Boise Cascade Company (BCC - Get Rating) delivered outstanding financial results in the last reported quarter, despite facing lower new single-family starts and commodities pricing headwinds. Its revenue came in 4.6% above analyst estimates, while earnings per share (EPS) surpassed forecasts by an impressive 49.1%, demonstrating the company’s robust business model.

Management remains steadfast in its strategies and growth initiatives, confidently relying on the strength of its balance sheet to weather economic uncertainty. What’s more, BCC offers a reliable dividend.

Let’s dig into some of BCC’s key metrics to uncover why this stock is worth considering.

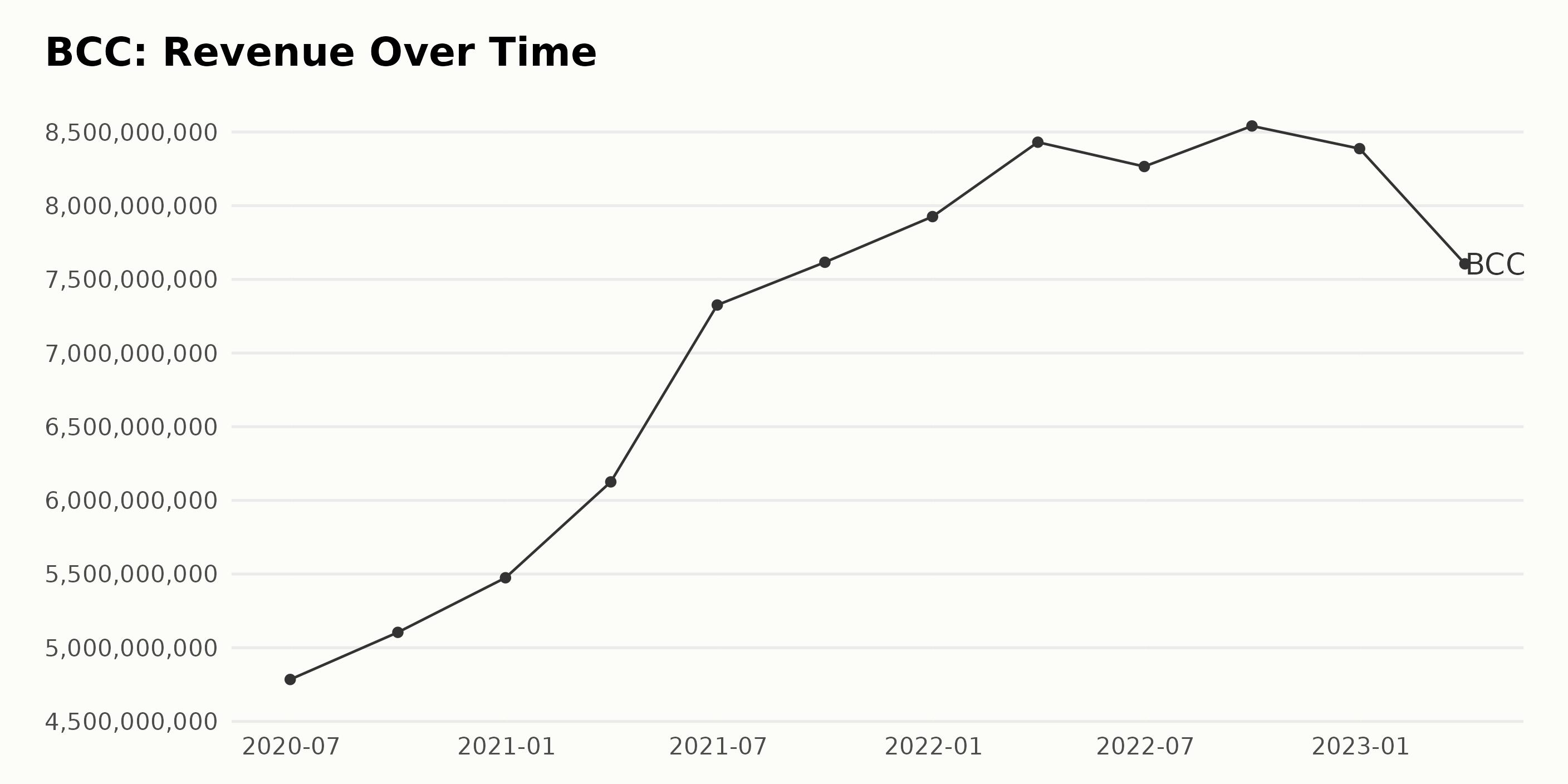

Tracking BCC’s Growth Over 3 Years

Since June 2020, BCC’s revenue has steadily increased from $47.8 million to $79.3 million in March 2023, representing a growth rate of 65.6%.

