Amtech Systems, Inc. (ASYS - Get Rating) is a chip company that sells capital equipment and related consumables for use in fabricating silicon carbide (SiC), silicon power devices, analog and discrete devices, and Light-Emitting Diodes (LEDs).

The broader semiconductor industry is alight with prospects due to the dynamic tech landscape, which requires a steady supply of chips. According to the Semiconductor Industry Association (SIA), global semiconductor industry sales were $46.6 billion in October 2023, indicating an increase of 3.9% compared to September.

However, sales were 0.7% year-over-year. Moreover, global chip sales are expected to decrease by 9.4% in 2023. However, they are projected to increase by 13.1% in 2024.

Against this backdrop, for the third fiscal quarter (ended June 30), ASYS’ net revenues increased 54% year-over-year but declined about 8% sequentially to $30.74 million, missing the consensus revenue estimate of $32.85 million by 6.4%.

Now, let’s look at the trends of ASYS’ key financial metrics to understand why it could be wise to watch and wait for a better entry point in the stock before its fourth-quarter earnings release on December 13.

Analyzing Amtech Systems, Inc.’s (ASYS) Financial Performance and Projections from 2020 to 2023

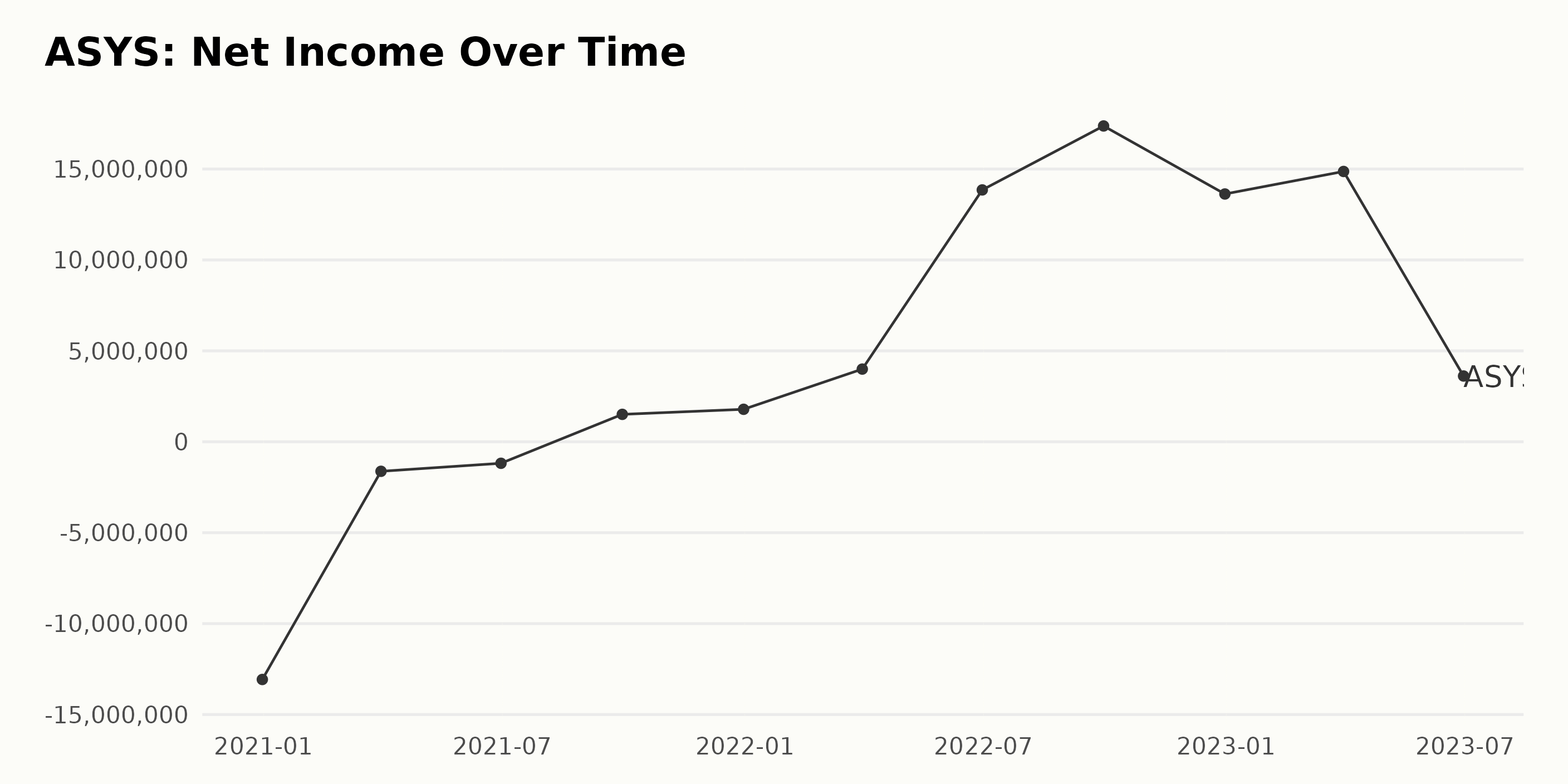

The trailing-12-month net income of ASYS has shown a significant upward trend from December 2020 to June 2023, with a few fluctuations.

- Starting with a net income of -$13.07 million in December 2020, ASYS faced what appears to be a temporary setback.

- By March 2021, the losses narrowed to -$1.62 million, followed by a slightly lower figure of -$1.18 million in June 2021.

- In September 2021, ASYS reported its first positive net income of $1.51 million, marking the beginning of stable growth in the succeeding periods.

- The company’s progress continued through December 2021 and March 2022, reporting net incomes of $1.79 million and $3.99 million, respectively.

- A significant leap was witnessed in June 2022 when the net income surged to $13.85 million, further escalating to $17.37 million by September 2022.

- There was a slight pullback to $13.63 million in December 2022, but the net income remained largely impressive, indicating sustained growth.

- In March 2023, another increase to $14.87 million was reported, further emphasizing the consistent expansion of ASYS’ profitability.

- The latest data point shows a sharp dip to $3.62 million in June 2023, suggesting possible fluctuation or temporary setbacks amid an overall upward economic trend.

The growth rate calculated from the first value (December 2020) to the last (June 2023) indicates a significant turnaround for ASYS, turning its net income from -$13.07 million to a positive $3.62 million. This signifies not only recovery from losses but also an appreciation in earnings, demonstrating an impressive growth trajectory.

