Multi-decade-high inflation, geopolitical issues, and the possibility of the economy witnessing a recession have caused immense turbulence in the stock market over the past few weeks.

According to Quincy Krosby, chief equity strategist for LPL Financial, “Given the history of bear markets, coupled with the fact that the Fed has just begun its rate hike cycle and would like to see financial conditions continue to tighten so that demand pulls back further, this rally will most likely weaken.” Amid the current market uncertainties, it could be wise to invest in stocks that are resilient to market fluctuations, exhibit solid growth prospects, and tend to outperform during economic downturns.

That’s why today we’re highlighting 3 stocks from our Top 10 Safest screen, which is just 1 of the 10 screens in our POWR Screens 10 service (more on that below). Coca-Cola Consolidated, Inc. (COKE - Get Rating), Sisecam Resources LP (SIRE - Get Rating), and Commvault Systems, Inc. (CVLT - Get Rating) could be great additions to your portfolio now because of their solid growth attributes and stability compared to the broader market. These stocks are also rated a ‘Strong Buy’ in our proprietary POWR Ratings system.

Coca-Cola Consolidated, Inc. (COKE - Get Rating)

COKE, along with its subsidiaries, manufactures, markets, and distributes nonalcoholic beverages, primarily products of The Coca-Cola Company in the United States. The company provides sparkling beverages, such as carbonated beverages; still beverages, including energy products, and noncarbonated beverages comprising bottled water, ready-to-drink coffee and tea, enhanced water, juices, and sports drinks.

For the first quarter ending April 1, 2022, COKE’s net sales increased 10.6% year-over-year to $1.40 billion. Its income from operations grew 39.1% from its year-ago value to $131.00 million, while its net income improved 75% from its prior-year quarter to $93.39 million. The company’s EPS rose 75.3% year-over-year to $9.94.

Analysts expect COKE’s revenue to increase 2.8% year-over-year to $5.72 billion for the fiscal year ending December 2022. The company’s EPS is expected to grow 8.1% year-over-year to $9.51 in the second quarter ending June 2022. Moreover, it has an impressive earnings surprise history, as it surpassed the consensus EPS estimates in three of the trailing four quarters.

COKE’s 24-month beta of 0.90 indicates its stability compared to the broader market. The company’s shares have soared 39% over the past year.

COKE’s POWR Ratings reflect this promising outlook. The company has an overall rating of A, which translates to Strong Buy in our proprietary rating system. The POWR Ratings assess stocks by 118 different factors, each with its own weighting.

The stock also has an A grade for Growth and a B grade for Stability and Quality. Within the A-rated Beverages industry, it is ranked #1 of 36 stocks. To see additional POWR Ratings for Value, Sentiment, and Momentum for COKE, click here.

Sisecam Resources LP (SIRE - Get Rating)

Headquartered in Atlanta, Georgia, SIRE is a subsidiary of Sisecam Chemicals Wyoming LLC. Together with its subsidiaries, the company engages in the trona ore mining and soda ash production businesses internationally. It processes trona ore into soda ash, a raw material in flat glass, container glass, detergents, chemicals, paper, and other consumer and industrial products.

During the first quarter ending March 31, 2022, SIRE’s net sales increased 27.9% year-over-year to $163.4 million. Its operating income grew 376.8% from its year-ago value to $32.9 million, while its net income amounted to $15.7million, up 554.2% from its prior-year quarter. The company’s EPS grew 550% year-over-year to $0.78.

Analysts expect SIRE’s revenue to increase 352.3% year-over-year to $2.44 billion for fiscal 2022. SIRE’s 24-month beta of 0.25 indicates its stability compared to the broader market. The stock has gained 47% over the past year.

SIRE’s strong fundamentals are reflected in its POWR Ratings. The stock has an overall A rating, which equates to Strong Buy in our POWR Ratings system. The stock also has an A grade for Growth and a B for Sentiment and Stability. Within the A-rated Chemicals industry, it is ranked #1 of 89 stocks.

