SAP SE ADR (SAP): Price and Financial Metrics

SAP Price/Volume Stats

| Current price | $213.45 | 52-week high | $214.94 |

| Prev. close | $210.81 | 52-week low | $126.75 |

| Day low | $210.91 | Volume | 688,287 |

| Day high | $214.05 | Avg. volume | 780,809 |

| 50-day MA | $196.34 | Dividend yield | 0.81% |

| 200-day MA | $174.69 | Market Cap | 251.78B |

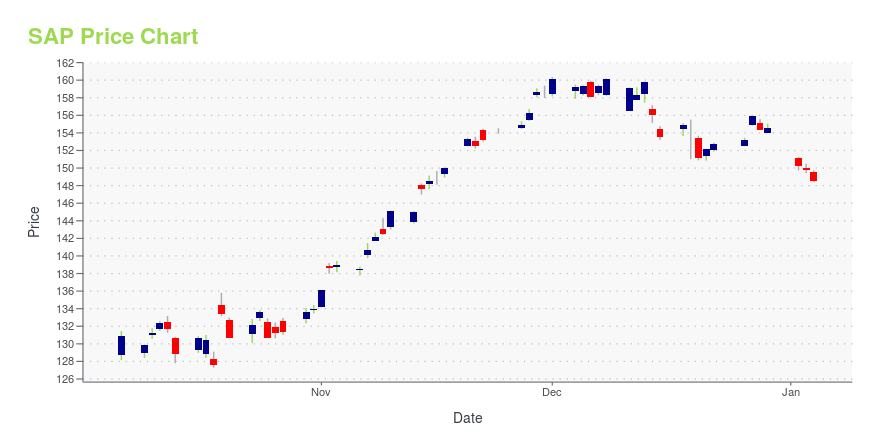

SAP Stock Price Chart Interactive Chart >

SAP SE ADR (SAP) Company Bio

SAP SE (/ˌɛs.eɪˈpiː/; German pronunciation: [ɛsʔaːˈpeː] (listen)) is a German multinational software company based in Walldorf, Baden-Württemberg. It develops enterprise software to manage business operations and customer relations. The company is the world's leading enterprise resource planning (ERP) software vendor. SAP is the largest non-American software company by revenue, the world's third-largest publicly traded software company by revenue, and the second largest German company by market capitalization. Apart from ERP software the company also sells database software and technology (particularly its own brands), cloud engineered systems, and other ERP software products, such as human capital management (HCM) software, customer relationship management (CRM) software (also known as customer experience), enterprise performance management (EPM) software, product lifecycle management (PLM) software, supplier relationship management (SRM) software, supply chain management (SCM) software, business technology platform (BTP) software and programming environment SAP AppGyver for business. (Source:Wikipedia)

Latest SAP News From Around the Web

Below are the latest news stories about SAP SE that investors may wish to consider to help them evaluate SAP as an investment opportunity.

The Next Big Thing: 3 Tech Stocks Ready for a 500% Leap by 2027Are you looking for the next big thing in the stock-market? |

17 Countries With Best Universities In EuropeIn this article, we will be looking at the 17 countries with the best universities in Europe. If you want to skip our detailed analysis of the global textile market, you can go directly to 5 Countries With Best Universities In Europe. Employment Trends in Europe: An Overview The European job market is changing swiftly. […] |

Robotics Revolution: 3 Stocks Engineering the FutureThese top robotics stocks are shaping the future with their innovative strategies, blending profit with technological advancement. |

SAP Surges 48% Year to Date: Will the Upward Trend Continue?SAP's performance is gaining from strength in cloud business as well as opportunities presented by the proliferation of generative AI. |

3 AI Stocks I Wouldn’t Touch With a 10-Foot PoleDiscover the AI stocks to sell before the bull run as we navigate the AI sector's winners and losers for informed investment choices. |

SAP Price Returns

| 1-mo | 7.48% |

| 3-mo | 15.69% |

| 6-mo | 24.01% |

| 1-year | 60.65% |

| 3-year | 58.54% |

| 5-year | 80.58% |

| YTD | 39.33% |

| 2023 | 51.64% |

| 2022 | -24.26% |

| 2021 | 8.77% |

| 2020 | -1.67% |

| 2019 | 35.89% |

SAP Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching SAP

Want to see what other sources are saying about Sap Se's financials and stock price? Try the links below:Sap Se (SAP) Stock Price | Nasdaq

Sap Se (SAP) Stock Quote, History and News - Yahoo Finance

Sap Se (SAP) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...