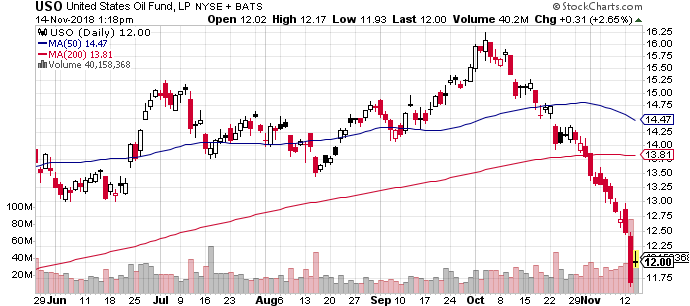

Meanwhile, oil has taken a steep tumble, going from a year high of about $76.50 to a new 52 week low of $55.50, which is a 28% decline in less than a month. This month included a record 12 consecutive down days for oil; the most rapid in the 45 years of tracking the data.

Source:Stockchart.com

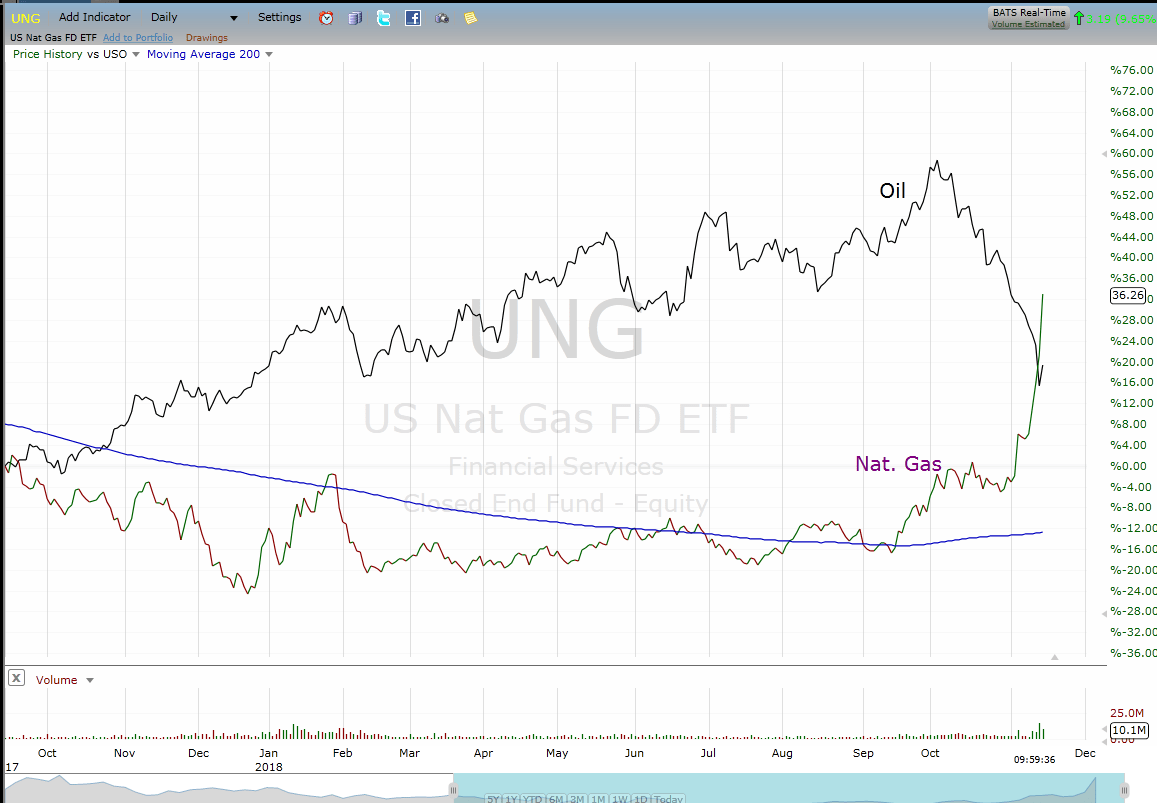

Source:Stockchart.com

The Big Unwind

The opposing price moves in natural gas and oil has accelerated over the past few days, as many people believe one or more large hedge funds were forced out of what is now a losing trade.

Mark Fisher, head of MBF Asset Management, spoke on CNBC this morning and said the price moves the past few days were exaggerated by hedge funds unwinding massive paired trade long oil/short natural gas saying, “They’ve been playing this aggressively all year and swiftness has more to do with forced liquidation rather than dramatic shift in fundamentals. Several might be put out business here.”

Fisher thinks today could represent the culmination of the unwind and therefore we’re near the lows for oil.

Source:Freestockchart.com

About the Author:

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!