Peoples Financial Services Corp. (PFIS): Price and Financial Metrics

PFIS Price/Volume Stats

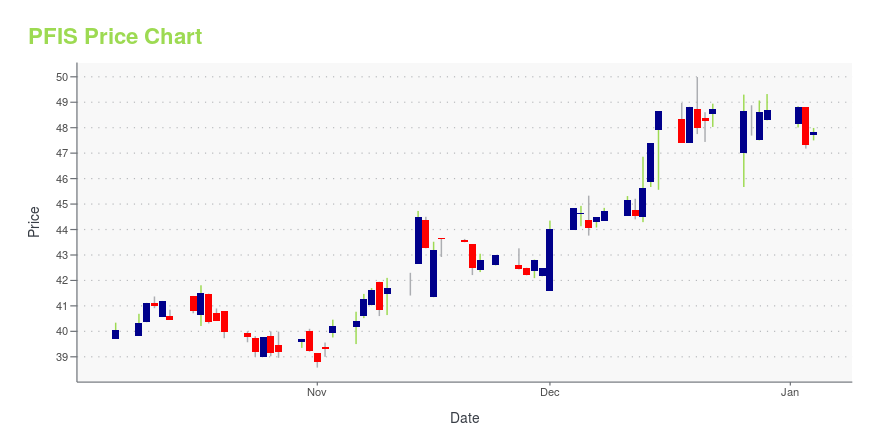

| Current price | $38.28 | 52-week high | $49.99 |

| Prev. close | $37.95 | 52-week low | $30.60 |

| Day low | $37.53 | Volume | 7,100 |

| Day high | $38.47 | Avg. volume | 12,389 |

| 50-day MA | $39.74 | Dividend yield | 4.23% |

| 200-day MA | $43.06 | Market Cap | 270.22M |

PFIS Stock Price Chart Interactive Chart >

Peoples Financial Services Corp. (PFIS) Company Bio

Peoples Financial Services Group provides commercial and retail banking services primarily in Northeastern Pennsylvania and Southern New York. The company is based in Scranton, Pennsylvania.

Latest PFIS News From Around the Web

Below are the latest news stories about PEOPLES FINANCIAL SERVICES CORP that investors may wish to consider to help them evaluate PFIS as an investment opportunity.

Peoples Financial Services Corp. (NASDAQ:PFIS) Passed Our Checks, And It's About To Pay A US$0.41 DividendSome investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be... |

Peoples Financial Services' (NASDAQ:PFIS) Dividend Will Be $0.41Peoples Financial Services Corp. ( NASDAQ:PFIS ) has announced that it will pay a dividend of $0.41 per share on the... |

The past year for Peoples Financial Services (NASDAQ:PFIS) investors has not been profitableIt's easy to match the overall market return by buying an index fund. But if you buy individual stocks, you can do both... |

PEOPLES FINANCIAL SERVICES CORP. Reports Unaudited Third Quarter 2023 EarningsPeoples Financial Services Corp. ("Peoples") (NASDAQ: PFIS), the bank holding company for Peoples Security Bank and Trust Company, today reported unaudited financial results at and for the three and nine months ended September 30, 2023. |

PEOPLES FINANCIAL SERVICES CORP. Declares Fourth Quarter 2023 DividendThe Board of Directors of Peoples Financial Services Corp. (NASDAQ: PFIS) declared a fourth quarter dividend of $0.41 per share. The $0.41 dividend represents a 2.5% increase over the dividend declared in the fourth quarter of 2022 of $0.40 per share. The dividend is payable December 15, 2023 to shareholders of record November 30, 2023. |

PFIS Price Returns

| 1-mo | -11.20% |

| 3-mo | -18.24% |

| 6-mo | -1.64% |

| 1-year | -1.37% |

| 3-year | 0.50% |

| 5-year | 2.21% |

| YTD | -20.59% |

| 2023 | -2.52% |

| 2022 | 1.47% |

| 2021 | 48.20% |

| 2020 | -24.30% |

| 2019 | 17.82% |

PFIS Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching PFIS

Here are a few links from around the web to help you further your research on Peoples Financial Services Corp's stock as an investment opportunity:Peoples Financial Services Corp (PFIS) Stock Price | Nasdaq

Peoples Financial Services Corp (PFIS) Stock Quote, History and News - Yahoo Finance

Peoples Financial Services Corp (PFIS) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...