Entertainment media giant The Walt Disney Company (DIS - Get Rating) topped profit expectations in the last reported quarter, as its ESPN+ and theme parks businesses picked up pace. However, pressured ad revenues led to its topline figure missing expectations.

For the fourth quarter of fiscal 2023 (ended September 30), DIS’ revenues came in at $21.24 billion, compared to the expected $21.33 billion. Its adjusted EPS came in at $0.82, topping the expected $0.70. Its total core Disney+ subscriber count stood at 112.6 million, adding approximately 7 million core subscribers from the previous quarter.

On the other hand, its Disney+ Hotstar subscriber count went down by about 3 million subscribers sequentially to 37.6 million. DIS is eyeing a merger of its India unit with Reliance, which also operates a streaming service, to create an entertainment powerhouse in the country. This deal is expected to help Hotstar’s loss-making business. However, it is expected to face significant antitrust scrutiny.

Given this backdrop, let’s look at the trends of DIS’ key financial metrics to understand why it could be prudent to wait for a better entry point in the stock.

An In-depth Analysis of The Walt Disney Company’s Financial Performance and Market Prospects (2021-2023)

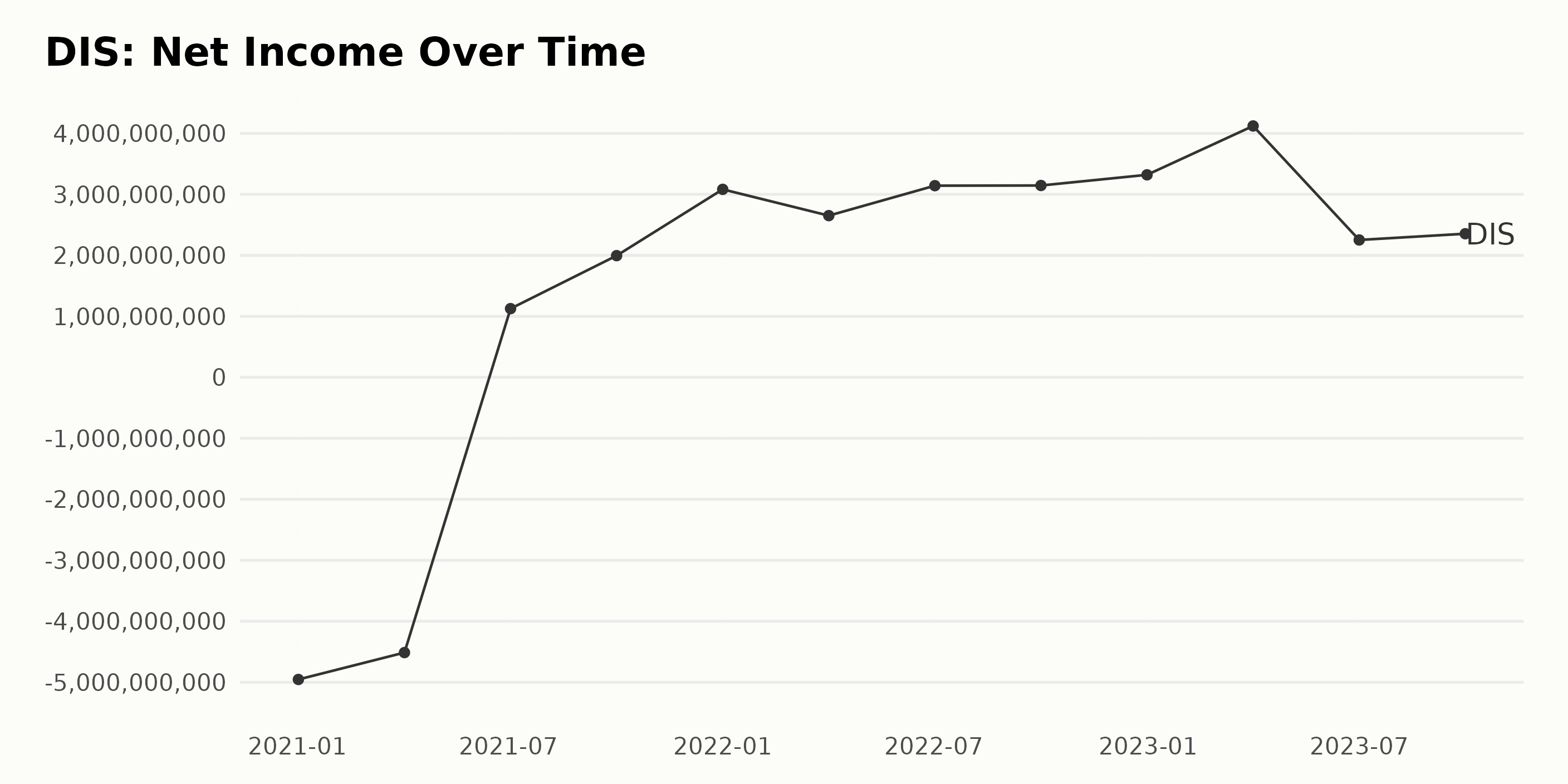

