CVS Health Corporation’s (CVS - Get Rating) stock has experienced notable fluctuations throughout the year, however, making its current valuation appealing to savvy investors. The downturn in share value presents an opportunity for potential purchasers looking for long-term investment.

CVS has strategically expanded its business portfolio via significant acquisitions, poised to bolster future expansion. CVS recently acquired Oak Street Health, a premier multi-payor, value-based primary care firm, which boasts a network of approximately 600 primary care providers and over 170 medical centers across 21 states, showcasing its broad reach and potential for significant impact.

In addition to diversification, CVS also took steps to enhance operational efficiency and cost-effectiveness through an organizational restructuring plan. The enterprise-wide transformation aims to streamline the organization and reduce costs, serving to further bolster CVS’ earnings potential.

Analysts anticipate CVS’ revenue and earnings for the soon-to-be-announced quarter, ended September 2023, to clock in at $88.17 billion and $2.13, respectively.

With the company’s earnings report imminent, it may be advantageous for investors to consider investing in CVS stock. In the following analysis, a critical assessment of CVS’ key metrics will provide further insight into this investment prospect.

Fluctuating Financial Indicators: A Comprehensive Analysis of CVS Health Corporation (20120-2023)

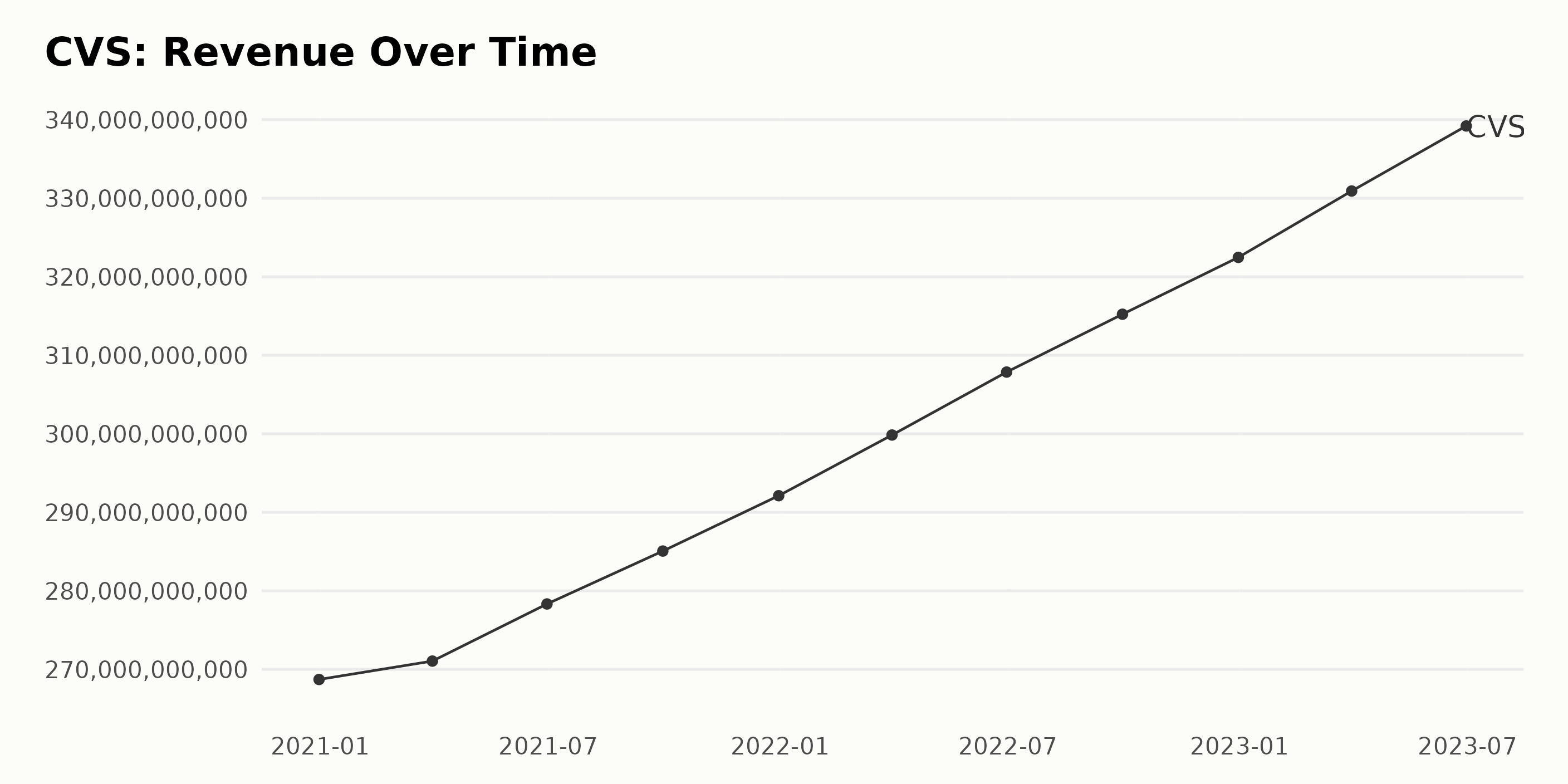

