Beverage giant Coca-Cola Consolidated, Inc. (COKE - Get Rating) demonstrated robust growth in the fiscal second quarter, achieving a 13.4% operating margin and higher net sales driven by price adjustments. The company is actively enhancing its supply chain and investing in expanding small bottle PET packages and mini cans.

Moreover, the blue-chip stock has remained a beloved choice for investors, generating remarkable wealth over the past few decades. The company recently declared a dividend of $0.50 per share on shares of the company’s common stock and Class B common stock, payable on August 11, 2023. The company boasts a 33-year record for consistent dividend payments.

While the company has a four-year average dividend yield of 0.36%, its forward annual dividend of $2 per share translates to an attractive dividend yield of 0.28%. Furthermore, COKE’s dividend payouts have consistently grown at a CAGR of 20.5% over the past three years.

Amidst high inflation and interest rates in the economy, COKE encountered a temporary dip in overall volume in the second quarter. However, Ave Katz, the President, and COO, emphasized in the quarterly report that the company’s proactive strategy of teaming up with retail partners intends to invigorate consumer footfall and transactions, focusing on driving growth throughout the remaining year.

Let’s look at the trends of COKE’s key financial metrics to understand why it could be a solid buy now.

COKE’s Financial Performance: Analyzing Revenue, Gross Margin, Current Ratio, and Dividend Per Share:

