Phibro Animal Health Corp. (PAHC): Price and Financial Metrics

PAHC Price/Volume Stats

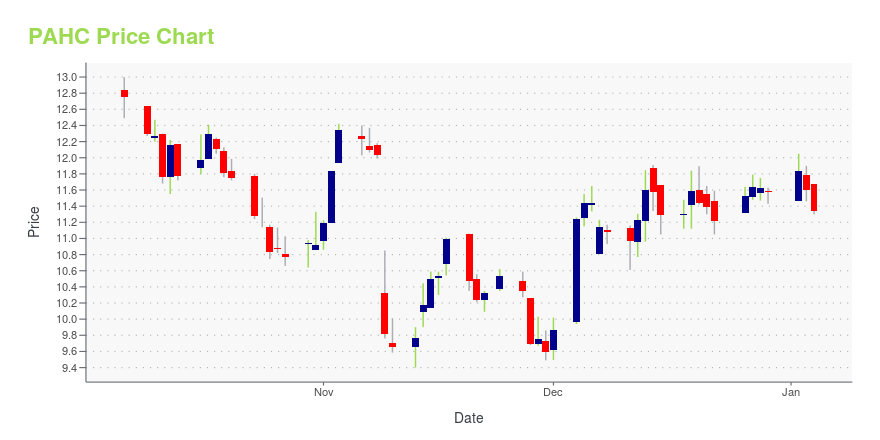

| Current price | $18.88 | 52-week high | $19.55 |

| Prev. close | $18.83 | 52-week low | $9.40 |

| Day low | $18.69 | Volume | 108,800 |

| Day high | $19.34 | Avg. volume | 140,471 |

| 50-day MA | $17.78 | Dividend yield | 2.54% |

| 200-day MA | $13.60 | Market Cap | 764.70M |

PAHC Stock Price Chart Interactive Chart >

Phibro Animal Health Corp. (PAHC) Company Bio

Phibro Animal Health Corporation is a diversified global developer, manufacturer and marketer of a broad range of animal health and mineral nutrition products for use in the production of poultry, swine, cattle, dairy and aquaculture. The company was founded in 2000 and is based in Teaneck, New Jersey.

Latest PAHC News From Around the Web

Below are the latest news stories about PHIBRO ANIMAL HEALTH CORP that investors may wish to consider to help them evaluate PAHC as an investment opportunity.

Charles Brandes' Firm Bolsters Position in Phibro Animal Health CorpFirm increases its holding in animal health company |

Charles Brandes Bolsters Position in Phibro Animal Health CorpCharles Brandes (Trades, Portfolio), through Brandes Investment Partners, has recently increased the firm's stake in Phibro Animal Health Corp (NASDAQ:PAHC). This addition has brought the total holdings to 2,040,380 shares, representing a 10.03% ownership in PAHC and a 0.38% position in Brandes' portfolio. The shares were acquired at a price of $9.59 each, with the trade having a 0.03% impact on the investment portfolio. |

Why Is Phibro (PAHC) Up 13.6% Since Last Earnings Report?Phibro (PAHC) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues. |

Phibro Animal Health Corporation (NASDAQ:PAHC) Q1 2024 Earnings Call TranscriptPhibro Animal Health Corporation (NASDAQ:PAHC) Q1 2024 Earnings Call Transcript November 10, 2023 Operator: Hello, and thank you for standing by. My name is Regina, and I will be your conference operator today. At this time, I would like to welcome everyone to the Phibro Animal Health Corporation FY 2024 Earnings Conference Call. All lines […] |

Phibro Animal Health (NASDAQ:PAHC) Has Announced A Dividend Of $0.12The board of Phibro Animal Health Corporation ( NASDAQ:PAHC ) has announced that it will pay a dividend on the 20th of... |

PAHC Price Returns

| 1-mo | 8.07% |

| 3-mo | 49.35% |

| 6-mo | 64.50% |

| 1-year | 37.80% |

| 3-year | -13.99% |

| 5-year | -25.50% |

| YTD | 65.64% |

| 2023 | -10.42% |

| 2022 | -32.33% |

| 2021 | 7.28% |

| 2020 | -20.09% |

| 2019 | -21.31% |

PAHC Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching PAHC

Here are a few links from around the web to help you further your research on Phibro Animal Health Corp's stock as an investment opportunity:Phibro Animal Health Corp (PAHC) Stock Price | Nasdaq

Phibro Animal Health Corp (PAHC) Stock Quote, History and News - Yahoo Finance

Phibro Animal Health Corp (PAHC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...