Auto dealership company Cars.com Inc. (CARS - Get Rating) in Chicago is a digital marketplace operator that provides solutions for the automotive industry. The company operates through its marketplace, dealer websites, and other digital products. Its platform connects car sellers with car shoppers.

The stock seems to be trading at a price below its intrinsic value. In terms of its forward non-GAAP P/E, CARS is currently trading at 4.93x, which is 71.4% lower than the 17.21x industry average. The stock’s 1.80 forward EV/Sales multiple is 16.6% lower than the 2.16 industry average. In terms of its forward EV/EBITDA, it is trading at 6.53x, which is 23.6% lower than the 8.54x industry average. Its 1.06 forward Price/Sales multiple is 24.7% lower than the 1.41 industry average.

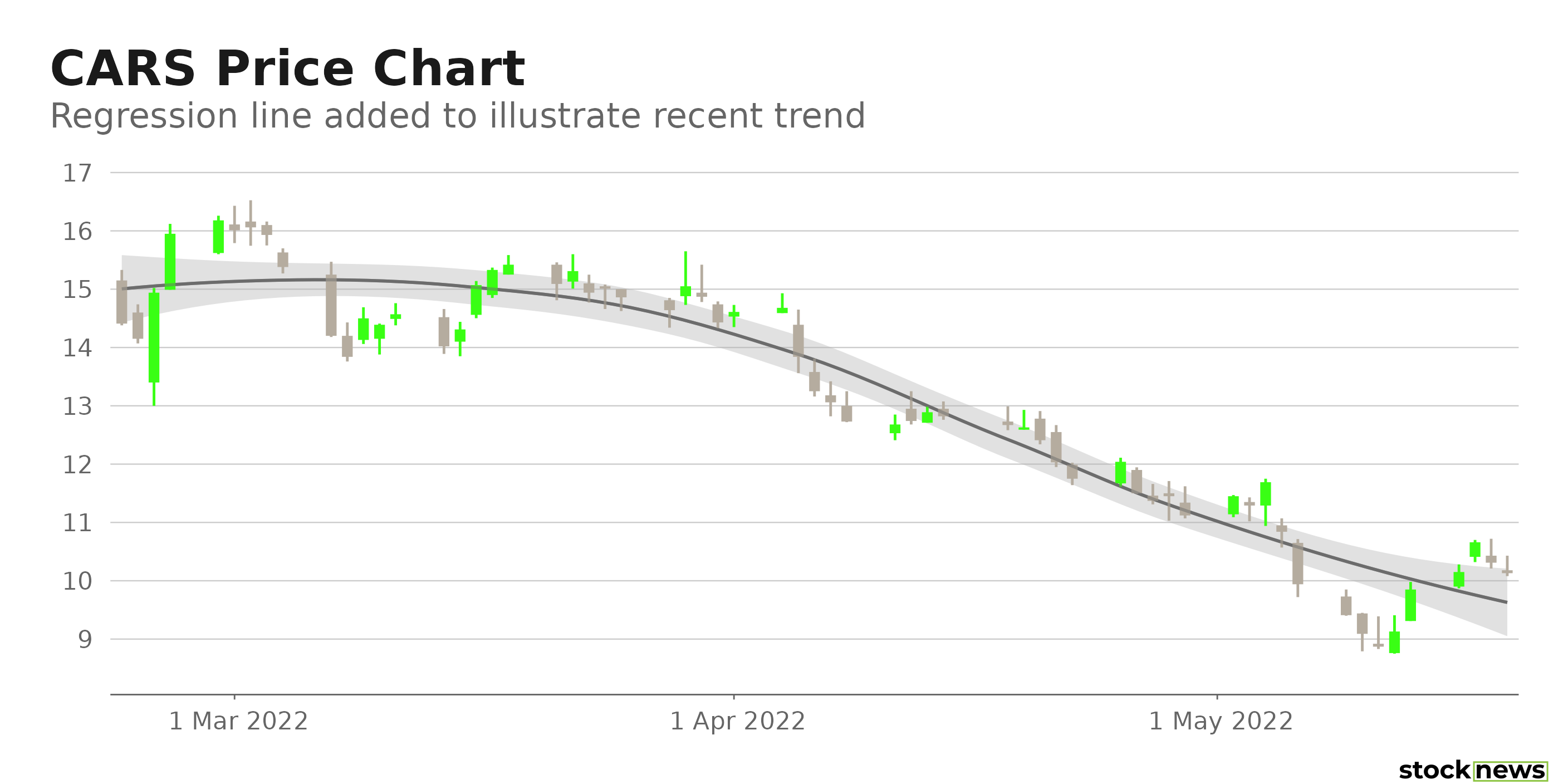

CARS’ stock has declined 37% year-to-date and 19.8% over the past month to close yesterday’s trading session at $10.13. It is currently trading 46.9% below its 52-week high of $19.09. However, the stock has gained 3% in price over the past five days.

Here are the factors that could affect CARS’ performance in the near term:

Strategic Acquisitions

Recently CARS acquired Accu-Trade and CreditIQ. The company expects the Accu-Trade acquisition to enable it to provide dealer clients with vehicle acquisition, which includes buying private party vehicles, while CreditIQ’s platform is expected to allow customers to digitally obtain car loans through dealers. These acquisitions align with the company’s strategy to increase revenue through an increase in offerings.

Favorable Analyst Expectations

The consensus EPS estimates of $0.53 and $1.98, respectively, for the quarter ending Sept. 30, 2022, and fiscal year 2022 indicate an increase of 23.3% and 200% year-over-year. The Street’s $2.19 EPS estimate for its fiscal 2023 reflects a 10.6% rise from the prior year. Its EPS is expected to increase 19.6% per annum over the next five years.

The consensus revenue estimates of $663.83 million and $710.54 million, respectively, for its fiscal 2022 and fiscal 2023 reflect an improvement of 6.4% and 7% from their respective prior-year periods.

Wall Street Analysts Expect Price Upside

