All investors dream of finding some secret sauce that can boost investment returns, ideally via a reproducible method that can deliver consistent market-beating returns over time.

In 23 years of investing, and five years as a professional analyst/investment writer I’ve tried/studies many approaches but found few worth recommending and even less worthy of entrusting my entire life savings to.

But just because powerful investing tools are rare, doesn’t mean there aren’t a few that might be just what you need to improve your long-term returns and maximize the chances of reaching your financial goals. Here are the two I’m using with my retirement portfolio, where I keep 100% of my life savings and net worth.

Why I Love Limit Orders and So Should You

I’m a big believer that the easiest road to great investing returns is to stand on the shoulders of giants. In other words emulate the examples of the most successful investors, who used time tested and proven methods to exponentially grow wealth and income over time.

Warren Buffett is famously the most successful investor of all time and one of my favorite quotes from “the Oracle of Omaha” is “We don’t need to be smarter than the rest, we just need to be more disciplined than the rest.”

By which Buffett means that great investing is easy in theory, but much harder in execution. That’s because it’s easy to say things like “buy low, sell high” or “be greedy when others are fearful” but the truth is the world is messy. Human psychology and emotion get in the way, which is why everyone says they want a bargain until it actually arrives.

For example, I used to work at The Motley Fool where a colleague told me about how during the Financial Crisis he was eyeing Starbucks and eager to buy at the best valuations in a decade. The trouble is that every time the price fell to his mental buy point he would think “yes but there are so many reasons it could keep dropping.”

Thus my former colleague didn’t actually buy the stock at all. Like all quality companies, Starbucks kept falling until it didn’t. On March 9th it bottomed along with the broader market and then took off like a bat out of hell. Just as my colleague was unable to bring himself to buy during the crash, he was unable to bring himself to pull the trigger on the way up, because it was so much higher than just the past day, week and month.

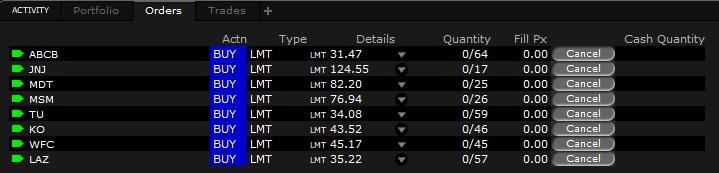

This is where the power of limit orders comes in. Here is a screenshot of the limits I currently have open for my retirement portfolio.

(Source: Interactive Brokers)

Each day I update my limits based on what companies on my watchlist (more on that in a second) are within 10% of my target buy price. I set each limit for my standard order size of $2,000 which is about 0.8% of my portfolio.

The idea is that I want to keep each buy large enough to matter (in case I only get one limit filled) but not so large that I’m unable to double down aggressively in case the market goes nuts and a great quality company crashes hard and fast.

Earnings season is famous for big market overreactions, including blue-chips like Walgreens tanking 13% in a single day. Or how about UnitedHealth crushing expectations, raising guidance AND then tanking 10% intraday (to finish -7% on the day) due to what the CEO said about Medicare For All during the conference call (surprise, he thinks it would be a bad idea, though one that’s not likely to happen).

Limit orders allow you to know exactly what price you’ll pay for any company, or more specifically the most you’ll pay. They convert to market orders when the price is hit and in the case that stock crashes fast (gapping down at the open) you can end up paying a lot less. That’s what happened with my Walgreens limits, where I had all six fill in a day (maxing out my position) and five of those were at the same rock bottom price (far below my actual limits).

The best thing about limits (I set all of mine “good-until-canceled”) is that they let you go about your day without staring at a screen. Once a day I check to see if any of my limits triggered and update the ones I have based on what the market is doing with my watchlist.

This helps me to minimize my risks of overpaying for a company, because I remain resolute and disciplined, offering only to pay less than I’ve calculated a company is worth and only ever putting money to work if the market becomes so pessimistic that someone actually sells me shares at that price or better.

Ok, so the appeal of limit orders is clear and easy enough to understand. But how do you know what limits to set in the first place? That’s where the second investing tool comes in.

Discipline + Limits + A Quality Watchlist = Profit

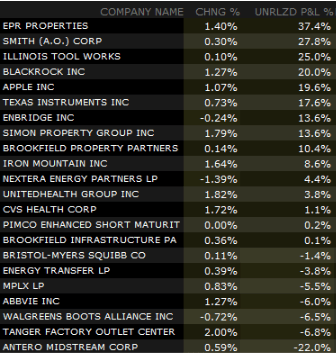

Perhaps the most powerful investing tool of all (that’s not your mind) is a quality watchlist of companies that you’d like to own. What’s in your watchlist will depend on your goals and needs but here’s a glimpse at the one that’s running my retirement portfolio(Source: Google Sheets)

The complete list is 132 companies long and represents five years of research (that’s ongoing and never-ending). As an analyst at Simply Safe Dividends, I cover over 200 companies per year, and as I go through our annual yearly deep dive and thesis update process, I add new companies to the list. They get screened for quality (based on dividend safety, the business model and management quality). Only companies with quality scores of 8+ (out of 11) make the list.

I programmed the spreadsheet to keep track of the 52 week low, derive a limit buy price off that, and tell me when a company was close to that target price. I can also sort the list by distance from limit price and that’s what I base my limit orders on (factoring in position size limits and sector limitation rules I use for risk management).

