PennyMac Financial Services, Inc. (PFSI): Price and Financial Metrics

PFSI Price/Volume Stats

| Current price | $99.91 | 52-week high | $105.94 |

| Prev. close | $99.30 | 52-week low | $62.15 |

| Day low | $99.35 | Volume | 257,400 |

| Day high | $101.72 | Avg. volume | 245,048 |

| 50-day MA | $93.90 | Dividend yield | 0.8% |

| 200-day MA | $86.08 | Market Cap | 5.09B |

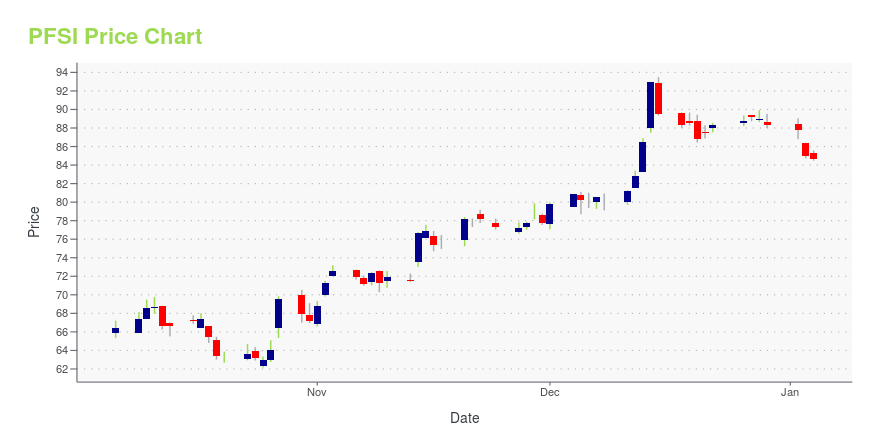

PFSI Stock Price Chart Interactive Chart >

PennyMac Financial Services, Inc. (PFSI) Company Bio

PennyMac Financial Services is a specialty financial services firm with a comprehensive mortgage platform and integrated business focused on the production and servicing of U.S. mortgage loans and the management of investments related to the U.S. mortgage market. The company was founded in 2008 and is based in Moorpark, California.

Latest PFSI News From Around the Web

Below are the latest news stories about PENNYMAC FINANCIAL SERVICES INC that investors may wish to consider to help them evaluate PFSI as an investment opportunity.

Insider Sell Alert: Chief Capital Markets Officer William Chang Sells Shares of PennyMac ...In the realm of financial markets, insider trading activity is often scrutinized for clues about a company's financial health and the confidence that insiders have in the firm's future prospects. |

Insider Sell Alert: Chief Servicing Officer Steven Bailey Sells 23,914 Shares of PennyMac ...In a notable insider transaction, Steven Bailey, the Chief Servicing Officer of PennyMac Financial Services Inc (NYSE:PFSI), sold 23,914 shares of the company on December 11, 2023. |

Insider Sell: Chief Mort Fulfillment Off. ...In a notable insider transaction, Chief Mort Fulfillment Officer James Follette has parted with 21,742 shares of PennyMac Financial Services Inc (NYSE:PFSI) on December 11, 2023. |

PennyMac Financial Services, Inc. Announces Upsizing and Pricing of Private Offering of $750 Million of Senior NotesWESTLAKE VILLAGE, Calif., December 06, 2023--PennyMac Financial Services, Inc. (NYSE: PFSI) and its subsidiaries (the "Company") today announced the pricing of its previously announced offering of $750 million aggregate principal amount of 7.875% Senior Notes due 2029 (the "Notes"). The offering size was increased from the previously announced offering size of $650 million aggregate principal amount of Notes. The Notes will bear interest at 7.875% per annum and will mature on December 15, 2029. |

Pennymac to issue $650M in unsecured debtPennymac Financial Services is the latest mortgage company to issue debt in a challenging market to raise more money for its business. |

PFSI Price Returns

| 1-mo | 8.80% |

| 3-mo | 15.09% |

| 6-mo | 14.51% |

| 1-year | 25.81% |

| 3-year | 73.67% |

| 5-year | 341.96% |

| YTD | 13.55% |

| 2023 | 57.84% |

| 2022 | -17.28% |

| 2021 | 7.69% |

| 2020 | 95.33% |

| 2019 | 60.72% |

PFSI Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching PFSI

Want to do more research on PennyMac Financial Services Inc's stock and its price? Try the links below:PennyMac Financial Services Inc (PFSI) Stock Price | Nasdaq

PennyMac Financial Services Inc (PFSI) Stock Quote, History and News - Yahoo Finance

PennyMac Financial Services Inc (PFSI) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...