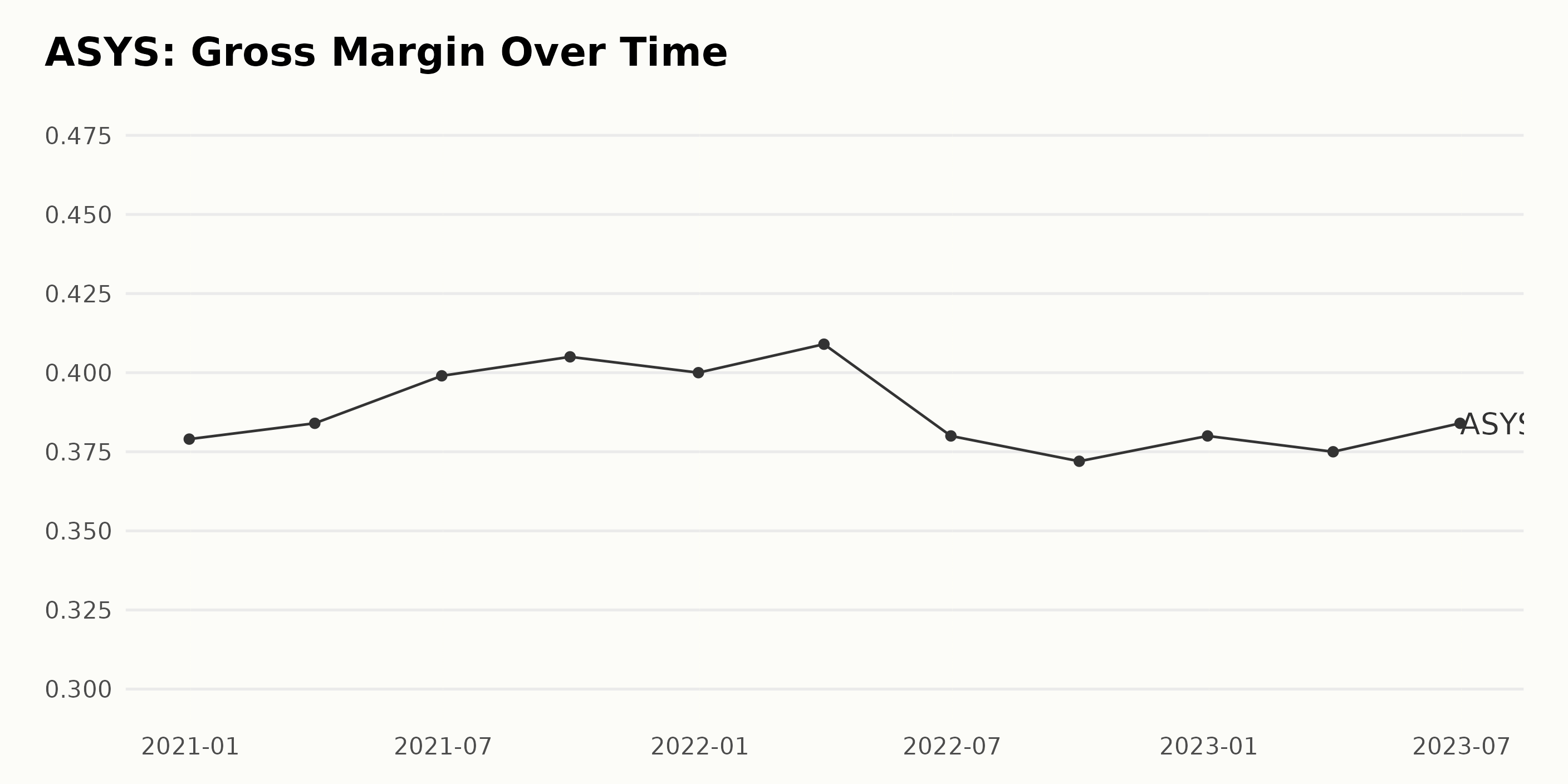

The gross margin trend for ASYS presents a pattern of fluctuations over the reported periods. Although there is a general increase from December 2020 to March 2022, the figures appear to experience a decline then, followed by recovery.

- The gross margin starts at 37.9% in December 2020, presenting the base value.

- A gradual increment is observed through the months, hitting 40.5% in September 2021.

- It shows a minor dip in December 2021 at 40% but picks up again to reach 40.9% in March 2022, the highest margin within this period.

- Then, the gross margin experienced a downturn, falling to 38% in June 2022 and bottoming out at 37.2% in September 2022.

- From December 2022, the gross margin seems to rebound reaching 38%, and it continues to rise gradually to 38.4% in June 2023.

Overall, comparing the last recorded value from June 2023 (38.4%) to the initial value from December 2020 (37.9%), we can calculate the growth rate of gross margin for ASYS as approximately 1.3%. This points toward rather subtle progress over the given period despite the noticeable fluctuations in the intervening times.

