Vodafone Group PLC ADR (VOD): Price and Financial Metrics

VOD Price/Volume Stats

| Current price | $9.47 | 52-week high | $10.19 |

| Prev. close | $9.27 | 52-week low | $8.02 |

| Day low | $9.30 | Volume | 4,176,273 |

| Day high | $9.47 | Avg. volume | 6,835,104 |

| 50-day MA | $9.19 | Dividend yield | 10.32% |

| 200-day MA | $8.92 | Market Cap | 25.52B |

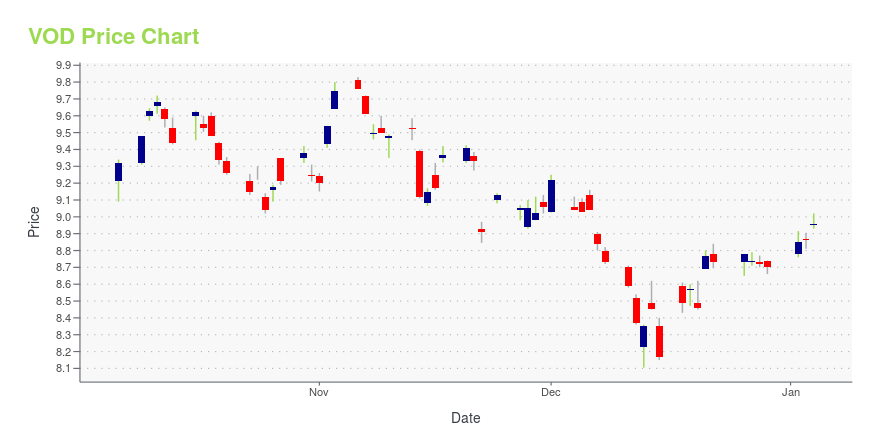

VOD Stock Price Chart Interactive Chart >

Vodafone Group PLC ADR (VOD) Company Bio

Vodafone Group Plc provides a range of mobile telecommunications services, including voice and data communications worldwide. The company was founded in 1984 and is based in Newbury, the United Kingdom.

Latest VOD News From Around the Web

Below are the latest news stories about VODAFONE GROUP PUBLIC LTD CO that investors may wish to consider to help them evaluate VOD as an investment opportunity.

Basic Materials Roundup: Market TalkFind insight on China’s coal-mining capex, the outlook for mining stocks and more in the latest Market Talks covering the Basic Materials sector. |

Tech, Media & Telecom Roundup: Market TalkGain insight on Chinese videogame regulators, tencent, and more in the latest Market Talks covering Technology, Media and Telecom. |

Surging bills prompt people to keep mobile phones for longerMobile phones are being kept for longer as surging bills force consumers to be more savvy with their spending. |

12 Most Profitable Cheap Stocks To BuyIn this piece, we will take a look at the 12 most profitable cheap stocks to buy. If you want to skip our coverage of the latest happenings in the renewable energy industry, then you can skip ahead to 5 Most Profitable Cheap Stocks To Buy. As investors seek to exit 2023 with the hopes […] |

Octopus Energy achieves £6.2bn valuation after raising £625m from investorsOctopus Energy has boosted its valuation to $8bn (£6.3bn) after raising $800m from investors. |

VOD Price Returns

| 1-mo | 7.61% |

| 3-mo | 15.50% |

| 6-mo | 9.89% |

| 1-year | 7.98% |

| 3-year | -26.01% |

| 5-year | -25.10% |

| YTD | 14.44% |

| 2023 | -4.80% |

| 2022 | -27.33% |

| 2021 | -3.79% |

| 2020 | -9.39% |

| 2019 | 5.57% |

VOD Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching VOD

Here are a few links from around the web to help you further your research on Vodafone Group Public Ltd Co's stock as an investment opportunity:Vodafone Group Public Ltd Co (VOD) Stock Price | Nasdaq

Vodafone Group Public Ltd Co (VOD) Stock Quote, History and News - Yahoo Finance

Vodafone Group Public Ltd Co (VOD) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...