While leading cruise line operator Carnival Corporation & plc (CCL - Get Rating) has been in rough waters amid the coronavirus pandemic, it is now benefiting from a surge in travel spending. The rebound in travel activity has helped CCL gain significant momentum. It trades above its 50-day and 200-day moving averages of $10.01 and $9.68, respectively.

However, the company faces significant challenges, including its massive debt load. Moreover, its bottom line is still in the red, and it might take a while for CCL to return to positive net income.

CCL is saddled with $36.46 billion in total debt, while its net debt is $31 billion. Its total cash stood at $5.46 billion. Furthermore, its insufficient cash inflows raise concerns regarding its debt repayment capacity. Its trailing-12-month net operating cash flow came in at a negative $70 million, while its trailing-12-month levered free cash flow stood at a negative $1.35 billion.

Its debt/free cash flow ratio is negative 34.05. Also, CCL’s quick ratio stands at 0.54, questioning its ability to pay its liabilities.

Amid a rising interest rate environment, the company might struggle to get back on its feet. Therefore, it could be risky to invest in CCL now.

Below are some of its key metrics that support the bearish case.

Analyzing CCL’s Financial Trends

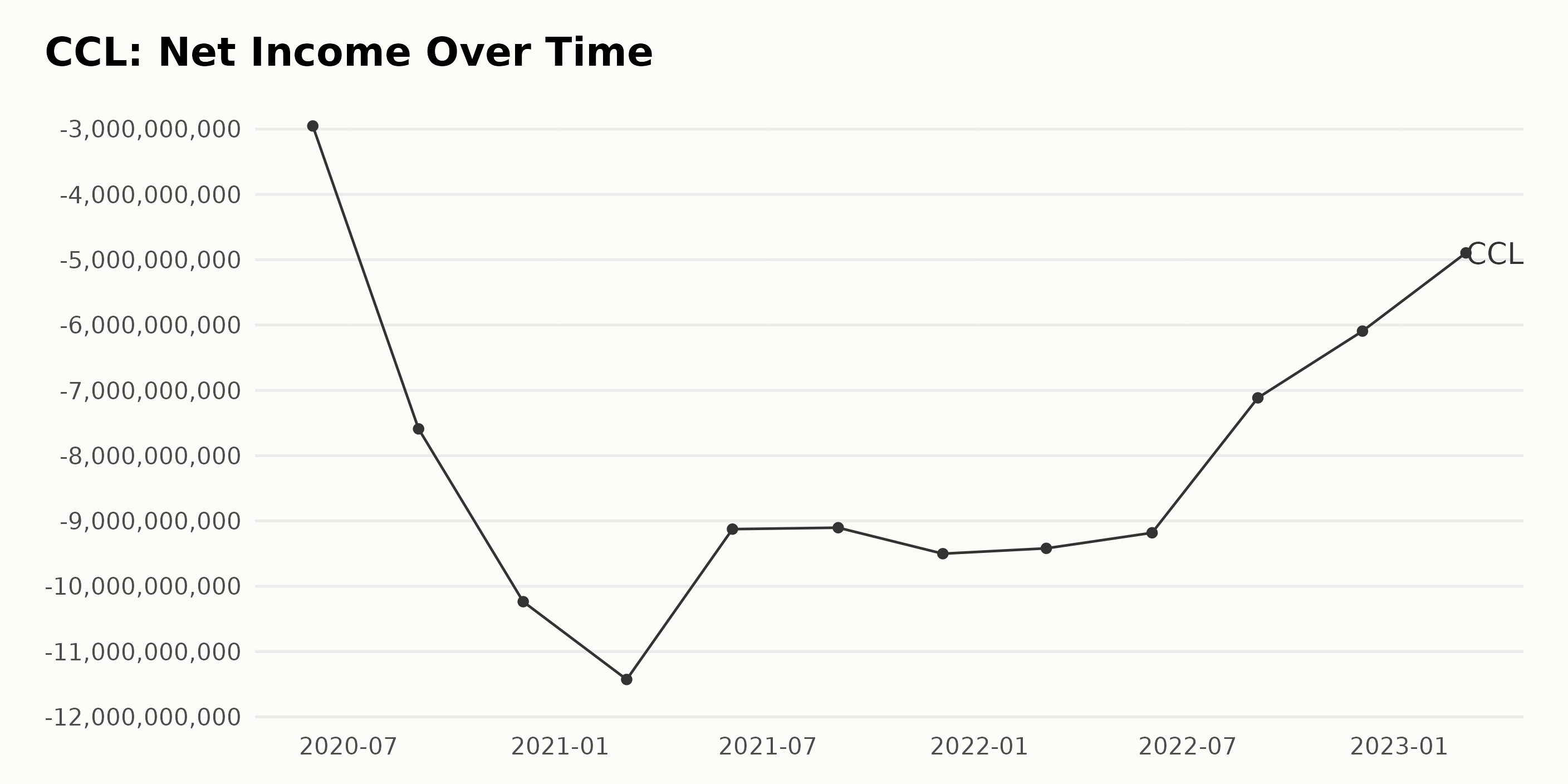

CCL’s net income has been declining since May 2020, from negative $295.20 million to its most recent value of negative $489.50 million in February 2023, representing an 83.19% decrease. The largest decline occurred between November 2020 and February 2021, decreasing by $1.15 billion or 10.52%. Since then, the decline has continued, with a decrease of $3.04 billion, or 24.29%, from February 2021 to February 2023.