The overall trend for the trailing-12-month revenue of CVS Health Corporation (CVS) has shown consistent growth over the past three years, from December 2020 to June 2023.

- In December 2020, the company’s revenue was $268.71 billion.

- By the end of March 2021, an increase was noted, pushing the revenue to $271.05 billion, marking a leap forward in the first quarter.

- In the subsequent quarters of 2021 (June and September), the revenues continued to grow steadily, reaching $278.32 billion and $285.06 billion, respectively.

- By the end of 2021 (December), CVS reported a further upsurge in its revenue to $292.11 billion, registering significant growth within a year.

- Revenue growth was sustained in 2022, where by end of each quarter (March, June, September, and December), the figures stood at $299.84 billion, $307.86 billion, $315.23 billion, and $322.47 billion respectively.

- The upward revenue trend continued into 2023, with CVS reporting $330.92 billion at the end of the first quarter (March) and $339.20 billion in the second quarter (June).

The pattern exhibits a consistent rise throughout these periods. The most recent figure, from June 2023, is considerably higher than the initial value recorded in December 2020, indicative of continuous growth. Looking at the difference between the first value ($268.71 billion) and the last value ($339.20 billion), the calculated growth rate is approximately 26.23%, suggesting a robust upward trend in the revenue of CVS Health Corporation over the evaluated period.