The trend and fluctuations in the DIS’ trailing-12-month net income of DIS over this period have been marked by significant change, both in terms of significant fluctuations and an overarching upward trend. A more detailed analysis is as follows:

- Starting on January 2, 2021, DIS had a negative net income of -$4.95 billion. This increased slightly by the next quarter on April 3, 2021, to -$4.51 billion.

- By July 3, 2021, the company managed to swing to profitability with a net income of $1.13 billion.

- This trend continued, with the net income climbing to $1.99 billion on October 2, 2021.

- The growth persisted into 2022, with net incomes of $3.08 billion, $2.65 billion, $3.14 billion, and $3.15 billion recorded for, respectively, January 1, April 2, July 2, and October 1.

- At the closing of the year on December 31, 2022, a slight increase was reported, recording a net income of $3.32 billion.

- Starting 2023 at a high, the net income escalated to $4.12 billion as of April 1, the highest throughout this chronology.

- However, a significant drop was experienced in the following quarters to $2.25 billion and $2.35 billion as of July 1 and September 30, 2023, respectively.

Measuring the growth rate from the first value to the last, it’s a drastic surge from -$4.95 billion to $2.35 billion, indicating that despite fluctuating periods, the organization demonstrated remarkable financial resilience and growth throughout this period. However, the significant drop in mid-2023 might require attention and further analysis.