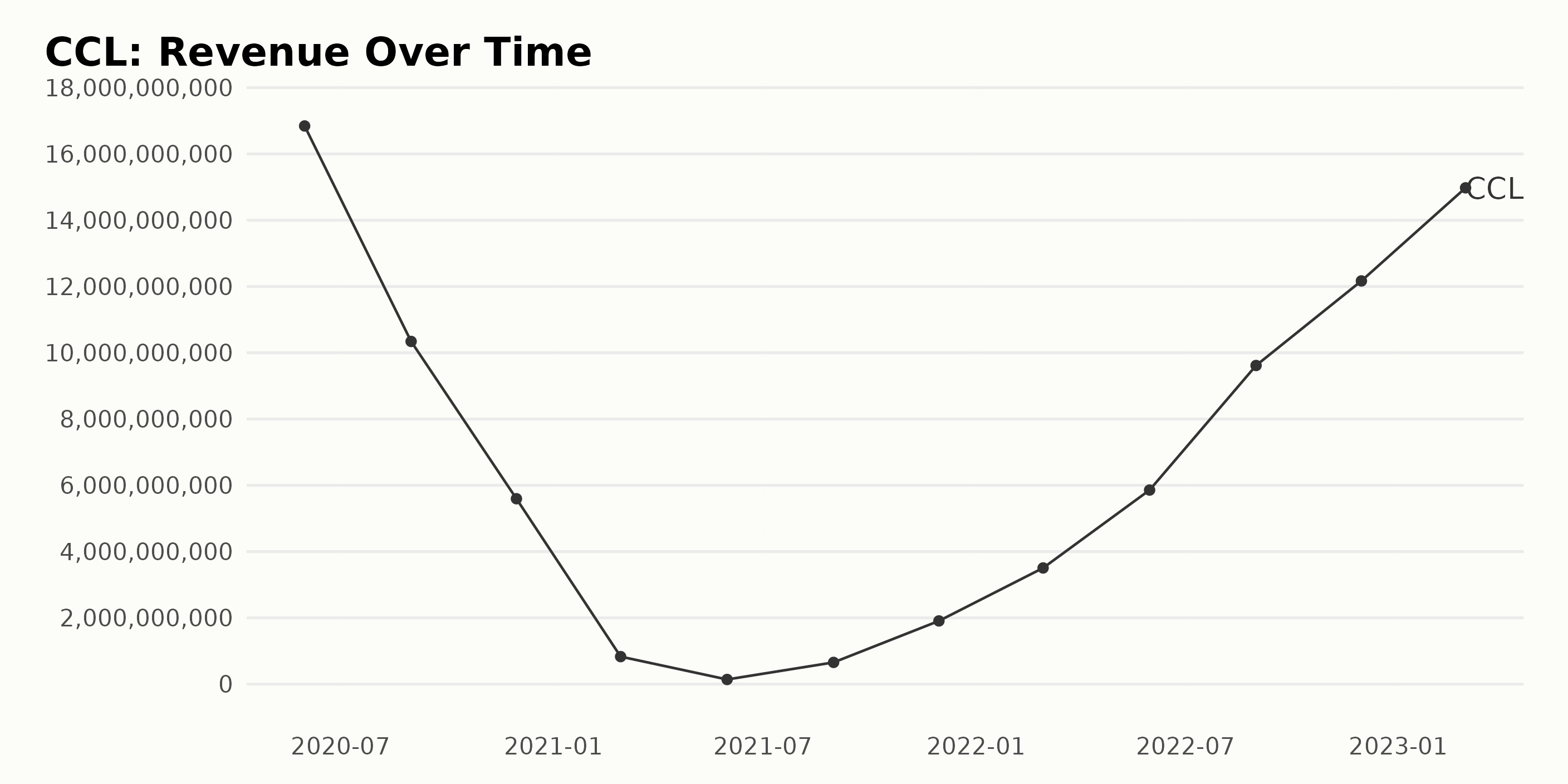

The series of data shows a general decreasing trend for CCL’s revenue. From May 2020 to February 2021, the revenue decreased from $16.8 billion to $0.8 billion. From February 2021, there were fluctuations in the trend, with the revenue increasing to $1.9 billion by November 2021 and then decreasing to $3.5 billion in February 2022 before rising again to $5.9 billion by May 2022. The recently reported revenue was $14.9 billion in February 2023, almost twofold growth from the first recorded data in May 2020.

