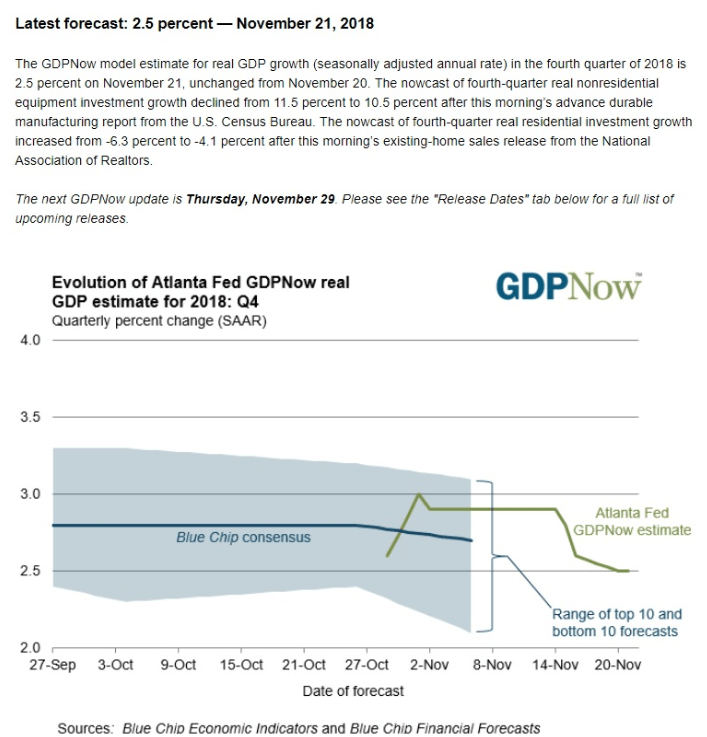

The current economist consensus is that America’s economy will grow just 2.6% this quarter, and the usually optimistic Atlanta Fed’s GDP now model say 2.5% growth is likely. That agrees with the New York Fed’s Nowcast which also calls for 2.5% growth.

Keep in mind that 2+% economic growth is still good, and not indicative of a coming recession. But the point is that 2018 was expected to be a very strong growth year for the US, with growth slowing to just 2.5% in 2019 and 2.0% in 2020 (due to fiscal stimulus wearing off). For growth to slow to 2.5% this early, and before US tariffs on Chinese imports are really even taking effect, is a worrying sign to economists, analysts, and administration officials. Goldman Sachs even believes that if the trade war continues all 2019 that US GDP growth will continue falling, hitting 1.6% in Q4 2019.

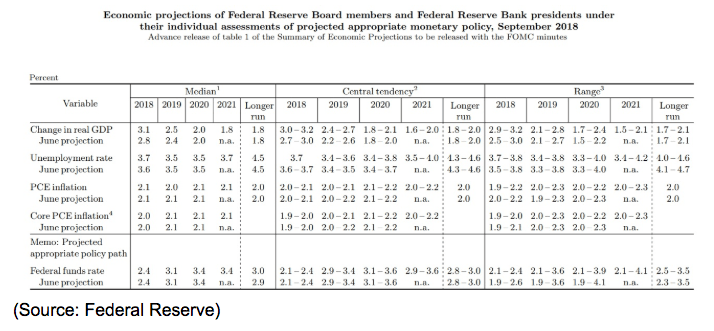

The Federal Reserve (and most economists) expect 2.5% GDP growth next year, 2.0% in 2020 and growth to finally bottom at 1.8% in 2021 and beyond. If the trade war reaches its maximum point (25% tariffs on all Chinese imports) and Goldman Sachs is right, then US growth could fall to levels significantly below even these highly conservative estimates, and two years ahead of expectation to boot.

Remember that President Trump is running for re-election in 2020 and his entire campaign strategy is to run on peace and prosperity that results from his promise to deliver “great deals” on trade and tax cuts. The tax cut stimulus is now over and done with, and so without a trade deal that removes the economic anchor that tariffs represent, his political life could be on the line if the US economy is growing under 2% in 2020.

Here are my thoughts on it…

Click on the Next Page to Continue Reading

About the Author:

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!