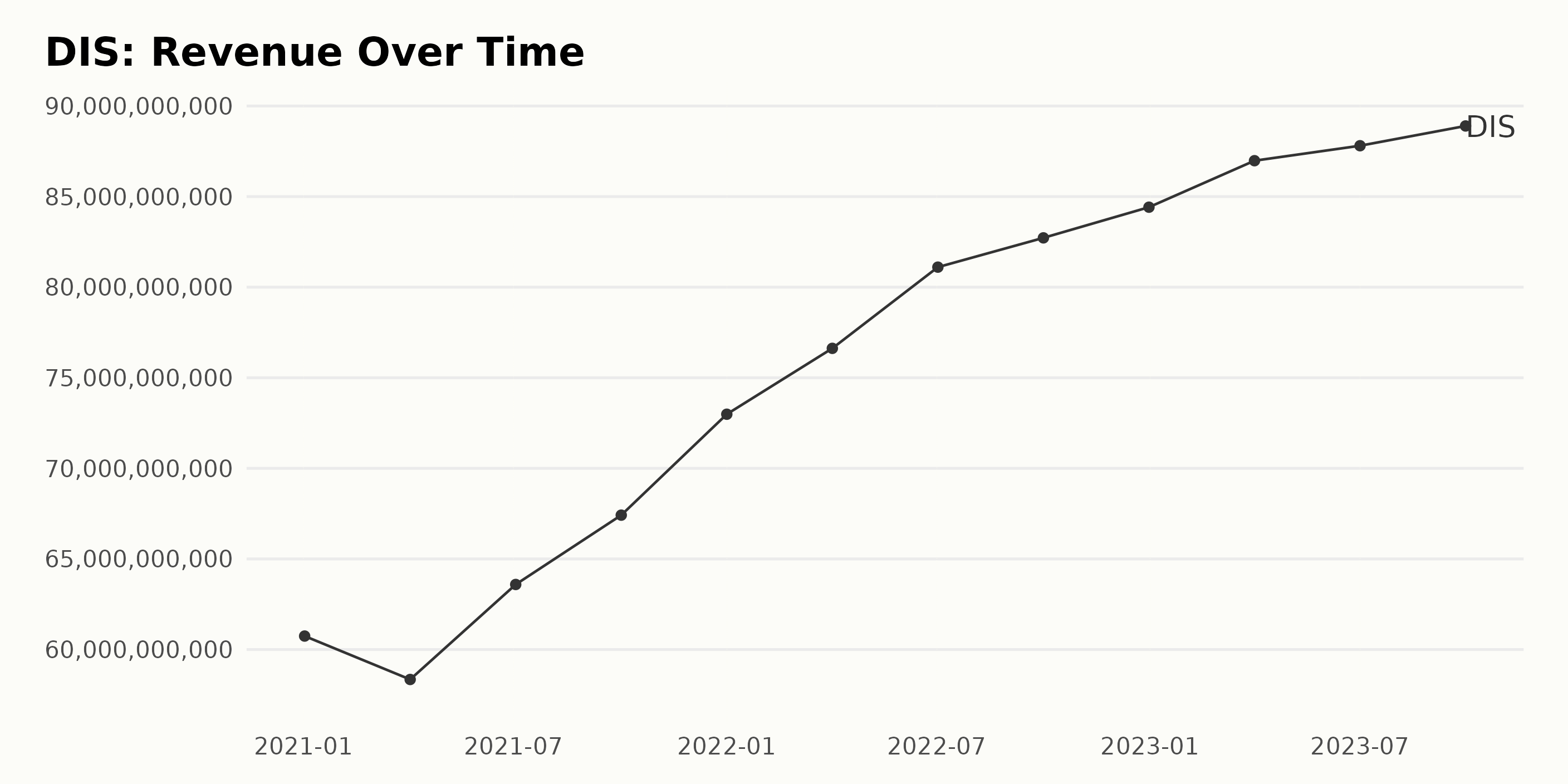

From the analyzed data, DIS’ reported trailing-12-month revenue has generally shown a consistent trend of increasing over the recent years. There were, however, minor fluctuations in growth.

- Beginning on January 2, 2021, DIS’ revenue started at $60.74 billion.

- By April 3, 2021, the company’s revenue had slightly decreased to $58.34 billion.

- Following this, a significant rebound was evident by July 3, 2021, with the revenue rising to $63.59 billion.

- There was continual growth over the successive quarters, with a record of $82.72 billion on October 1, 2022.

The most recent data points still indicate an upward trend, albeit at a slower pace. Specifically:

- On December 31, 2022, the revenue reached $84.42 billion, representing a steady ballooning over time.

- After a slight jump in revenue to $86.98 billion by April 1, 2023, the quarters of July 1, 2023, and September 30, 2023, indicated further growth but at a decelerating pace, rising to $87.81 billion and $88.90 billion, respectively.

The overall growth rate from January 2, 2021, to September 30, 2023, is approximately 46.32%, representing a substantial appreciation in revenue over this period.