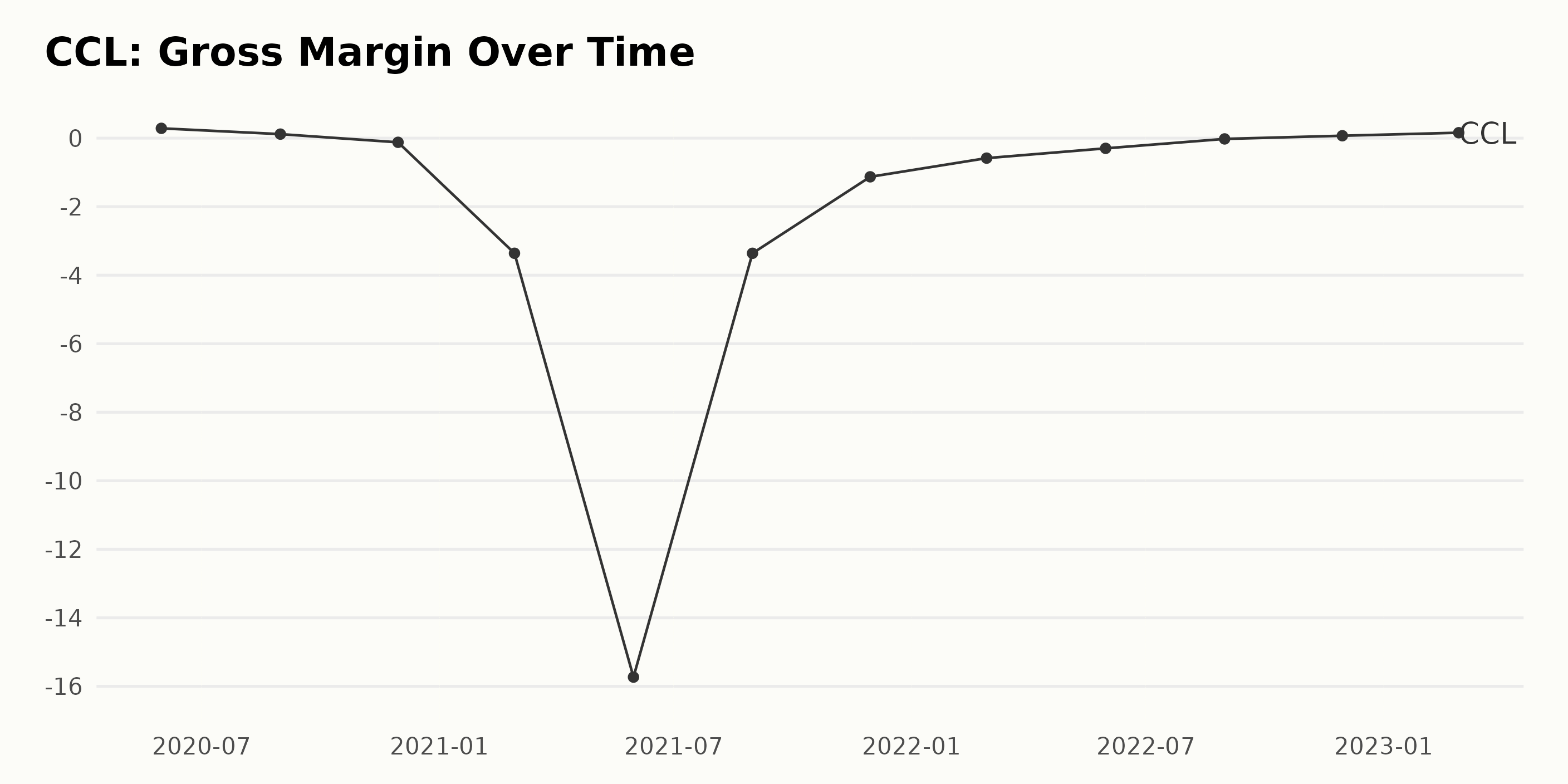

CCL’s gross margin has decreased from 28.6% in May 2020 to a negative 15.73% in May 2021, a 44.3% decrease. Since then, the gross margin has improved slightly, with the most recent value in February 2023 being 15.8%.

