In its third quarter, Coinbase Global, Inc. (COIN - Get Rating) exceeded revenue forecasts despite witnessing a decrease in trading volumes for a consecutive quarter. The prominent cryptocurrency exchange reported third-quarter trading volumes amounting to $11 billion, a shrinkage compared to the $26 billion observed in the corresponding period last year.

The crypto sector has confronted a tepid response from investors throughout this year, following a series of notable collapses inducing over a trillion dollars in outflows.

Coinbase’s dropping trading volumes can be attributed to its ongoing battle with the U.S. Securities and Exchange Commission (SEC). The SEC filed a suit against the company in June, alleging it traded at least 13 crypto assets that are securities without registering them with the regulator. Coinbase and the SEC are currently enmeshed in multiple lawsuits; the exchange lodged a counter-suit against the regulator in April, only to be sued by the SEC in June.

Despite a substantial recovery in the crypto market, the future of COIN seems less certain in the present year. While a number of analysts maintain an optimistic view, others warn that the market is not likely to hit its record highs of 2021. Furthermore, officials from the Federal Reserve have hinted that rates are not set to drop in the near future.

Considering the ongoing regulatory scrutiny, it may not be an opportune time to invest in COIN. A more detailed examination of the company’s essential performance indicators could provide valuable insights.

COIN Financial Performance Analysis: Significant Fluctuations and Trends from December 2021 to September 2023

