Bionano Genomics, Inc. (BNGO - Get Rating) is a genome analysis software provider that enables genomics labs to analyze and interpret data across a range of platforms. The company’s revenue saw a significant jump in the recent past, increasing at CAGRs of 46.4% and 25.3% over the past three and five years, respectively.

However, for the quarter ended March 31, 2023, BNGO’s net loss per share came in at $0.12, missing the consensus estimate by 9.1%. Moreover, its EPS is expected to remain negative for the current fiscal year (ending December 2023).

Let’s look at some of BNGO’s key financial metrics trends to see why it could be wise to avoid the stock now.

Analyzing Financials for BNGO: Revenue Growth and Analyst Price Target

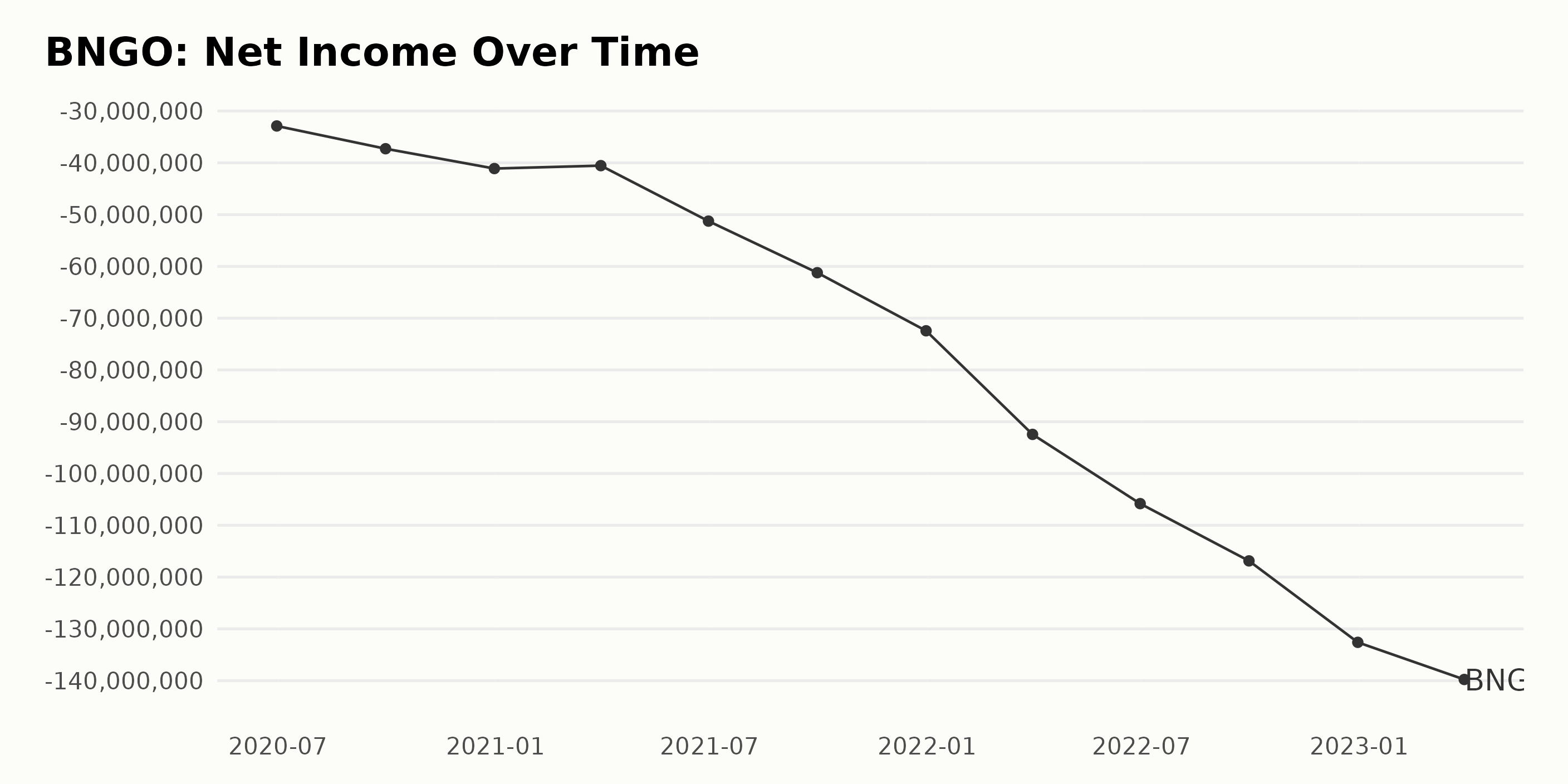

The series shows a clear overall trend of decreasing net income for BNGO, beginning at -$32.88 million in June 2020 and ending at -$139.77 million in March 2023. The largest fluctuations occurred between December 2021 (-$72.44 million) and March 2022 (-$92.44 million), a difference of -$19.99 million.

The difference between the first and last value is -$106.09 million, equivalent to a growth rate of -321.84%.