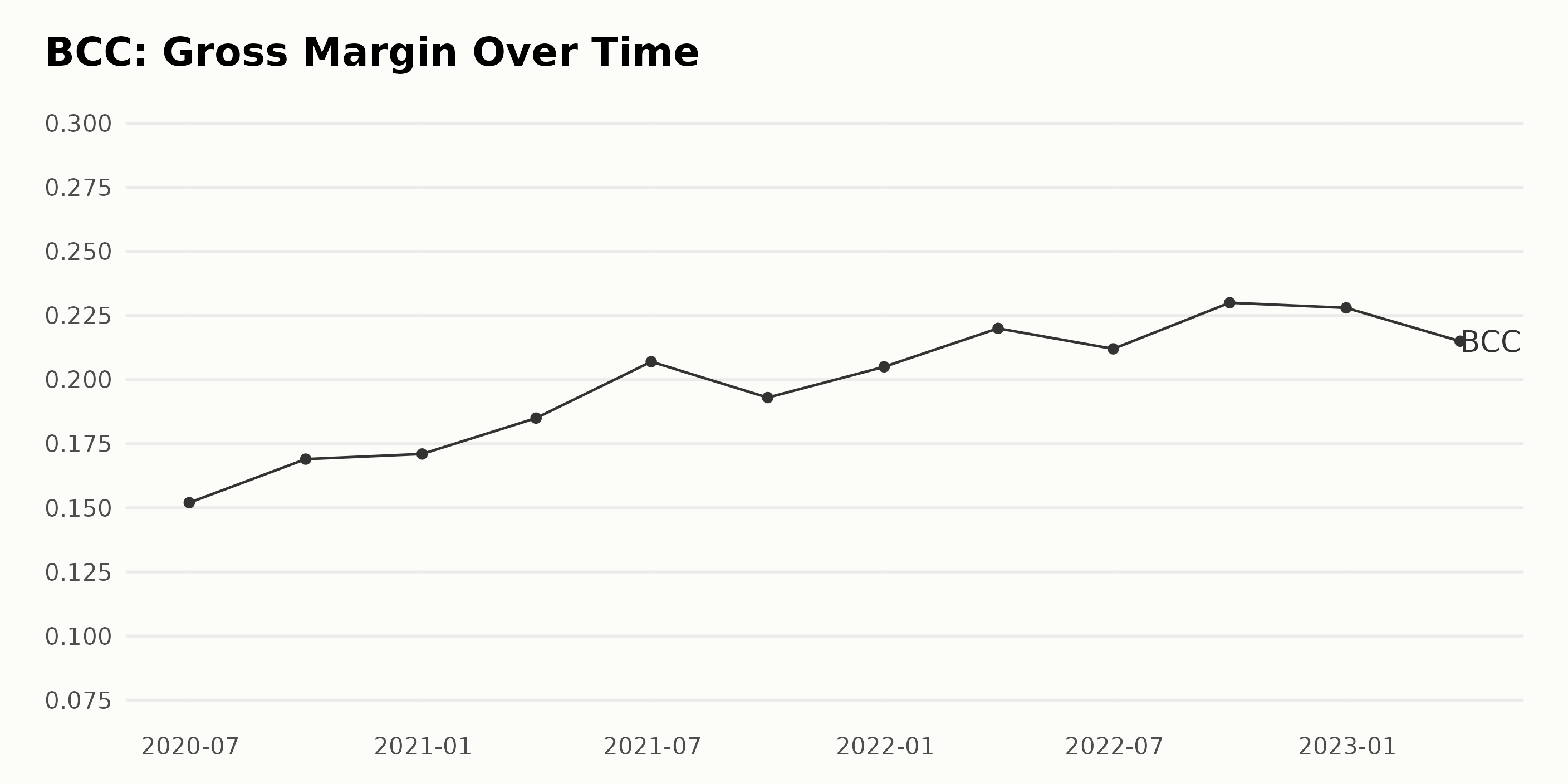

BCC’s gross margin has shown a generally increasing trend over the past few years, with fluctuations along the way. The gross margin in June 2020 was 15.2%, increasing to 23.0% in September 2023. This indicates a growth of 52.6% from June 2020 to September 2023. The most recent value reported was 21.5% in March 2023.