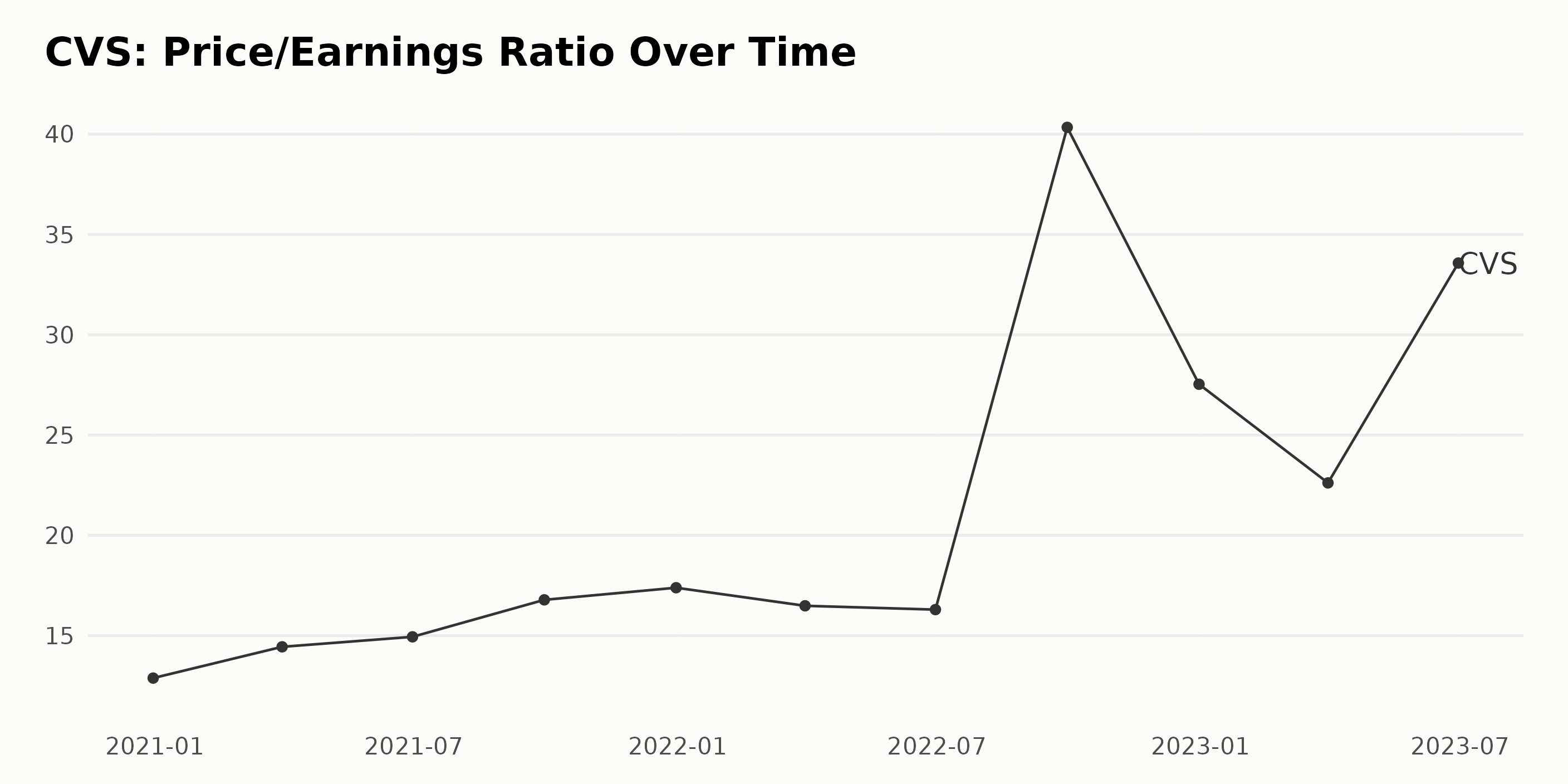

The reported Price/Earnings Ratio (PE) of CVS depicts a fluctuating trend over the given timeline. Starting on December 31, 2020 with a PE of 12.88, the ratio has experienced both rises and drops. Key points to note include:

- From its value of 12.88 in December 2020, the PE gradually rose till it reached a high of 17.39 at the end of December 2021.

- However, there was a noticeable dip to 16.49 by the end of March 2022, slightly picking up to 16.3 by end of June 2022.

- A significant surge was observable as PE shot up to 40.34 in September 2022 before declining again to 27.53 by the end of December 2022.

- Continuing its downward trend, the PE value fell to 22.61 at the end of March 2023, only to rise once more to 33.58 by the end of June 2023.

The overall growth rate of the PE when comparing the first value (12.88) to the last value (33.58) is approximately 161% over the reported period, speaking to significant oscillations in CVS’ value perception among traders. This analysis reflects greater emphasis on more recent data, ultimately highlighting a generally upward, albeit volatile, trend in the company’s Price/Earnings Ratio. The most recent value reported in June 2023 is markedly higher than that recorded at the start of the examined timeline.

