Carvana Co. (CVNA - Get Rating) operates an e-commerce platform for buying and selling used cars. The company raised its second-quarter outlook last month. It now expects to report an adjusted EBITDA above $50 million and non-GAAP total gross profit per unit above $6,000.

While this outlook is encouraging, analysts don’t expect substantial gains as the company struggles to sell cars at higher prices amid recessionary concerns. Analysts are also concerned about CVNA’s debt burden.

Given this backdrop, let’s look at the trends of the company’s key financial metrics to get an idea of why it could be wise to avoid the stock now.

Examining Carvana Co.’s Fluctuating Financial Health from 2020-2023

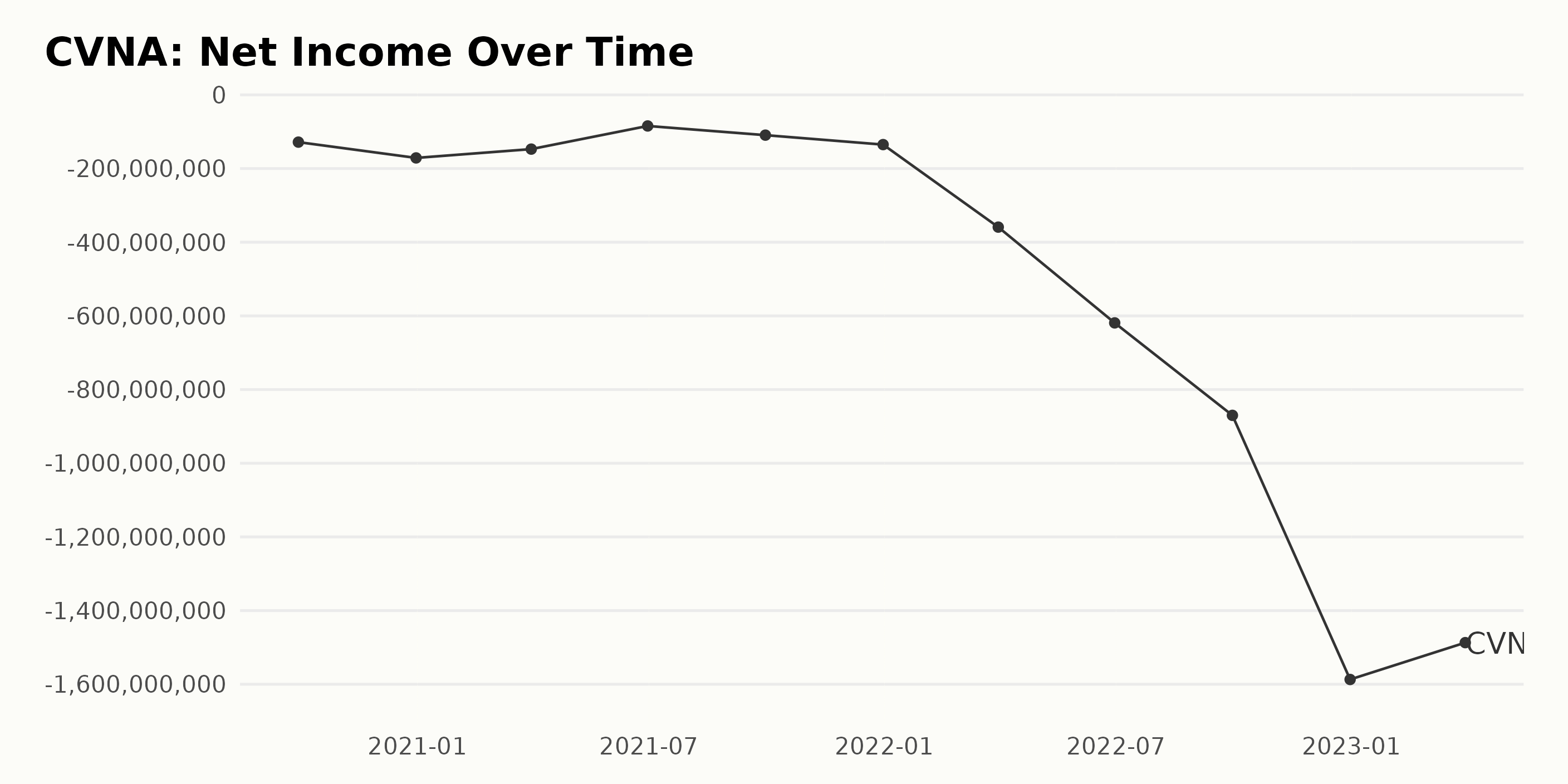

An analysis of the trailing-12-month net income data from CVNA shows a fluctuating yet predominantly negative trend over the observed period. Key observations include:

- Starting from September 2020, CVNA reported a net income of -$128.29 million.

- By the end of 2020, their net income had slightly worsened to -$171.14 million.

- The first quarter of 2021 showed moderate improvement in net income to -$147.25 million.

- A significant improvement was noted by mid-year 2021, with the net income reaching -$84.42 million.

- However, net income again worsened slightly in the third quarter to -$109.34 million before deteriorating further to -$135 million by the end of 2021.

- The first quarter of 2022 saw a steep decline in CVNA’s net income to -$359 million.

- This downward trajectory continued, with net income falling to -$619 million in the second quarter of 2022 and -$870 million in the third quarter.

- By the end of 2022, CVNA’s net income had severely worsened to -$1.59 billion.

- The most recent data from March 2023 showed a slight improvement when compared to the last data point of 2022, with the net income at -$1.49 billion.

In summary, CVNA’s net income has been consistently negative and has shown a substantially increasing negative growth rate from -$128.29 million in September 2020 to -$1.49 billion in March 2023. This represents an exacerbation in losses over the period. The recent values show a deterioration in financial health, which could be an area of concern.