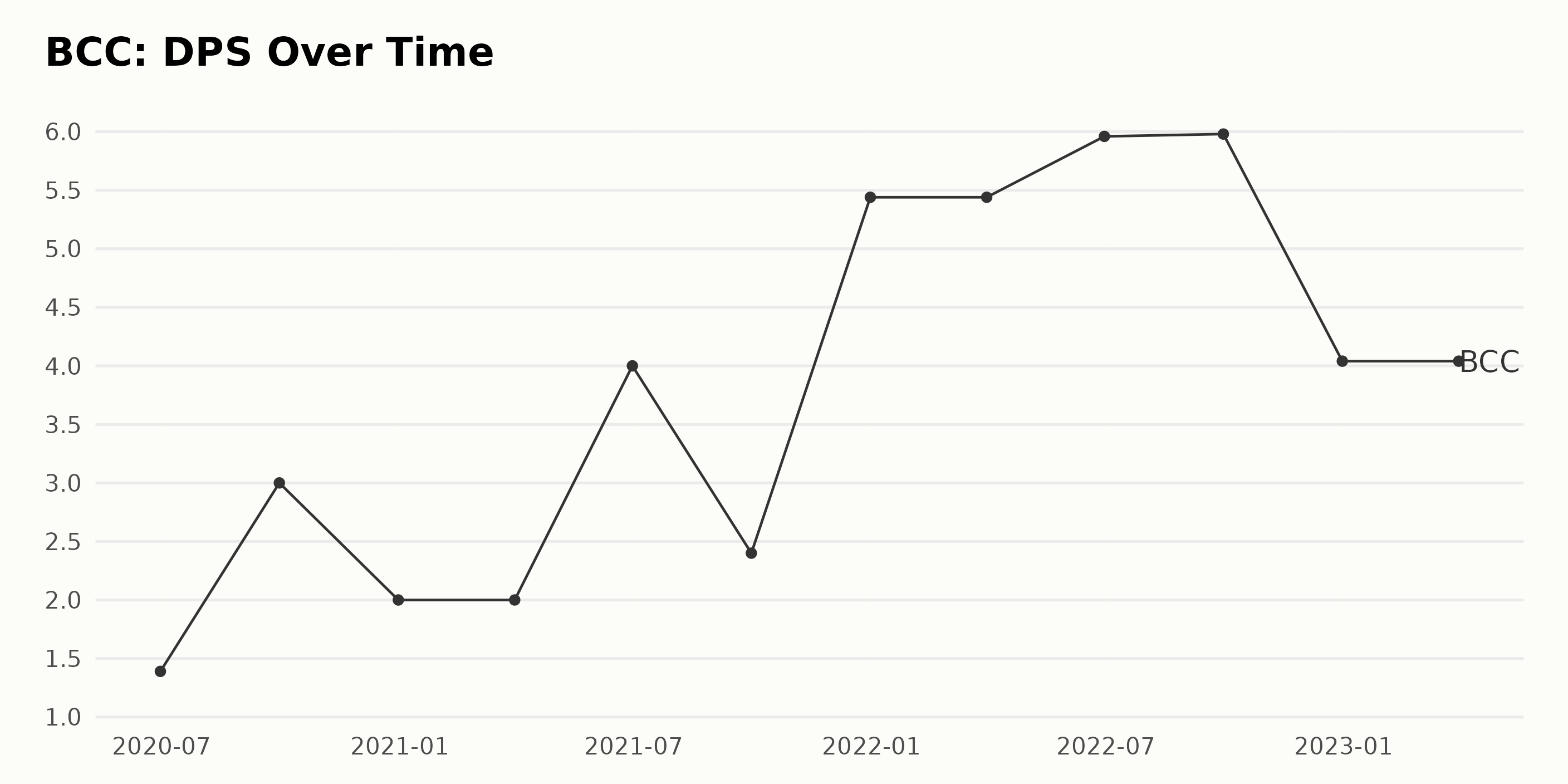

BCC’s Dividend Per Share (DPS) has seen an overall growth trend over the past three years, from $1.39 on June 30, 2020, to $4.04 on March 31, 2023. Its value of $5.96 on June 30, 2022, is a growth rate of 330% compared to the first value in the series. Over the period, the DPS has fluctuated between a high of $5.98 on September 30, 2022, and a low of $2.00 on December 31, 2020.

