Old National Bancorp (ONB): Price and Financial Metrics

ONB Price/Volume Stats

| Current price | $20.22 | 52-week high | $20.38 |

| Prev. close | $19.93 | 52-week low | $12.36 |

| Day low | $19.93 | Volume | 2,663,771 |

| Day high | $20.30 | Avg. volume | 2,116,090 |

| 50-day MA | $17.37 | Dividend yield | 2.77% |

| 200-day MA | $16.35 | Market Cap | 6.45B |

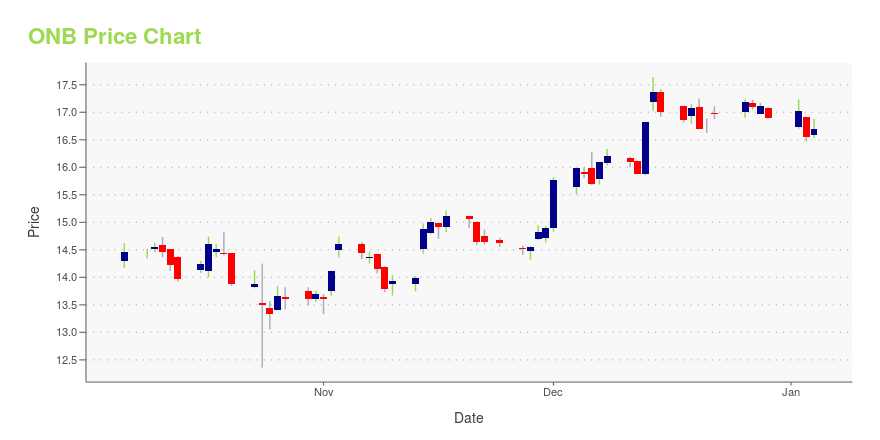

ONB Stock Price Chart Interactive Chart >

Old National Bancorp (ONB) Company Bio

Old National Bancorp operates as the holding company for Old National Bank, which provides various financial services to individual and commercial customers in Indiana, Southeastern Illinois, Western Kentucky, and Southwestern Michigan. The company was founded in 1834 and is based in Evansville, Indiana.

Latest ONB News From Around the Web

Below are the latest news stories about OLD NATIONAL BANCORP that investors may wish to consider to help them evaluate ONB as an investment opportunity.

Old National Bancorp (ONB) Moves to Buy: Rationale Behind the UpgradeOld National Bancorp (ONB) has been upgraded to a Zacks Rank #2 (Buy), reflecting growing optimism about the company's earnings prospects. This might drive the stock higher in the near term. |

Strength Seen in Mercantile Bank (MBWM): Can Its 5.8% Jump Turn into More Strength?Mercantile Bank (MBWM) witnessed a jump in share price last session on above-average trading volume. The latest trend in earnings estimate revisions for the stock doesn't suggest further strength down the road. |

Old National Names Goldfeder Chief Credit OfficerCarrie Goldfeder Carrie Goldfeder EVANSVILLE, Ind., Dec. 07, 2023 (GLOBE NEWSWIRE) -- (NASDAQ: ONB) – Carrie Goldfeder, a seasoned credit executive with over 25 years of credit and corporate finance experience across all facets of loan production, credit performance and portfolio management, has joined Old National Bank, the wholly-owned banking subsidiary of Old National Bancorp (“Old National”), as Chief Credit Officer. She will office out of Chicago. For the past eight years Goldfeder served |

Old National Bancorp (ONB) Surges 5.8%: Is This an Indication of Further Gains?Old National Bancorp (ONB) witnessed a jump in share price last session on above-average trading volume. The latest trend in earnings estimate revisions for the stock doesn't suggest further strength down the road. |

Should You Buy Old National Bancorp (NASDAQ:ONB) For Its Upcoming Dividend?Old National Bancorp ( NASDAQ:ONB ) stock is about to trade ex-dividend in 3 days. The ex-dividend date is one business... |

ONB Price Returns

| 1-mo | 22.25% |

| 3-mo | 23.07% |

| 6-mo | 19.86% |

| 1-year | 23.34% |

| 3-year | 39.01% |

| 5-year | 35.47% |

| YTD | 21.78% |

| 2023 | -2.47% |

| 2022 | 2.51% |

| 2021 | 12.89% |

| 2020 | -6.07% |

| 2019 | 22.41% |

ONB Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching ONB

Here are a few links from around the web to help you further your research on Old National Bancorp's stock as an investment opportunity:Old National Bancorp (ONB) Stock Price | Nasdaq

Old National Bancorp (ONB) Stock Quote, History and News - Yahoo Finance

Old National Bancorp (ONB) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...