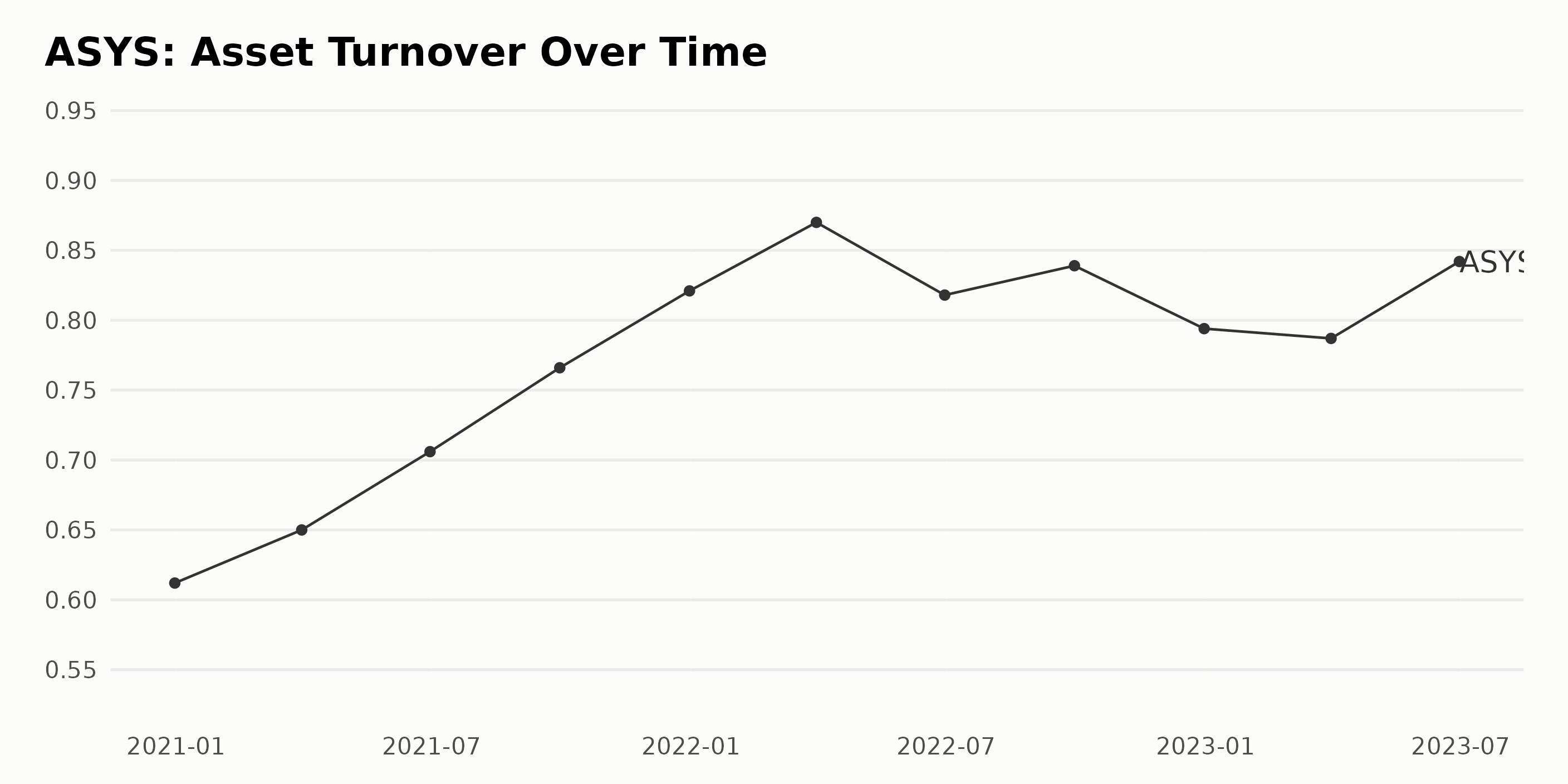

The data series reflects the asset turnover of ASYS from December 2020 to June 2023. An overall analysis reveals a mostly increasing trend despite some slight fluctuations.

- Starting at 0.61 in December 2020, the asset turnover rate gradually improved.

- The highest peak was noted in March 2022 at 0.87, marking a growth rate of approximately 42% from the first value.

- There were slight declines after this peak, with the asset turnover dipping to 0.79 in December 2022 before slightly bouncing back to 0.84 toward the end of the period in review (June 2023), which is still higher than the value at the beginning of the period.

- The last value in the series recorded in June 2023 is 0.84, although it is slightly lower than the March 2022 peak, showing an overall upward trend since the beginning of the observation period.

The data indicates that even though there were periods of slight dipping in ASYS’ asset turnover, the overall trend shows an increase within the reviewed time frame, illustrating an improvement in the company’s ability to generate revenue from its assets.