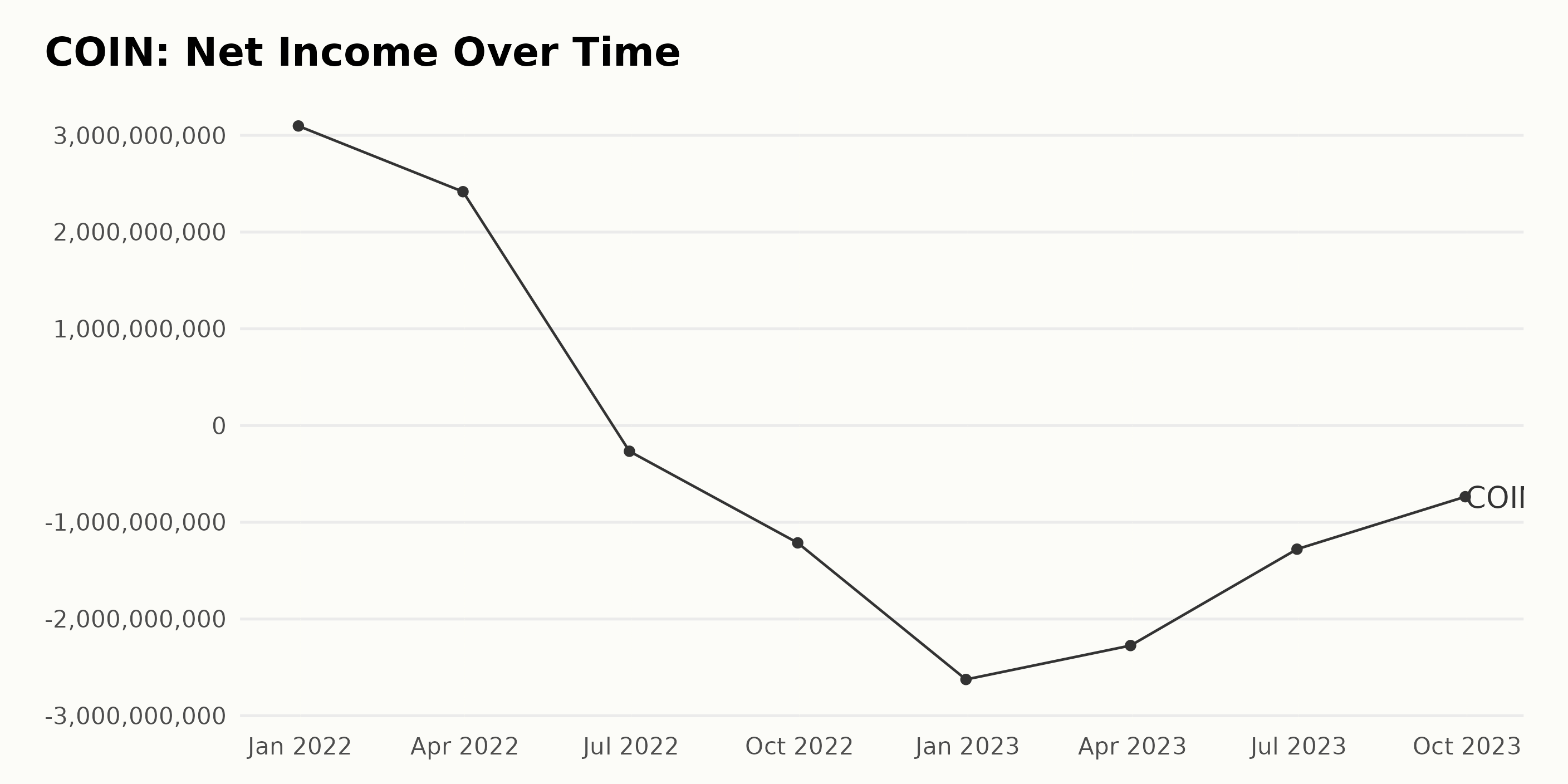

The trailing-12-month Net Income of the COIN has displayed significant fluctuations within the period from December 31, 2021, to September 30, 2023.

- From December 31, 2021, when the Net Income was $3.1 billion, there was an initial decline to $2.42 billion by March 31, 2022.

- By June 30, 2022, COIN reported negative Net Income at -$265.80 million, indicating a more severe drop.

- The pattern of decline in Net Income continued with -$1.21 billion and -$2.62 billion at the end of September and December, 2022, respectively.

- Net Income remained negative in 2023, but the magnitude of loss decreased gradually. From -$2.27 billion in March, it went to -$1.28 billion by June, and further dropped to -$735.57 million by September 30, 2023.

In summary, the Net Income for COIN has shown a downward trend over this given period. There is a noticeable shift from positive to negative Net Income in mid-2022. After moving into a loss from June 2022, COIN manages to reduce its losses incrementally through 2023. The growth rate, measured by the last value from the first value, indicates a negative growth or a decline in Net Income.

