A.O Smith (AOS)

Yield: 1.9%

Estimated Fair Value: $79

Discount To Fair Value: 40%

10 Year Analyst EPS/Dividend Growth Consensus: 9.9%

10 Year CAGR Total Return Potential: 17%

A.O Smith is an industrial dividend aristocrat and thus its share price has been battered in recent months by both fears of a slowing economy as well as the trade war. That’s because of A.O Smith, a leading producer of water heaters and air/water purifiers, is extremely exposed to China.

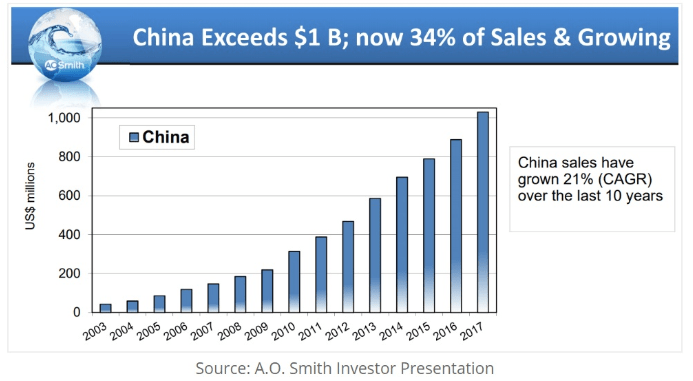

The company entered China’s market back in 2003 and has done a masterful job of establishing a 9,000 strong distributor network in 30% of China’s largest cities and 70% of its medium-sized cities. That’s fueled 21% sales growth which means that today over $1 billion or 34% of the company’s revenue comes from the middle kingdom.

But now with the trade war threatening its biggest growth market, (and slowing China’s economic growth), Wall Street is terrified that A.O Smith’s best growth days are behind it. But what the street is missing is that A.O Smith isn’t just the best way US dividend investors can profit from China’s growth, but India’s as well.

In fact, A.O Smith is my favorite dividend growth stock set to profit from the massive growth in both China’s and India’s middle class. A.O Smith set up its first office in India in 2008, began making and selling water heaters in 2010, and then water/air purifiers in 2015.

What does this mean for the markets?…

Click on the Next Page to Continue Reading

About the Author:

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!