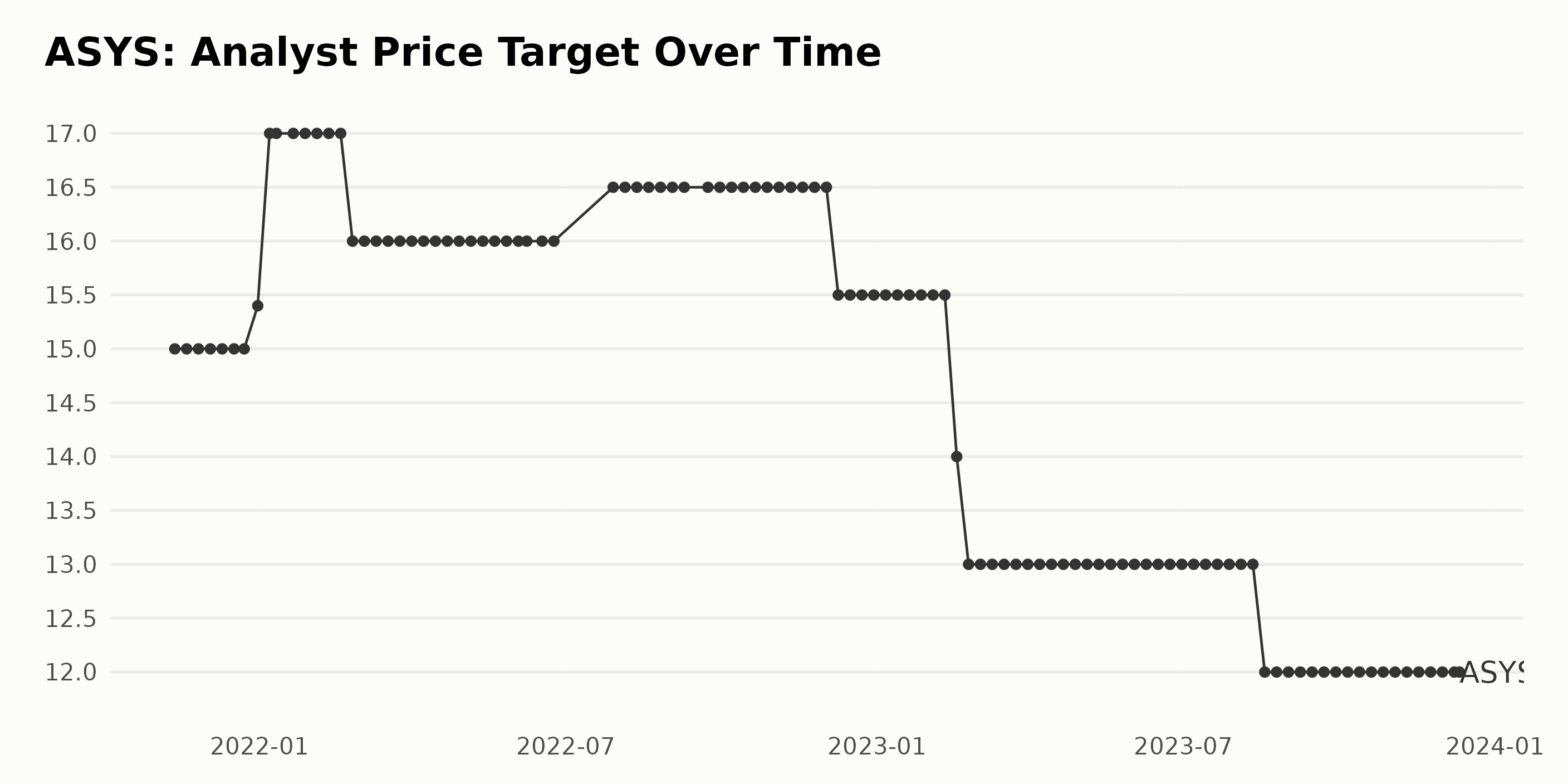

The analyst price target trend for ASYS over the identified time series demonstrates a steady increase, with fluctuations followed by a markdown. Here are the key takeaways:

- Starting from November 12, 2021, with the analyst price target of $15, it maintained the same figure until December 31, 2021.

- On December 31, 2021, there was a mild uptick, raising the value to $15.4.

- In 2022, a clearer upward trend took the price target to $17 on January 7, which it maintained through February 18, 2022.

- Post that, it observed a slight drop-down to $16 in late February and stuck around this mark until July 29, 2022.

- By the end of July 2022, a minor spike took the price target to $16.5, maintaining the same for a quarter till December 9, 2022.

- A downward trend started in mid-December 2022, reducing the value to $15.5.