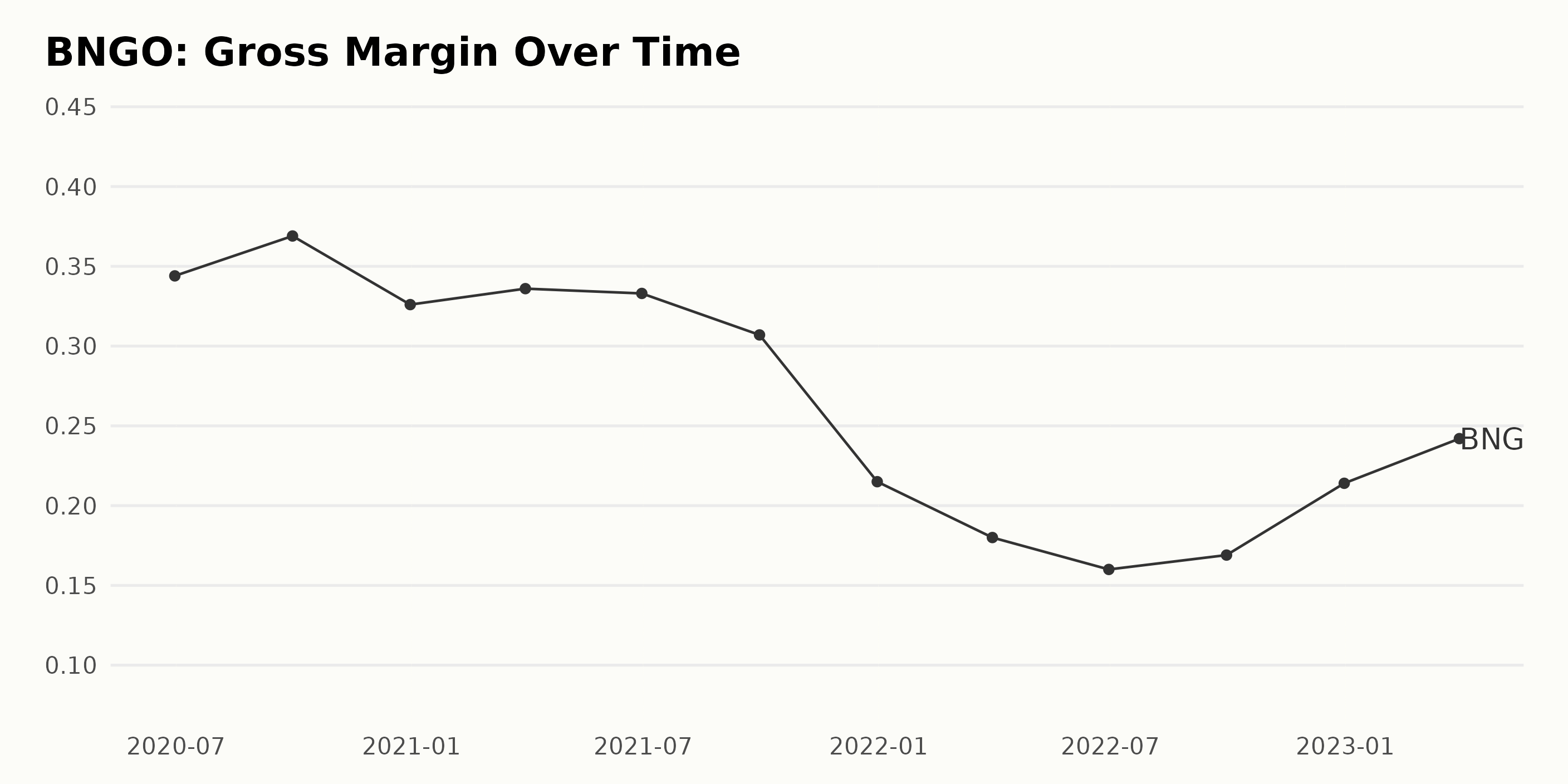

The gross margin of BNGO has had a generally declining trend, with the value dropping from 34.4% in June 2020 to 21.4% in March 2023. The lowest point was 18.0% in Mar 2022, while the most recent data point of 24.2% in Mar 2023 shows an increase from the previous quarter.