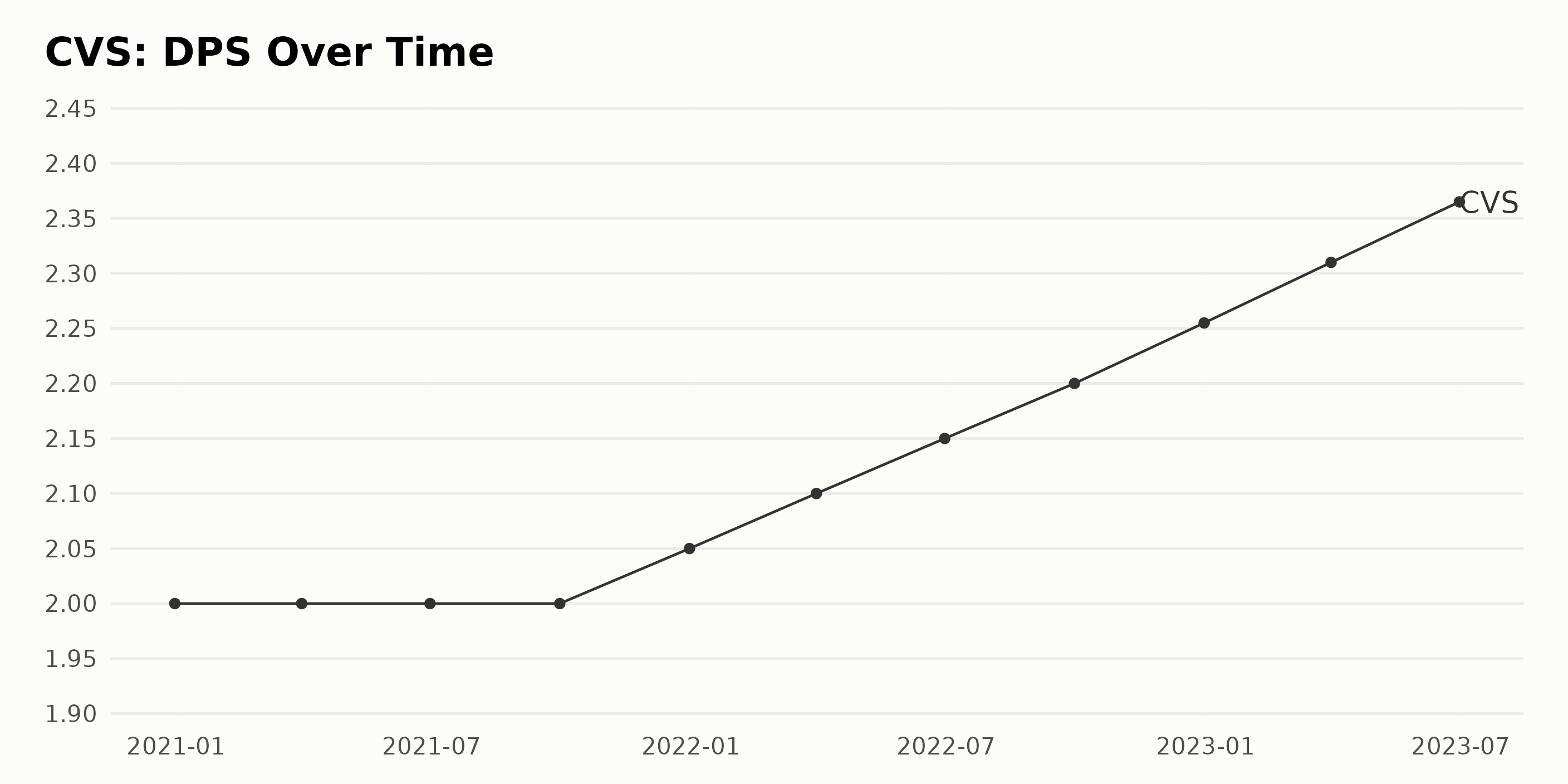

Looking at the provided series of data on the Dividend Per Share (DPS) of CVS Health Corporation (CVS), an ongoing upward trend is observed from December 31, 2020, to June 30, 2023. While there have been fluctuations, the overall trajectory appears to be positive.

- On December 31, 2020, the DPS reported was $2.

- By March 31, 2021, they maintained a steady DPS value of $2 for subsequent quarters until the end of the year.

- A slight increase could be seen by December 31, 2021, when the DPS rose to $2.05 – marking a significant turn in the trend.

- The first quarter of 2022 brought a continued rise in DPS to $2.1. This rise became consistent in the subsequent quarters with the DPS reaching $2.15 by June 30, 2022, and then $2.2 by September 30, 2022.

- By the end of 2022, CVS’s DPS had increased to $2.255 – reflecting a faster pace of increase which continued into the next year.

- As of June 30, 2023, the CVS’ DPS has seen a steady increase reaching up to $2.365, showing sustained growth.

