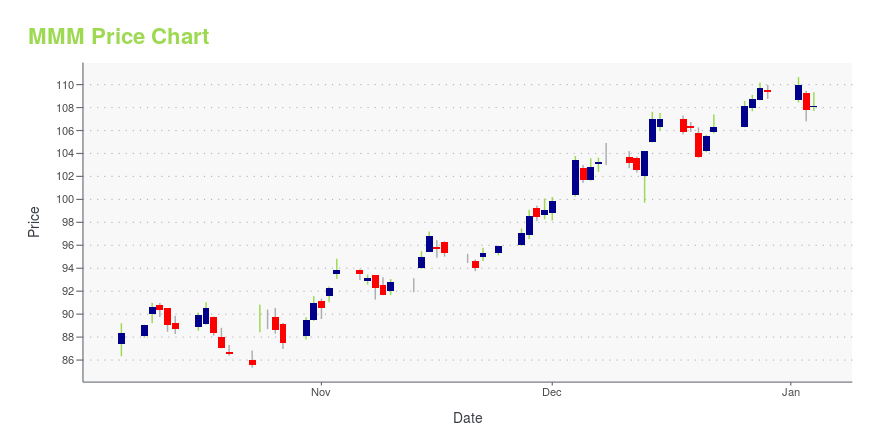

MMM Stock Price Chart Interactive Chart >

3M Company (MMM) Company Bio

3M Company manufactures products related to electronics, telecommunications, industrial, consumer and office, health care, safety, and other markets. The company was founded in 1902 and is based in St. Paul, Minnesota.

MMM Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | N/A |

| 3-year | N/A |

| 5-year | N/A |

| YTD | N/A |

| 2023 | N/A |

| 2022 | N/A |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

MMM Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching MMM

Want to do more research on 3M Co's stock and its price? Try the links below:3M Co (MMM) Stock Price | Nasdaq

3M Co (MMM) Stock Quote, History and News - Yahoo Finance

3M Co (MMM) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...