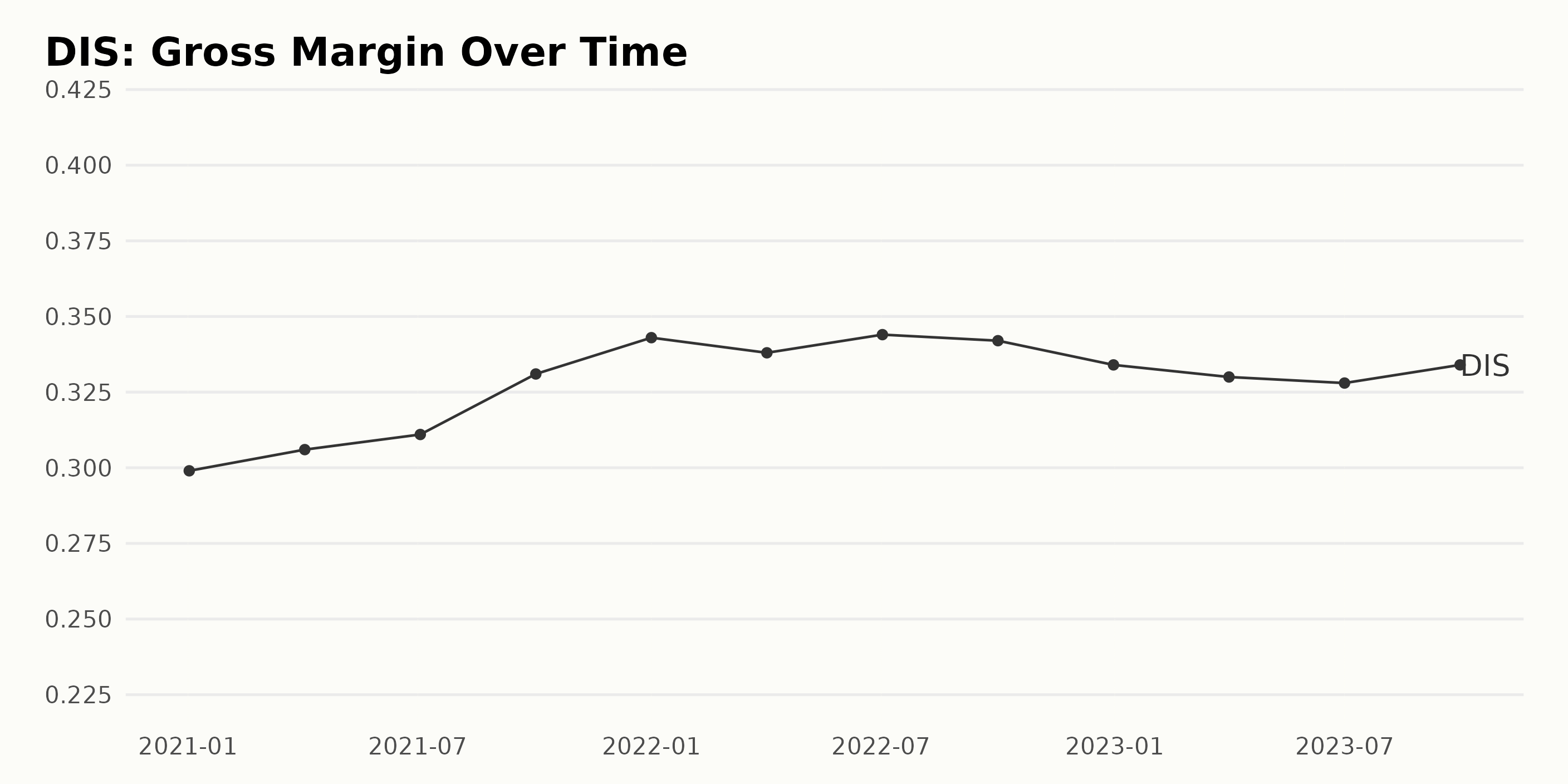

The gross margin trends of DIS from the start of 2021 to the end of September 2023 show both growth and fluctuations.

- In January 2021, DIS started with a gross margin of 29.90%.

- There was a gradual increase, reaching a peak of 34.40% in July 2022, signifying growth.

- This growth was accompanied by slight fluctuations, with the gross margin dipping and increasing at intervals through the year 2021 and the first half of 2022.

- However, toward the second half of 2022, it experienced a slight fall to 33.40% in December that year.

- A consistent dip could be observed from January 2022 to July 2023, with the gross margin falling to 32.80%.

- Thereafter, a recovery was observed when the gross margin slightly increased to 33.40% in September 2023.

Looking at the overall growth rate from the first value in January 2021 to the last value in September 2023, DIS’ gross margin saw a positive growth of 3.50%. This indicates that despite observed fluctuations, the company’s gross margin has generally improved during this period.

