Citius Pharmaceuticals, Inc. (CTXR - Get Rating), a late-stage biopharmaceutical firm focusing on the development and market distribution of premier critical care products, holds a diversified portfolio of products in the pipeline grounds. It encompasses anti-infectives in areas such as oncology, adjunct cancer care, stem cell therapy, and exclusive prescription products.

This company, with a market cap of $135.74 million, recorded a financial loss in its most recent quarter. Street analysts predict that the company’s earnings per share (EPS) for the quarter ended September 2023 will stand at a negative $0.06, translating to a year-over-year downturn of 26.7%.

Moreover, CTXR is an early-stage company still developing its business and isn’t currently generating revenue. Also, the company is not projected to report revenues for the quarter ended in September.

The organization has, however, made marked advances in product development and met substantial milestones, suggesting potential boosts for the company’s future prospects. However, considering the present scenario, the stock does not appear to be a promising investment opportunity owing to the company’s weak financial stature, which may expose the stock to significant volatility. A closer look at essential financial metrics can assist in offering a better perspective of the situation.

Increasing Loss Trend, Static Revenue, Fluctuating Metrics: An Analysis of Citius Pharmaceuticals Finances

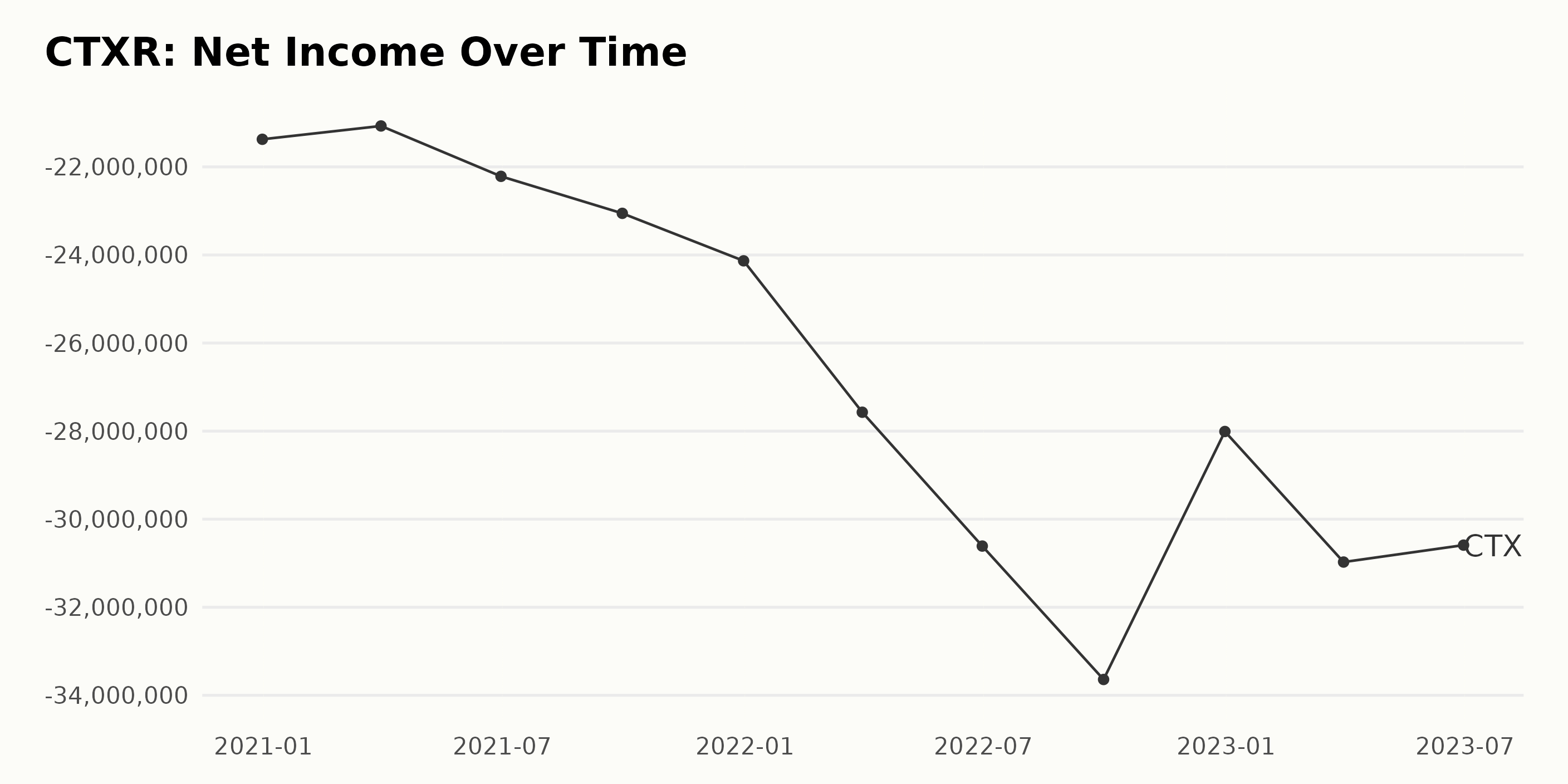

The trailing-12-month Net Income of CTXR has seen a generally increasing negative trend over the analyzed period with some fluctuations in the values. This means that CTXR’s losses have been deepening.

- As of December 31, 2020, the net income was reported at -$21.37 million.

- It slightly reduced to -$21.07 million by March 31, 2021, and then started a steady increase, reaching -$30.61 million by the end of June 2022.

- However, the largest decline occurred on September 30, 2022, reaching -$33.64 million.

- In the recent period, there was an abrupt decline to -$28.01 million by December 31, 2022, but then it started increasing again, reaching -$30.97 million by June 30, 2023. The growth rate from December 31, 2020, to June 30, 2023, representing an increase in the company’s losses, is approximately 43.03%.

This shows that CTXR’s financial performance, as marked by its Net Income, has worsened considerably over the period under review. It’s important to note that while the numbers represent negative values (indicating increased losses), they have been referred herein as ‘increased’ for the sake of clarity regarding the larger magnitude of losses.