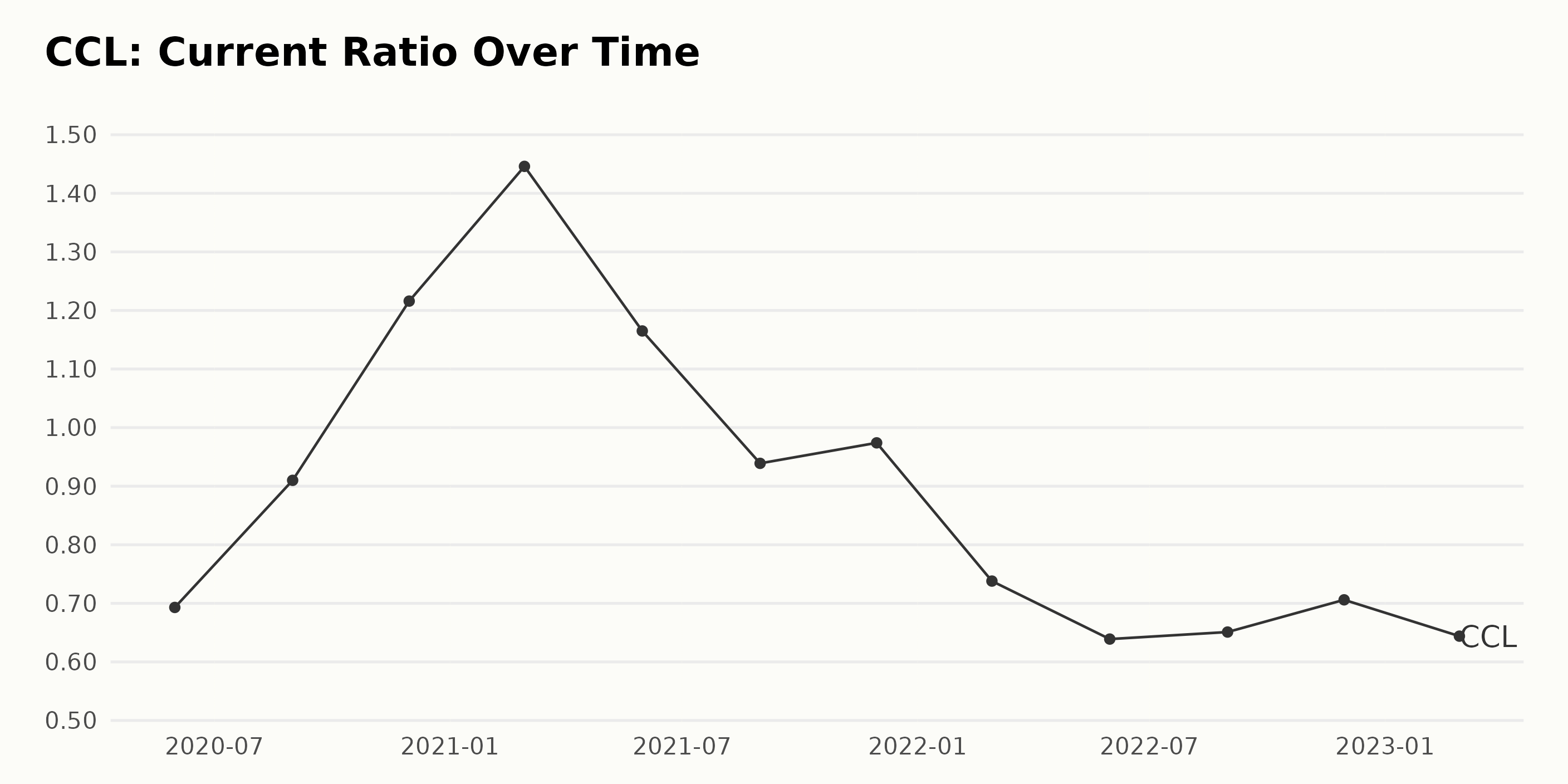

The company’s current ratio trend shows an initial increase from 0.69 (May 2020) to 1.45 (February 2021). However, the ratio decreased steadily afterward, reaching a low of 0.64 in February 2023. The growth rate was negative 7.7% over these two years. There were considerable fluctuations along the way, especially in the latest period, with the ratio dipping to 0.63 in May 2022 and then rising to 0.71 in November 2022.