Looking at this set, it would seem that CVS’ DPS has steadily increased over the years, particularly from late 2021 onwards. To calculate an approximate growth rate, measuring from the first value to the last value indicates an approximate growth of over 18%. This reflects an ongoing growth trend in CVS’s DPS, with an acceleration in the rate of growth noticed from the end of 2021 onwards. While there can be fluctuations, the general trend appears to be strong and positive.

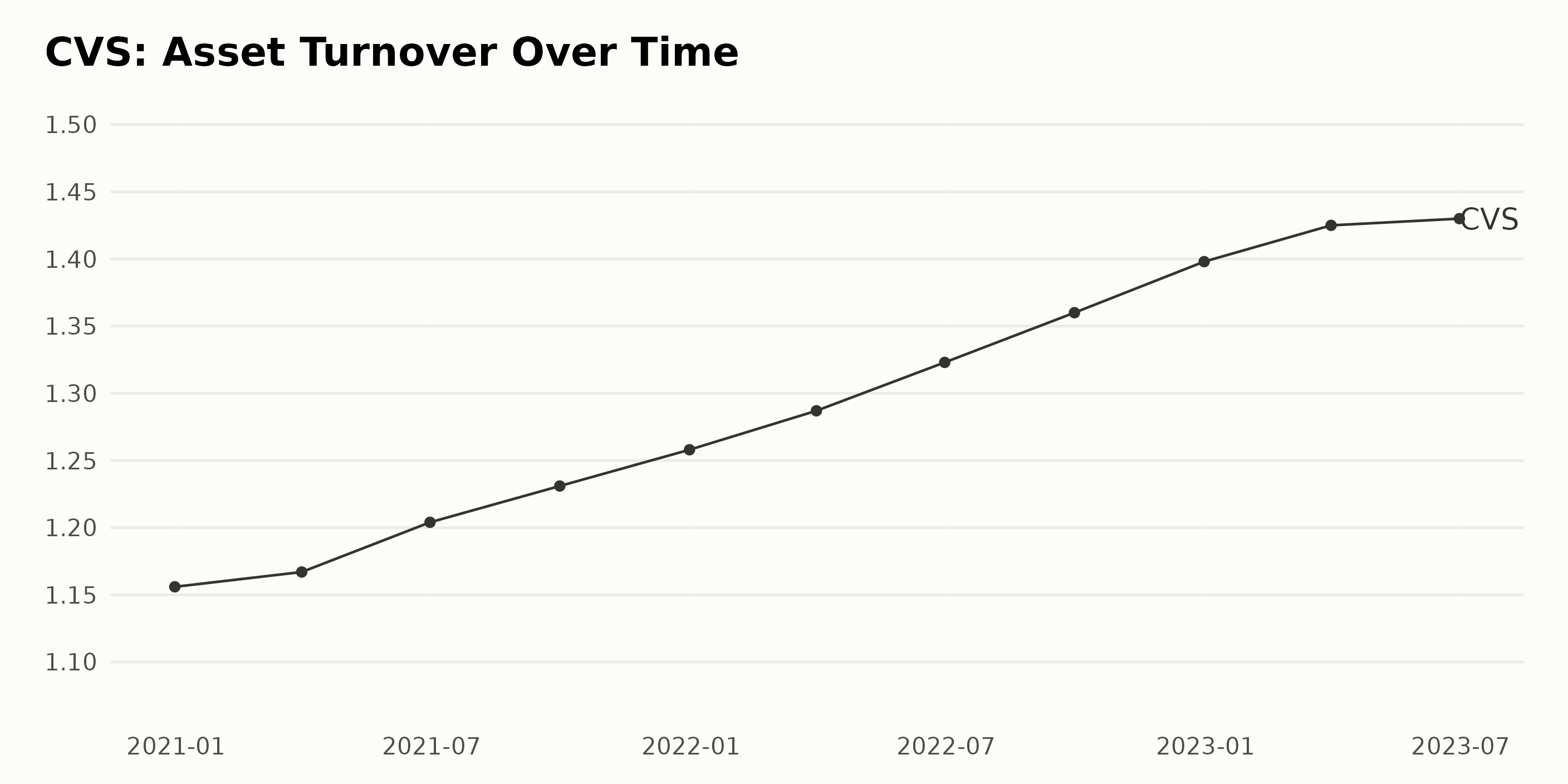

Here’s a summarized analysis of the reported Asset Turnover data of CVS Health Corporation (CVS):

- The Asset Turnover began at 1.16 on December 31, 2020.

