As nations invest heavily in creating a sustainable future and reversing the effects of climate change, Canadian Solar Inc. (CSIQ - Get Rating) is poised to benefit. Recently, CSIQ announced its majority-owned subsidiary, CSI Solar Co., Ltd.’s expansion plans to meet the ever-increasing demand and ensure continued growth.

CSIQ achieved record financial results in 2022 and appears well-positioned to continue its strong performance. In this article, we’ll take a closer look at some of the metrics that show CSIQ’s vast potential for growth.

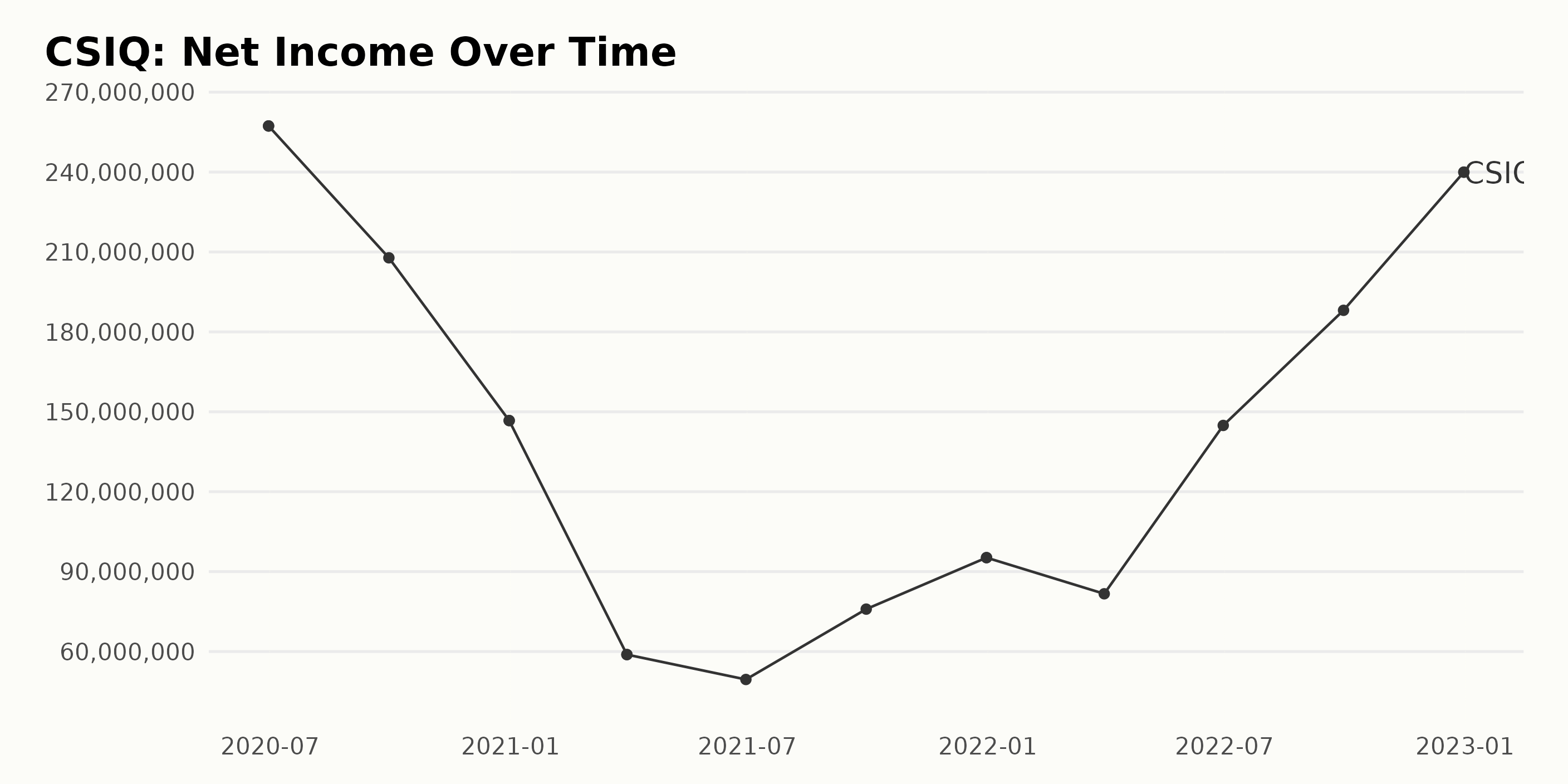

CSIQ Net Income Triples in Two-Year Period

The net income of CSIQ fluctuated over the last two years, changing from a low of $58.85 million in March 2021 to a high of $257.30 million in June 2020. Net income recorded at the end of June 2022 is $239.97 million, an increase of 308% compared to the same period two years ago. Net income attributable to Canadian Solar came in at $78 million in the fiscal fourth quarter ended December 2022.