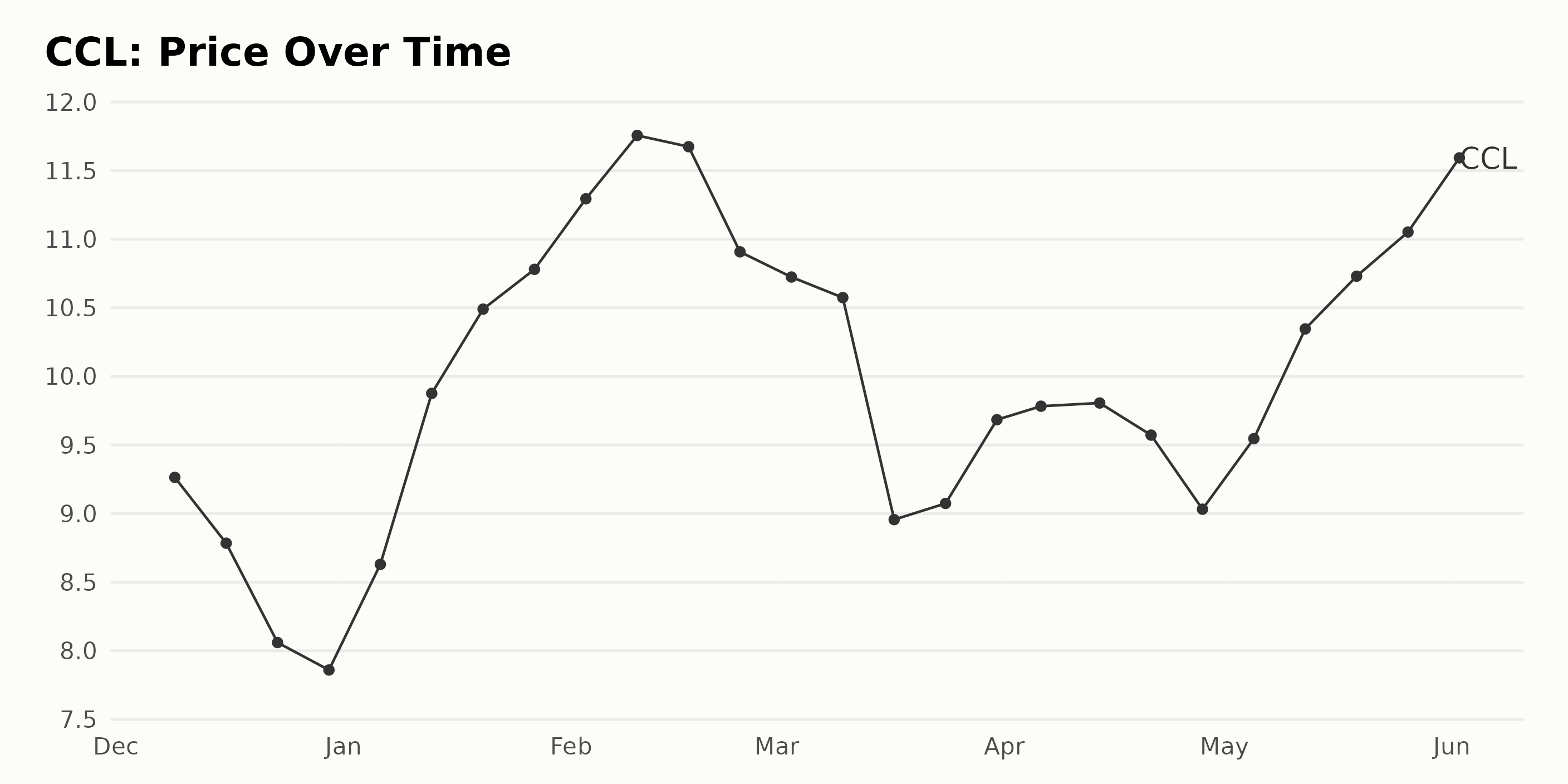

CCL Share Prices Show Steady Growth

CCL’s share prices trend from December 9, 2022, to June 1, 2023, shows overall growth. Prices started at $9.26 on December 9, 2022, and grew steadily over the rest of the year, closing at $11.85 on June 1, 2023. The growth rate is quite consistent during this period. Here is a chart of CCL’s price over the past 180 days.