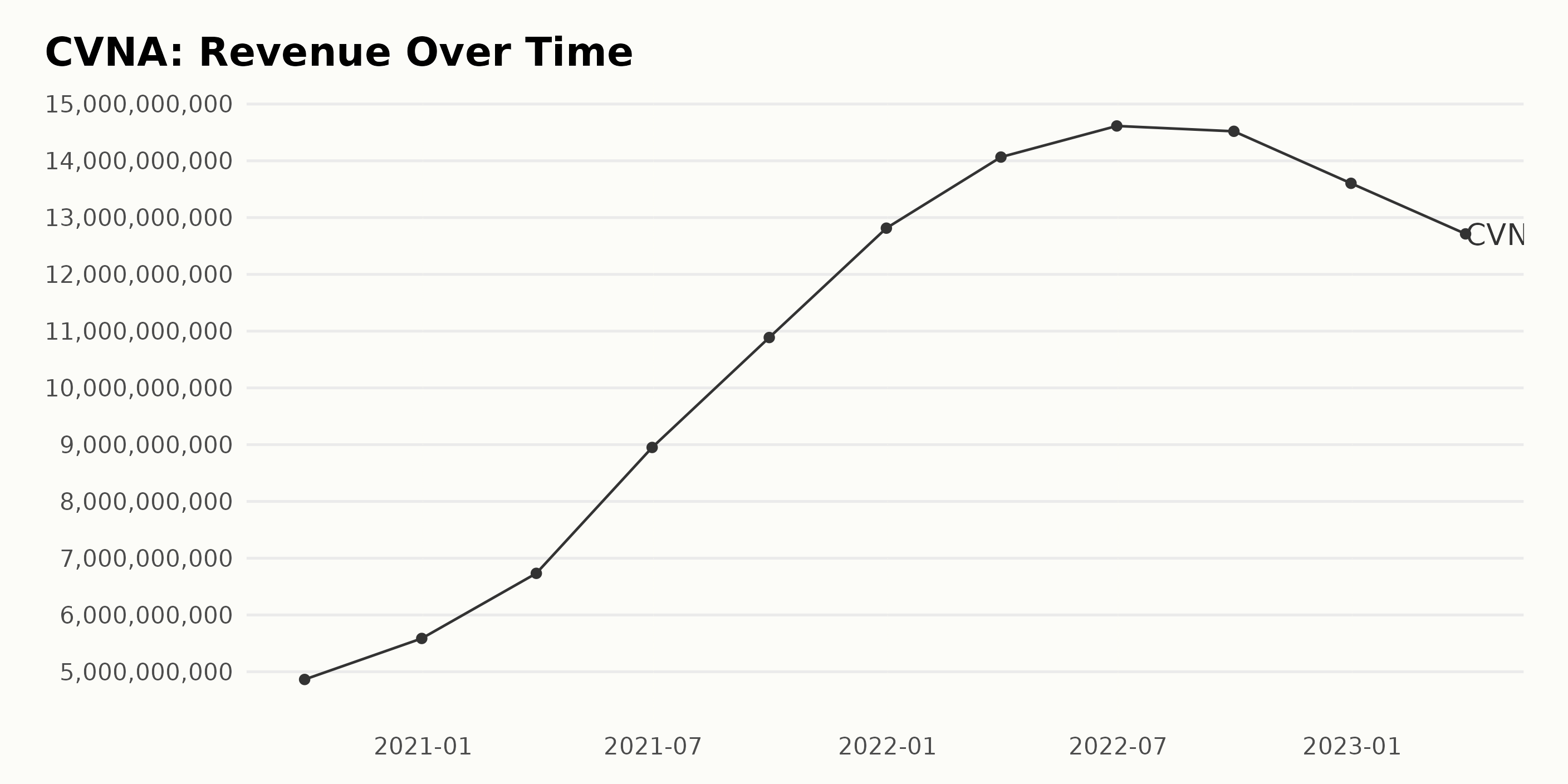

The series of data indicates the fluctuations and growth trajectory of the reported trailing-12-month revenue for CVNA from September 2020 through March 2023. Here is a summarized representation:

- In September 2020, CVNA’s revenue stood at $4.86 billion.

- It gradually increased over the quarters, showing an upward trend up until June 2022, when it peaked at $14.61 billion.

- However, a notable decline was seen in subsequent quarters, with revenue decreasing to $13.60 billion by December 2022 and further dropping to $12.71 billion as of March 2023.

Emphasizing recent data and valuation, after reaching a high in June 2022, a consistent decrease in CVNA’s revenue is observed through the later part of 2022 into early 2023. The significant decrease in numbers suggests fluctuations in CVNA’s performance and a recessive trend.

When calculating growth from the first value to the last, there seems to be a growth rate of approximately 161%, despite the recent declining revenues. This shows the considerable overall expansion of the company’s revenue since 2020.