- We observe sharp decreases in early 2023. By February 17, 2023, the value was further down to $14 and steadily reduced to $13 for an extended period from late February to mid-August.

- The trend continues to fall in late August 2023, finally settling at $12.

To calculate the growth rate, we measure the final value against the first. The price dropped from $15 to $12 over the two-year period, emphasizing a negative growth rate of 20%.

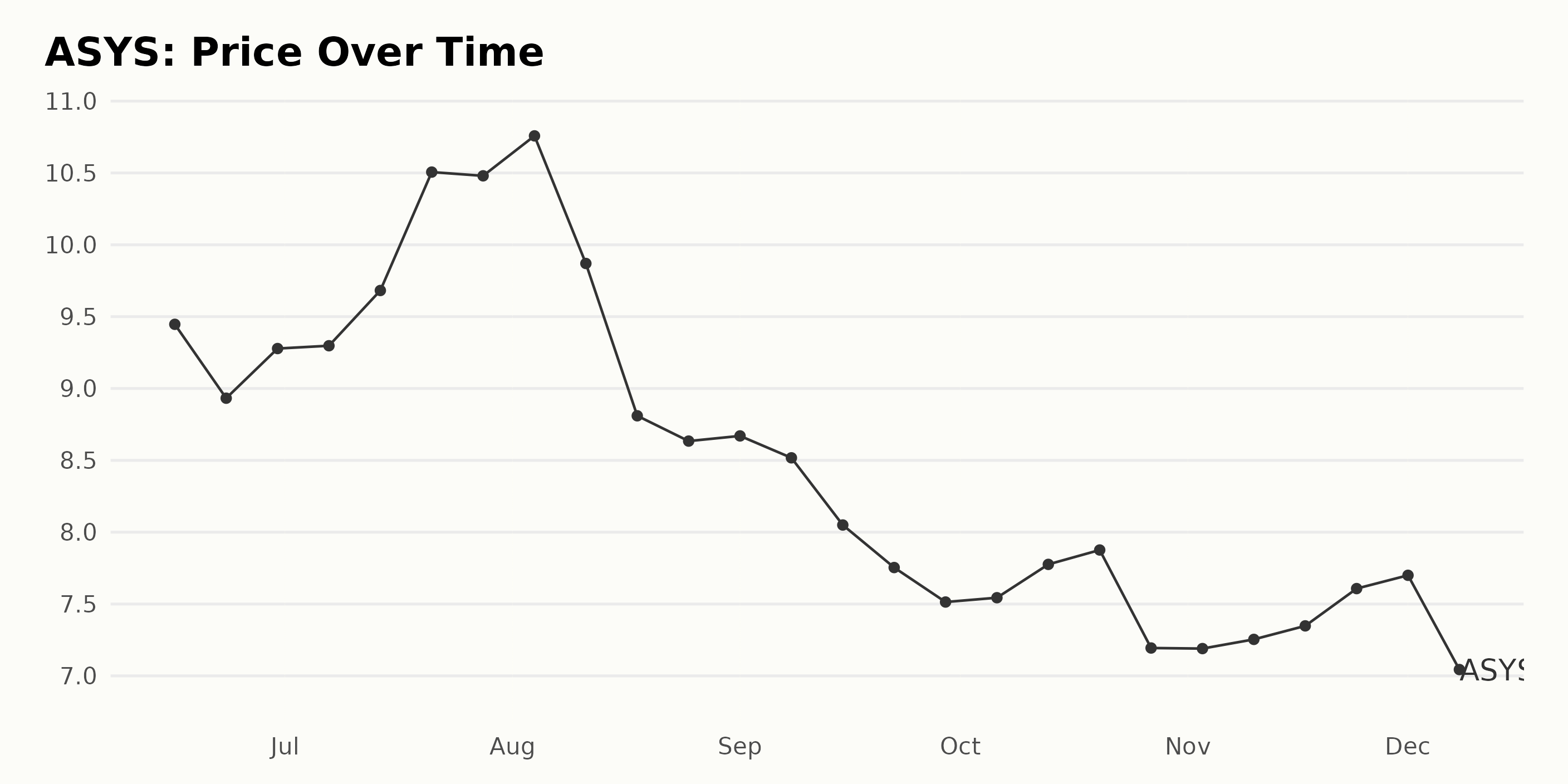

Analyzing Amtech Systems, Inc.’s Six-Month Share Price Fluctuation in 2023

The data illustrates the fluctuation in the share price of ASYS from June to December 2023. Below are some significant points:

- On June 16, 2023, the share price was $9.45.