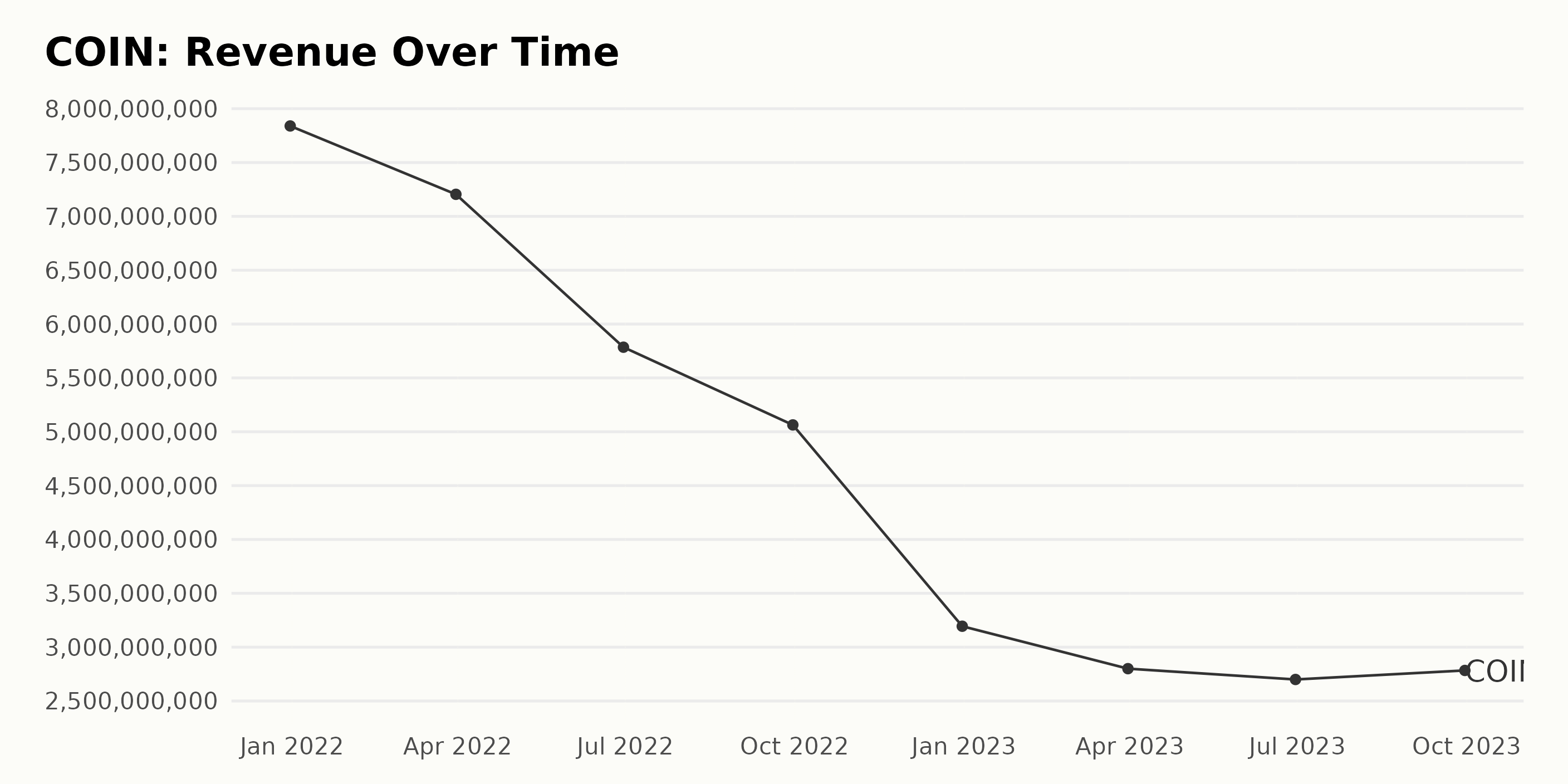

The trend of the trailing-12-month Revenue for COIN shows a fluctuating behavior.

- As of December 31, 2021, COIN reported a Revenue of $7.84 billion.

- By March 31, 2022, the Revenue witnessed a slight decline to $7.20 billion.

- In June 30, 2022, there was a noticeable drop in Revenue to $5.79 billion.

- Further, by September 30, 2022, the Revenue had a slight decrease to $5.06 billion.

- By the end of the year, on December 31, 2022, a significant drop was seen bringing the Revenue down to $3.19 billion.

- During the first quarter of 2023, on March 31, the declining trend continued, setting the Revenue at $2.80 billion.

- There was a minimal decrease to $2.70 billion on June 30, 2023.

- Interestingly, a minor increase is observed in the Revenue back to $2.78 billion by the end of third quarter on September 30, 2023.

The overall growth rate from December 31, 2021, to September 30, 2023, represented a downward trend with an overall decrease in Revenue by approximately 64.56%. This reveals a challenging financial period for COIN, but the last data point indicates a potential for slight recovery. The final numbers will indeed be crucial in determining the future trajectory of COIN’s financial health.