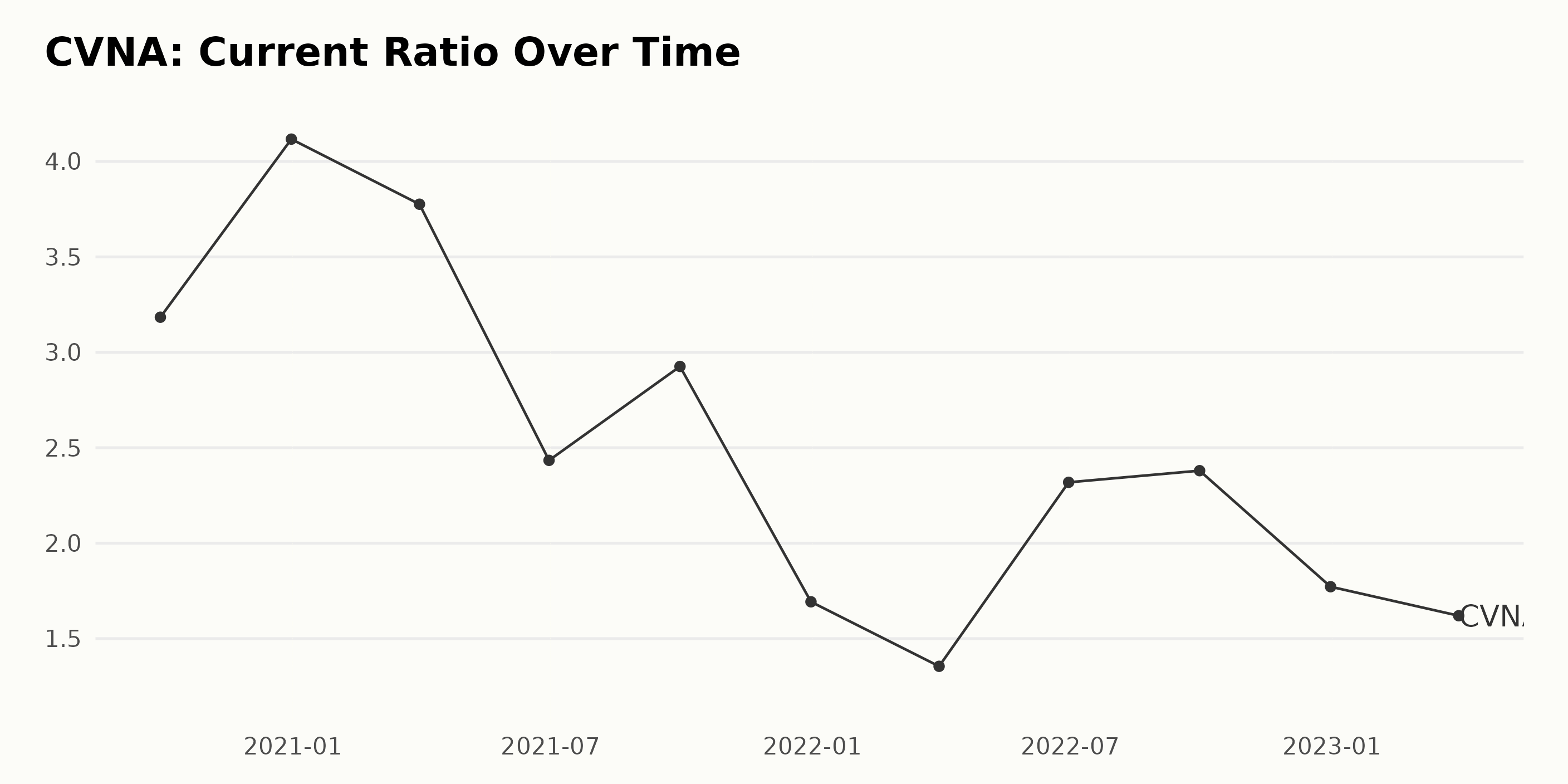

Looking at the current ratio trends of CVNA from September 2020 to March 2023, we perceive notable fluctuations:

- In September 2020, the current ratio was at a value of 3.18.

- At the close of 2020, specifically on December 31, it saw a substantial peak at 4.12.

- By the end of the first quarter of 2021, there was a reduction to 3.78.

- The series observed its notable slump in June 2021 as the current ratio dropped to 2.43.

- In September 2021, it rebounded slightly to 2.93, but by the end of 2021, it had plummeted to 1.69.

- A further decline was observed in the first quarter of 2022, bringing it down to 1.36.

- However, an upturn transpired by the end of the second quarter, with the value ascending to 2.32. It maintained almost these digits until the end of the third quarter with 2.38.

The concluding values for 2022 and 2023 stood at 1.77 and 1.62, respectively. Over the study period, there was reported about a 49% decline in the current ratio from 3.18 in 2020 to 1.62 in 2023 despite some fluctuations in the middle.

This indicates a descending trend in the liquidity position of CVNA over this period, though elements of instability were detectable across different quarters. Emphasizing the latest data point, we observe CVNA’s current ratio at 1.62 in March 2023.