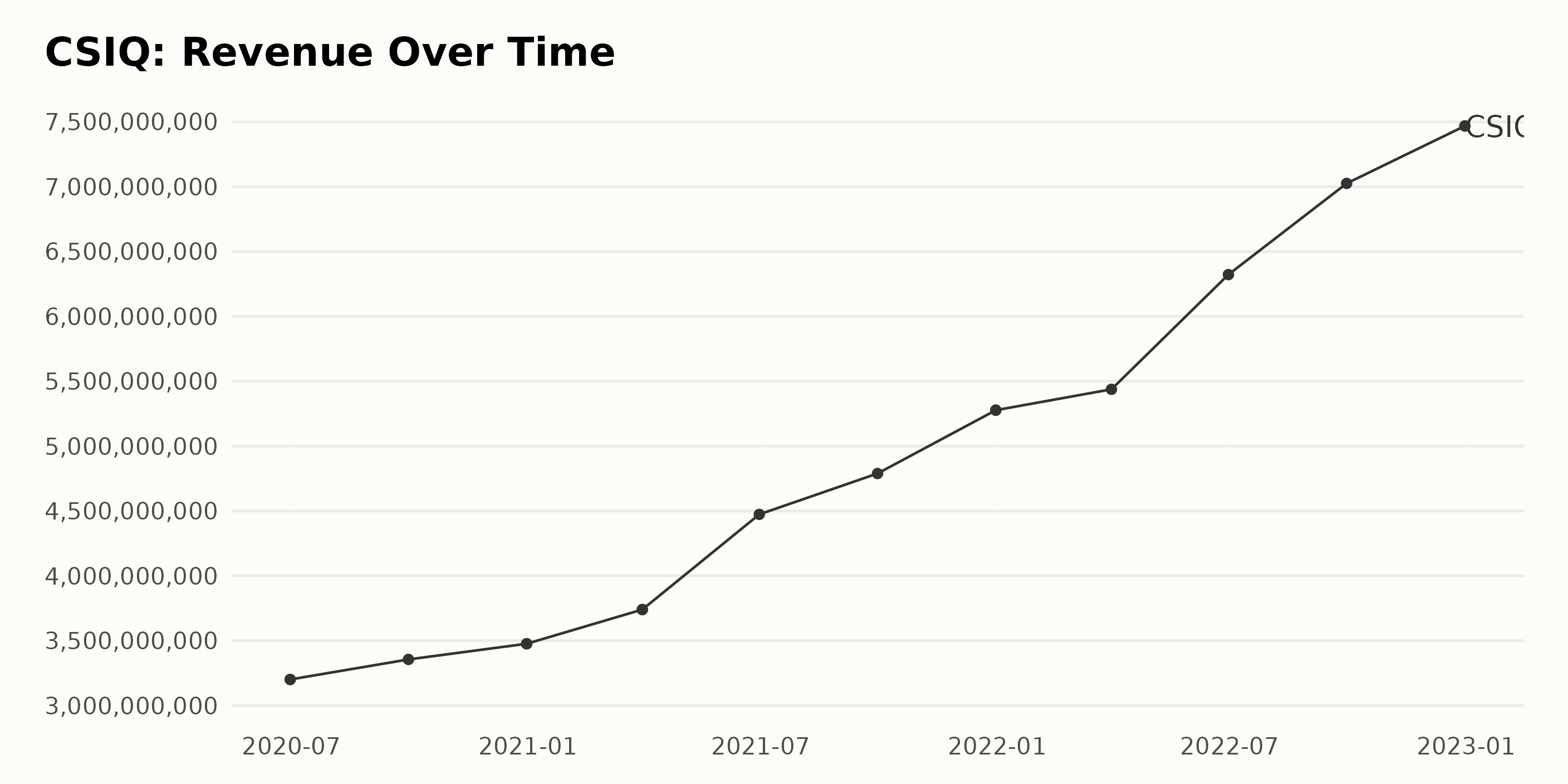

CSIQ’s revenue has shown an upward trend, increasing from $320.11 million on June 30, 2020, to $746.86 million on December 31, 2022, with an overall growth rate of 132%. There have been fluctuations in between, with the most recent maximum value occurring on March 31, 2021, at $374.02 million and the minimum on September 30, 2020, at $335.55 million.