The watchlist tells me what quality companies are on sale and the limits allow me to put my money to work most effectively for my goals. When a limit triggers I set a new one slightly lower, again for a modest $2,000 in size. This tight spacing of moderate size buys allows me to “catch a falling blue-chip with conviction” and is how I’ve managed to obtain all my biggest winners.

(Source: Google Sheets)

The complete list is 132 companies long and represents five years of research (that’s ongoing and never-ending). As an analyst at Simply Safe Dividends, I cover over 200 companies per year, and as I go through our annual yearly deep dive and thesis update process, I add new companies to the list. They get screened for quality (based on dividend safety, the business model and management quality). Only companies with quality scores of 8+ (out of 11) make the list.

I programmed the spreadsheet to keep track of the 52 week low, derive a limit buy price off that, and tell me when a company was close to that target price. I can also sort the list by distance from limit price and that’s what I base my limit orders on (factoring in position size limits and sector limitation rules I use for risk management).

The watchlist tells me what quality companies are on sale and the limits allow me to put my money to work most effectively for my goals. When a limit triggers I set a new one slightly lower, again for a modest $2,000 in size. This tight spacing of moderate size buys allows me to “catch a falling blue-chip with conviction” and is how I’ve managed to obtain all my biggest winners.

(Source: Interactive Brokers)

My oldest holding is EPR Properties, which I bought in early 2018 during the first correction of that year, and the end of a two year REIT bear market. That stock is now paying me 8% of my investment each year in safe and steadily rising dividends. Including 15 monthly dividend payments, I’m up about 46% in just over a year.

The other big winners were bought during the last correction when the market was freaking out over many risks, like a recession in 2019 (highly unlikely at the time or today), and a trade war that now appears likely to end with a definitive trade deal at the G20 summit on June 20th.

Apple famously fell off a cliff in early January when it announced its first pre-earnings warning in 16 years. I made the high probability assumption that the company wasn’t doomed and bought at $172 (it ultimately bottomed at $142). I didn’t catch the bottom but am still up over 20% including dividends in just five months.

Most recently I’ve been pounding the table (to the tune of $28,000 worth of buys over three weeks) on healthcare blue-chips, which now make up 20% of my portfolio. While I’m not positive on all of those positions, CVS Health (3 limits worth) is already positive and UnitedHealth (three limits worth) is up about 4% within a week.

I’m not a market timer, and I use no technical analysis chart. I simply know what companies are worth owning, and buy them at fantastic prices when the future return potential is greatest because shares are baking in extremely low expectations that quality management teams can easily beat.

This isn’t a complex strategy, just one that requires time, patience, and a well-designed watchlist that I am constantly improving and expanding. Since I began using this approach my annualized total returns have been steadily improving and I expect that to continue. My valuation-adjusted total return model (based on what the investing legends at Brookfield Asset Management use) estimates that my portfolio, from today’s valuations (I’m already up over $20,000 so far) will deliver about 14% long-term total returns.

Given that the market historically delivers 9.1% CAGR total returns (since 1871) and analysts expect between 1% and 7% returns from the S&P 500 over the next five to 10 years, my approach should have me swimming in safe and fast-growing dividends, plus impressive market-beating returns to boot.

Best of all, the approach I’m using, which is hardly the only good investing strategy you can use (just the one that works best for my needs/temperament) is pretty much on auto-pilot now and requires very little upkeep. It’s designed to be reproducible, meaning work consistently over time. I am not relying on any one stock to carry me to riches, but just a lot of smaller positions in quality companies bought at “fat pitch” prices. It’s also infinitely scalable and will work well whether I have $2,000 to invest per trade or $2 million.

That’s why I’m entrusting my entire life savings to this strategy, which is based on several time-tested and proven strategies that have worked for decades are likely to continue working for the foreseeable future.

Bottom Line: Great Investing Returns Require Both the Right Approach and Minimizing The Damaging Effects of Investor Emotion

It would be wonderful if investing were entirely about logic, probabilities, fundamentals and valuation. That would allow us to fully automate a successful strategy and just wait to get rich over time.

Unfortunately, the stock market is based on real companies, run by humans, who sell goods/services to people all over the world. That means there are few absolutes and a whole lot of grey areas requiring a lot of judgment and thought.

Fortunately, while you can’t entirely automate a sure-fire investing system, you can come close by combining the power of a quality watchlist with limit orders. This lets you remain highly disciplined, and follow the time tested mantra of “quality first, valuation second, and patience and discipline always.”

Limit orders allow you to determine the price of a company that meets your investing objectives, at a valuation that both minimizes risk and maximizes total return potential. Then you can just sit back and let the market decide what companies you buy, when and how much.

While this approach isn’t 100% guaranteed (no strategy is) it’s a high probability technique that maximizes your ability to remain disciplined, patient and harness the market’s famous twin abilities to be infinitely irrational in the short-term, and to compound wealth and income exponentially over time.

Just remember that limits and watchlists still require the use of prudent risk management and asset allocation. All investing is probabilistic meaning something can (and eventually will) go wrong with a company you buy. Proper diversification (position/sector caps) and good asset allocation (owning the right mix of cash/bonds for your needs) will let you remain disciplined and meet expenses during those inevitable future times when the market freaks out and even the highest quality blue-chips crash.

And best of all, if you combine the power of a good watchlist with limit orders, then during such periods you might be able to set yourself up for truly impressive returns, even with low-risk blue-chip stocks.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!