- There was a minor dip in the price during June, with the lowest on June 23 ($8.93), but it started to recover by the end of the month hitting $9.28 on June 30.

- July saw an overall increasing trend, with the share price hitting a high of $10.51 on July 21. The month ended at $10.48 on July 28.

- August started strongly, reaching $10.76 on August 4. However, there was a steady decline thereafter. By the end of the month, on August 25, the price was down to $8.63.

- The decreasing trend continued throughout September, eventually reaching down to $7.51 by September 29.

- There were signs of recovery in October with an increase, reaching up to $7.88 on October 20, but this was short-lived as the price fell back down to $7.19 on November 3.

- By December 8, 2023, the closing price of ASYS’ shares was at $6.55.

In terms of growth rates, we see a general deceleration from the high in mid-July until the end of the year. Despite a few intermittent periods of slight gains, the overall trajectory of the share price of ASYS during this period was on a downward slope. Here is a chart of ASYS’ price over the past 180 days.

Analyzing Momentum, Sentiment, and Value Ratings of Amtech Systems, Inc.

ASYS, a stock in the Semiconductor & Wireless Chip category, which comprises a total of 91 stocks, presents a consistent POWR Ratings grade over multiple weeks, as shown by the data.

- The latest POWR grade for ASYS was C (Neutral) on December 11, 2023.

- Its rank within its category varied somewhat over the period. However, it generally fell around the 60th percentile. Remember that a lower rank denotes a superior position within its category.

- As of December 11, 2023, ASYS returned to a superior position with a rank in the category of #55.

Overall, ASYS appears to maintain a quite stable POWR grade of C (Neutral) and a middle-range ranking within its respective category of Semiconductor & Wireless Chip stocks. This suggests that the stock demonstrates a certain level of consistency.