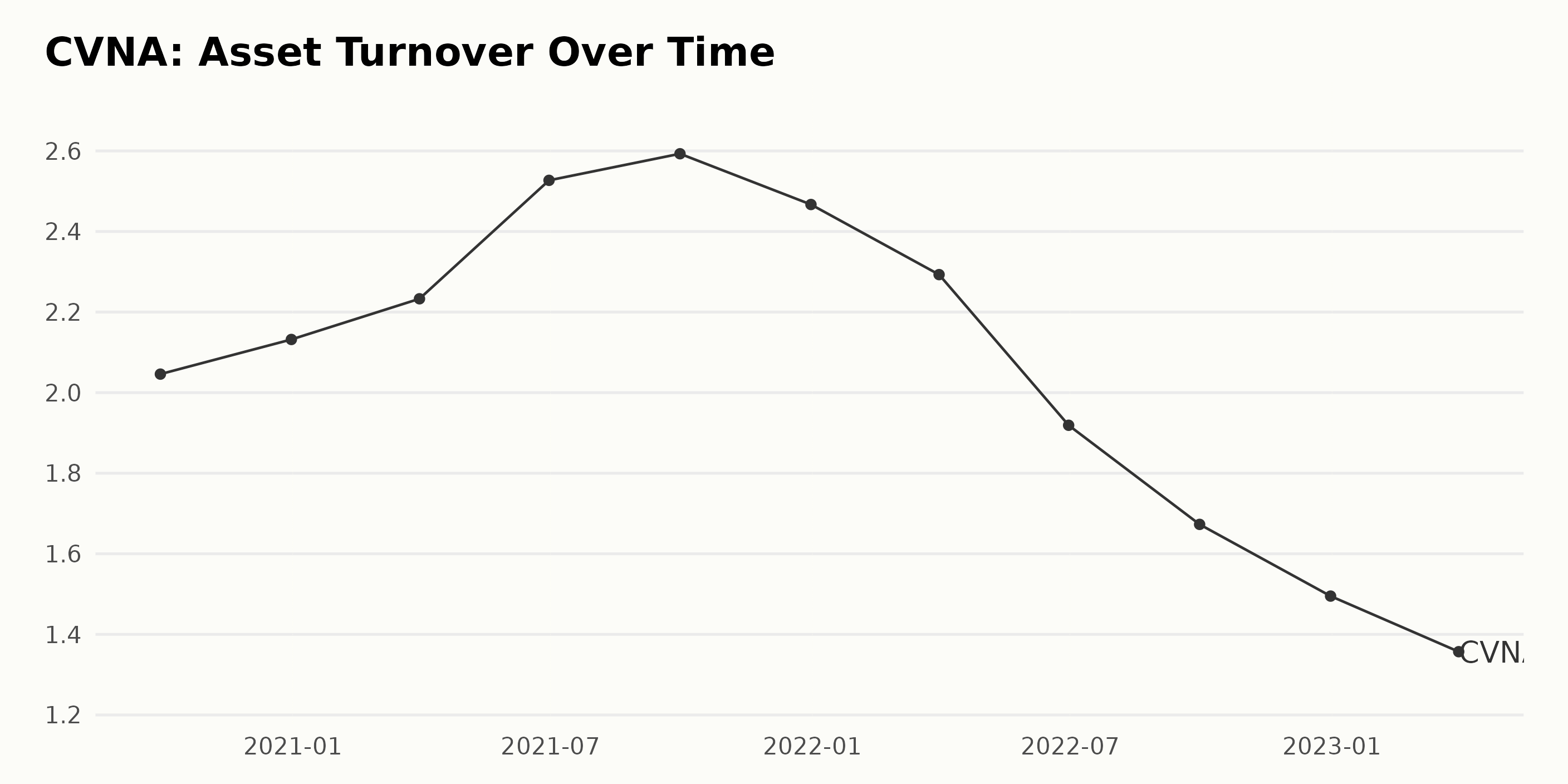

The trend and fluctuations in CVNA’s asset turnover between September 2020 and March 2023 can be summarized as follows:

- September 2020: The asset turnover read at 2.05, denoting early values reference point.

- December 2020: An increase could be noticed as the value rose to 2.13.

- March 2021 – June 2021: There was a consistent rise in asset turnover, peaking at 2.53 in June 2021.

- September 2021: This was another high point with a value of 2.59, the highest recorded during this period.

- December 2021: A slight decrease occurred, pulling the figure to 2.47.

- 2022 Q1 – 2023 Q1: This period marked a steady decline. The downturn began with an asset turnover of 2.29 in March 2022, lowering to 1.92 by June of the same year. It further decreased to 1.67 in September and closed the year at 1.5 in December. The declining trend continued into 2023, reaching an all-time low of 1.36 in March.