In total, we rate SIRE on eight different levels. Beyond what we’ve stated above, we have also given SIRE grades for Growth, Value, and Momentum. Get all the SIRE ratings here.

Commvault Systems, Inc. (CVLT - Get Rating)

Headquartered in Tinton Falls, New Jersey, CVLT offers data protection and information management software applications and related services internationally. The company offers Commvault Backup and Recovery, a backup and recovery solution; Commvault Disaster Recovery, an easy-to-use replication, and disaster recovery solution; and Commvault Complete Data Protection, an easy-to-use data protection solution.

In February, CVLT is rolling out its Metallic Data Management as a Service (DMaaS) solutions in Qatar. Metallic’s enterprise-grade portfolio comprises cloud-based solutions for safeguarding a broad range of workloads from SaaS applications like Office 365 to VMs and containers, enterprise databases, endpoints, and more. This expanded availability would enable customers to seamlessly address growing business concerns around cost, scalability, and security as they manage data across increasingly complex hybrid cloud environments, drive compliance and protect against growing cyber threats.

Also, in February, CVLT announced the general availability for Feature Release 11.26. These improvements to CVLT’s best-in-class Intelligent Data Services aid in hardening infrastructure against the attack and improve recoverability, continuing CVLT’s commitment to reduce cyber threats—including ransomware—in any infrastructure: on-premises, in the cloud, and even across multiple clouds.

CVLT’s revenues increased 7.6% year-over-year to $205.95 million for the fourth quarter ending March 31, 2022. Its income from operations grew 10.7% from its year-ago value to $11.45 million, while its net income improved 27.6% from its prior-year quarter to $8.00 million. The company’s EPS amounted to $0.17, up 30.8% year-over-year.

The consensus EPS estimate of $0.63 for the first quarter ending June 2022 represents 2.3% year-over-year growth. Analysts expect revenue to increase 6.5% year-over-year to $195.26 million for the same period. In addition, it has an impressive earnings surprise history, as it surpassed the consensus EPS estimates in three of the trailing four quarters. CVLT’s 60-month beta of 0.66 indicates that it’s stable compared to the broader market

It is no surprise that CVLT has an overall A rating, equating to Strong Buy in our POWR Ratings system. CVLT has an A grade for Quality and a B grade for Sentiment and Growth.

In the F-rated Software – Application industry, it is ranked #1 of 157 stocks. Click here to see the additional POWR Ratings for CVLT (Stability, Momentum, and Value).

Want more stocks like these?

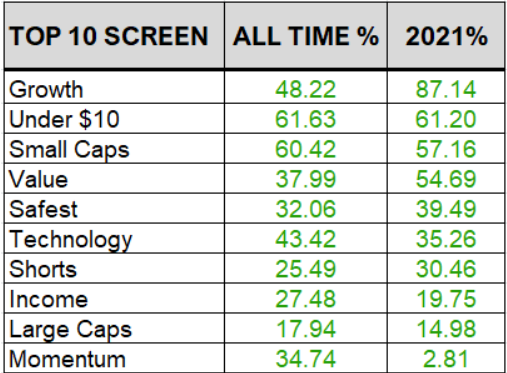

These three stocks are just a fraction of what you will find in our coveted Top 10 Safest strategy. And the safest strategy is just a fraction of what you get with our popular service; POWR Screens 10.

POWR Screens provides 10 market beating strategies with exactly 10 stocks each. Truly something for every investor with verified performance.

Learn More About POWR Screens 10 >>

Want More Great Investing Ideas?

COKE shares were trading at $495.26 per share on Friday morning, up $3.21 (+0.65%). Year-to-date, COKE has declined -19.94%, versus a -17.58% rise in the benchmark S&P 500 index during the same period.

About the Author: Spandan Khandelwal

Spandan's is a financial journalist and investment analyst focused on the stock market. With her ability to interpret financial data, she aims to help investors evaluate the fundamentals of a company before investing. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| COKE | Get Rating | Get Rating | Get Rating |

| SIRE | Get Rating | Get Rating | Get Rating |

| CVLT | Get Rating | Get Rating | Get Rating |