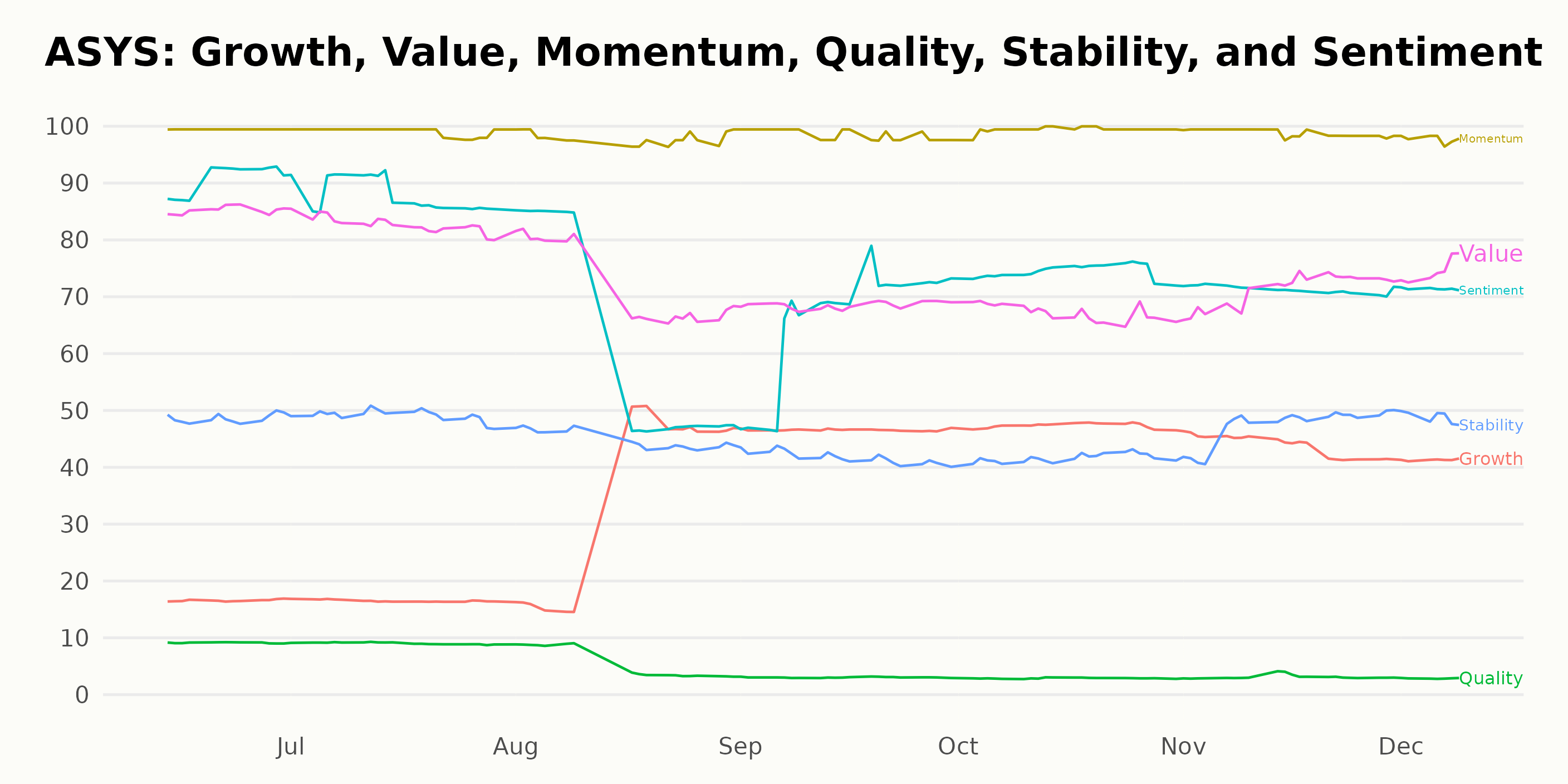

The POWR Ratings for ASYS have some noticeable features across its dimensions, particularly Momentum, Sentiment, and Value. These three dimensions displayed the highest ratings and showcased clear trends over the designated period.

Momentum

- This dimension displayed the highest rating consistently across the time frame. Starting from a high value of 99 in June 2023, it maintained this peak value until September 2023, slightly dropping to 98 in August and December, but quickly regained to 99 in October and November. This shows a steady and strong Momentum for ASYS during this period.

Sentiment

- The Sentiment dimension started at a high of 91 in June 2023, dropped to 88 in July, and then experienced a plummet to 62 in August. However, thereafter, it started to rise again, reaching 66 in September, 75 in October, and 71 in November, and maintaining the same until early December. The dip and subsequent continuous rise in sentiment showcase a strong recovery trend.

Value

- Initially, in June 2023, the Value dimension was at a respectable 85, slightly dropping to 83 in July. A more noticeable drop occurred in August, bringing the value down to 72. However, starting in September, the value gradually increased from 69 to 75 by December. Despite initial fluctuations, there was a steady rising trend towards the latter part of the year.

In summary, while there were slight dips in the ratings across these three dimensions, the overall high ratings and upward trends suggest a good performance by ASYS during this period.

How does Amtech Systems, Inc. (ASYS) Stack Up Against its Peers?

Other stocks in the Semiconductor & Wireless Chip sector that may be worth considering are ChipMOS TECHNOLOGIES INC. (IMOS - Get Rating), Everspin Technologies, Inc. (MRAM - Get Rating), and STMicroelectronics N.V. (STM - Get Rating) – they have better POWR Ratings. Click here to explore more Semiconductor & Wireless Chip stocks.

What To Do Next?

43 year investment veteran, Steve Reitmeister, has just released his 2024 market outlook along with trading plan and top 11 picks for the year ahead.

Want More Great Investing Ideas?

ASYS shares were trading at $6.57 per share on Monday morning, up $0.02 (+0.31%). Year-to-date, ASYS has declined -13.55%, versus a 21.74% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| ASYS | Get Rating | Get Rating | Get Rating |

| IMOS | Get Rating | Get Rating | Get Rating |

| MRAM | Get Rating | Get Rating | Get Rating |

| STM | Get Rating | Get Rating | Get Rating |