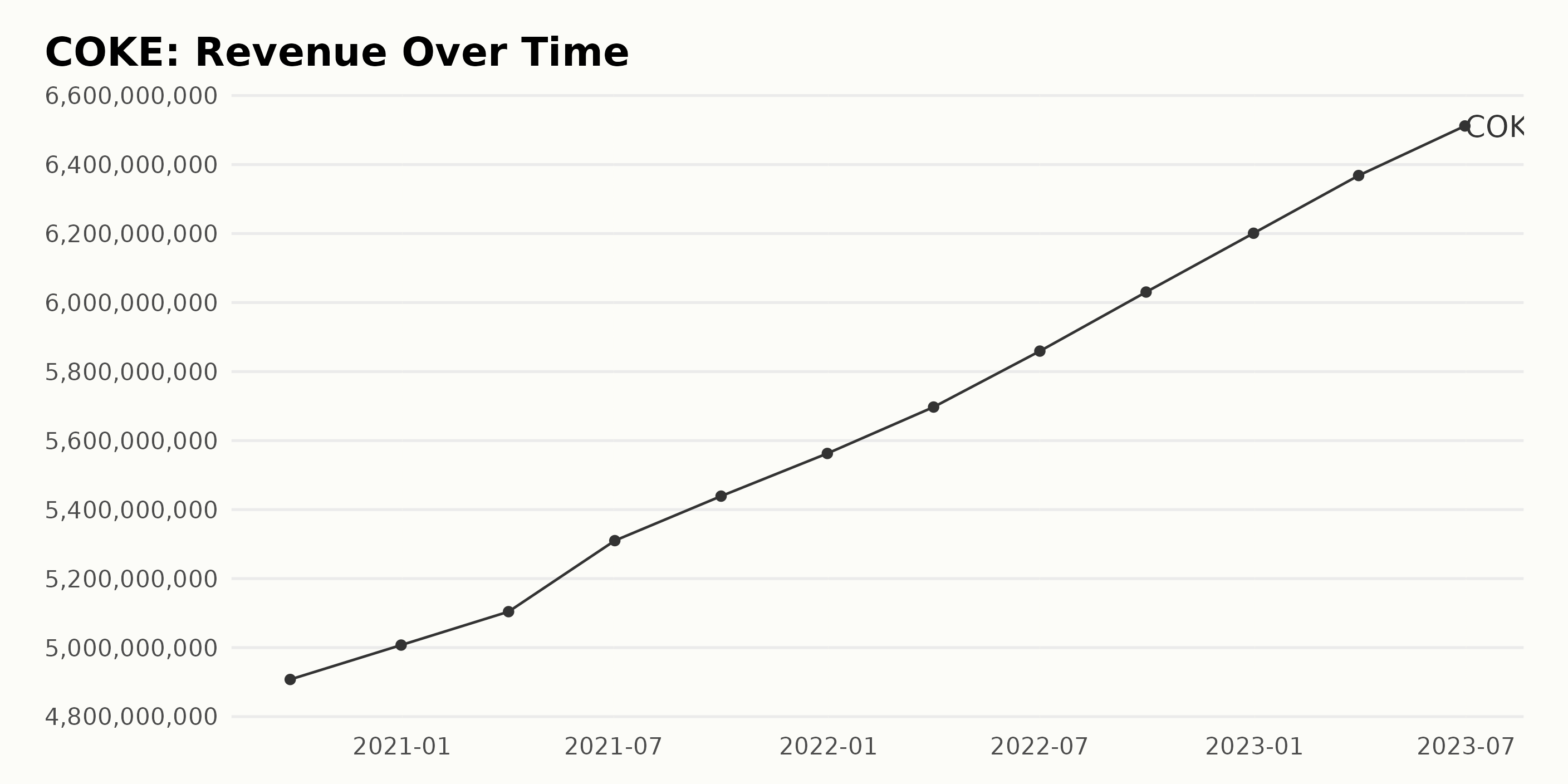

COKE’s trailing-12-month revenue has demonstrated a clear increasing trend over the past three years. The observations for each quarter are as follows:

- September 27, 2020: $4.91 billion

- December 31, 2020: $5.01 billion

- April 2, 2021: $5.10 billion

- July 2, 2021: $5.31 billion

- October 1, 2021: $5.44 billion

- December 31, 2021: $5.56 billion

- April 1, 2022: $5.70 billion

- July 1, 2022: $5.86 billion

- September 30, 2022: $6.03 billion

- December 31, 2022: $6.20 billion

- March 31, 2023: $6.37 billion

- June 30, 2023: $6.51 billion

From September 2020 to June 2023, COKE’s revenue displayed consistent growth of about 33%. This could indicate that COKE is successfully expanding its sales and operations, leading to higher revenue generation.