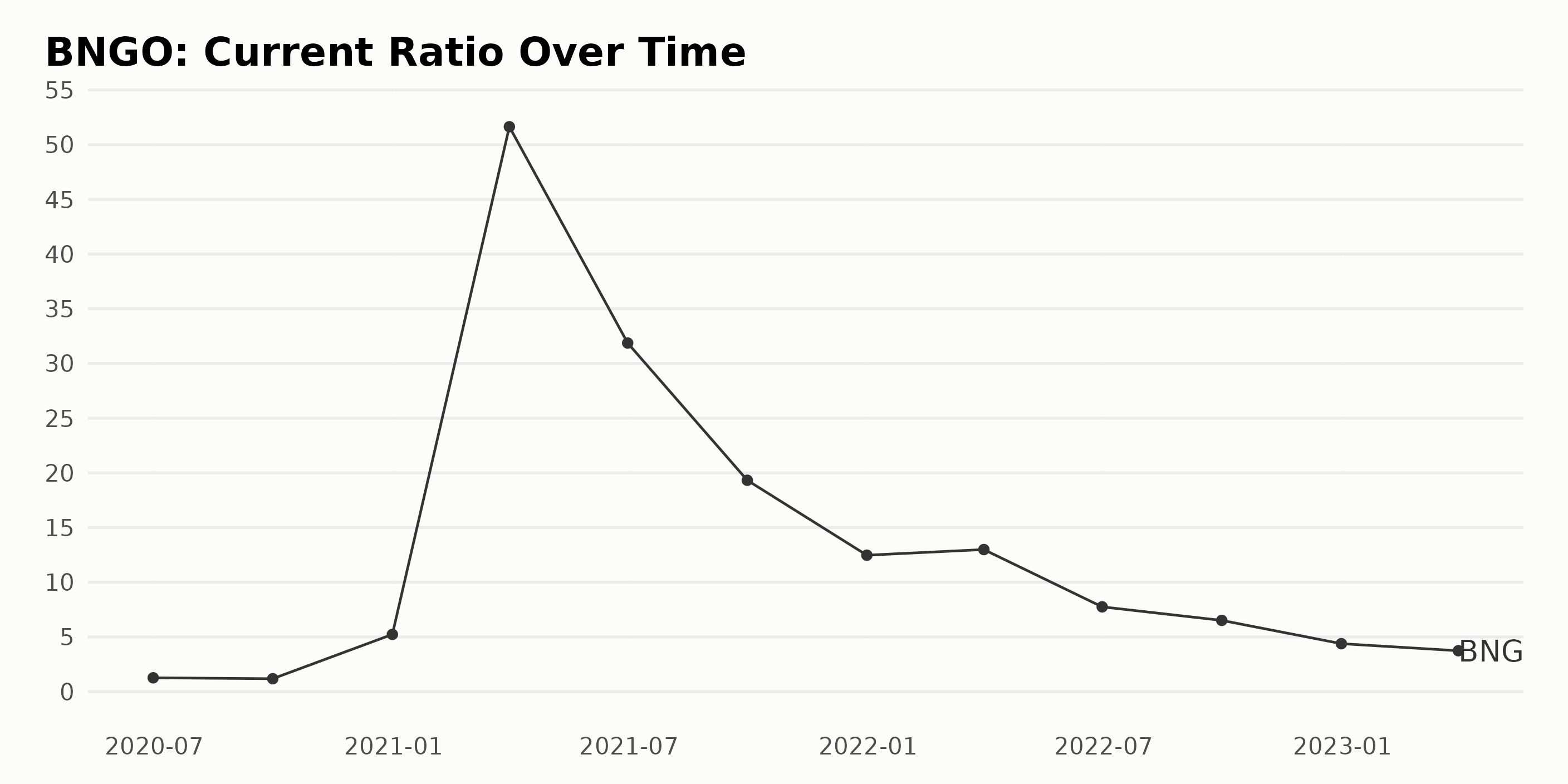

The current ratio of BNGO has fluctuated significantly since 2020. From June 30, 2020, to March 31, 2021, the current ratio increased from 1.26 to 51.65, representing a growth rate of 3,722.2%.

Then from March 31, 2021, to December 31, 2022, the current ratio decreased steadily from 51.65 to 4.38, showing a drop of 92.4%. As of March 31, 2023, the current ratio was 3.74.

The analyst price target for BNGO has fluctuated significantly over the past few years. Starting at $12 in November 2021, it slowly decreased to $11 by February 2022 and then experienced a more rapid downward shift to $7.5 by April 2022.

This value stayed fairly flat until May 2023, when it fell to $4.8, the lowest point so far. As of June 1, 2023, the analyst price target stands at $4.8. Overall, there has been a 59% decrease from the starting value.

