Sociedad Quimica y Minera S.A. (SQM): Price and Financial Metrics

SQM Price/Volume Stats

| Current price | $43.51 | 52-week high | $81.50 |

| Prev. close | $43.27 | 52-week low | $38.50 |

| Day low | $42.13 | Volume | 1,212,300 |

| Day high | $43.62 | Avg. volume | 1,442,421 |

| 50-day MA | $46.99 | Dividend yield | 2.93% |

| 200-day MA | $54.40 | Market Cap | 12.43B |

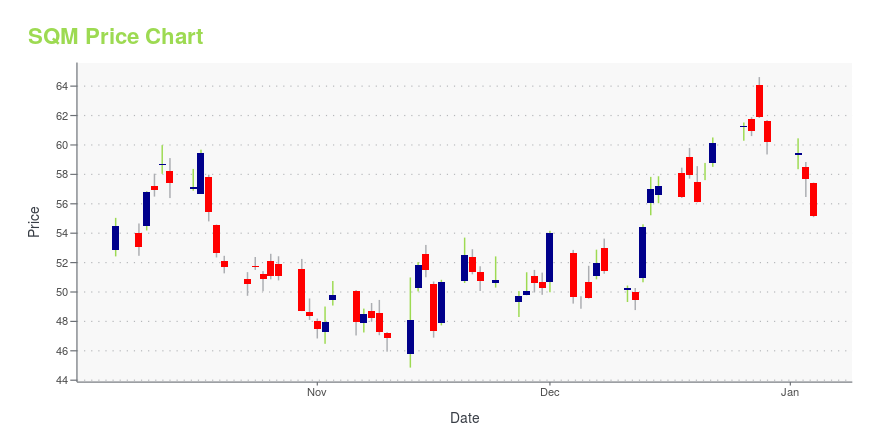

SQM Stock Price Chart Interactive Chart >

Sociedad Quimica y Minera S.A. (SQM) Company Bio

Chemical & Mining Company of Chile is an integrated producer and distributor of specialty plant nutrients, iodine, lithium, potassium-related fertilizers and industrial chemicals. The company was founded in 1968 and is based in Santiago, Chile.

Latest SQM News From Around the Web

Below are the latest news stories about CHEMICAL & MINING CO OF CHILE INC that investors may wish to consider to help them evaluate SQM as an investment opportunity.

5 Things to Know Before The Stock Market OpensApple resumed sales of watches after an appeals court temporarily paused an International Trade Commission ban on the product, while Chilean lithium miner SQM jumped after it reached a deal to extend access to lithium-rich deposits in that country for three decades. Here’s what investors need to know today. |

Best Lithium Stocks 2024: 7 to Add to Your Must-Buy ListInvestors may want to use recent weakness as an opportunity with these seven beaten-down lithium stocks heading into 2024. |

7 Top Growth Stocks to Buy BEFORE They Take Off in 2024These top growth stocks across high-potential sectors have been executing very well recently and seem poised to take off in 2024. |

Global Giants: 3 Stocks to Buy in Emerging EconomiesEmerging economies stocks must be a part of every healthy portfolio, get started by adding these to your watchlist so you don't miss out. |

13 Best Lithium Stocks To Buy NowIn this article, we will take a look at 13 of the best lithium stocks to buy now. To skip our analysis of the lithium industry and its impacts on the battery and EV sectors, go directly to the 5 Best Lithium Stocks To Buy Now. Often lauded as the ‘new oil’ of the clean […] |

SQM Price Returns

| 1-mo | -10.27% |

| 3-mo | -7.35% |

| 6-mo | -13.55% |

| 1-year | -31.73% |

| 3-year | -9.09% |

| 5-year | 42.70% |

| YTD | -27.75% |

| 2023 | -20.68% |

| 2022 | 67.65% |

| 2021 | 5.36% |

| 2020 | 87.33% |

| 2019 | -28.34% |

SQM Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching SQM

Want to see what other sources are saying about Chemical & Mining Co Of Chile Inc's financials and stock price? Try the links below:Chemical & Mining Co Of Chile Inc (SQM) Stock Price | Nasdaq

Chemical & Mining Co Of Chile Inc (SQM) Stock Quote, History and News - Yahoo Finance

Chemical & Mining Co Of Chile Inc (SQM) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...