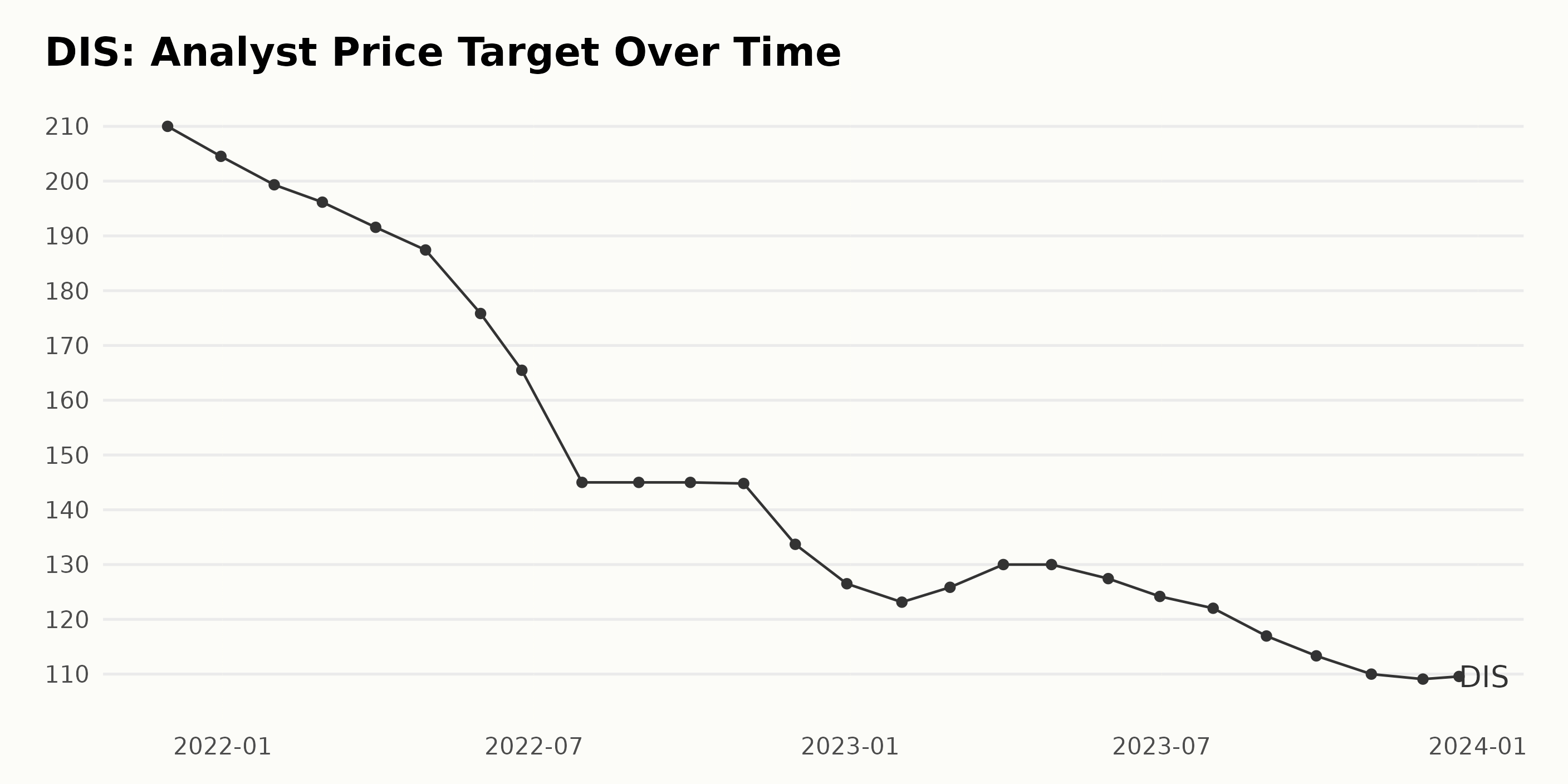

Summary of analyst price targets for DIS:

- The reported data shows a general declining trend in the analyst price target of DIS from November 2021 to December 2023, indicating a pessimistic outlook on the stock performance.

- In November 2021, the analyst price target of DIS reached a high value of $210. However, this figure consistently decreased throughout the sequence, hitting the lowest value of $109.09 in November 2023.

- Notably, the price target faced significant drops, especially between June 2022 (value: $165.47) and July 2022 (value: $145), as well as between October 2022 (value: $144.8) and November 2022 (value: 133.69).

- Despite the overall downward trend, there are periods of stability or negligible change. The analyst price target remained steady at $145 from July 2022 to September 2022 and at $130 from March 2023 to April 2023.

- Interestingly, the series concluded with a slight increase in the analyst price target, rising from $109.09 in November 2023 to $109.57 in December 2023.

- The growth rate, considering the fall from $210 in November 2021 to $109.57 in December 2023, stands at approximately -47.83%. Which asserts the substantial decrease in analyst expectations for DIS over the period covered.

Given the emphasis on recent data, it is significant to note that since its all-time low in November 2023, DIS’ analyst price target slightly rebounded in December 2023; whether this signifies a change to positive sentiment or merely a temporary fluctuation would require ongoing analysis.