In its early stages, CVNA’s asset turnover demonstrated an increasing trend, reaching a peak in September 2021. However, it started showing a significant shrinking trend from 2022 to early 2023. As for the growth rate calculated based on comparing the last value to the first has descended by approximately 34%, indicating a negative growth over the observed period.

Analyzing Carvana Co. Fluctuating Yet Upward Stock Performance in 2023

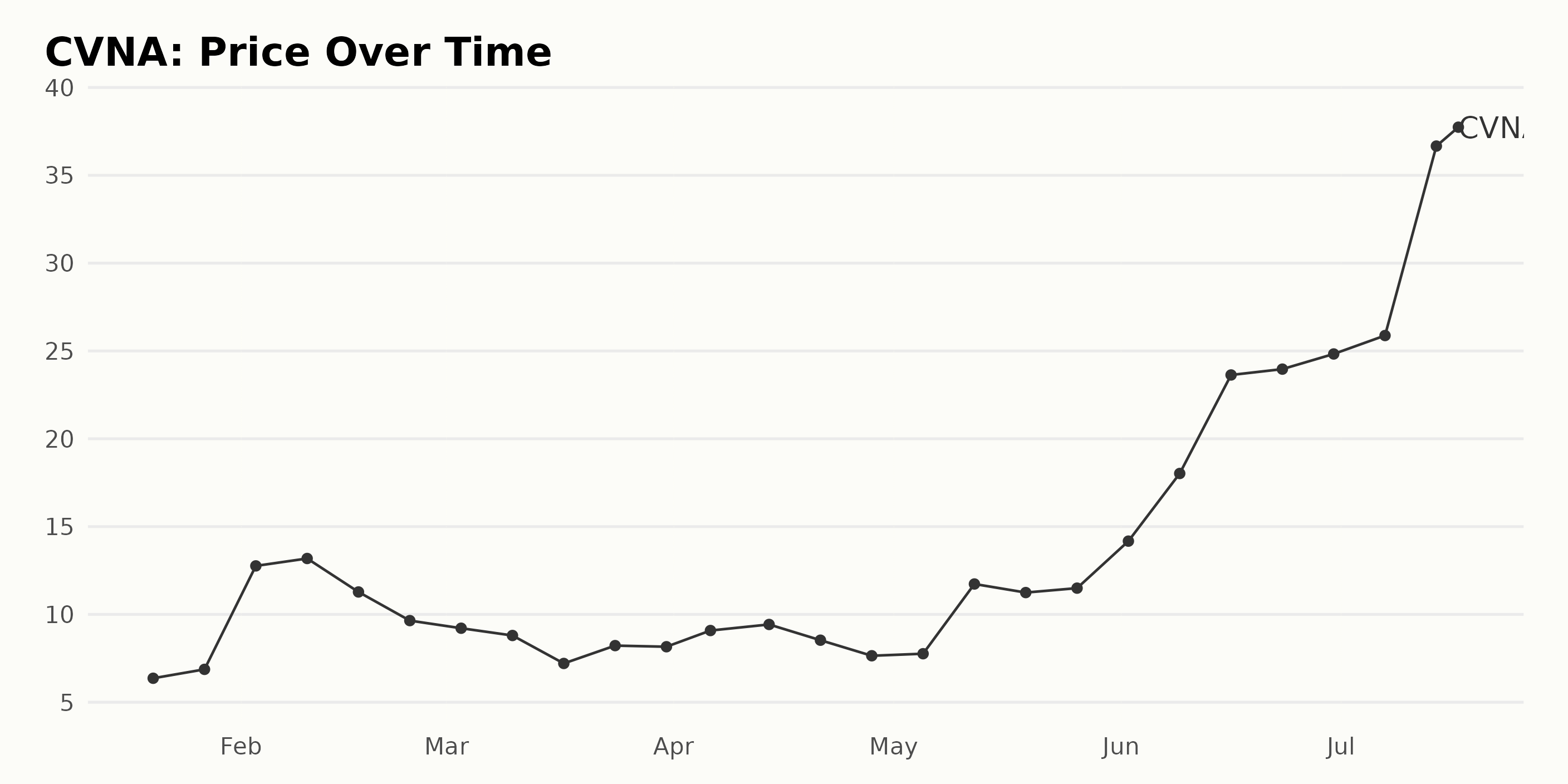

The trend and growth rate of CVNA share prices over time is identified as follows:

- On January 20, 2023, the price started at $6.37

- By January 27, 2023, it had risen to $6.87, showing a minor increase.

