Elon Musk has long defied the skeptics as he went on to build a solar, space ship and have an electric car company. In the process, shares of his company Tesla (TSLA) have both defied gravity and befuddled the bears.

But, it seems that the company is now facing some operational realities with cracks are beginning to show in the business.

On Friday, Tesla’s shares plunged 12% — it’s largest one day drop in over year, to $302 per share after the company announced plans to lay off 7% of its workforce.

This is the second round of job cuts since June and also comes on the heels of the company being forced to cut prices on its vehicles to compensate for a reduction in U.S. tax incentives for buyers, which will eventually be phased out. It’s slated to happen in May of this year.

Strangely enough, it was just two quarters or so ago when Tesla announced, in terms of layoffs, that Elon Musk said, “I also want to emphasize that we are making this hard decision now so that we never have to do this again.”

Too Expensive, Too Little Demand

The usually upbeat Musk took a decidedly more dour tone in this latest message writing, “our products are still too expensive for most people. It seems we likely have burned through accumulated higher priced orders, exposing limited demand increasingly sensitive to tax credits reductions and new competition.”

He added, “that higher volume and manufacturing improvements are needed to be able to produce the company’s $35,000 version of its Model 3 Sedan and still be a viable company.”

The problem is that nearly three years after Tesla began taking deposits for such a vehicle, an offering at that price point is nowhere in sight.

Convert Bonds Due Could Spell Doom

The reason for Musk’s downbeat mood is likely tied to the fact this bad news couldn’t have come at a worse time.

For most of the past year, Musk has consistently reiterated the company would not need to raise more capital — even as it burned through cash. And the fact the company turned cash flow positive during the second quarter seemed to warrant his optimism and relieve investors.

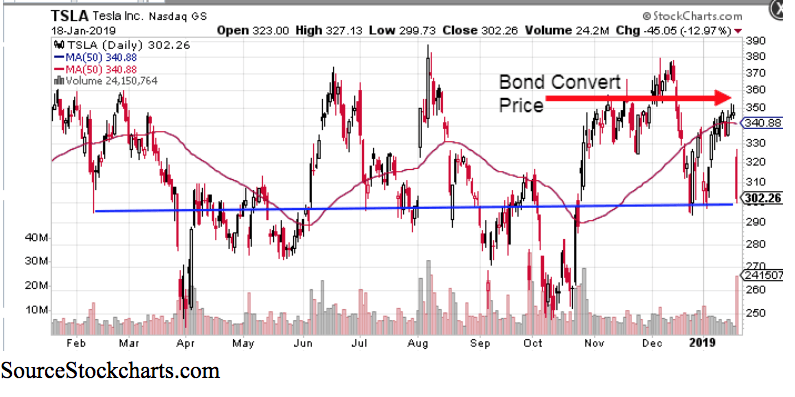

Shares soared in days, and weeks following that October Q2 report, nearly reaching the $385 high achieved following this summers’ “funding secured” tweet. They also managed to hold their own during November decline and recently bounced back to the $350 area.

That is a key level not just from a technical standpoint. But more importantly, as it relates to the trigger point on nearly $1 billion, in convertible bonds due on March 1st.

Tesla has over $10 billion in debt, much in the form of convertible notes — that is bonds that can be exchanged for stocks if the shares are above a certain price at a certain date.

On March 1st, $920 million with a converted price of $359 come due. If shares are not above that level on that date, the company needs to start repaying the principal to the bondholders.

These convertible notes have always been a ticking time bomb for the company, some even suspected the “funded secured” and hints at taking the company private, were moves to good shares above all the conversion levels which run as high as $395 per share.

That’s one of the reasons the otherwise seemingly random $420 takeover price made some sense. Along with the benefit of having some cannabis-related humor.

All of this is making bondholder nervous as notes plunged to a low of 86 cents on the dollar, the clearest sign yet creditors aren’t totally sure the company will be money good.

With the company set to report earnings on Jan 30, anymore bad news, such as a production miss or slowing sales, could tank the stock further putting those notes deeper in the hole.

And that won’t make it any easier for Tesla to persuade bond investors to hand over more money. One area that certainly seems to need a capital infusion is money for building charging stations.

More than halfway into his 3 to 6-month promise to cover all of North America with service centers, half of the states in the US still don’t have one. Additionally, the company needs to average adding 1,000 supercharging stalls each month to meet expansion guidance. Yet through 12 days in January, it has installed just under 100.

The lack of a sub-$35,000 car, and sparse recharging outside of a few coastal cities make it a long road before Tesla can be a mainstream car and a profitable company.

It’s interesting to note that in most of his prior messages Musk has pointed out that Ford and Tesla are the only two U.S. car companies that never filed for bankruptcy. He made no such mention this time around.

With the domino effect of bonds coming due, demand sliding could ultimately drive the company towards bankruptcy.

About the Author: Steve Smith

Steve has more than 30 years of investment experience with an expertise in options trading. He’s written for TheStreet.com, Minyanville and currently for Option Sensei. Learn more about Steve’s background, along with links to his most recent articles. More...

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!