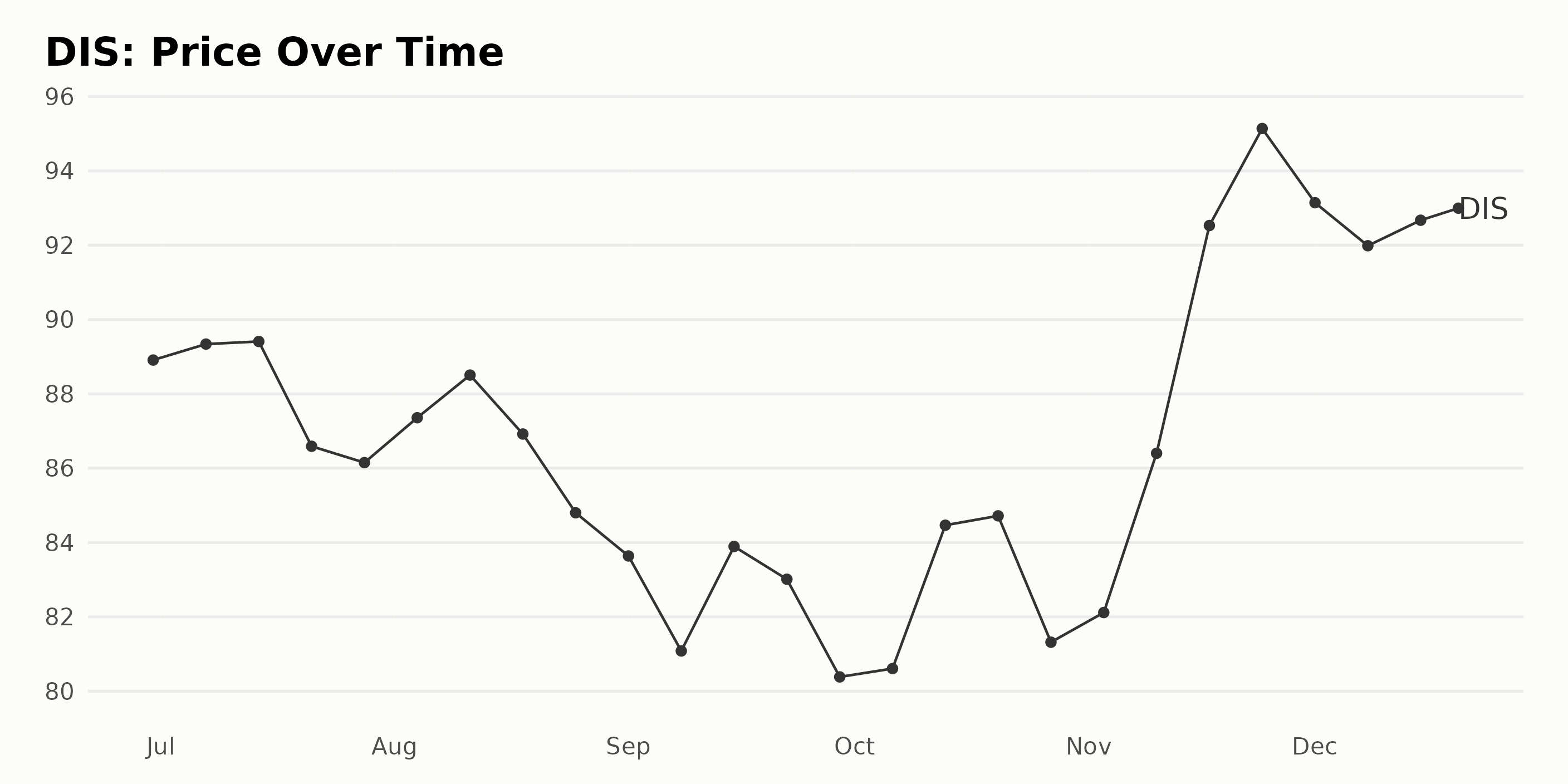

Analyzing Walt Disney Company’s Fluctuating Share Prices from June to December 2023

The share price of DIS has shown a marked fluctuation in the analyzed period, but the general trend indicates growth over time, with occasional dips observed. Here are the key observations:

- On June 30, 2023, the share price was at $88.91.