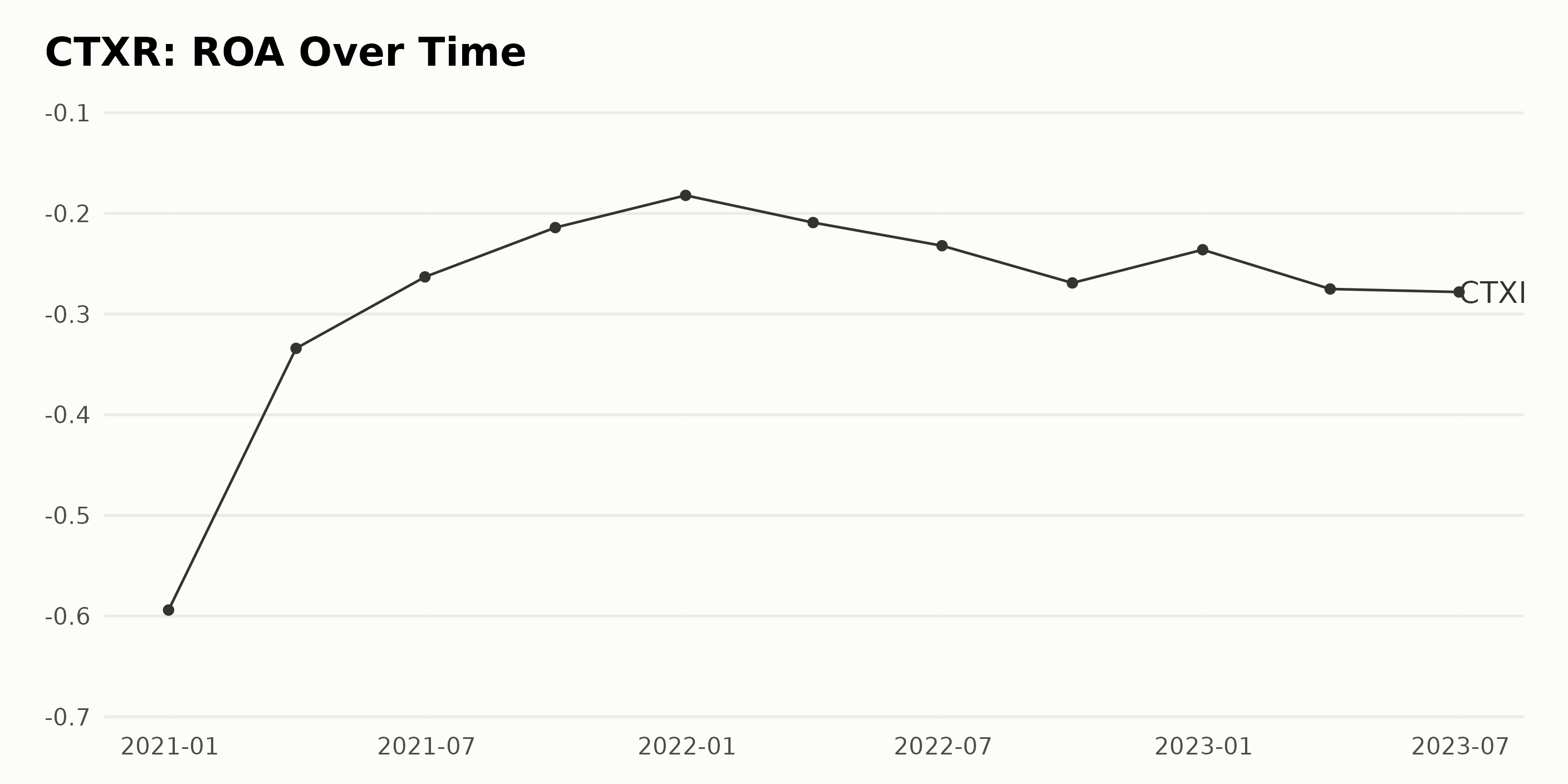

The ROA data of CTXR from 2020 to 2023 showcases a fluctuating trend. Some key highlights are:

- From December 2020 to December 2021: The ROA of CTXR showed an improving trend, moving from -0.59 in December 2020 to -0.18 in December 2021. This corresponds to a 69.5% increase in value over the year, suggesting a significant improvement in the company’s operational efficiency.

- From December 2021 to December 2022: The company’s ROA experienced high variability, initially decreasing to -0.21 in March 2022, then worsening further to -0.27 by September 2022, before improving slightly to -0.24 in December 2022. Over the course of this year, there was a decrease of roughly 31%, indicating a decline in performance.

- Current Status (As of June 2023): CTXR continued its downward trend in 2023 with ROA reaching -0.28 by June 2023. This represents a further 17% decline compared to December 2022, signaling continued operational challenges.

Overall, despite some positive growth seen in 2021, Citius Pharmaceuticals Inc’s ROA has been showing a negative, declining trend for the most recent periods.