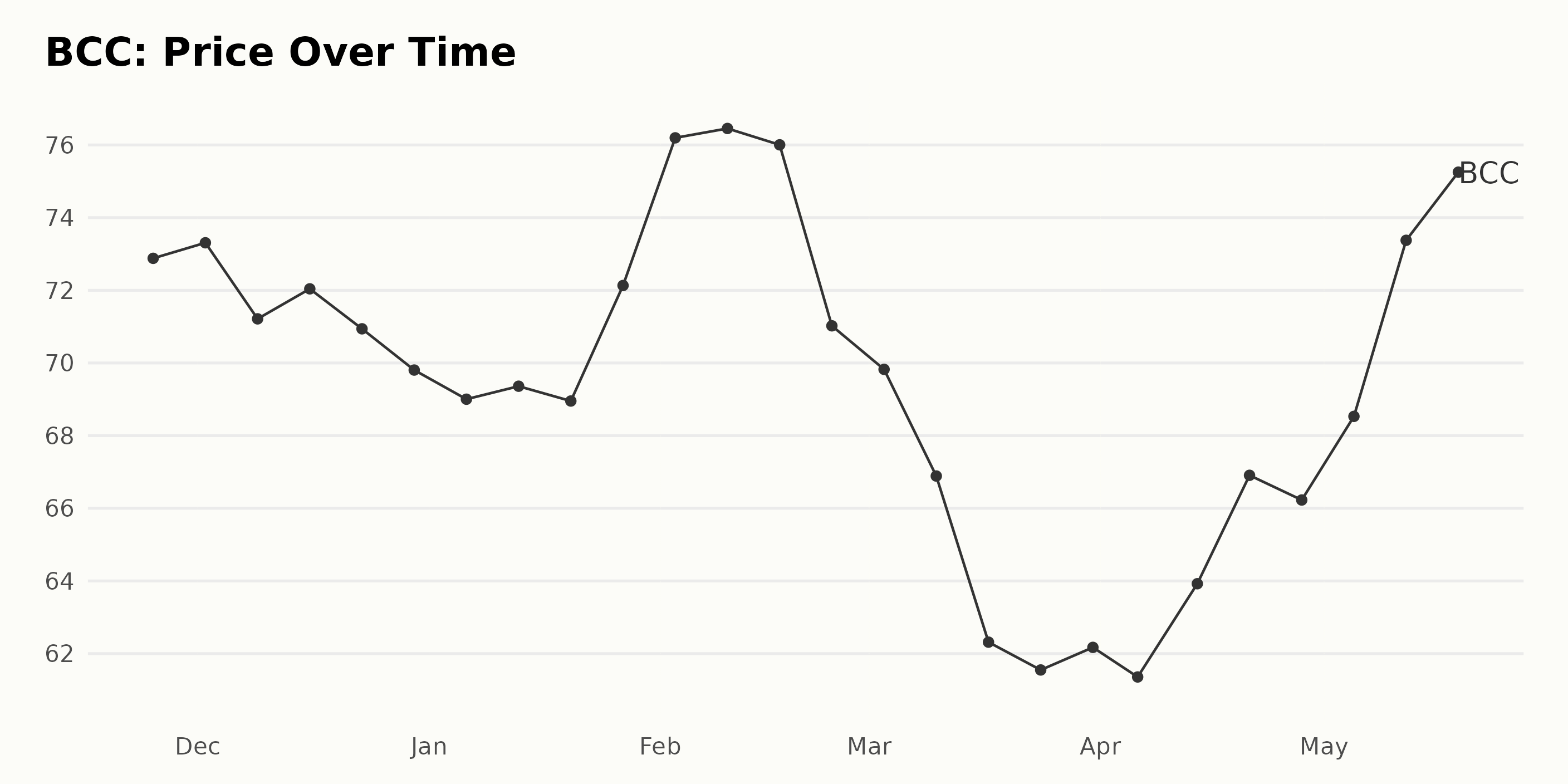

BCC’s Share Price Uptrend: November 2022-May 2023

Between November 2022 and May 2023, BCC’s share price has fluctuated around $70, but overall, there has been a general upward trend. BCC’s growth rate has accelerated from an initial value of $72.88 on November 25, 2022, to the current value of $75.01 on May 18, 2023 (an increase of $2.13 or 2.9% in total). Here is a chart of BCC’s price over the past 180 days.