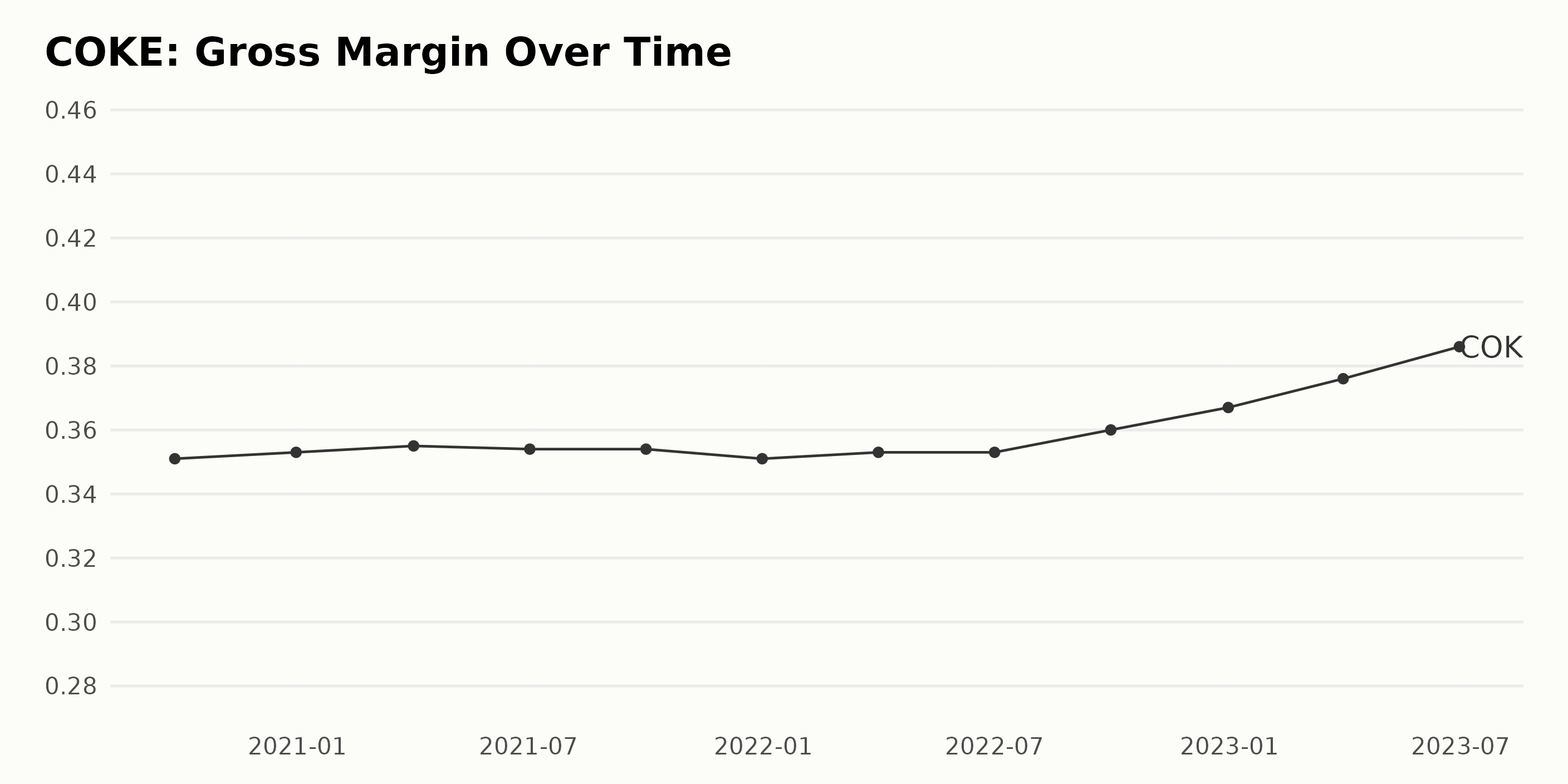

COKE’s gross margin has witnessed a gradual increase over the observed period despite minor fluctuations. Here’s a breakdown of the relevant figures:

- September 27, 2020 – Gross margin stood at 35.1%

- December 31, 2020 – Increased slightly to 35.3%

- April 2, 2021 – Continued to rise to 35.5%, representing a steady growth

- July 2, 2021 – Minor dip with a gross margin of 35.4%

- October 1, 2021 – Maintained similar gross margin figures at 35.4%

- December 31, 2021 – Saw a small drop to 35.1%, resembling the value from September 2020

- April 1, 2022 – Recovered back to a gross margin of 35.3%, reflecting the same as December 2020

- July 1, 2022 – Gross margin remained steady at 35.3%

- September 30, 2022 – Started growing again, reaching 36.0%

- December 31, 2022 – Marked an increase to 36.7%

- March 31, 2023 – Continued the upward trend to 37.6%

- June 30, 2023 – Registered the highest growth till date at 38.6%

The gross margin as of June 30, 2023 shows a significant improvement compared to 35.1% as of September 27, 2020. Despite the slight volatility, recent trends show a more pronounced increase in COKE’s gross margin, especially from 2022 onward.