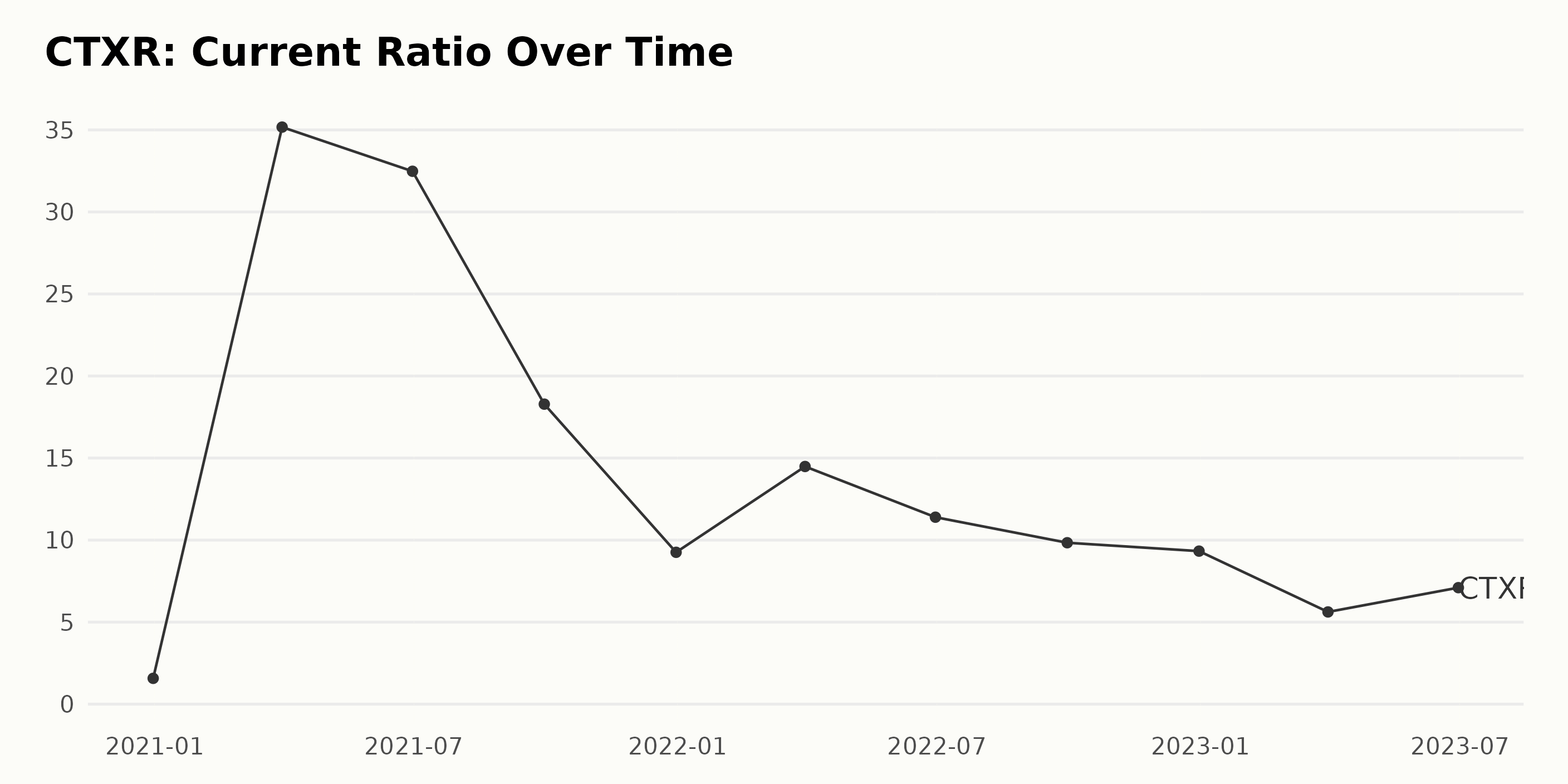

The Current Ratio of CTXR has demonstrated considerable fluctuations over the considered period, from December 31, 2020, to June 30, 2023. Here are key observations:

- The Current Ratio stood at 1.57 as of December 31, 2020.

- A drastic increase was seen up to March 31, 2021, when it hit a peak value of 35.17 in the series.

- The ratio began to decrease steadily from that high point, reaching 9.256 by December 31, 2021.

- In the first quarter of 2022, there was a brief recovery to 14.484, but the general downward trend resumed afterward, affecting the ratio to plunge to 9.327 on December 31, 2022.

- In the first half of 2023, the numbers went through another significant fluctuation, sinking to 5.62 at March end and rebounding to 7.1 by June 30, 2023.

Since the ratio reached a remarkable peak early on, most of the following period was marked with a decreasing trend. Emphasizing the pattern in recent years, this declining trend became particularly noticeable from the start of 2022 onwards. This illustrates a range of volatility for the Current Ratio of Citius Pharmaceuticals Inc. throughout the tracked era, with the more recent data revealing a predilection for a downward trend.

The Analyst Price Target for CTXR exhibits a fluctuating trend pattern over the given data series spanning from November 2021 to December 2023. Focusing on more recent data and the final value in the series, we observe a range of significant fluctuations. Key Highlights:

- Starting from $7 in November 2021, the Analyst Price Target remained constant till the end of December 2021.