- There is a consistent and overall increasing trend in the data, with each quarter experiencing growth as compared to the previous one.

- The most significant quarterly increase was seen between March 31, 2022 (1.29), and June 30, 2022 (1.32), indicating an increase by 0.03.

- By June 30, 2023, the reported Asset Turnover peaked at 1.43, showing a steady upward trend over the observed period.

Growth rate calculation from the first value to the last values indicates that there was approximately 0.27 (or 27%) growth in the Asset Turnover for CVS over this period. In conclusion, CVS’ Asset Turnover has seen steady and consistent growth between December 31, 2020, and June 30, 2023. This increase suggests that CVS has become more efficient at using its assets to generate revenue.

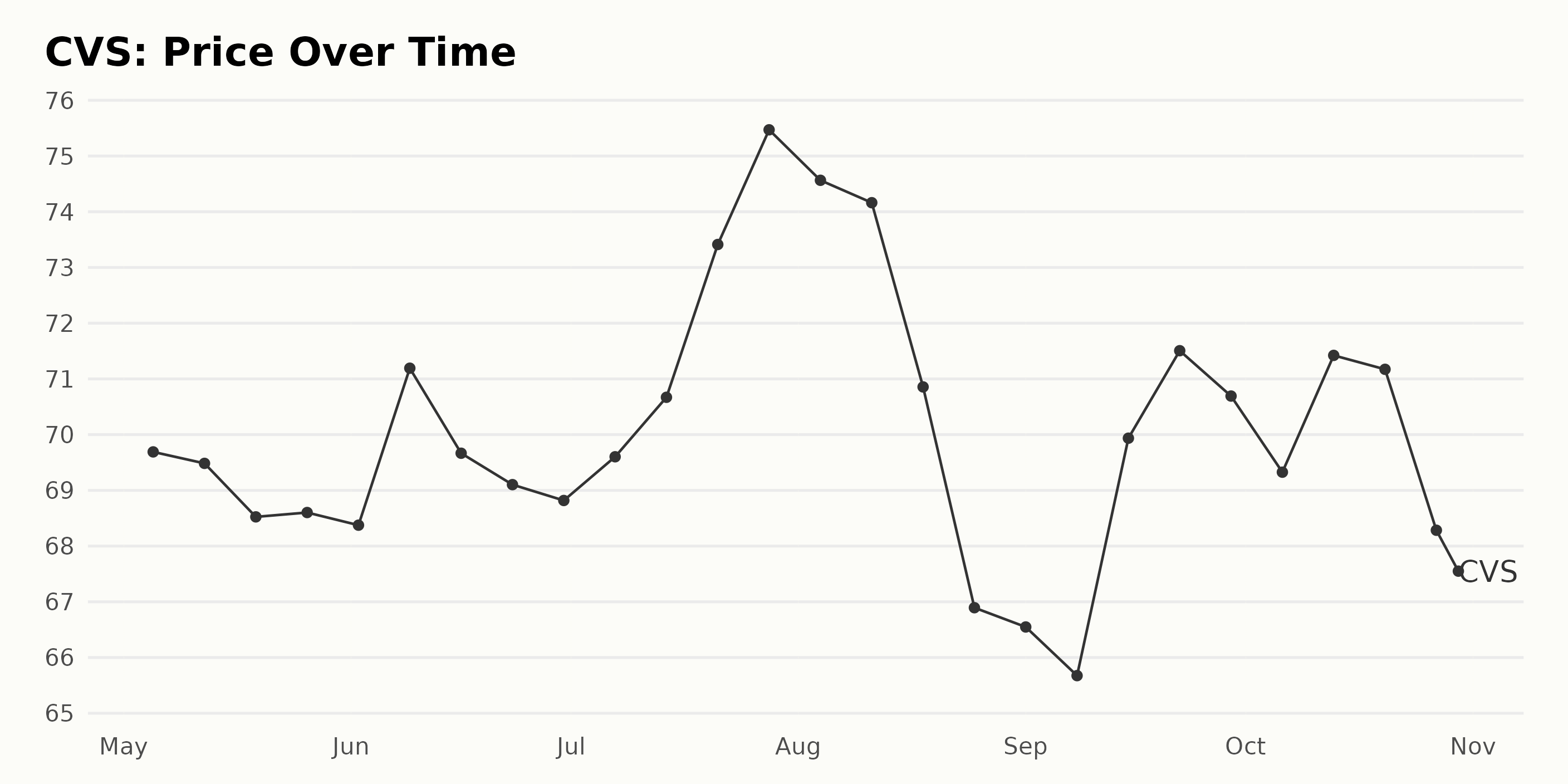

CVS Health Corporation’s Share Price Volatility: An Analysis from May-October 2023

Here are key observations and trends from CVS share price data:

- Starting from May 5, 2023, CVS price, initially at $69.69, began to follow a slight downward trajectory by the end of May where it fell to $68.60 on May 26.

- There was a brief spike to $71.19 on June 9, 2023, before going down and stabilizing around $69 into the middle of July.

- In the latter half of July 2023, CVS experienced an accelerated growth which brought its share price up to $75.47 value by July 28, marking this period as the most significant increase in the recorded timespan.

- A decline started in August, reaching the lowest point on August 25, at $66.89. This can be considered a significant drop compared to the previous highs in late July.

- Throughout September, there was another wave of slight increases and decreases leading up to a price of $70.69 on the 29th.

- In October, the prices peaked at $71.42 on October 13 before dropping to $67.55 on October 30.

Overall, CVS experienced a series of ups and downs from May to October 2023. Despite some periods of increase, such as in late July, there was a general downward trend with prices at the end of October being lower than those at the start of May. The share prices jumped between highs and lows, testifying to the volatility during this period. Consequently, if we consider the first and last data point, the overall growth rate would be negative due to the drop in share prices. Here is a chart of CVS’s price over the past 180 days.