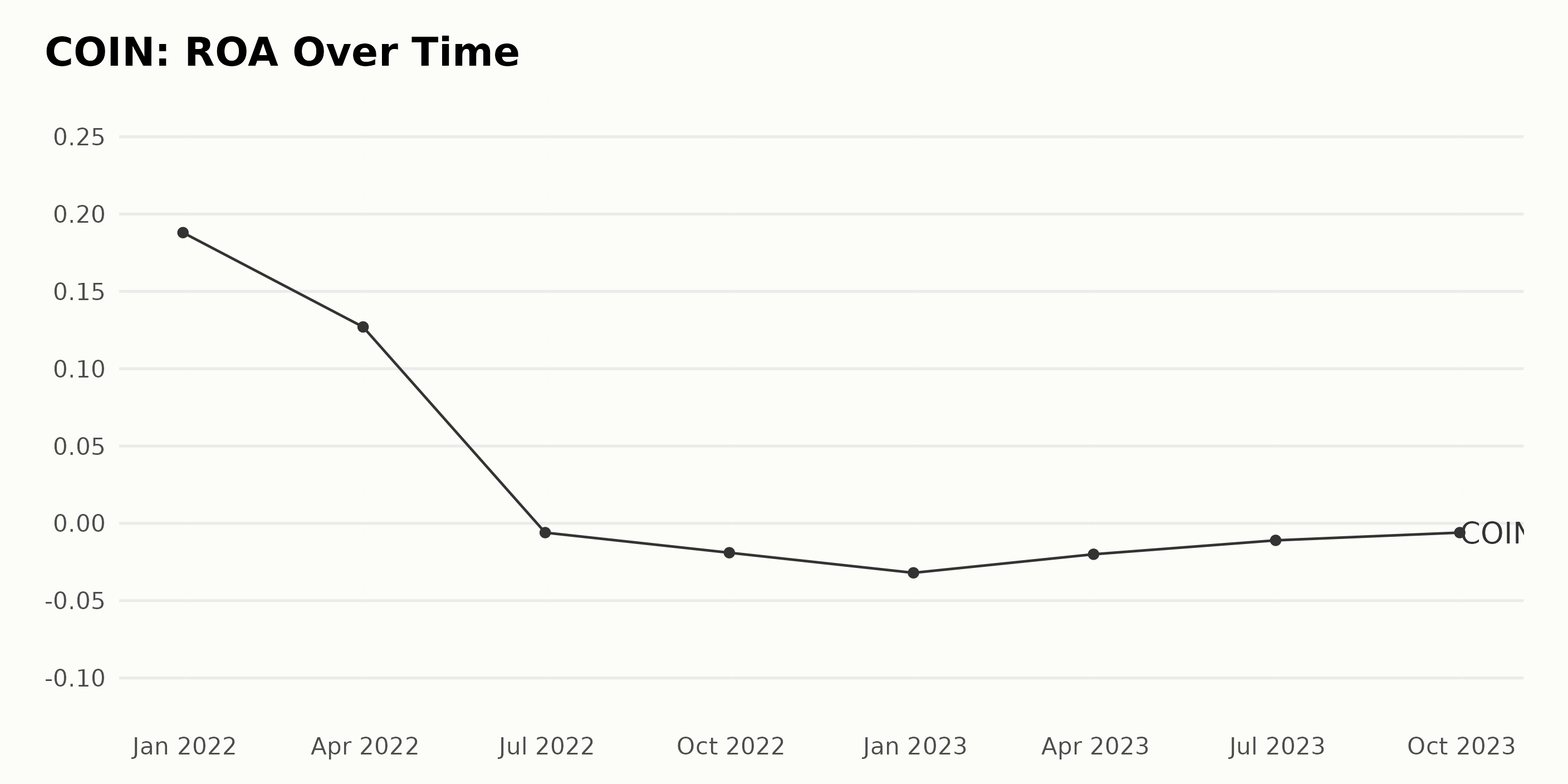

Analyzing the reported Return on Assets (ROA) for COIN, we observe a significant trend and fluctuations in the data:

- On December 31, 2021, COIN started with an ROA of 0.19.

- By March 31, 2022, it had decreased to 0.13, which is about a 32% decrease.

- Thereafter, the ROA continued on a downward trajectory, going negative by June 30, 2022 with a value of -0.006.

- The trend continued with lower ROA reported at -0.019 and -0.032 on September 30, 2022, and December 31, 2022, respectively.

- Moving into 2023, there was a slight improvement in ROA to -0.02 on March 31, then to -0.011 by June 30, and finally to -0.006 by September 30.

Key Takeaways:

- COIN started on a promising note at the end of 2021 but experienced consistent decreases in ROA throughout 2022.

- The ROA went from positive to negative during 2022, indicating financial difficulties during this period.

- Although not returning to positive figures, the ROA inched up slightly in the first three quarters of 2023, possibly showing signs of gradual financial recovery.

The overall growth rate of COIN’s ROA from December 31, 2021, to September 30, 2023, represents a stark decline from its starting point. However, the most recent quarter shows a minor upward trend.