A Steady Decline in BNGO Share Price

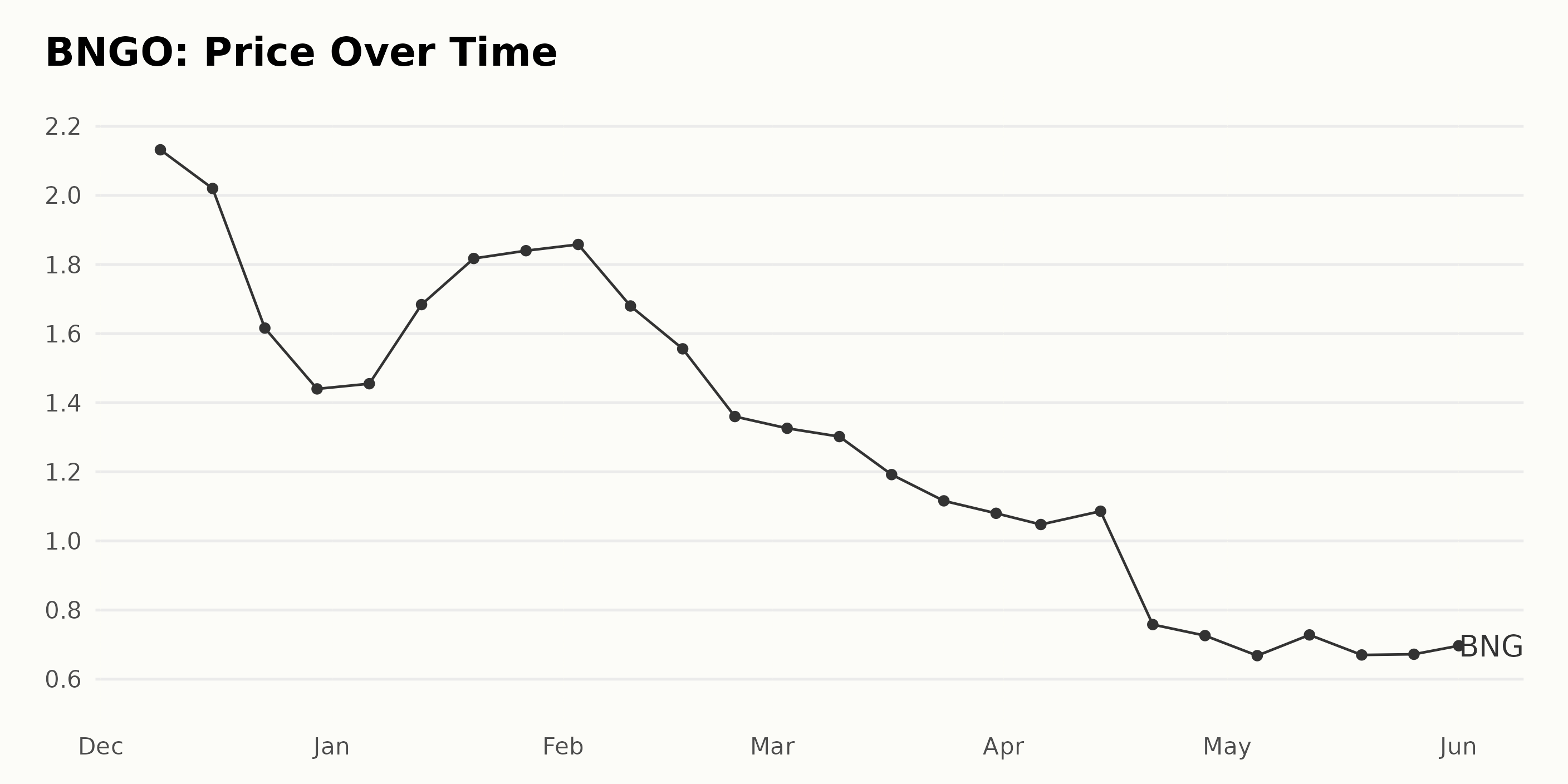

The share price of BNGO, beginning at $2.13 in December 2022, decreased steadily until April 2023, when it reached its lowest price of $0.73. After April 2023, the share price of BNGO started increasing again, with the share price at $0.69 as of May 31, 2023. Here is a chart of BNGO’s price over the past 180 days.

The Notable Trends of BNGO’s POWR Ratings

The overall POWR Ratings grade of BNGO is currently an F, which equates to a Strong Sell. The most recent week’s ranking for BNGO in the F-rated Biotech industry is #374 out of a total of 378 stocks.

