Johnson Outdoors Inc. - (JOUT): Price and Financial Metrics

JOUT Price/Volume Stats

| Current price | $42.02 | 52-week high | $64.71 |

| Prev. close | $42.29 | 52-week low | $41.16 |

| Day low | $41.16 | Volume | 42,100 |

| Day high | $42.36 | Avg. volume | 44,040 |

| 50-day MA | $44.22 | Dividend yield | 3.12% |

| 200-day MA | $50.39 | Market Cap | 432.13M |

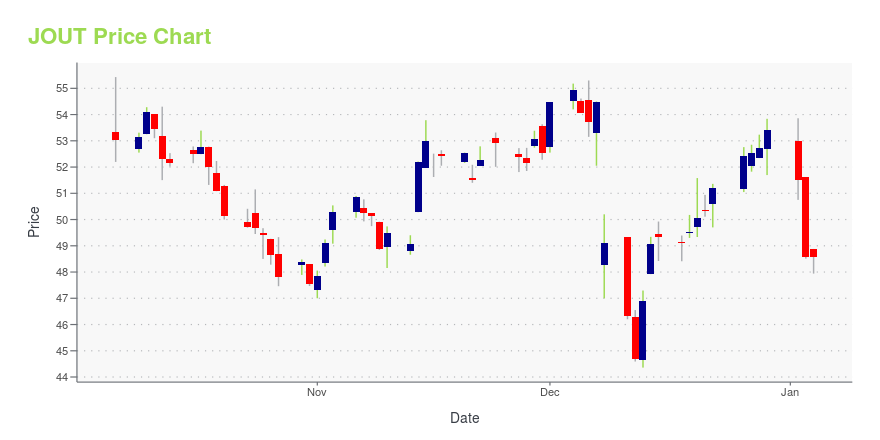

JOUT Stock Price Chart Interactive Chart >

Johnson Outdoors Inc. - (JOUT) Company Bio

Johnson Outdoors Inc. designs, manufactures, and markets seasonal outdoor recreation products used for fishing, diving, paddling, hiking, and camping primarily in the United States, Canada, Europe, and the Pacific Basin. The company was founded in 1985 and is based in Racine, Wisconsin.

Latest JOUT News From Around the Web

Below are the latest news stories about JOHNSON OUTDOORS INC that investors may wish to consider to help them evaluate JOUT as an investment opportunity.

13 Most Promising Small-Cap Stocks According to AnalystsIn this piece, we will take a look at the 13 most promising small-cap stocks according to analysts. If you want to skip our overview of small cap investing and the latest stock market news, then you can take a look at the 5 Most Promising Small-Cap Stocks To Buy. Within the broader world of […] |

Johnson Outdoors Inc. Annual Shareholders MeetingRACINE, Wis., Dec. 18, 2023 (GLOBE NEWSWIRE) -- Johnson Outdoors Inc. (Nasdaq: JOUT), a leading global innovator of outdoor recreation equipment and technology, will hold its Annual Shareholders meeting on Wednesday, February 28, 2024, beginning at 8:00 a.m. Central Standard Time. The annual meeting will be a completely “virtual meeting.” Shareholders of record as of December 20, 2023, will be able to attend the annual meeting as well as vote and submit questions during the live webcast of the m |

The past three years for Johnson Outdoors (NASDAQ:JOUT) investors has not been profitableIf you are building a properly diversified stock portfolio, the chances are some of your picks will perform badly. Long... |

Johnson Outdoors Inc. (NASDAQ:JOUT) Q4 2023 Earnings Call TranscriptJohnson Outdoors Inc. (NASDAQ:JOUT) Q4 2023 Earnings Call Transcript December 8, 2023 Operator: Hello, everyone, and welcome to the Johnson Outdoors Fourth Quarter 2023 Earnings Conference Call. Today’s call will be led by Helen Johnson-Leipold, Johnson Outdoors Chairman and Chief Executive Officer. Also on the call is David Johnson, Vice President and Chief Financial Officer. […] |

Johnson Outdoors' (JOUT) Q4 Earnings and Sales Miss EstimatesModerating pandemic-driven demand and elevated retail inventory levels hurt Johnson Outdoors' (JOUT) Q4 performance. |

JOUT Price Returns

| 1-mo | -7.52% |

| 3-mo | -13.01% |

| 6-mo | -10.88% |

| 1-year | -25.11% |

| 3-year | -69.68% |

| 5-year | -40.77% |

| YTD | -20.22% |

| 2023 | -17.48% |

| 2022 | -28.12% |

| 2021 | -16.17% |

| 2020 | 48.21% |

| 2019 | 31.73% |

JOUT Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching JOUT

Want to do more research on Johnson Outdoors Inc's stock and its price? Try the links below:Johnson Outdoors Inc (JOUT) Stock Price | Nasdaq

Johnson Outdoors Inc (JOUT) Stock Quote, History and News - Yahoo Finance

Johnson Outdoors Inc (JOUT) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...