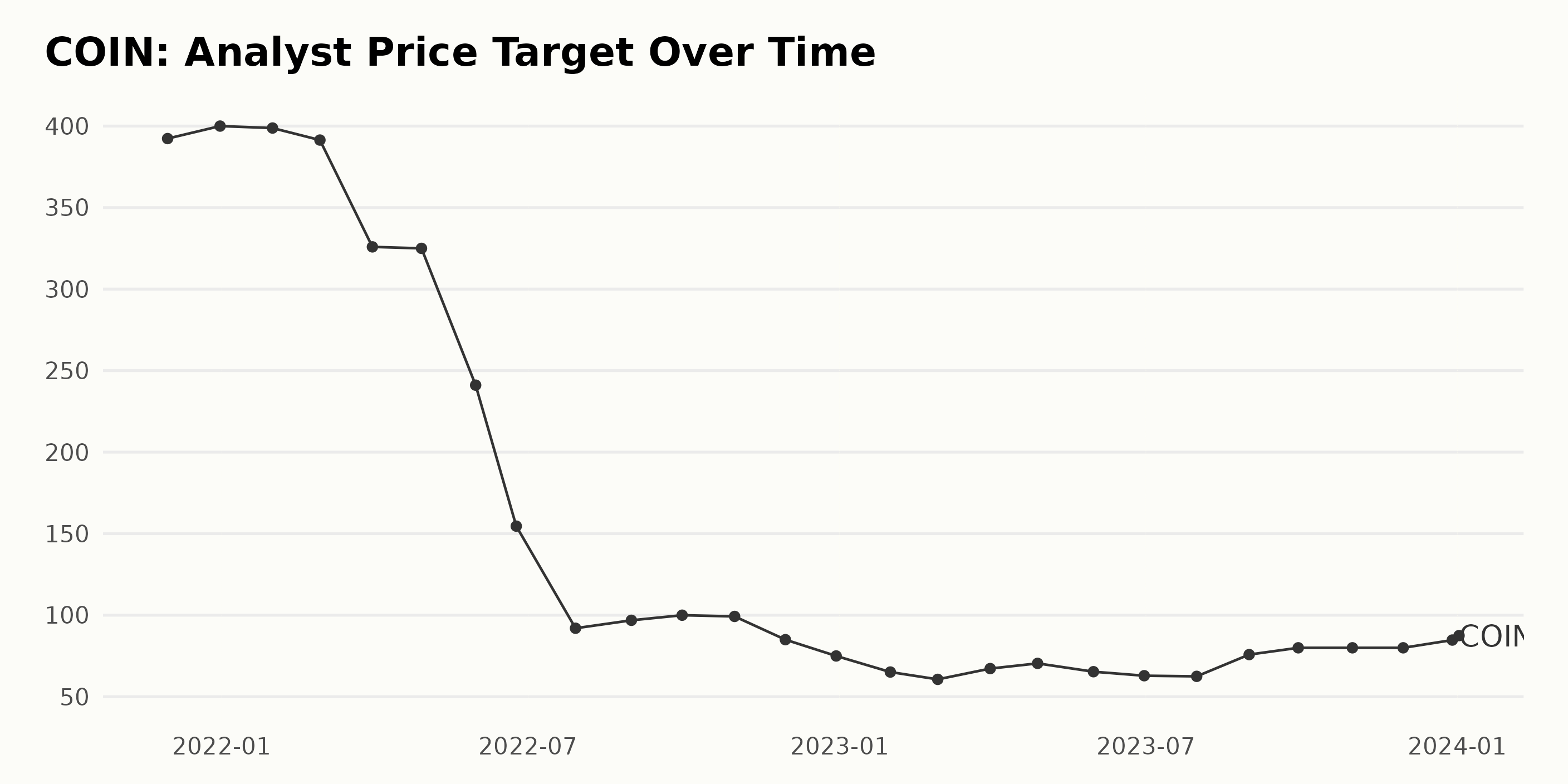

The Analyst Price Target (APT) for COIN has witnessed significant fluctuations from November 2021 to January 2024. Here is a summarized evaluation of the data, with emphasis on recent data: General Overview:

- The APT started at 392.33 in November 2021, reached a peak of 400 in December 2021, and dipped to a low of 60.65 in February 2023. It then started recovering to reach 87.5 by January 2024.

Key Points of Fluctuation:

- There was slighty inconsistency in the APT at the end of 2021 and the start of 2022, reaching a value of 400 in December 2021, before decreasing to 398.8 in January 2022 and 391.42 by February 2022.