- Noticably, there was a decrease in January 2022, falling first to $6.4 and then rapidly to $4 within a couple of weeks. This is followed by a rise to $6 which remained consistent until Jan 2023.

- Early 2023 saw a notable increase when the target price rose to $8 in mid-January and maintained the same rate till the end of February before descending back to $6 in March and remaining steady at that value until August.

- After the steady period, a noticeable decrease happens in August 2023, where the price fell to $5.6 and then plunged to $4 within one week and remains constant at this level till the end of the data series in December 2023.

Overall, the growth rate from the initial value ($7 in November 2021) to the last value ($4 in December 2023), shows a decline of about 43%. These fluctuations indicate a volatile pattern for the Analyst Price Target for Citius Pharmaceuticals over this time frame. Maintaining a focus on the most recent data suggests lowered expectations towards the end of 2023 as reflected in the lowered price target.

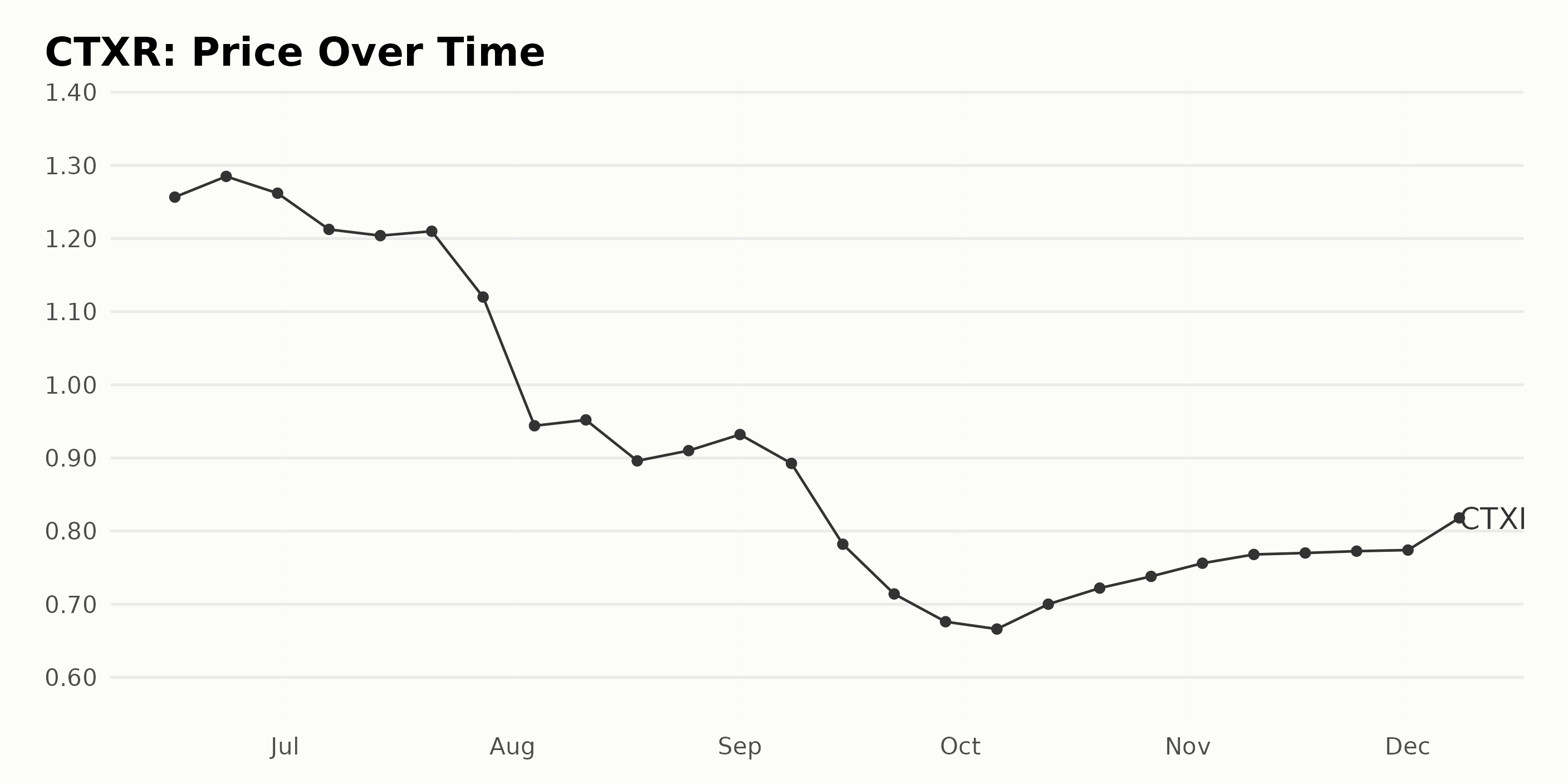

Reviewing CTXR’s Share Price Fluctuations and Recovery Trends: June-December 2023

The data for Citius Pharmaceuticals Inc. (CTXR) shares reveals the following trend and growth rates:

- On June 16, 2023, the share price was $1.26.

- The share price mildly increased to $1.29 by June 23, 2023.

- There was a slight decrease to $1.26 on June 30, 2023, followed by a more substantial drop to $1.21 by July 7, 2023.

- The share price continued to decrease over July and August 2023, reaching its lowest value of $0.89 by August 18, 2023.

- After a small rise to $0.93 on September 1, it afterwards again dropped to a new low of $0.68 by the end of September.

- Prices remained relatively low through October 2023, hovering in the $0.66 – $0.74 range.

- From November and into early December 2023, the share price for CTXR steadily increased from $0.76 on November 3, to $0.82 by December 8.

In summary, the data shows an initial decrease in the share price from June to September 2023, showing a decelerating negative trend. However, beginning in late October and continuing to the beginning of December, there is a consistent upward trend in the share price, indicating a slight acceleration in share price recovery. The trend does not appear to be extremely steep, suggesting relatively slow changes over time. Here is a chart of CTXR’s price over the past 180 days.

Rise in Growth, Sentiment, and Stability Ratings: Citius Pharmaceuticals’s Notable Trends

CTXR has an overall D rating, translating to a Sell in our POWR Ratings system. It is ranked #302 out of the 347 stocks in the Biotech category.