The three Wall Street analysts that have rated CARS have rated the stock a Buy. The 12-month median price target of $21.33 indicates a 110.6% potential upside. The price targets range from a low of $19.00 to a high of $25.00.

Sound Trailing 12-Month Financials

CARS’ trailing 12-month revenue and operating income came in at $628.60 million and $44.93 million, respectively. The company’s trailing 12-month EBITDA, net income, and EPS stood at $145.74 million, $6.78 million, and $0.09.

POWR Ratings Reflect Promising Prospects

CARS’ strong fundamentals are reflected in its POWR Ratings. The stock has an overall B rating, which equates to Buy in our proprietary rating system. The POWR Ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

The stock has a Value grade of B, which is in sync with its discounted valuations. The stock has a B grade for Sentiment, which is consistent with its favorable analyst sentiments.

In the 70-stock Internet industry, it is ranked #5. Click here to see the additional POWR Ratings for CARS (Growth, Momentum, Stability, and Quality).

View all the top stocks in the Internet industry here.

Bottom Line

CARS’ recent acquisitions should enhance the company’s operational capability. The stock looks oversold at its current price, and Wall Street sees significant upside potential in the stock. Furthermore, analysts expect sound top- and bottom-line growth this year. Hence, I think investors should buy the dip in CARS.

Note that CARS, TRVG and TZOO are three of the few stocks handpicked by our Chief Growth Strategist, Jaimini Desai, currently in the POWR Stocks Under $10 portfolio. Learn more here.

How Does Cars.com Inc. (CARS) Stack Up Against its Peers?

While CARS has an overall POWR Rating of B, one might consider looking at its industry peers, Yelp Inc. (YELP - Get Rating), which has an overall A (Strong Buy) rating, and trivago N.V. (TRVG - Get Rating) and Travelzoo (TZOO - Get Rating), which have an overall B (Buy) rating.

Want More Great Investing Ideas?

CARS shares were unchanged in premarket trading Friday. Year-to-date, CARS has declined -37.04%, versus a -17.75% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| CARS | Get Rating | Get Rating | Get Rating |

| YELP | Get Rating | Get Rating | Get Rating |

| TRVG | Get Rating | Get Rating | Get Rating |

| TZOO | Get Rating | Get Rating | Get Rating |