Capital One Financial Corporation (COF - Get Rating) in McLean, Va., operates as the financial services holding company for Capital One Bank (USA), and Capital One, which provides various financial products and services. It operates in three segments: Credit Card; Consumer Banking; and Commercial Banking. The company manages checking accounts, money market deposits, negotiable orders of withdrawals, savings, and time deposits. Its loan products include credit card loans, auto, and retail banking loans, commercial and multifamily real estate, and commercial and industrial loans.

Interest rates are rising in the United States to fight multi-decade high inflation. The Federal Reserve raised its benchmark interest rate by 50 basis points yesterday, its largest hike since 2000. Fed Chairman Jerome Powell said, “Inflation is much too high, and we understand the hardship it is causing. We are moving expeditiously to bring it back down.” A higher interest rate environment bodes well for the financial industry because it helps them increase their interest income. According to a Research And Markets report, the global financial services market is expected to grow at a 6% CAGR to $28.53 trillion by 2025.

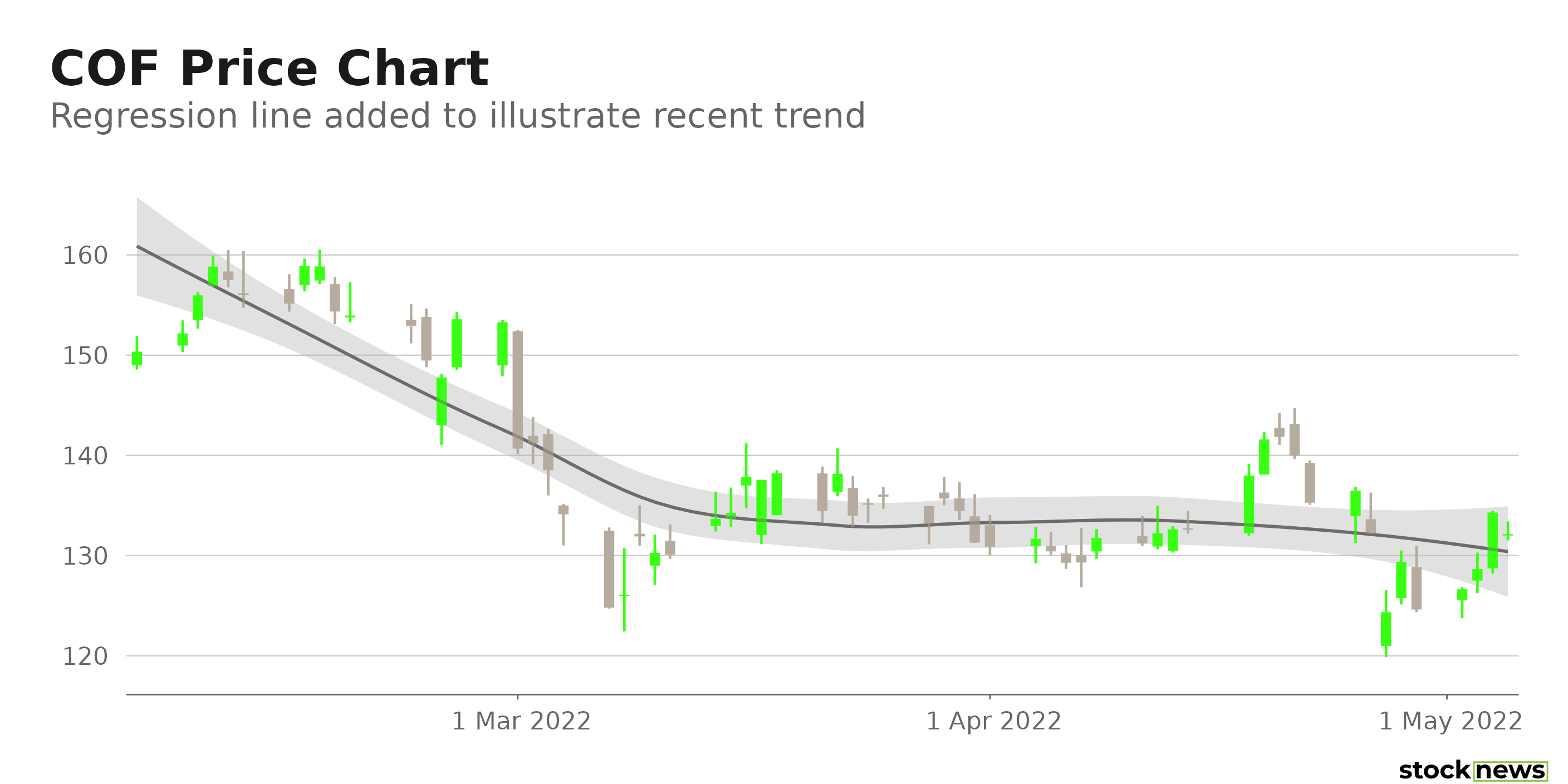

COF stock has declined 16.3% in price over the past nine months and 11.3% over the past year to close the last trading session at $134.30. It is currently trading 24.5% below its 52-week high of $177.95, which it hit on Aug. 13, 2021.

Here is what could influence COF’s performance in the upcoming months:

Underwhelming Valuation

In terms of forward non-GAAP P/E, COF’s 6.72x is 36.4% lower than the 10.57x industry average. And its 0.08x forward non-GAAP PEG is 92.5% lower than the 1.11x industry average. The stock’s 0.91x forward P/B is 20.6% lower than the 1.14x industry average.

Robust Financials

COF’s total net revenue increased 14.9% year-over-year to $8.17 billion for the first quarter ended March 31, 2022. The company’s net interest income increased 9.8% year-over-year to $6.39 billion. Its net income available to common shareholders increased 0.9% sequentially to $2.31 billion. In addition, its EPS came in at $5.62, representing a 3.8% increase sequentially.

Unfavorable Analyst Estimates

Analysts expect COF’s EPS for its fiscal 2022 and 2023 to decline 25.1% and 4.4%, respectively. Also, its EPS is expected to decline 6.7% per annum over the next five years.

High Profitability