- In the first half of 2022, the APT dropped significantly from 325.91 in March to 154.63 by June and bottomed out at just 92 in July.

- The latter half of 2022 saw some stabilization with the APT hovering around 96.87 by August, peaking to 100 in September, then slightly decreased to remain near 85 in November and further reduced to 75 by December.

- The Analyst Price Target began rebounding from a low of 60.65 in Feburary 2023 and gradually increased over the months to reach 80 by October 2023 where it remained consistent till November.

- By December 2023, the price target had appreciated to 84.75 and finished at 87.5 in January 2024.

Calculating the growth rate from the first and last values, COIN has decreased by around 77.71% by January 2024 from its November 2021 level. This summary should provide an overview of (COIN)’s APT trend and its significant fluctuations over the observed period. Please note that while interpreting such data, various external factors could influence these respective evaluations and trends.

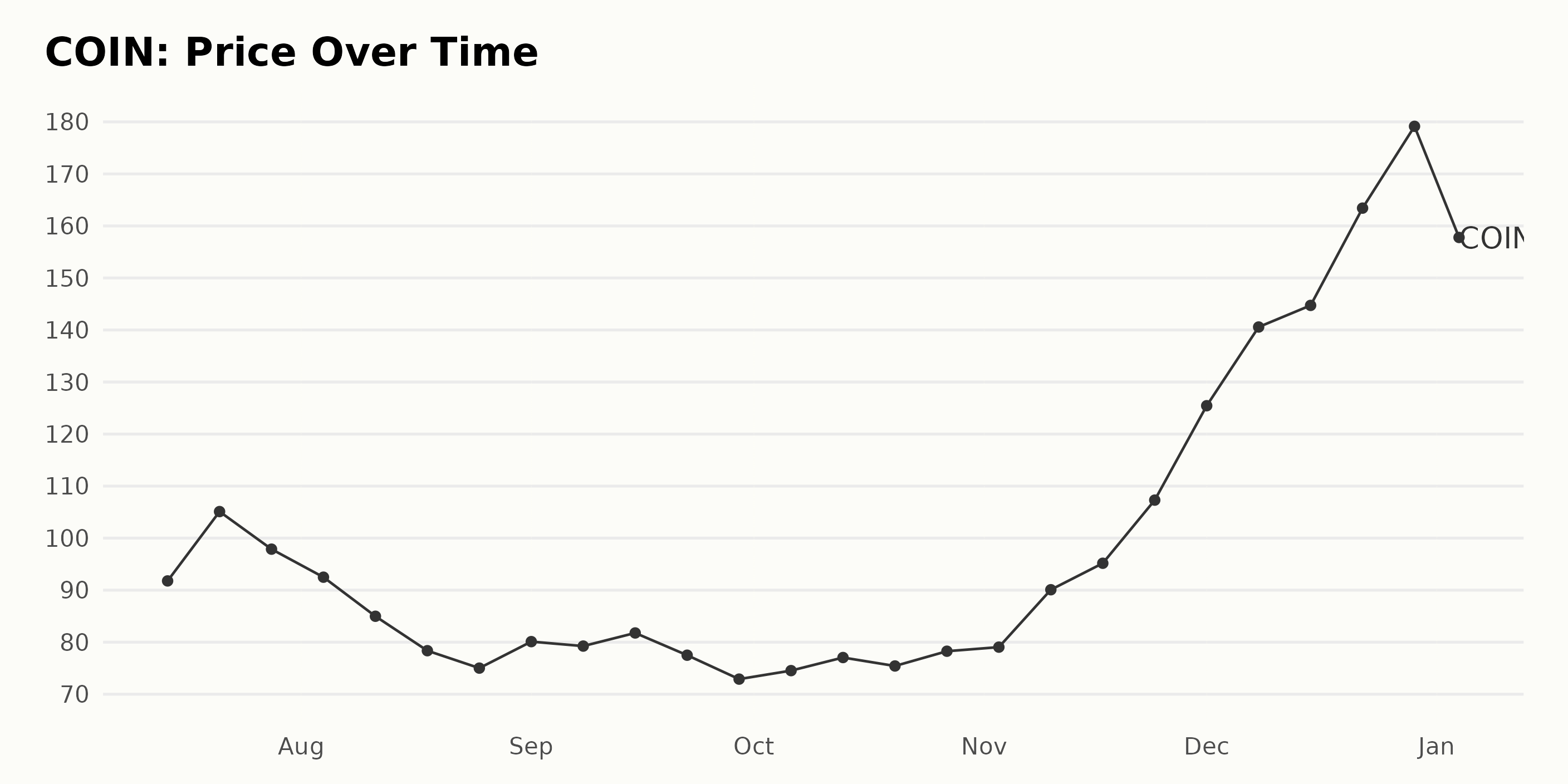

2023-2024 Performance Overview: COIN’s Volatility and Upward Trend

- On July 14, 2023, the share price of COIN was $91.77.

- There was a moderate increase observed on July 21, 2023 when the price rose to $105.10.

- The following week, however, there was a slight downturn, with the price falling to $97.88 on July 28, 2023.

- This downward trend continued into August, with the price lingering around the mid-$90s and eventually slipping into the mid-$80s, achieving a low of $75.01 on August 25, 2023.

- In September 2023, the stock price fluctuated around the high-$70s and low-$80s, before falling once again to $72.90 on September 29, 2023.

- In October 2023, we witnessed another period of volatility with the prices fluctuating between $74.53 and $78.26.

- Then, in November, there is a noticeable growth in the value of the asset. Price increased from $79.04 on November 3, 2023, to $107.30 on November 24, 2023.

- By December 2023, the stock sees a significant acceleration in its price appreciation, starting at $125.44 on December 1, 2023, and ending dramatically higher at $179.14 on December 29, 2023.

- This sharp upward trend decelerated in January 2024, as the price dropped to $157.79 on January 4, 2024.

Upon review, it appears the price of COIN experiences periods of stagnation and decline, but also periods of rapid growth. From this data, we can infer that COIN demonstrated a general upward trend through 2023 into early 2024, with occasional dips and particularly rapid growth in the final months of 2023. Here is a chart of COIN’s price over the past 180 days.