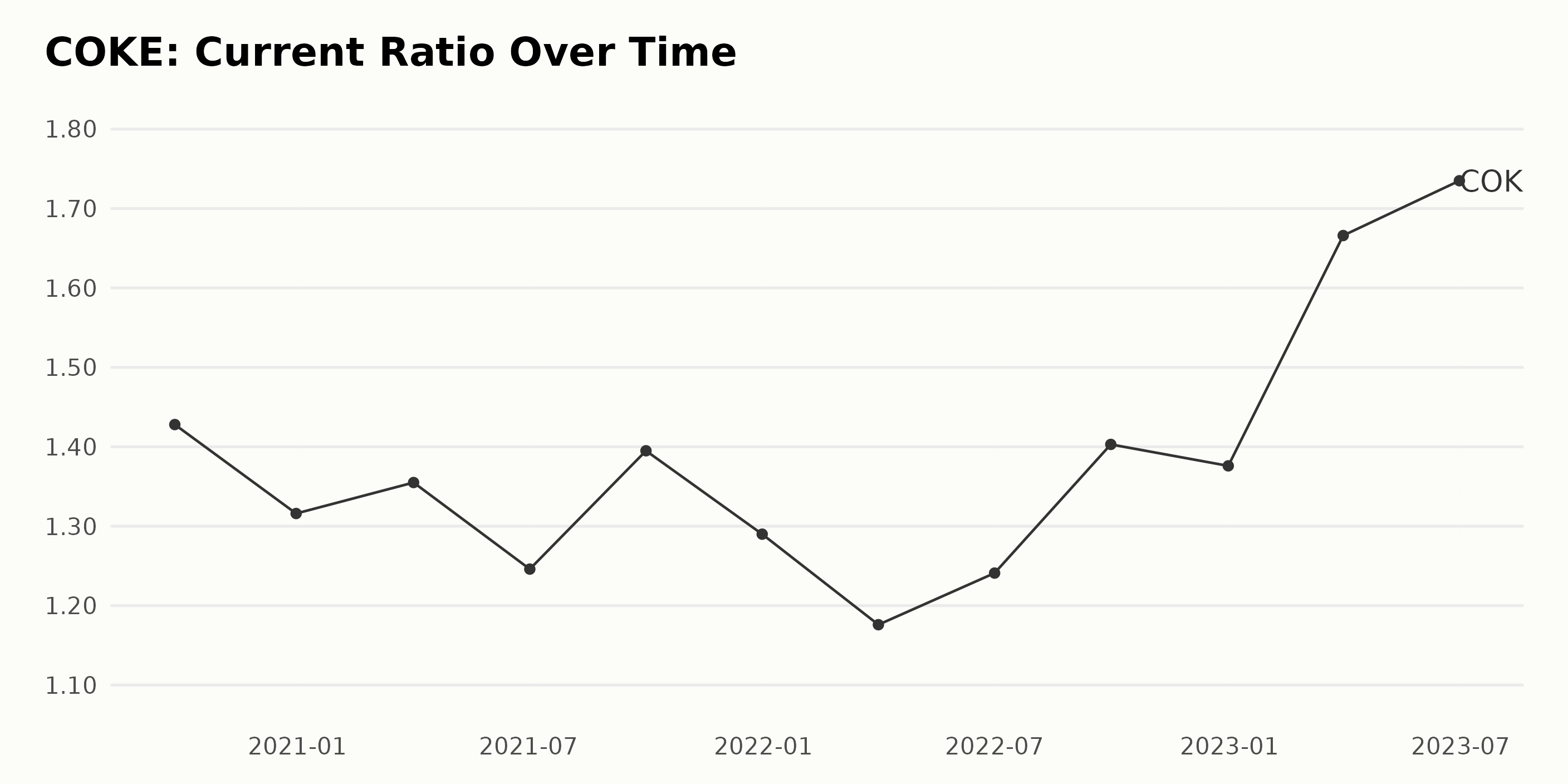

The Current Ratio (CR) of COKE has experienced a fluctuating trend from the end of September 2020 to the end of June 2023. Here are the key points:

- The CR initially declined from 1.43 in September 2020 to 1.32 by the end of December 2020 and then slightly recovered to 1.36 in April 2021.

- During the subsequent months until October 2021, it experienced a downward trend, falling to 1.25 in July 2021 before marginally recovering to 1.40 in October 2021.

- In the second half of 2021, the ratio again showed a declining trend, settling at 1.29 at the end of the year. It further dropped to reach its lowest point of 1.18 in April 2022.

- From this low point, COKE’s CR embarked on an upward trajectory, reaching 1.24 in July 2022, 1.40 by the end of September 2022, and finishing the year at 1.38.

- In 2023, the ratio displayed considerable growth, ascending to 1.67 by the end of March, and further growing to close at 1.74 by the end of June, the highest level during the whole period.

Overall, from September 2020 to June 2023, COKE’s CR grew by approximately 21.5%. The more recent data suggests that the company is improving its ability to cover its short-term liabilities with its short-term assets.

