GW Pharma (GWPH) is a medical marijuana company that is truly about “getting well, not getting high” and may end up being the best long term investment in the entire cannabis sector.

Most of the buzz (pun intended) surrounding the cannabis industry pertains to using the THC component for recreational purposes of getting high.

Ther’se also the area of using Cannabidiol (CBD), which is non-intoxicating, in various forms for moderately-therapeutic uses such as pain management, relief of anxiety and nausea other non-life threatening ailments.

A lot of speculative money has been thrown into these areas and will be due for a shakeout with just a few winners and many losers.

And then there are applications that are truly medical. This refers to pharmaceutical applications for developing drugs to treat serious diseases or chronic conditions, ranging from epilepsy to cancer. This area that could have the greatest impact on disrupting the healthcare industry and result in several multi-billion dollar prescription drugs.

My top pick is GW Pharma, a true biotech/pharmaceutical company focused on discovering, developing, and commercializing cannabinoid prescription medicines using botanical extracts derived from the cannabis plant.

Its lead product is Epidiolex, which the FDA approved last year. It is an oral medicine for the treatment of refractory childhood epilepsies, as well as for the treatment of Dravet syndrome, Lennox-Gastaut syndrome, tuberous sclerosis complex, and infantile spasms.

The uptake of Epidiolox has been huge as evidenced by the company’s earnings report today, which showed revenues jumping 66% with the bulk of it coming from the $4.7 million in revenue Epidolex chalked up since its November launch. This is expected to be a $3 billion per year product by 2021.

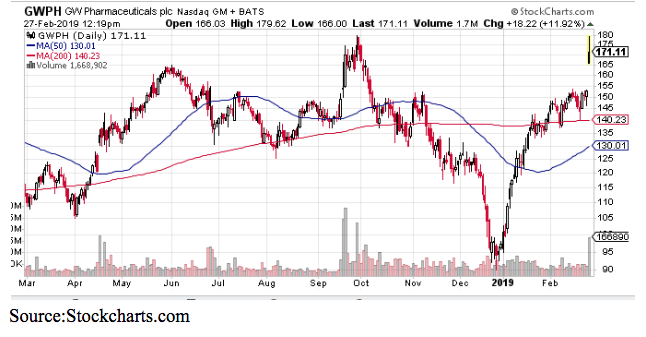

The stock, like many bio-pharma companies, has been volatile. But today’s earnings report has pushed shares up over 10% and back to 52-week highs near $180

GWPH is not a one-trick pony as it has a pipeline of other drugs in the works, such as Sativex, an oromucosal spray for the treatment of spasticity due to multiple sclerosis. And is working on products that are candidates for the treatment of glioblastoma, neonatal hypoxic-ischemic encephalopathy, and schizophrenia. Further, the company has license and development agreements with Almirall S.A. and Bayer HealthCare.

It may be tough to chase right now after today’s big move. But the results confirm that this should be a great long term investment. I’d be looking to add on a pullback into the $160 per share level.

About the Author: Steve Smith

Steve has more than 30 years of investment experience with an expertise in options trading. He’s written for TheStreet.com, Minyanville and currently for Option Sensei. Learn more about Steve’s background, along with links to his most recent articles. More...

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!