- There was a slight increase in July 2023 – from $89.34 on July 7, 2023, to $89.41 on July 14, 2023. However, by the end of July, the share price fell to $86.15.

- In August 2023, the share price initially increased, reaching $88.51 on August 11, 2023, but it started declining toward the end of August, dropping to $84.8 on August 25th, 2023.

- Throughout September 2023, there was a brief fall until mid-September, and then the price recovered slightly. Share prices ranged from $83.89 on September 15, 2023, to $80.38 on September 29, 2023.

- October 2023 saw a rise in prices from $80.61 on October 6, 2023, to $84.72 on October 20, 2023, before falling again to $81.32 by October 27, 2023.

- In November 2023, the price showed a significant increase, rising from $82.12 on November 3, 2023, to a peak of $95.14 on November 24, 2023.

- Despite some decline in early December 2023, the share price remained relatively stable for the rest of the month, closing at $91.27 on December 20, 2023.

Overall, while the growth rate hasn’t been consistent, with several ups and downs over the period, the final value presents an overall increase when compared to the initial price, indicating a positive growth rate from June to December 2023. Here is a chart of DIS’ price over the past 180 days.

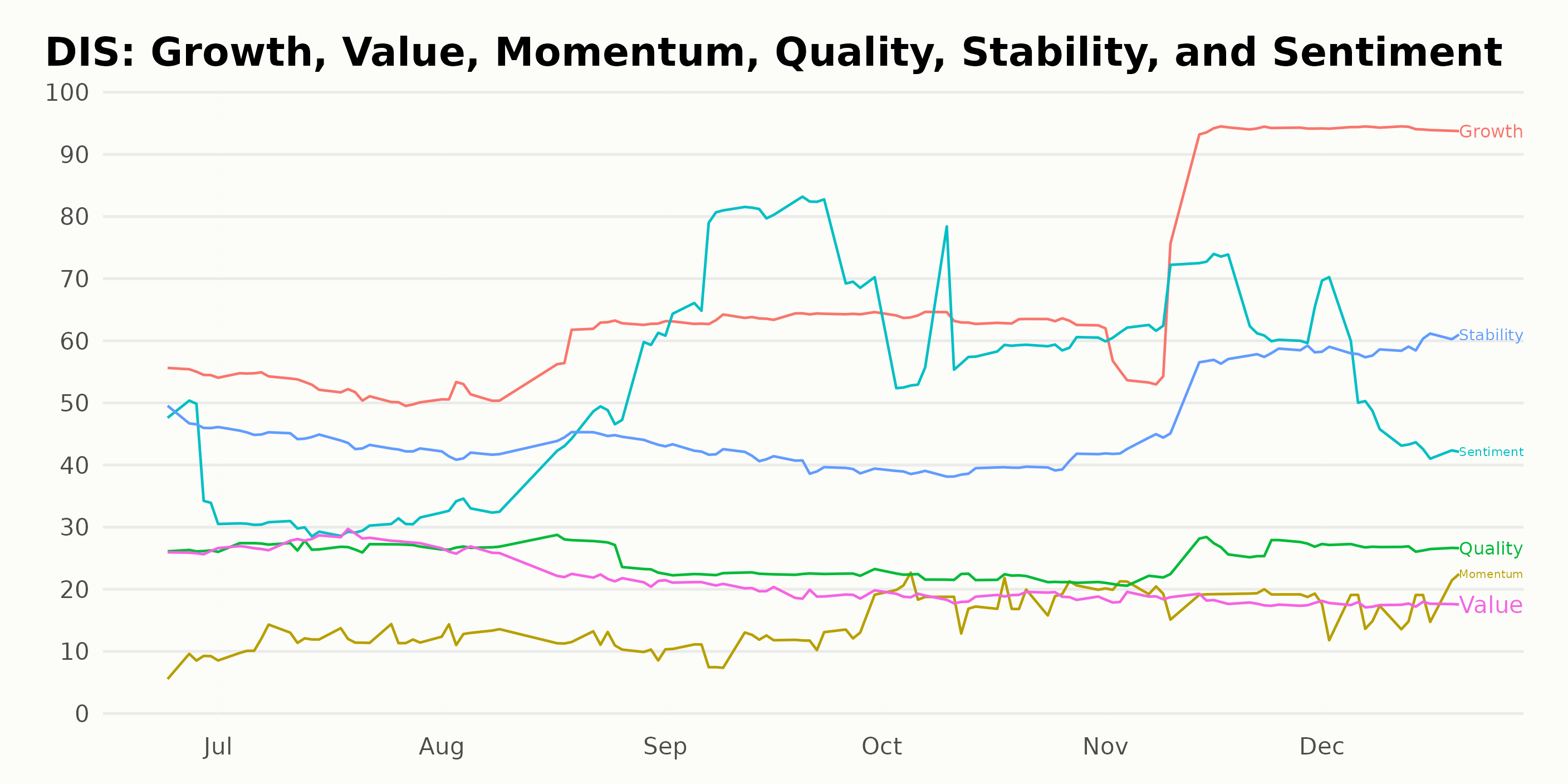

Analyzing Disney’s 2023 Performance: Growth, Momentum, and Sentiment Ratings Reviewed

The POWR Ratings grade of DIS, which falls under the Entertainment – Media Producers category, has shown a significant alteration over the span of months from June 2023 to December 2023. Notably, this category constitutes a total of 11 stocks. Key Observations:

- From June 24, 2023, to August 5, 2023, DIS persistently had a POWR grade of D (Sell) and ranked #9 in its category.

- On August 9, 2023, although the POWR grade remained D (Sell), there was a slight drop in its rank-in-category to #10.

- Between August 19, 2023, and October 28, 2023, DIS’ POWR grade was unchanged at D (Sell), while its rank improved slightly and stayed at #8.

- There was another temporary dip in rank to #10 on November 10, 2023, with the POWR grade remaining at D (Sell).

- Moving forward, from November 18, 2023, DIS saw an improvement in its POWR grade, climbing to C (Neutral), along with its rank-in-category being sustained at #8.

- On December 2, 2023, the POWR grade of C (Neutral) was maintained while the rank further improved to #7 for DIS. However, this turned out to be fleeting as the rank returned to #8 from December 9, 2023, onwards, while the POWR grade continued to be C (Neutral).