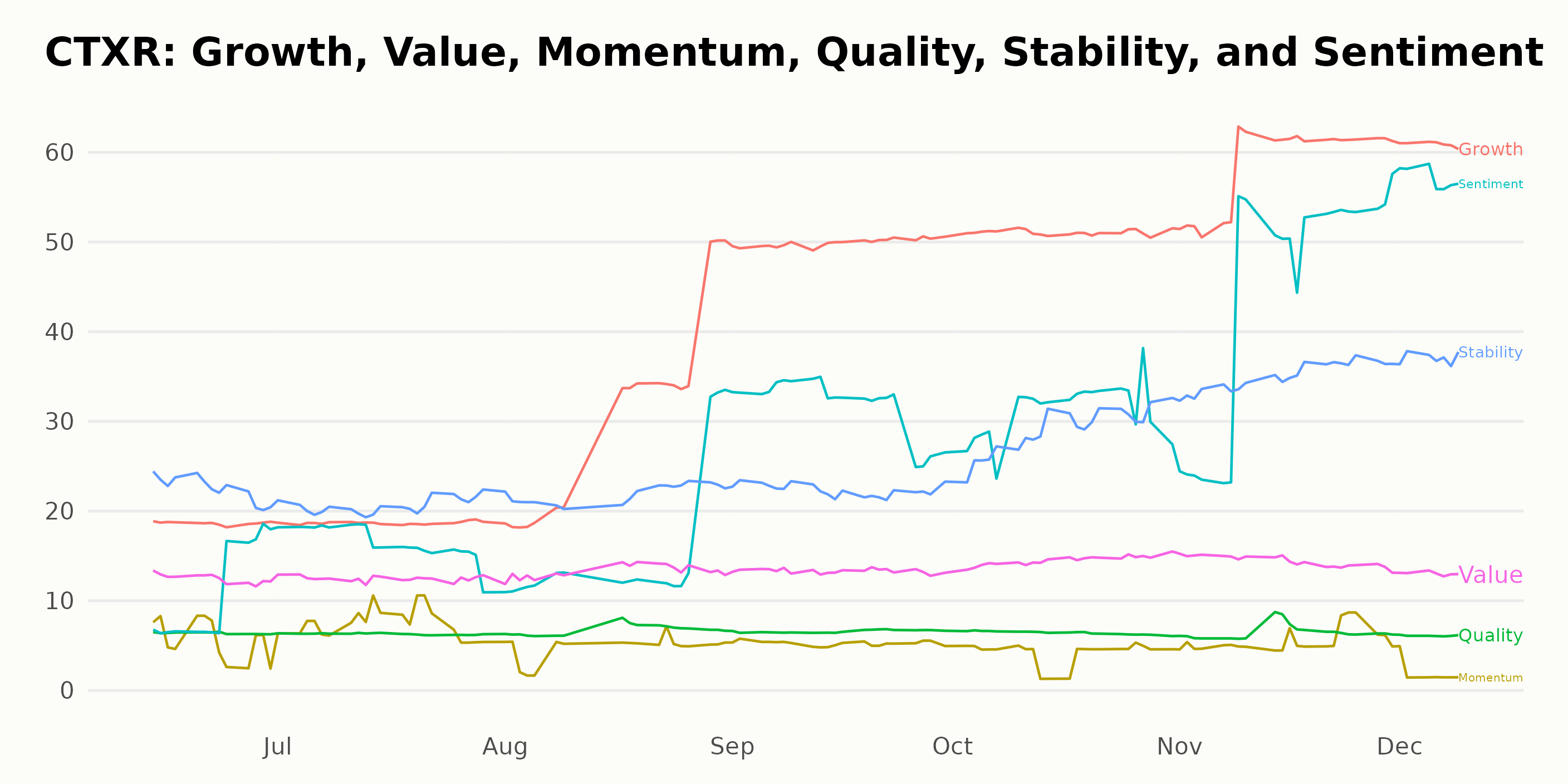

Looking at the POWR Ratings for CTXR, three dimensions clearly stand out in terms of their ratings and trends over time, Growth, Sentiment, and Stability.

Growth: This dimension shows a promising upward trend throughout the period observed. In June 2023, the Growth rating was at 19. From this point onward, there is a consistent increase until we see a peak value of 61 in December 2023, showing remarkable growth for CTXR.

Sentiment: The Sentiment rating also displays a continual rise over the observed period. Starting from a relatively low point of 11 in June 2023, it gained significant traction and reached a high rating of 57 by December 2023, indicating increasingly positive market sentiment towards CTXR.

Stability: The Stability dimension exhibits moderate but steady growth. From a rating of 22 in June 2023, it witnessed a gradual increase, with slight fluctuations, and ends at 37 by December 2023. This growing Stability rating indicates that CTXR is becoming a more reliable investment as time passes.

These three dimensions, Growth, Sentiment, and Stability, show the most notable trends for Citius Pharmaceuticals Inc, hence make noteworthy discussion points.

How does Citius Pharmaceuticals Inc. (CTXR) Stack Up Against its Peers?

Other stocks in the Biotech sector that may be worth considering are Incyte Corporation (INCY - Get Rating), Vertex Pharmaceuticals Incorporated (VRTX - Get Rating), and Alexion Pharmaceuticals Inc. (ALXN - Get Rating) — they have better POWR Ratings.

What To Do Next?

43 year investment veteran, Steve Reitmeister, has just released his 2024 market outlook along with trading plan and top 11 picks for the year ahead.

Want More Great Investing Ideas?

CTXR shares were trading at $0.85 per share on Monday afternoon, down $0.00 (-0.01%). Year-to-date, CTXR has gained 7.59%, versus a 21.87% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| CTXR | Get Rating | Get Rating | Get Rating |

| INCY | Get Rating | Get Rating | Get Rating |

| VRTX | Get Rating | Get Rating | Get Rating |

| ALXN | Get Rating | Get Rating | Get Rating |