In terms of trailing-12-month net income margin, COF’s 35.91% is higher than the 29.63% industry average. And its 20.49% trailing-12-month return on common equity is 60.9% higher than the 12.73% industry average. Furthermore, the stock’s trailing-12-month 2.19% Capex/S is higher than the 1.55% industry average.

POWR Ratings Reflect Uncertainty

COF has an overall C rating, which equates to a Neutral in our POWR Ratings system. The POWR Ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

Our proprietary rating system also evaluates each stock based on eight distinct categories. COF has a D grade for Growth, which is in sync with an expected 32.8% year-over-year decline in EPS to $5.12 for the quarter ending June 30, 2022.

COF is ranked #26 out of 50 stocks in the Consumer Financial Services industry. The industry is rated D.

Click here to access COF’s ratings for Value, Momentum, Stability, Sentiment, and Quality.

Bottom Line

Although rising interest rates bode well for the financial industry, COF is currently trading below its 50-day and 200-day moving averages of $134.82 and $151.78, respectively, indicating a downtrend. In addition, analysts expect its EPS for its fiscal 2022 and 2023 to decline. Thus, we think it could be wise to wait for a better entry point in the stock.

How Does Capital One Financial Corporation (COF) Stack Up Against its Peers?

While COF has an overall POWR Rating of C, one might want to consider investing in the following Consumer Financial Services stocks with a B (Buy) rating: Atlanticus Holdings Corporation (ATLC), EZCORP, Inc. (EZPW - Get Rating), and 360 DigiTech, Inc. (QFIN - Get Rating).

Want More Great Investing Ideas?

COF shares were trading at $132.16 per share on Thursday morning, down $2.14 (-1.59%). Year-to-date, COF has declined -8.56%, versus a -10.74% rise in the benchmark S&P 500 index during the same period.

About the Author: Dipanjan Banchur

Since he was in grade school, Dipanjan was interested in the stock market. This led to him obtaining a master’s degree in Finance and Accounting. Currently, as an investment analyst and financial journalist, Dipanjan has a strong interest in reading and analyzing emerging trends in financial markets. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| COF | Get Rating | Get Rating | Get Rating |

| Get Rating | Get Rating | Get Rating | |

| EZPW | Get Rating | Get Rating | Get Rating |

| QFIN | Get Rating | Get Rating | Get Rating |