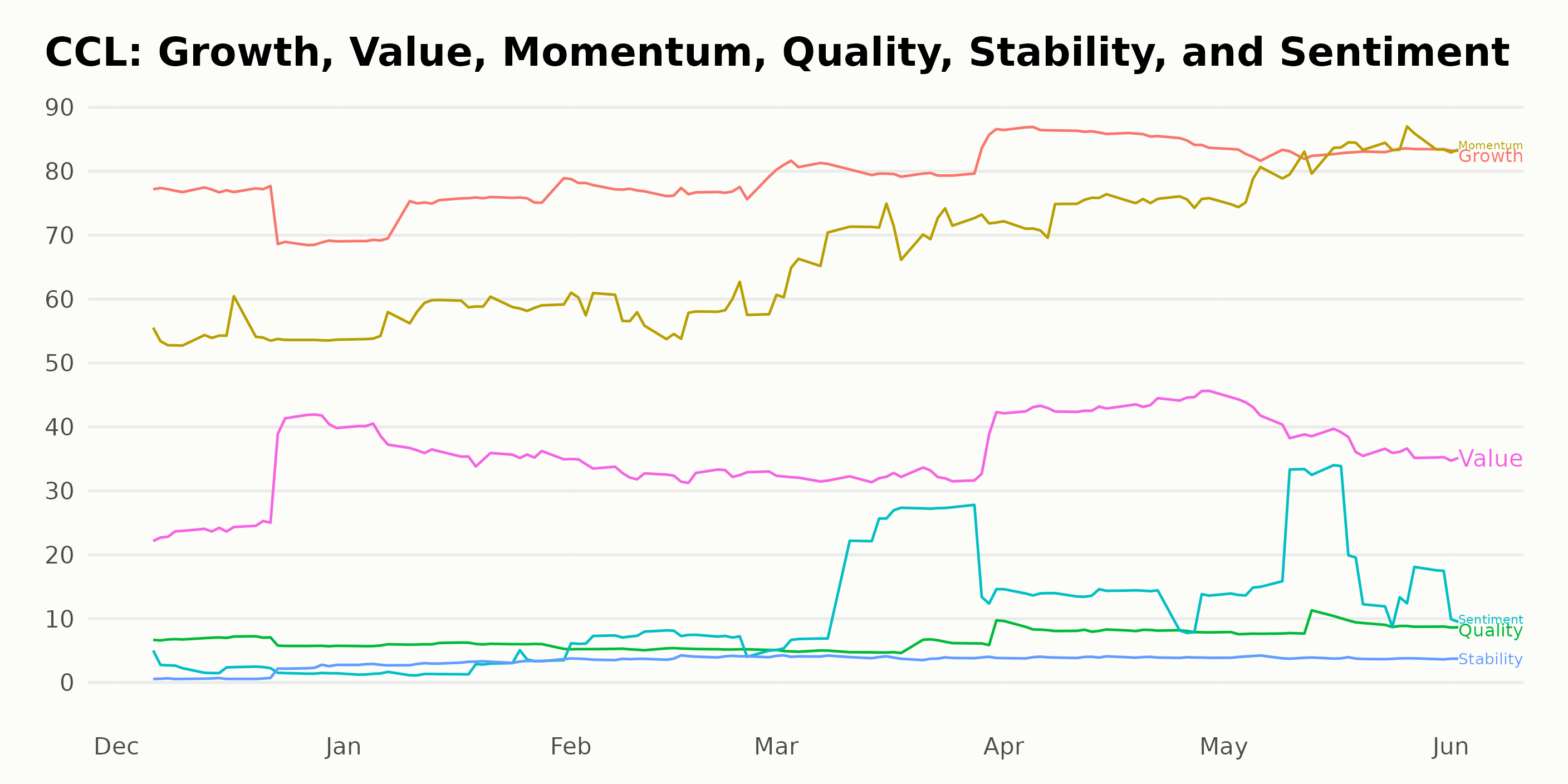

CCL’s POWR Ratings Analysis

CCL has an overall D rating, translating to a Sell in our POWR Ratings system. It is ranked the last among the four stocks in the Travel – Cruises category. It has an F grade for Stability and a D for Sentiment and Quality.

Stocks to Consider Instead of Carnival Corporation (CCL)

Other stocks that may be worth considering are Bluegreen Vacations Holding Corp. (BVH - Get Rating), Playa Hotels & Resorts N.V. (PLYA - Get Rating), and Marriott International Inc. (MAR - Get Rating) — they have better POWR Ratings.

What To Do Next?

Get your hands on this special report with 3 low priced companies with tremendous upside potential even in today’s volatile markets:

3 Stocks to DOUBLE This Year >

Want More Great Investing Ideas?

CCL shares were trading at $12.21 per share on Friday afternoon, up $0.36 (+3.04%). Year-to-date, CCL has gained 51.49%, versus a 12.35% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| CCL | Get Rating | Get Rating | Get Rating |

| BVH | Get Rating | Get Rating | Get Rating |

| PLYA | Get Rating | Get Rating | Get Rating |

| MAR | Get Rating | Get Rating | Get Rating |