UBS Group AG (UBS): Price and Financial Metrics

UBS Price/Volume Stats

| Current price | $30.55 | 52-week high | $32.13 |

| Prev. close | $30.17 | 52-week low | $21.34 |

| Day low | $30.33 | Volume | 775,445 |

| Day high | $30.63 | Avg. volume | 2,436,143 |

| 50-day MA | $30.64 | Dividend yield | 0.74% |

| 200-day MA | $28.84 | Market Cap | 97.96B |

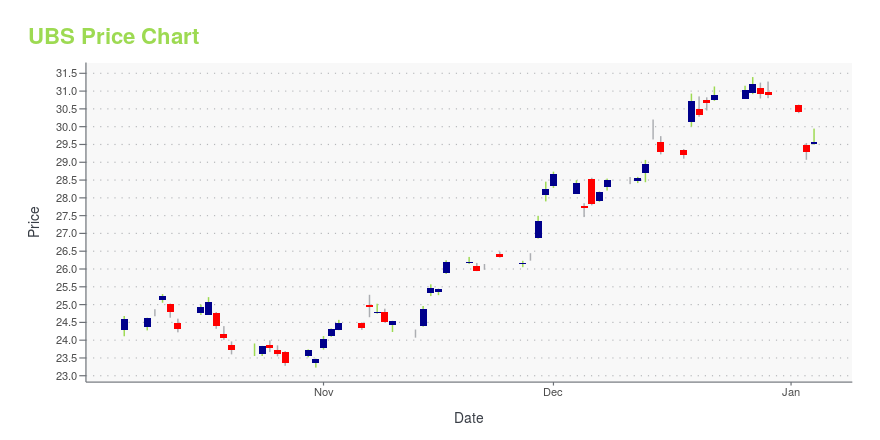

UBS Stock Price Chart Interactive Chart >

UBS Group AG (UBS) Company Bio

UBS Group AG is a multinational investment bank and financial services company founded and based in Switzerland. Co-headquartered in the cities of Zürich and Basel, it maintains a presence in all major financial centres as the largest Swiss banking institution and the largest private bank in the world. UBS client services are known for their strict bank–client confidentiality and culture of banking secrecy. Because of the bank's large positions in the Americas, EMEA, and Asia Pacific markets, the Financial Stability Board considers it a global systemically important bank. (Source:Wikipedia)

Latest UBS News From Around the Web

Below are the latest news stories about UBS GROUP AG that investors may wish to consider to help them evaluate UBS as an investment opportunity.

‘Guess What, Buddy? I’m a Match.’ How Work Friends Saved One Banker’s Life.In May, Bill Carroll’s doctor told him that his one functioning kidney, which his wife had donated to him seven years earlier, was failing. At work, the UBS wealth management executive told the grim news to his colleague Jane Schwartzberg. A few decades ago, kidney donations from people who weren’t blood relatives of the recipients were extremely rare. |

15 Prominent NYSE Stocks That Hit 52-Week Highs This WeekIn this article, we will take a look at the 15 prominent NYSE stocks that hit 52-week highs this week. To skip our analysis of the recent trends, and market activity, you can go directly to see the 5 Prominent NYSE Stocks That Hit 52-Week Highs This Week. The Wall Street ended another week in […] |

7 Unusual Options Activity Stocks That You Need to Pay Attention ToOne of the beautiful aspects of the derivatives market is that you don’t need to trade options to benefit from the underlying data; case in point is unusual options activity. |

UBS Can Be Morgan Stanley, Says ActivistCevian Capital is making a $1.3 billion bet that Swiss bank UBS can reach the same valuation multiple as Morgan Stanley. |

These Stocks Moved the Most Today: Affirm, Sunnova, Enphase, Chewy, FuelCell, Boeing, and MoreAffirm will provide buy-now-pay-later services at Walmart self-checkout kiosks, Sunnova Energy surges after shares of the solar company are upgraded, and Enphase Energy is cutting 10% of its workforce. |

UBS Price Returns

| 1-mo | 4.59% |

| 3-mo | 12.53% |

| 6-mo | 3.15% |

| 1-year | 41.86% |

| 3-year | 93.38% |

| 5-year | 180.19% |

| YTD | -0.29% |

| 2023 | 66.90% |

| 2022 | 5.40% |

| 2021 | 27.41% |

| 2020 | 13.41% |

| 2019 | 1.62% |

UBS Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching UBS

Here are a few links from around the web to help you further your research on UBS Group AG's stock as an investment opportunity:UBS Group AG (UBS) Stock Price | Nasdaq

UBS Group AG (UBS) Stock Quote, History and News - Yahoo Finance

UBS Group AG (UBS) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...