- In February 2023, prices notably increased, reaching a high of $13.18 on February 10. However, this was soon followed by a downward trend leading into March 2023, with the lowest point being $7.21 on March 17.

- From late March through April 2023, prices fluctuated modestly and hovered closely around the $9 mark, hitting a peak at $9.43 on April 14, 2023.

- A noticeable drop is observed in late April 2023, with a low at $7.65 on April 28 before it makes an upward adjustment to $7.76 in the first week of May.

- May 2023 shows signs of recovery, with the price increasing significantly from $7.76 to $11.73 midway through the month. By May 26, the price slightly stabilizes to close at $11.50

- In June 2023, accelerated growth is seen, commencing the month at $14.17 and ending with an impressive $24.83 on June 30, marking a significant upsurge in its performance.

- In July 2023, the upward trajectory continued, climbing steeply to $36.66 on July 14 and finally closing at a remarkable $36.53 on July 17, indicating continued bullish momentum.

To sum up, CVNA shows a significant upward trend with some fluctuations in-between. The second half of June 2023 and the first half of July 2023 mark rapid and noteworthy growth. The trend appears to be accelerating.

Here is a chart of CVNA’s price over the past 180 days.

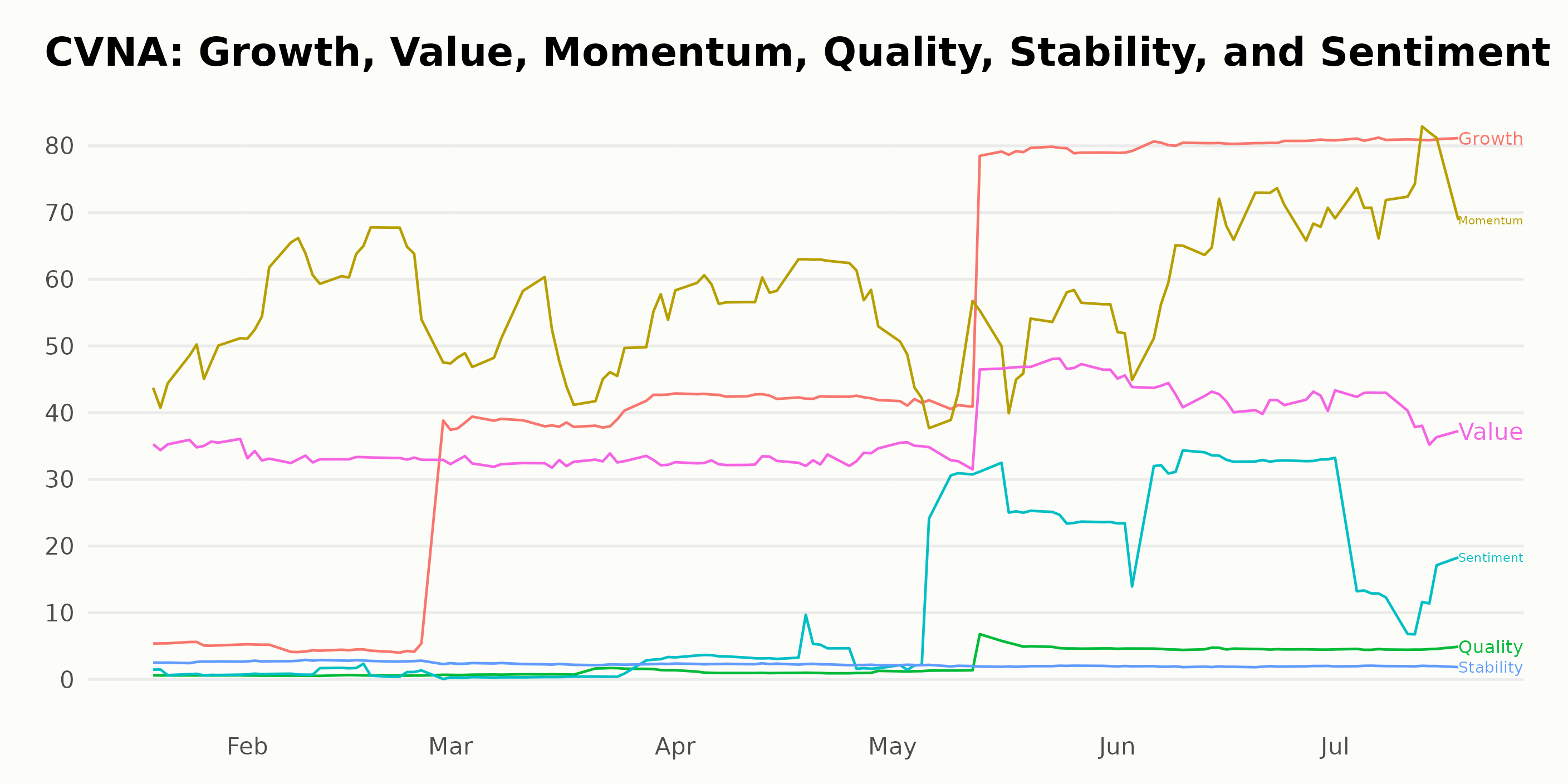

Analyzing Carvana’s Steady Improvement through Growth, Momentum, and Value Ratings

Based on the data provided, here’s an overview of CVNA’s POWR Ratings grade:

- From January 21, 2023, to May 6, 2023, CVNA received a POWR Grade of F (Strong Sell) and had an inconsistent ranking within the D-rated Internet category.

- A change is noted from the week of May 13, 2023, when the grade improved to D (Sell). Its rank in the category also improved, moving to spot #53.

- As of the latest date recorded, July 18, 2023, CVNA maintained its POWR Grade of D (Sell) and held a rank of #55 in the Internet category out of 58 stocks.