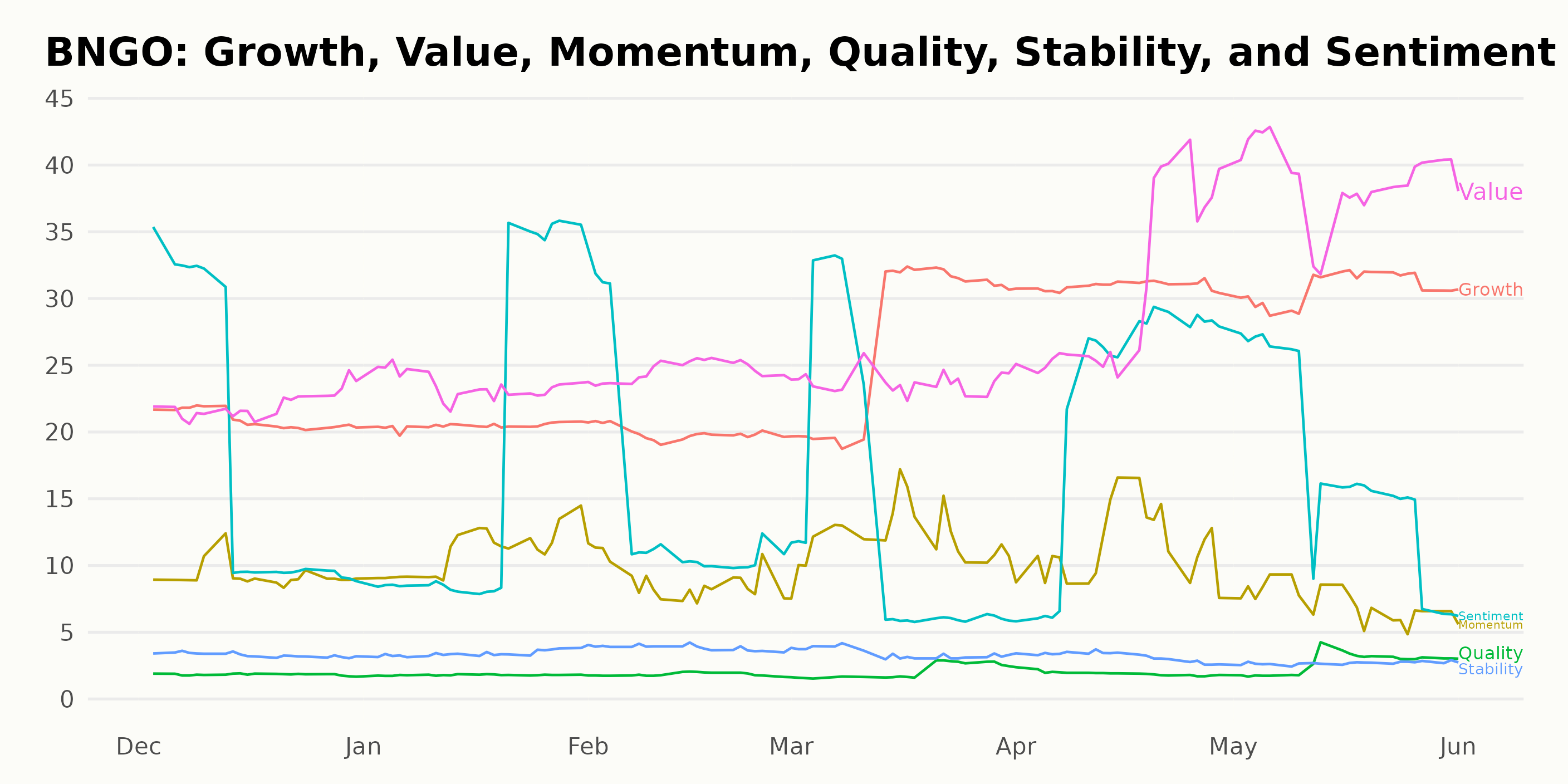

The POWR Ratings of BNGO have had a particularly noteworthy trend across three dimensions: Value, Growth, and Momentum. The Value dimension has been steadily increasing, going from 22 in December 2022 to 39 in May 2023.

The Growth dimension has also largely seen increases, increasing from 21 in December 2022 to 31 in May 2023. And finally, the Momentum dimension had steadily increased until peaking at 12 in March 2023 before dropping back down to 7 in May 2023.

How Does Bionano Genomics, Inc. (BNGO) Stack Up Against Its Peers?

Other stocks in the Biotech sector that may be worth considering are Alkermes plc (ALKS - Get Rating), Biogen Inc. (BIIB - Get Rating), and Gilead Sciences, Inc. (GILD - Get Rating) — they have better POWR Ratings.

Discover 10 widely held stocks that our proprietary model shows have tremendous downside potential. Please make sure none of these “death trap” stocks are lurking in your portfolio:

Want More Great Investing Ideas?

BNGO shares were trading at $0.71 per share on Thursday afternoon, up $0.02 (+2.77%). Year-to-date, BNGO has declined -51.37%, versus a 10.65% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| BNGO | Get Rating | Get Rating | Get Rating |

| ALKS | Get Rating | Get Rating | Get Rating |

| BIIB | Get Rating | Get Rating | Get Rating |

| GILD | Get Rating | Get Rating | Get Rating |