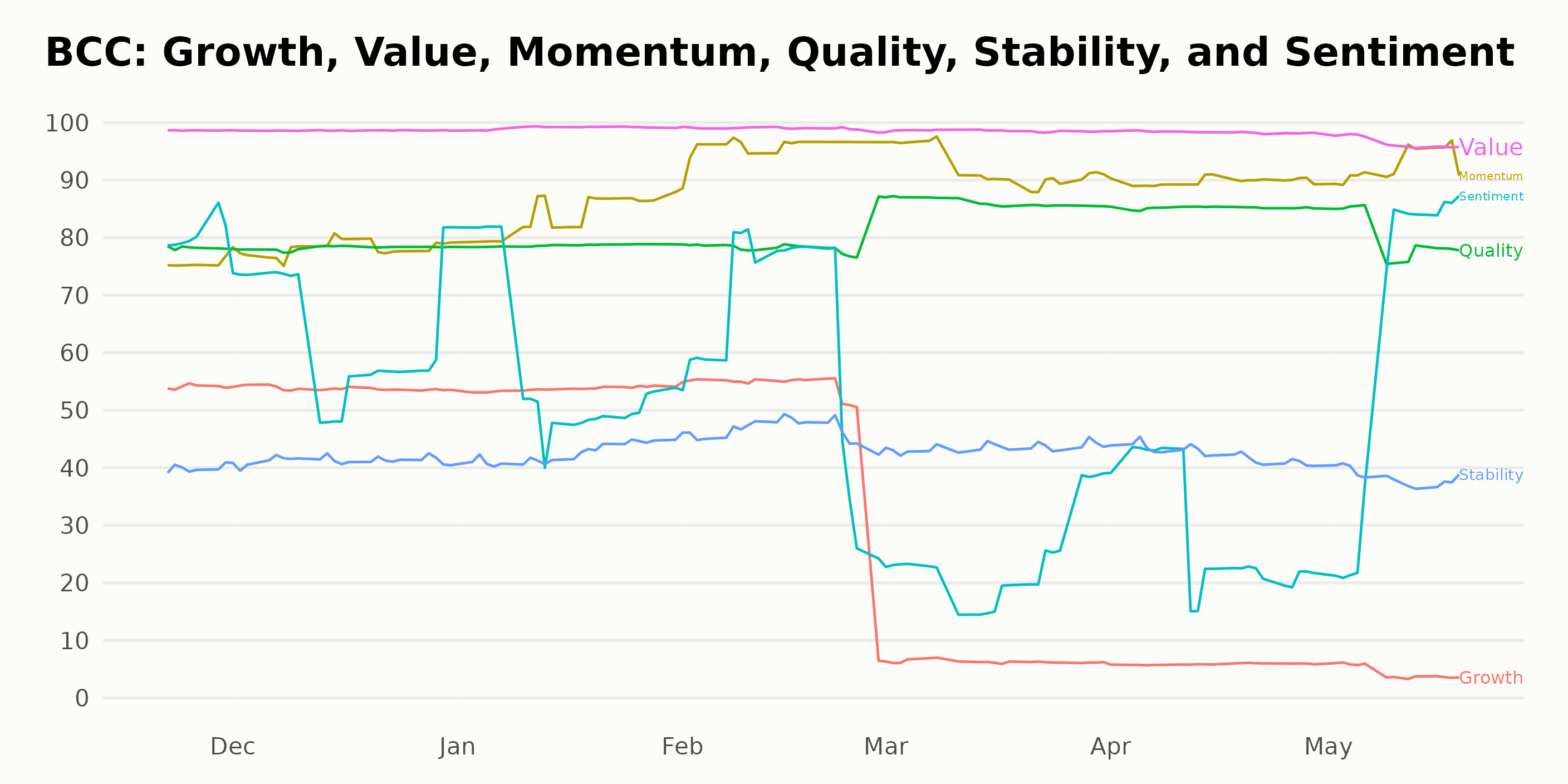

Analysis of BCC’s POWR Ratings

BCC has an overall B rating, translating to a Buy in our POWR Ratings system. It is ranked first among the six stocks in the Industrial – Wood industry.

BCC’s two most noteworthy dimensions, according to its POWR ratings, are Quality and Value. Quality has a rating of 79, while Value has the highest rating at 99. Over time, Quality and Value ratings have largely stayed the same.

How does Boise Cascade Company (BCC) Stack Up Against its Peers?

Other stocks that may be worth considering are Universal Forest Products Inc. (UFPI - Get Rating), Carrier Global Corp. (CARR - Get Rating), and Terex Corporation (TEX - Get Rating), which are also rated B.

Discover 10 widely held stocks that our proprietary model shows have tremendous downside potential. Please make sure none of these “death trap” stocks are lurking in your portfolio:

Want More Great Investing Ideas?

BCC shares were trading at $75.86 per share on Friday afternoon, down $0.58 (-0.76%). Year-to-date, BCC has gained 10.69%, versus a 9.80% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| BCC | Get Rating | Get Rating | Get Rating |

| UFPI | Get Rating | Get Rating | Get Rating |

| CARR | Get Rating | Get Rating | Get Rating |

| TEX | Get Rating | Get Rating | Get Rating |