Texas Instruments Inc. (TXN): Price and Financial Metrics

TXN Price/Volume Stats

| Current price | $216.62 | 52-week high | $221.69 |

| Prev. close | $216.59 | 52-week low | $139.95 |

| Day low | $215.91 | Volume | 4,550,200 |

| Day high | $218.65 | Avg. volume | 7,169,522 |

| 50-day MA | $197.65 | Dividend yield | 2.51% |

| 200-day MA | $0.00 | Market Cap | 196.79B |

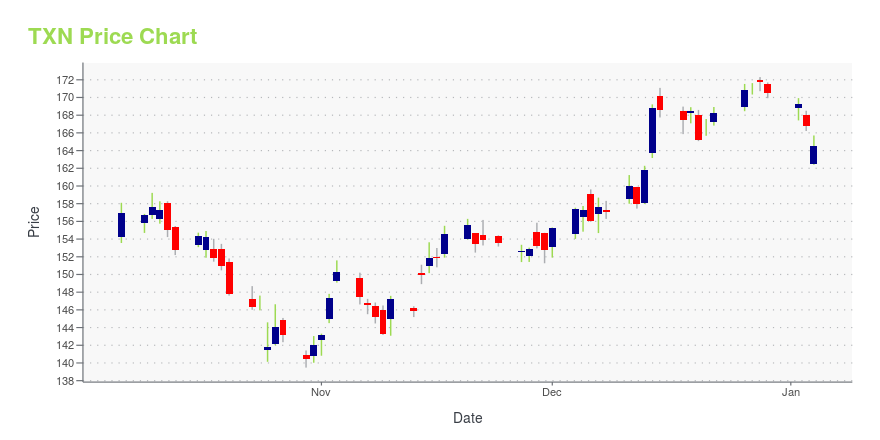

TXN Stock Price Chart Interactive Chart >

Texas Instruments Inc. (TXN) Company Bio

Texas Instruments Incorporated (TI) is an American technology company headquartered in Dallas, Texas, that designs and manufactures semiconductors and various integrated circuits, which it sells to electronics designers and manufacturers globally. It is one of the top 10 semiconductor companies worldwide based on sales volume. The company's focus is on developing analog chips and embedded processors, which account for more than 80% of its revenue. TI also produces TI digital light processing technology and education technology products including calculators, microcontrollers and multi-core processors. The company holds 45,000 patents worldwide as of 2016. (Source:Wikipedia)

TXN Price Returns

| 1-mo | 9.29% |

| 3-mo | 50.04% |

| 6-mo | 12.73% |

| 1-year | 11.99% |

| 3-year | 42.23% |

| 5-year | 83.92% |

| YTD | 17.37% |

| 2024 | 13.14% |

| 2023 | 6.41% |

| 2022 | -9.86% |

| 2021 | 17.53% |

| 2020 | 31.70% |

TXN Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching TXN

Want to do more research on Texas Instruments Inc's stock and its price? Try the links below:Texas Instruments Inc (TXN) Stock Price | Nasdaq

Texas Instruments Inc (TXN) Stock Quote, History and News - Yahoo Finance

Texas Instruments Inc (TXN) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...