The POWR Ratings for CVNA reveal several trends over time with respect to the Growth, Momentum, and Value dimensions, respectively.

Growth: This dimension scores have greatly improved over the term. In January 2023, CVNA had a modest growth rate of 5, but by July 2023, the growth rating burgeons to reach a high of 81. This demonstrates a consistently increasing trend in its growth rate.

Momentum: The momentum dimension begins at a decently high rating of 47 in January 2023, showing some promising potential for CVNA. Throughout the period, this rating sees gradual rising trends, with some minor fluctuations, reaching a high of 74 by July 2023.

Value: While the value score has been relatively consistent over the period, it showed slight improvement. The value rating started at 35 in January 2023, dipped slightly in February, then continued steadily to reach 42 in May, maintaining it through June, then dropping slightly to 40 by July 2023.

In essence, these three dimensions indicate an overall trend of improvement for CVNA, with the most significant growth observed in the Growth and Momentum dimensions.

How does Carvana Co. (CVNA) Stack Up Against its Peers?

Other stocks in the Internet sector that may be worth considering are trivago N.V. (TRVG - Get Rating), Yelp Inc. (YELP - Get Rating), and Travelzoo (TZOO - Get Rating) – they have better POWR Ratings.

What To Do Next?

Discover 10 widely held stocks that our proprietary model shows have tremendous downside potential. Please make sure none of these “death trap” stocks are lurking in your portfolio:

Want More Great Investing Ideas?

CVNA shares were trading at $41.60 per share on Tuesday afternoon, up $5.07 (+13.88%). Year-to-date, CVNA has gained 777.64%, versus a 19.42% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| CVNA | Get Rating | Get Rating | Get Rating |

| TRVG | Get Rating | Get Rating | Get Rating |

| YELP | Get Rating | Get Rating | Get Rating |

| TZOO | Get Rating | Get Rating | Get Rating |