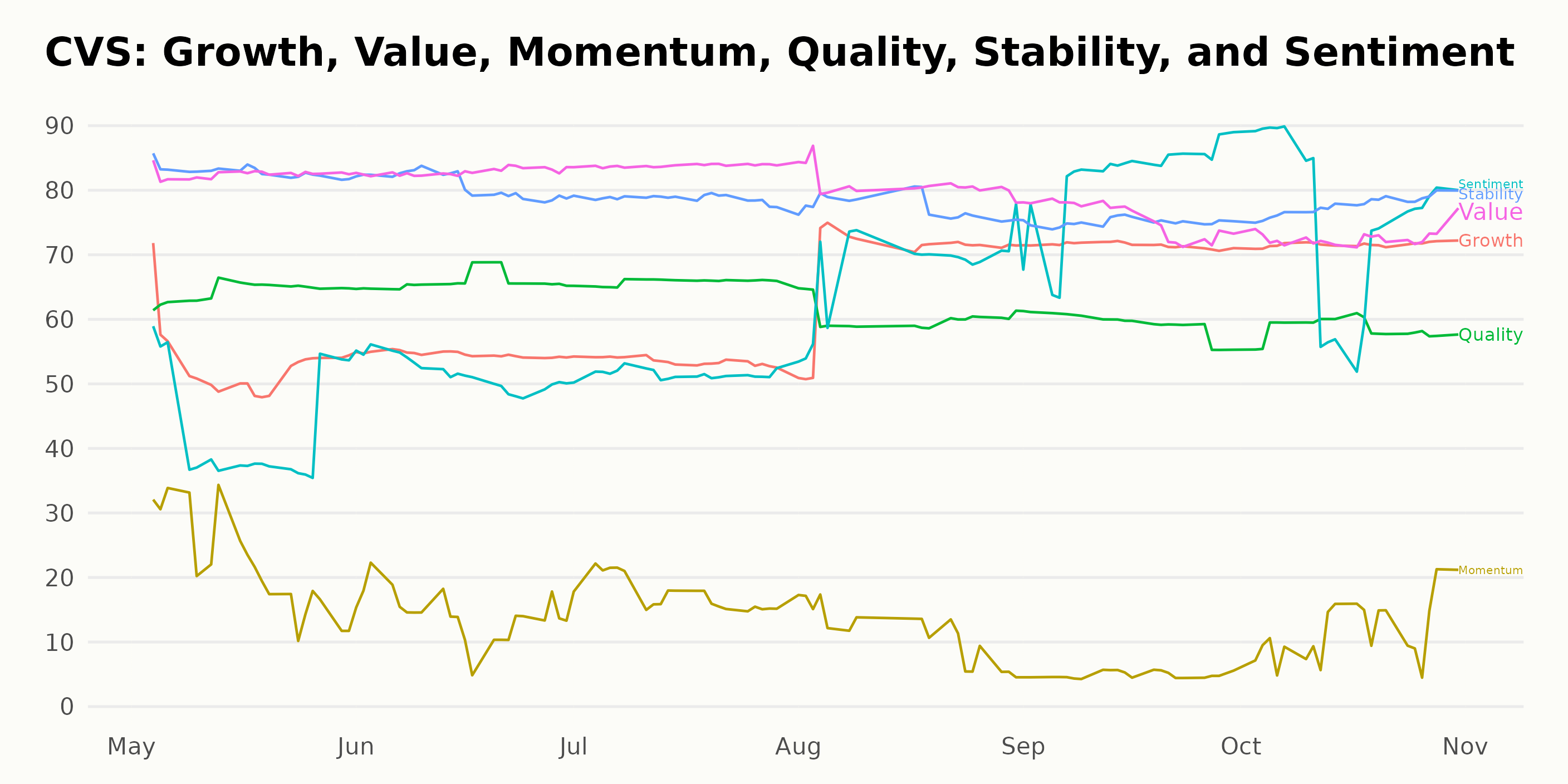

Analyzing CVS Health Corporation’s Performance: Value, Stability, and Growth Trends

CVS has an overall B rating, translating to a Buy in our POWR Ratings system. It is ranked #1 out of the four stocks in the Medical – Drug Stores category.

The three most noteworthy dimensions in the POWR Ratings for CVS are Value, Stability, and Growth. An examination of their trends from May to October 2023 reveals some distinct patterns and high ratings.

Value

The Value dimension maintained consistently high scores throughout the duration, signifying the good value that CVS offers to its investors. It started high at 83 in May 2023, and although it fluctuated slightly, it remained strong. By October 2023, the rating dropped slightly to 73 but still remained one of the strongest performers.

Stability

Stability is another dimension where CVS Health Corporation scored high. In May 2023, the Stability rating was a robust 83. By October 2023, there was a slight overall decrease to 78, indicating a slight reduction in stability yet still performing well.

Growth

The Growth score showed an upward trend, marking a positive growth trajectory for CVS. From an initial score of 53 in May 2023, it increased significantly to reach 72 by October 2023. This suggests an optimistic outlook for the company’s growth potential within the given period.

How does CVS Health Corporation (CVS) Stack Up Against its Peers?

Other stocks in the sector that may be worth considering are AbbVie Inc. (ABBV - Get Rating), Novartis AG (NVS - Get Rating) and Taro Pharmaceutical Industries Ltd. (TARO - Get Rating) — they have better POWR Ratings.

What To Do Next?

Discover 10 widely held stocks that our proprietary model shows have tremendous downside potential. Please make sure none of these “death trap” stocks are lurking in your portfolio:

Want More Great Investing Ideas?

CVS shares were trading at $68.87 per share on Tuesday afternoon, up $0.86 (+1.26%). Year-to-date, CVS has declined -23.71%, versus a 10.34% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| CVS | Get Rating | Get Rating | Get Rating |

| ABBV | Get Rating | Get Rating | Get Rating |

| NVS | Get Rating | Get Rating | Get Rating |

| TARO | Get Rating | Get Rating | Get Rating |