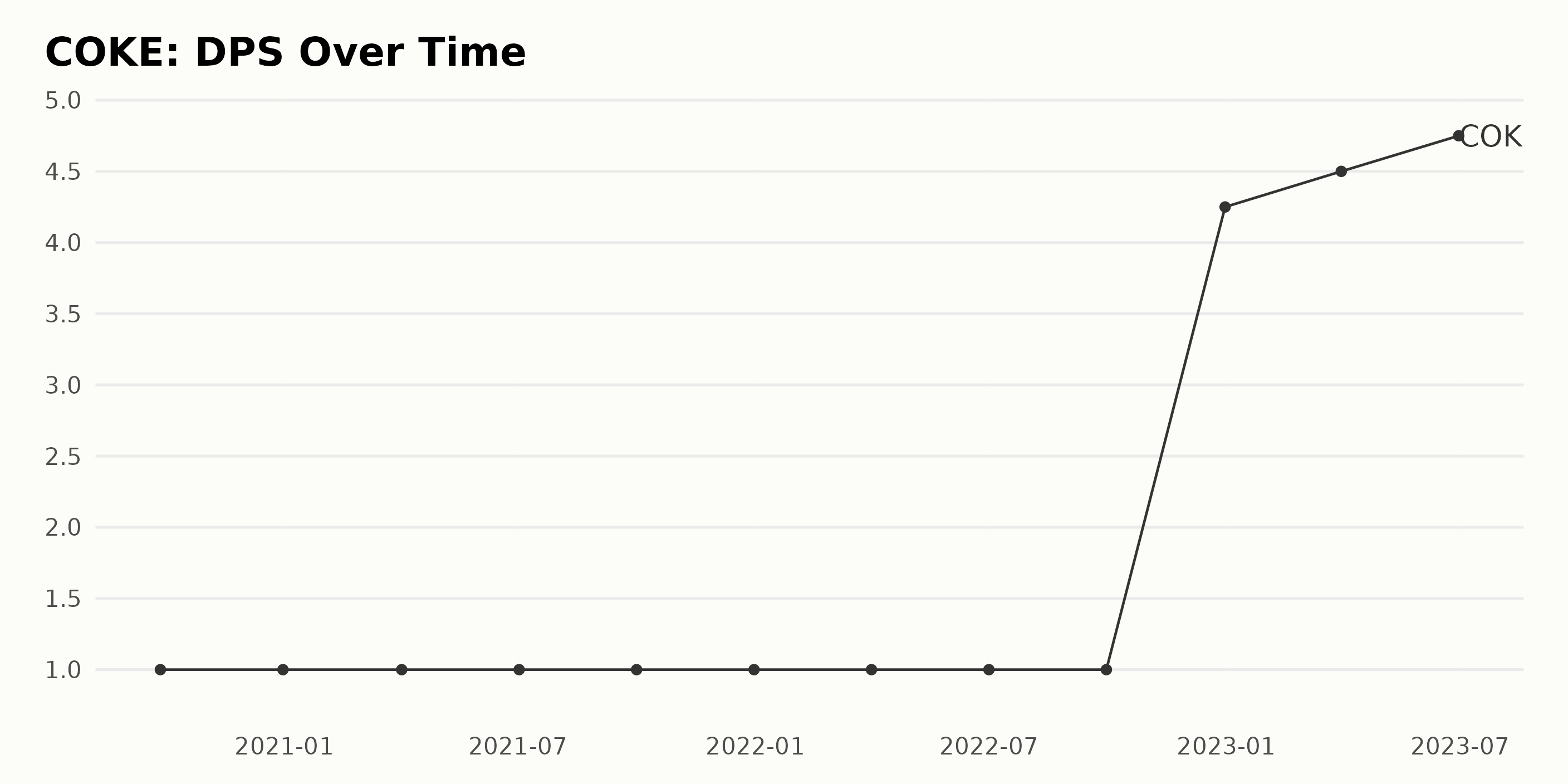

COKE’s Dividend Per Share (DPS) demonstrates a consistent trend with marked fluctuations towards the more recent figures.

- The series begins with a stable DPS of $1 from September 27, 2020, to September 30, 2022. However, there is a sudden surge in the last quarter of 2022.

- On December 31, 2022, the DPS sharply increased to $4.25, signifying a substantial rise compared to the previous uniform rate. This increase signals an upswing in COKE’s performance and investment returns.