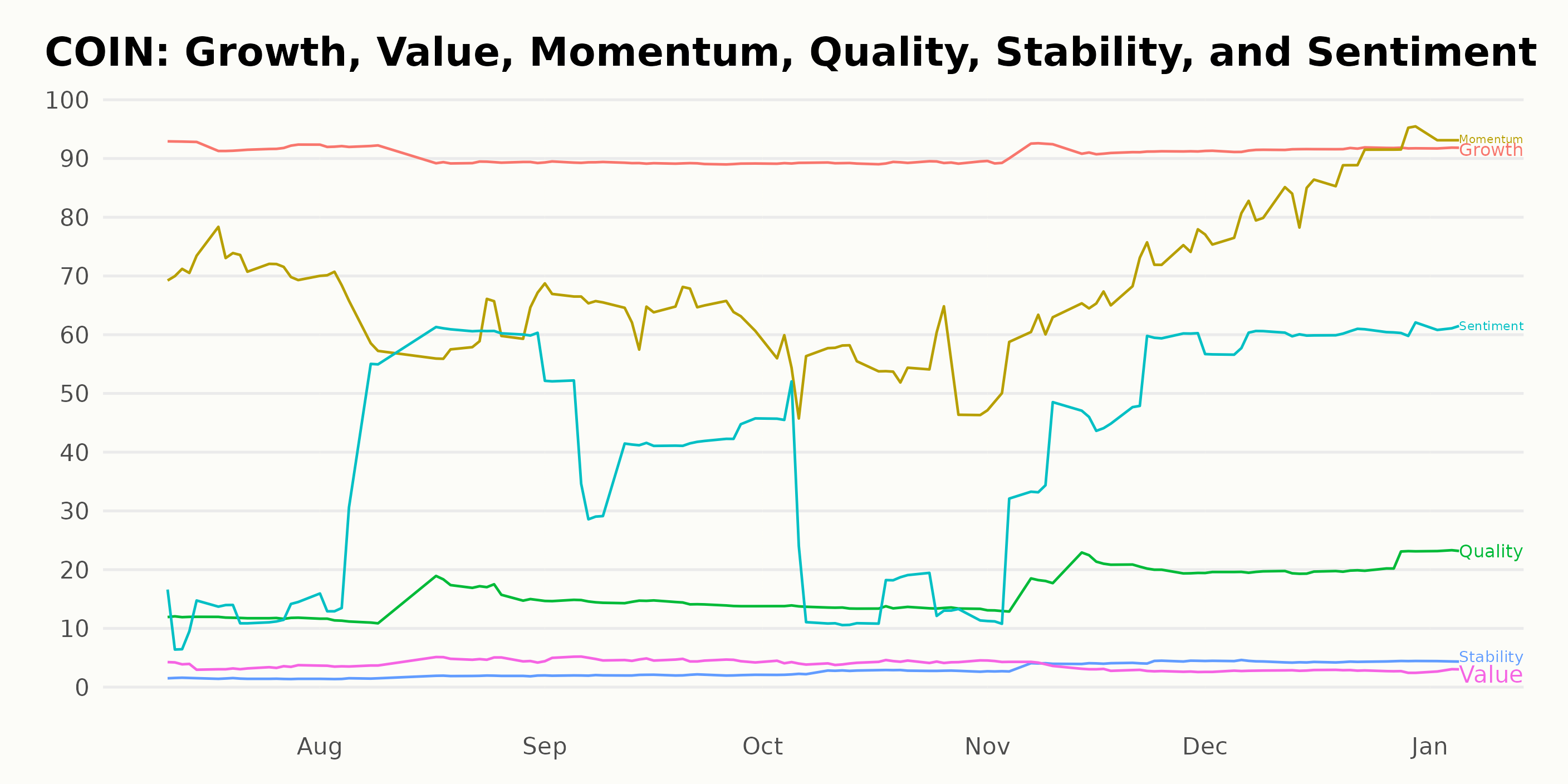

COIN’s Strong Market Performance: Evaluating Growth, Momentum, and Sentiment Trends

COIN has an overall D rating, translating to a Sell in our POWR Ratings system. It is ranked #119 out of the 133 stocks in the Software – Application category.

Based on the provided POWR ratings data, the three most noteworthy dimensions for COIN are Growth, Momentum, and Sentiment.

Growth: The growth dimension consistently holds the highest ratings over all the mentioned periods, ranging from 89 to 92. This showcases a strong growth score with slight fluctuations at different stages.

- In July 2023, Growth stood at a high of 92.

- This value slightly decreased in August to 90, dropped to 89 in September and October, and then increased to 91 in November onwards.

Momentum: Another dimension worth mentioning is Momentum. Although there was some fluctuation in this dimension, it showed steady growth from 72 in July 2023 to a high of 93 in January 2024, indicating a positive momentum trend for COIN.

The lowest rating for Momentum during the considered period was 55 recorded in October 2023. However, this was a short-lived dip as the ratings saw a steady rise after that to reach 93 by January 2024.

Sentiment: The Sentiment dimension had the most noticeable upward trend among the three. Starting at a low of 12 in July 2023, it rose significantly reaching a value of 61 by January 2024.

- An interesting observation in the Sentiment dimension is the consistent increase from August to December 2023, before it reached its peak in January 2024.

Overall, COIN shows noteworthy performance in terms of growth and upward trends in momentum and sentiment. These insights indicate a strong market perception and potential for continued growth for COIN.

How does Coinbase Global, Inc. (COIN) Stack Up Against its Peers?

Other stocks in the Software – Application sector that may be worth considering are Commvault Systems Inc. (CVLT - Get Rating), TeamViewer SE (TMVWY - Get Rating), and Rimini Street Inc. (RMNI - Get Rating) — they have better POWR Ratings.

What To Do Next?

Get your hands on this special report with 3 low priced companies with tremendous upside potential even in today’s volatile markets:

3 Stocks to DOUBLE This Year >

Want More Great Investing Ideas?

COIN shares were trading at $156.21 per share on Friday afternoon, up $0.61 (+0.39%). Year-to-date, COIN has declined -10.18%, versus a -1.46% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| COIN | Get Rating | Get Rating | Get Rating |

| CVLT | Get Rating | Get Rating | Get Rating |

| TMVWY | Get Rating | Get Rating | Get Rating |

| RMNI | Get Rating | Get Rating | Get Rating |