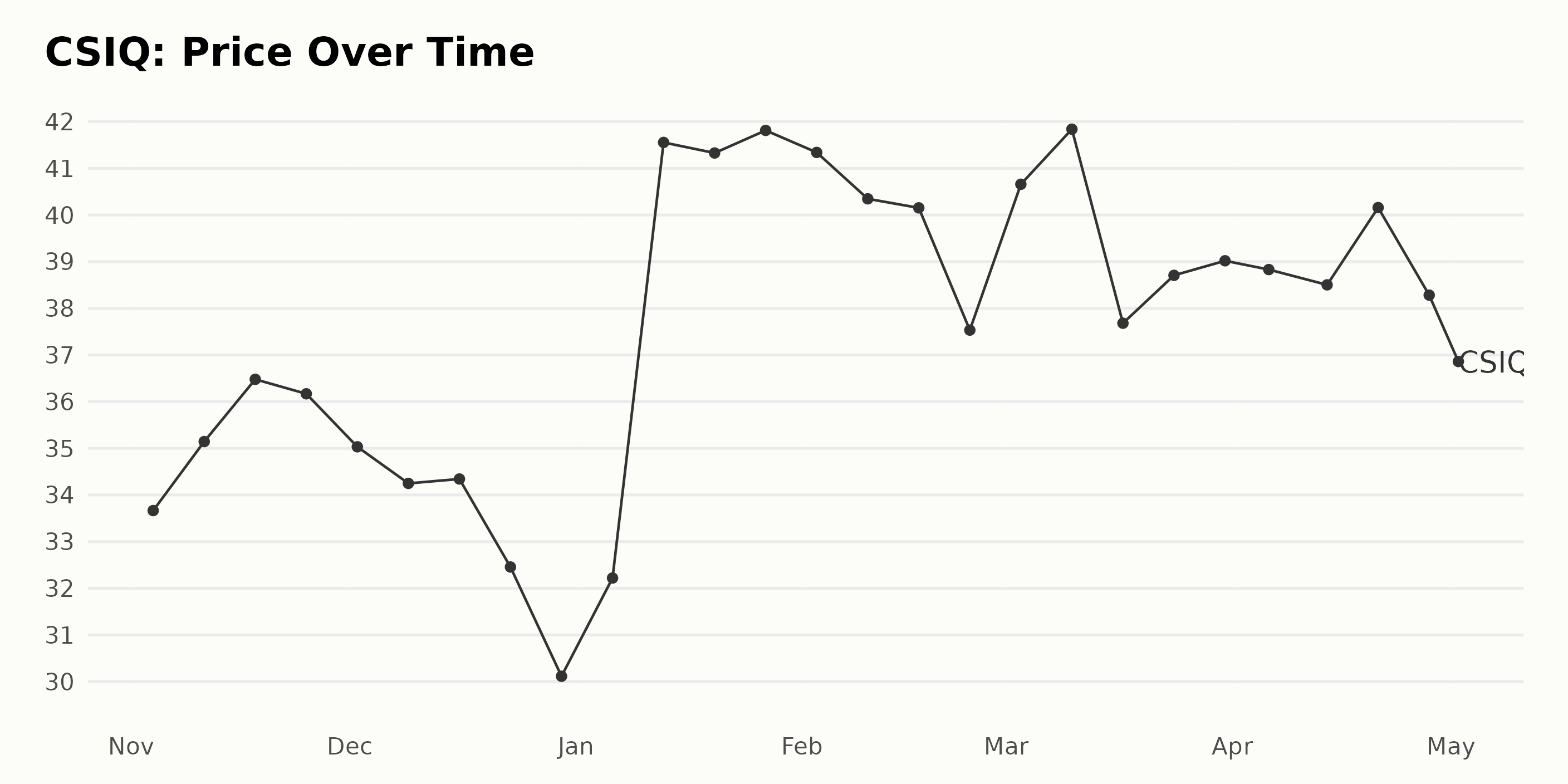

CSIQ Share Price Shows Overall Growth

CSIQ’s share price trend from November 2022 to May 2023 appears to be generally increasing. Prices rose steadily from $33.66 on November 4, 2022, to a peak of $41.81 on January 27, 2023, and then dropped back to a low of $30.11 on December 30, 2022, before rising again to a current level of $37.28 on May 2, 2023. The overall growth rate is approximately 0.7% per week. Here is a chart of CSIQ’s price over the past 180 days.