- Following the leap in December 2022, the DPS continued to rise steadily throughout 2023. By March 31, 2023, it had grown to $4.50, and this positive growth trend persisted into mid-2023, with the DPS reaching $4.75 by June 30, 2023.

Looking at the entire data series, the DPS growth rate from the first to the last value shows an impressive increase of 375%. Despite the stability observed initially, the recent fluctuations illustrate significant growth and improved performance for COKE.

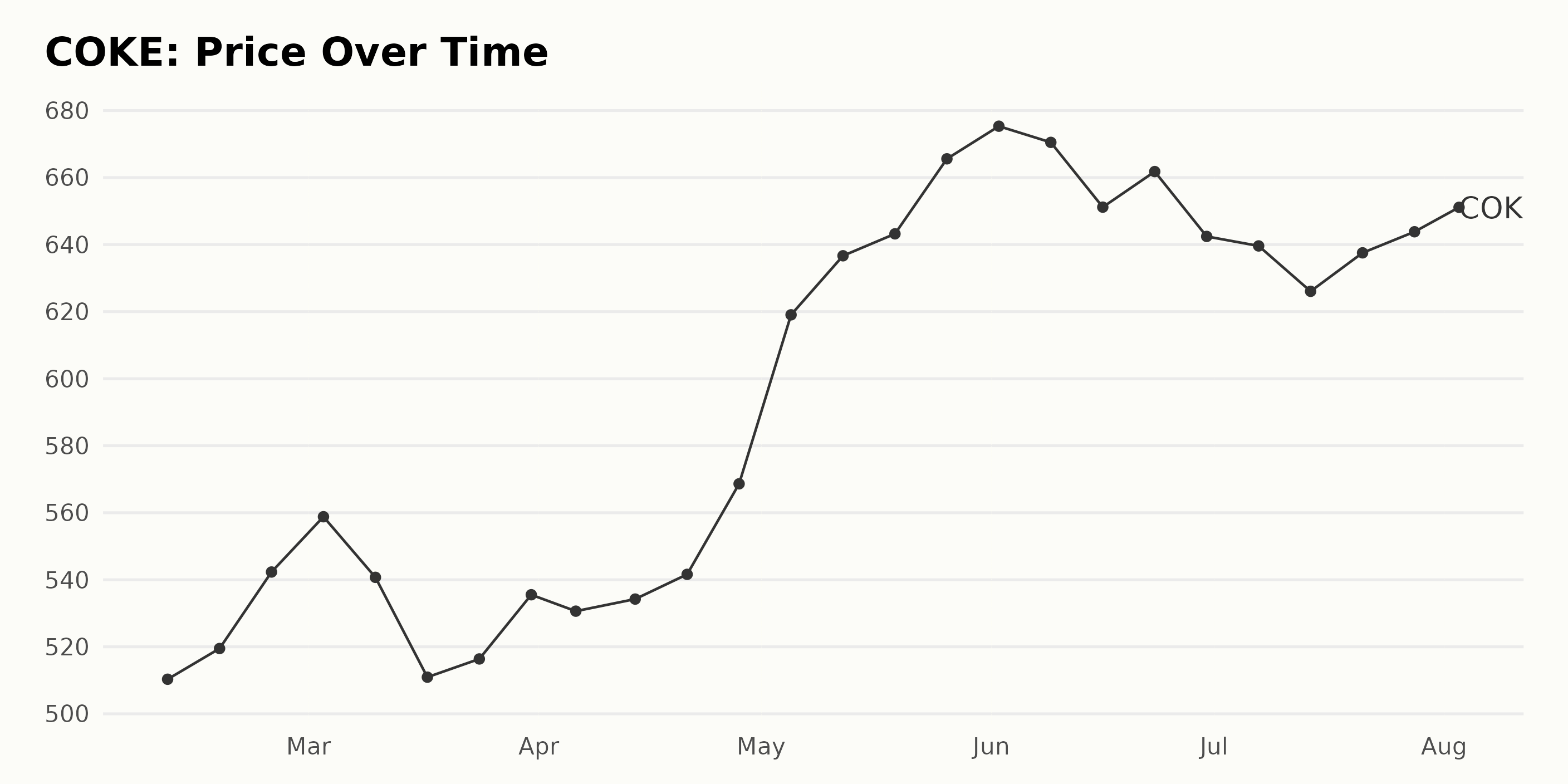

COKE’s Shares: An Steady Upward Journey from February to August 2023

The data indicates a generally upward trend for COKE’s shares of from February 2023 to August 2023.

