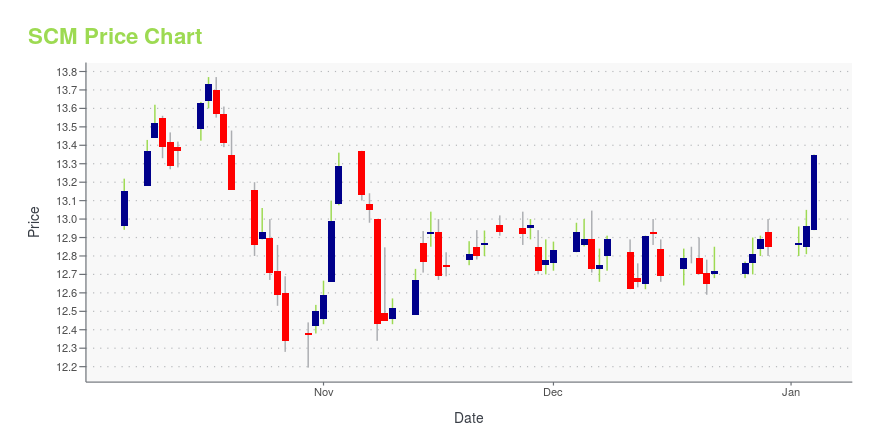

Stellus Capital Investment Corporation (SCM): Price and Financial Metrics

SCM Price/Volume Stats

| Current price | $14.39 | 52-week high | $15.40 |

| Prev. close | $14.24 | 52-week low | $12.19 |

| Day low | $14.29 | Volume | 135,600 |

| Day high | $14.43 | Avg. volume | 134,485 |

| 50-day MA | $13.96 | Dividend yield | 11.21% |

| 200-day MA | $13.33 | Market Cap | 347.17M |

SCM Stock Price Chart Interactive Chart >

Stellus Capital Investment Corporation (SCM) Company Bio

Stellus Capital Investment Corporation is a business development company specializing in investments in private middle-market companies. It invests through first lien, second lien, unitranche, and mezzanine debt financing, often with a corresponding equity investment. The company was founded in 2012 and is based in Houston, Texas.

Latest SCM News From Around the Web

Below are the latest news stories about STELLUS CAPITAL INVESTMENT CORP that investors may wish to consider to help them evaluate SCM as an investment opportunity.

13 Cheap Monthly Dividend Stocks to BuyIn this article, we discuss 13 cheap monthly dividend stocks to buy. You can skip our detailed analysis of dividend stocks and their previous performance, and go directly to read 5 Cheap Monthly Dividend Stocks to Buy. According to a Wisdom Tree report, dividends have increased by an average of 5.7% annually since 1957—over 2% […] |

Stellus Capital Investment Corporation (NYSE:SCM) Q3 2023 Earnings Call TranscriptStellus Capital Investment Corporation (NYSE:SCM) Q3 2023 Earnings Call Transcript November 8, 2023 Operator: Good morning, ladies and gentlemen, and thank you for standing by. At this time, I would like to welcome everyone to Stellus Capital Investment Corporation’s Conference Call to Report Financial Results for its Third Fiscal Quarter Ended September 30, 2023. [Operator […] |

Q3 2023 Stellus Capital Investment Corp Earnings CallQ3 2023 Stellus Capital Investment Corp Earnings Call |

Stellus Capital Investment Corporation Reports Results for its Third Fiscal Quarter Ended September 30, 2023Stellus Capital Investment Corporation (NYSE:SCM) ("Stellus" or the "Company") today announced financial results for its third fiscal quarter ended September 30, 2023. |

Stellus Capital Investment Corporation Schedules Third Quarter 2023 Financial Results Conference CallStellus Capital Investment Corporation (NYSE: SCM) will release its financial results for the third quarter ended September 30, 2023 on Tuesday, November 7, 2023, after the close of the stock market. |

SCM Price Returns

| 1-mo | 5.99% |

| 3-mo | 4.74% |

| 6-mo | 13.58% |

| 1-year | 6.57% |

| 3-year | 46.95% |

| 5-year | 67.45% |

| YTD | 18.79% |

| 2023 | 8.68% |

| 2022 | 12.87% |

| 2021 | 30.09% |

| 2020 | -14.13% |

| 2019 | 20.97% |

SCM Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching SCM

Want to do more research on Stellus Capital Investment Corp's stock and its price? Try the links below:Stellus Capital Investment Corp (SCM) Stock Price | Nasdaq

Stellus Capital Investment Corp (SCM) Stock Quote, History and News - Yahoo Finance

Stellus Capital Investment Corp (SCM) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...