Based on the latest available data, as of December 21, 2023, the POWR grade for DIS is C (Neutral), and it secured the 8th position in the rank-in-category under the Entertainment – Media Producers group.

Based on the POWR Ratings, the three most noteworthy dimensions for DIS are Growth, Momentum, and Sentiment.

Growth: This dimension displays a clear upward trend, making it significant. In June 2023, the rating stood at 55, but by December of the same year, the Growth rating had risen sharply to reach a high of 94. This suggests consistent growth for DIS within this period.

- In June 2023, growth stood at 55.

- By December 2023, the growth had significantly increased to 94.

Momentum: The Momentum rating shows moderate fluctuations across the designated time frame, with numbers generally residing in the range of 12-19 from July to December 2023.

- July 2023 showed a Momentum rating of 12.

- The rating increased marginally to 19 by October 2023 before declining slightly to 17 in December 2023.

Sentiment: The Sentiment rating also constitutes a noteworthy trend, seeing significant shifts across the timeline. In September 2023, the sentiment spiked to 76 from its previous value of 43 in August of the same year.

- June 2023 had a Sentiment rating of 43.

- The Sentiment rating spiked to 76 in September 2023.

- By the end of the year in December 2023, the rating had dropped to 49.

These trends give considerable insights into the performance of DIS over this period within these three specific areas.

How does The Walt Disney Company (DIS) Stack Up Against its Peers?

Other stocks in the Entertainment – Toys & Video Games sector that may be worth considering are Electronic Arts Inc. (EA - Get Rating), Gravity Co., Ltd. (GRVY - Get Rating), and Playtika Holding Corp. (PLTK - Get Rating) – they have better POWR Ratings. Click here to explore more Entertainment – Toys & Video Games sector.

What To Do Next?

Get your hands on this special report with 3 low priced companies with tremendous upside potential even in today’s volatile markets:

3 Stocks to DOUBLE This Year >

Want More Great Investing Ideas?

DIS shares were trading at $91.37 per share on Thursday morning, up $0.10 (+0.11%). Year-to-date, DIS has gained 5.51%, versus a 25.05% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| DIS | Get Rating | Get Rating | Get Rating |

| EA | Get Rating | Get Rating | Get Rating |

| GRVY | Get Rating | Get Rating | Get Rating |

| PLTK | Get Rating | Get Rating | Get Rating |