- The share price began at $510.32 on February 10, 2023, and within a fortnight, by February 24, 2023, displayed a noticeable acceleration to $542.31

- In March 2023, the share price experienced some fluctuations, first rising to $558.81 in the first week, then experiencing a slight deceleration to $510.94 in mid-March. By the end of the month, however, it once again climbed back to $535.53.

- April 2023 saw continued but slower growth, with the price eventually reaching $568.63 by April 28, 2023.

- May 2023 marked significant accelerating growth in the share price, beginning with $619.05 on May 5, 2023, and ending with a high value of $665.59 by the end of the month.

- Throughout June, the price remained fairly stable, with a peak of $675.33 early in the month, but experienced some minor fluctuation downwards before settling around $642.44 on June 30, 2023. In July, a slight increase was noticed, with the share price closing the month at $643.83 on July 28, 2023.

- As the time progresses into early August 2023, the share price continues to climb slowly, at $651.13 on August 3.

Overall, the overarching trend displays a general increase in share price over this time frame. Here is a chart of COKE’s price over the past 180 days.

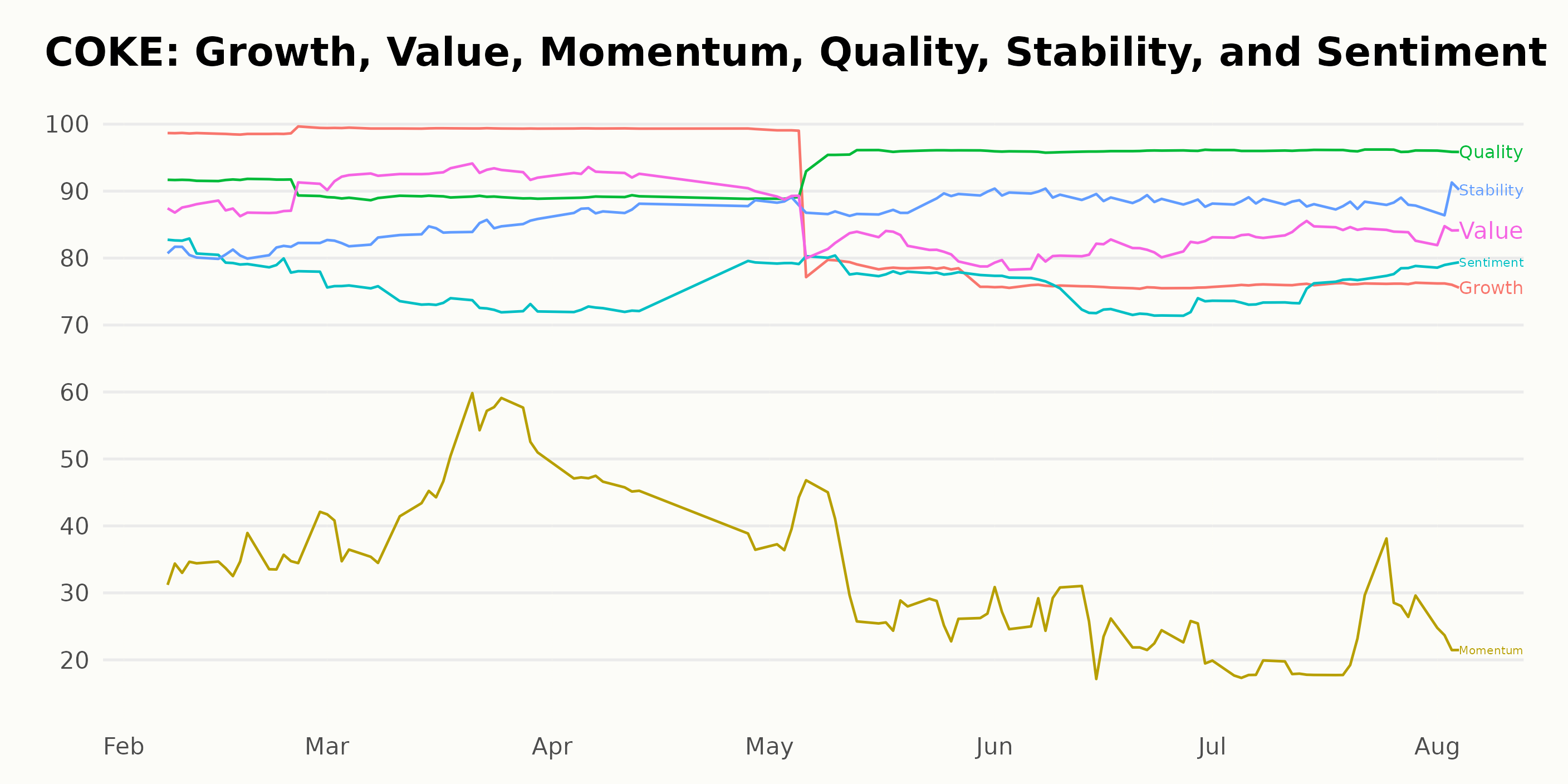

Assessing COKE’S POWR Ratings:

COKE has an overall A rating, translating to a Strong Buy in our POWR Ratings system. Based on the given data, COKE’s POWR Ratings have shown improvement over time in the A-rated Beverages category of stocks, which comprises 37 stocks in total, and COKE is ranked first. Here is a summary of the changes over time:

- As of February 11, 2023, COKE held a rank of 1 within its category, the best possible rank.

- In the week of March 4, 2023, its rank dipped slightly to 2 but resumed a superior ranking by March 18, 2023.

- From April 8, 2023, through May 27, 2023, COKE maintained a top position within the 37 stocks in the Beverages category.

- The rank varied between 1 and 2 in the weeks through June, and then it again consistently held the top slot from July 8, 2023 onwards.