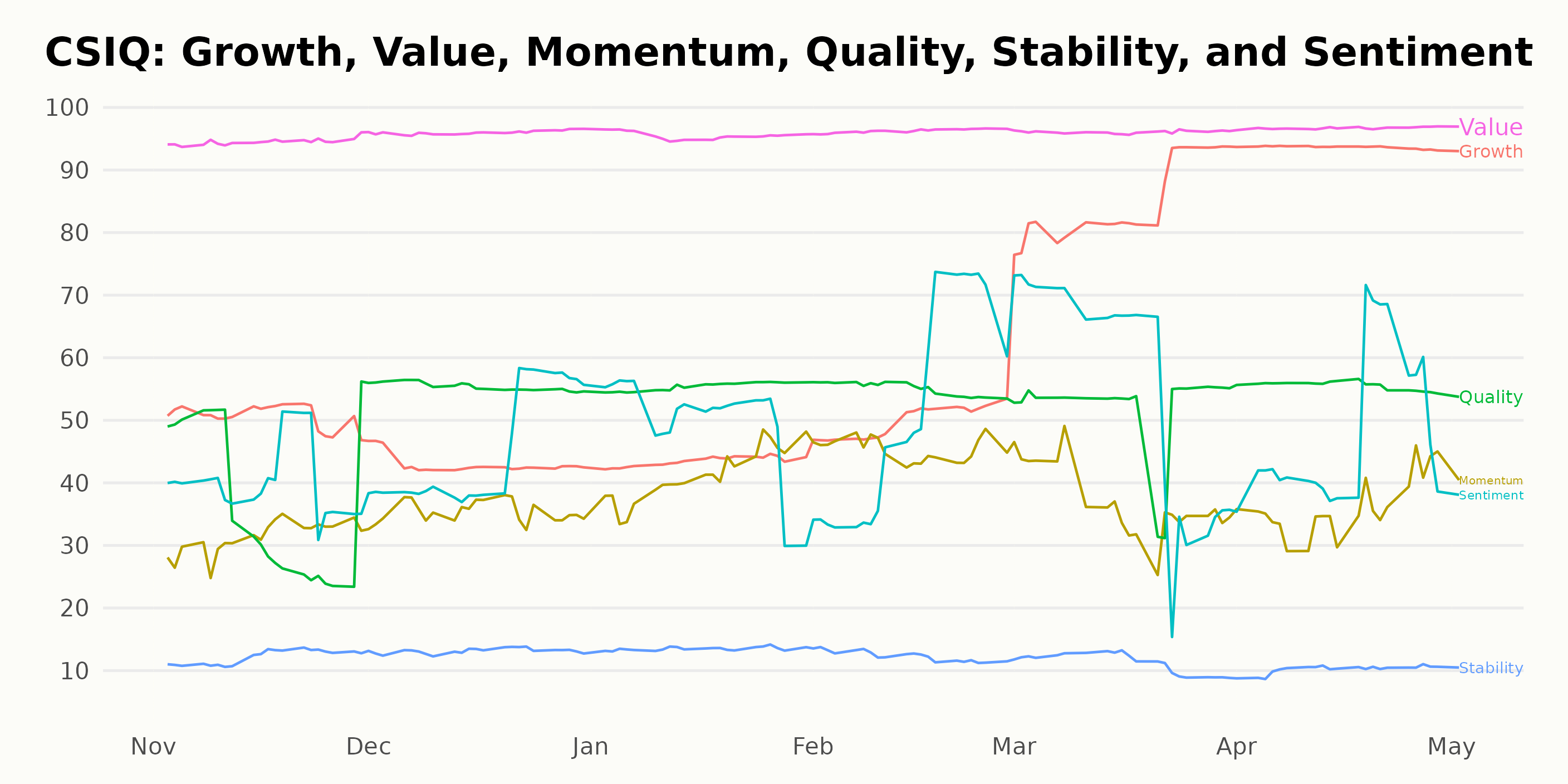

Canadian Solar: Rating Trends in Value, Quality, and Growth

CSIQ has an overall rating of B, translating to a Buy in our POWR Ratings system. It has consistently been in the top two ranks out of the 17 stocks in its Solar industry since November 5, 2022. It reached its highest rank of 1 on January 21, 2023, and has consistently maintained a rank of 1 or 2 since then, with its latest value as of April 29, 2023, being a B and a rank in the category of 1.

The POWR Ratings for CSIQ portray three noteworthy dimensions in November 2022, December 2022, January 2023, February 2023, March 2023, and April 2023. The highest-rated dimensions during all these months were Value, with ratings of 95, 96, 95, 96, 96, and 97, respectively. Quality was also rated highly, with values of 37, 55, 55, 55, 52, and 56, respectively, followed by Growth which had ratings of 51, 43, 43, 50, 85, and 94, respectively. It appears that Value has seen a clear upward trend in the ratings starting from November 2022 to April 2023.

How does Canadian Solar Inc. (CSIQ) Stack Up Against its Peers?

Other stocks in the Solar sector that may be worth considering are JinkoSolar Holding Co. Ltd. (JKS - Get Rating), Enphase Energy Inc. (ENPH - Get Rating), and Maxeon Solar Technologies, Ltd. (MAXN - Get Rating) — they have better POWR Ratings.

The Bear Market is NOT Over…

That is why you need to discover this timely presentation with a trading plan and top picks from 40 year investment veteran Steve Reitmeister:

REVISED: 2023 Stock Market Outlook >

Want More Great Investing Ideas?

CSIQ shares were trading at $36.46 per share on Tuesday afternoon, down $0.47 (-1.27%). Year-to-date, CSIQ has gained 17.99%, versus a 7.56% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| CSIQ | Get Rating | Get Rating | Get Rating |

| JKS | Get Rating | Get Rating | Get Rating |

| ENPH | Get Rating | Get Rating | Get Rating |

| MAXN | Get Rating | Get Rating | Get Rating |