Based on COKE’s POWR Ratings , the three most noteworthy dimensions are Growth, Quality, and Stability. Below are detailed insights for these three dimensions from February 2023 to August 2023:

- Growth: This dimension had the highest rating amongst all, maintaining a consistent value of 99 from February 2023 to April 2023. However, it exhibited a clear downward trend starting from May 2023, decreasing from 82 in that month to 76 by June and remaining at this level through August 2023.

- Quality: The quality dimension remained steady at 91 in February 2023 but gradually improved to 96 by June 2023, maintaining this high rating through August 2023. This makes it one of the highest-rated categories for COKE during this period.

- Stability: The stability ratings for COKE showed an upward trend, starting from 81 in February 2023, it gradually increased month by month, peaking at 89 in June and sustaining this trend at 88 until August 2023.

How does Coca-Cola Consolidated (COKE) Stack Up Against its Peers?

Other stocks in the Beverages sector that may be worth considering are Suntory Beverage & Food Ltd (STBFY - Get Rating), Coca Cola Femsa S.A.B. de C.V. (KOF - Get Rating), and Embotelladora Andina S.A. (AKO.B - Get Rating) — they have better POWR Ratings.

What To Do Next?

Get your hands on this special report with 3 low priced companies with tremendous upside potential even in today’s volatile markets:

3 Stocks to DOUBLE This Year >

Want More Great Investing Ideas?

COKE shares were trading at $695.00 per share on Friday afternoon, down $12.79 (-1.81%). Year-to-date, COKE has gained 36.83%, versus a 19.14% rise in the benchmark S&P 500 index during the same period.

About the Author: Kritika Sarmah

Her interest in risky instruments and passion for writing made Kritika an analyst and financial journalist. She earned her bachelor's degree in commerce and is currently pursuing the CFA program. With her fundamental approach, she aims to help investors identify untapped investment opportunities. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| COKE | Get Rating | Get Rating | Get Rating |

| STBFY | Get Rating | Get Rating | Get Rating |

| KOF | Get Rating | Get Rating | Get Rating |

| AKO.B | Get Rating | Get Rating | Get Rating |