DraftKings Inc. (DKNG) has seen steady revenue growth, with more states legalizing sports betting. The company has earned a substantial market share and is poised to see even more expansion in the coming years, as the global sports betting market is expected to grow at a CAGR of 10.3% from 2023 to 2030.

While the company raised its 2023 revenue guidance, its bottom line remains in the red. Wall Street analysts even predict that it won’t become profitable until 2025. Moreover, increasing competition and the possibility of new regulations might create bumps on its road to profitability. So, I think DKNG is not the right stock to gamble with now.

In this article, we’ll dive deeper into some metrics that depict the company’s struggles.

Analyzing DKNG’s Net Income, Revenue, Gross Margin & Current Ratio

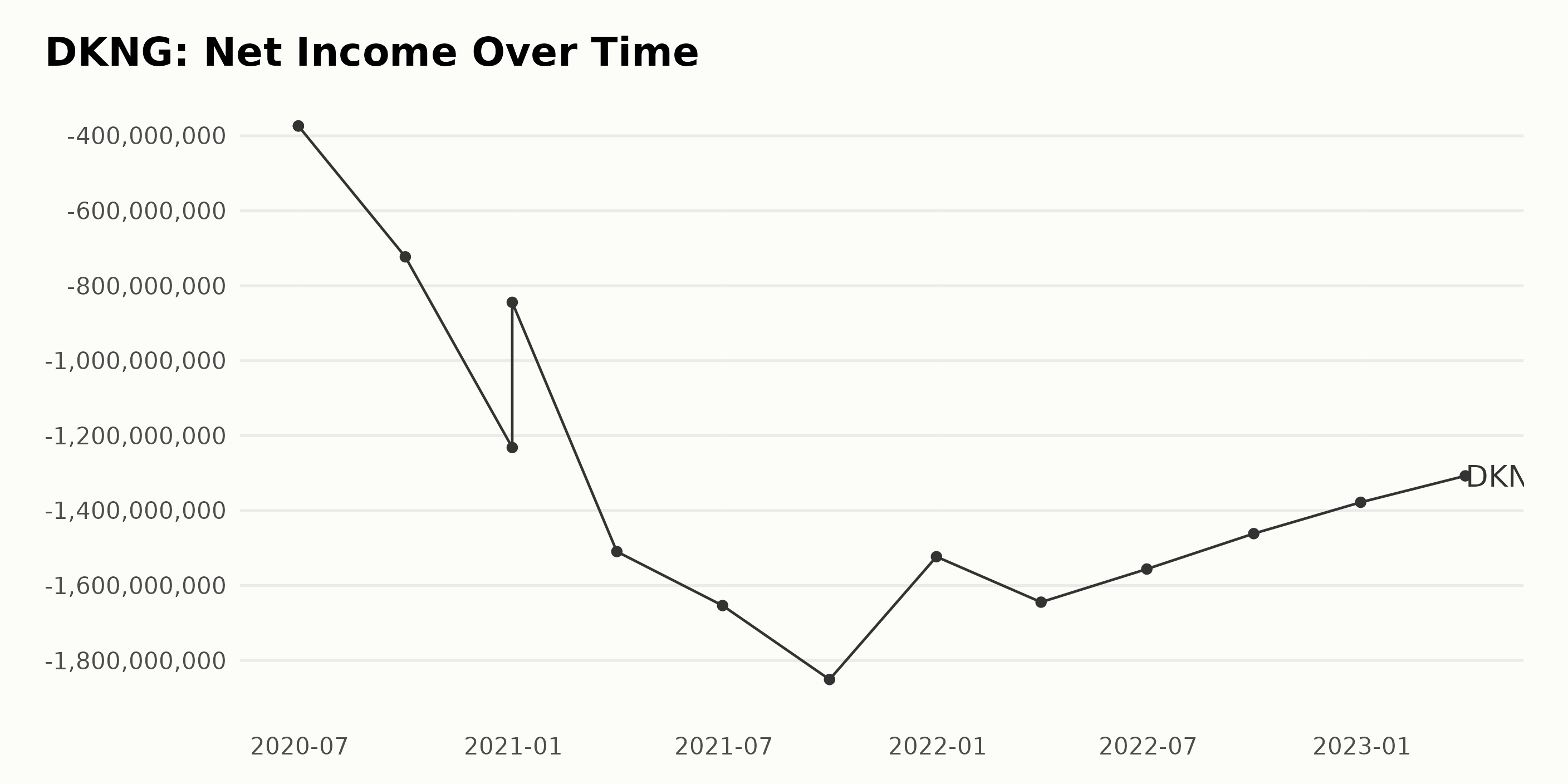

DKNG’s net income had fluctuated since June 2020, when it was negative $37.4 million. Since then, it declined to its lowest point of negative $185.1 million in September 2021. The most recent data point from March 2023 shows an improvement to negative $130.7 million. Over this period, the overall growth rate for DKNG’s net income was negative 67%.

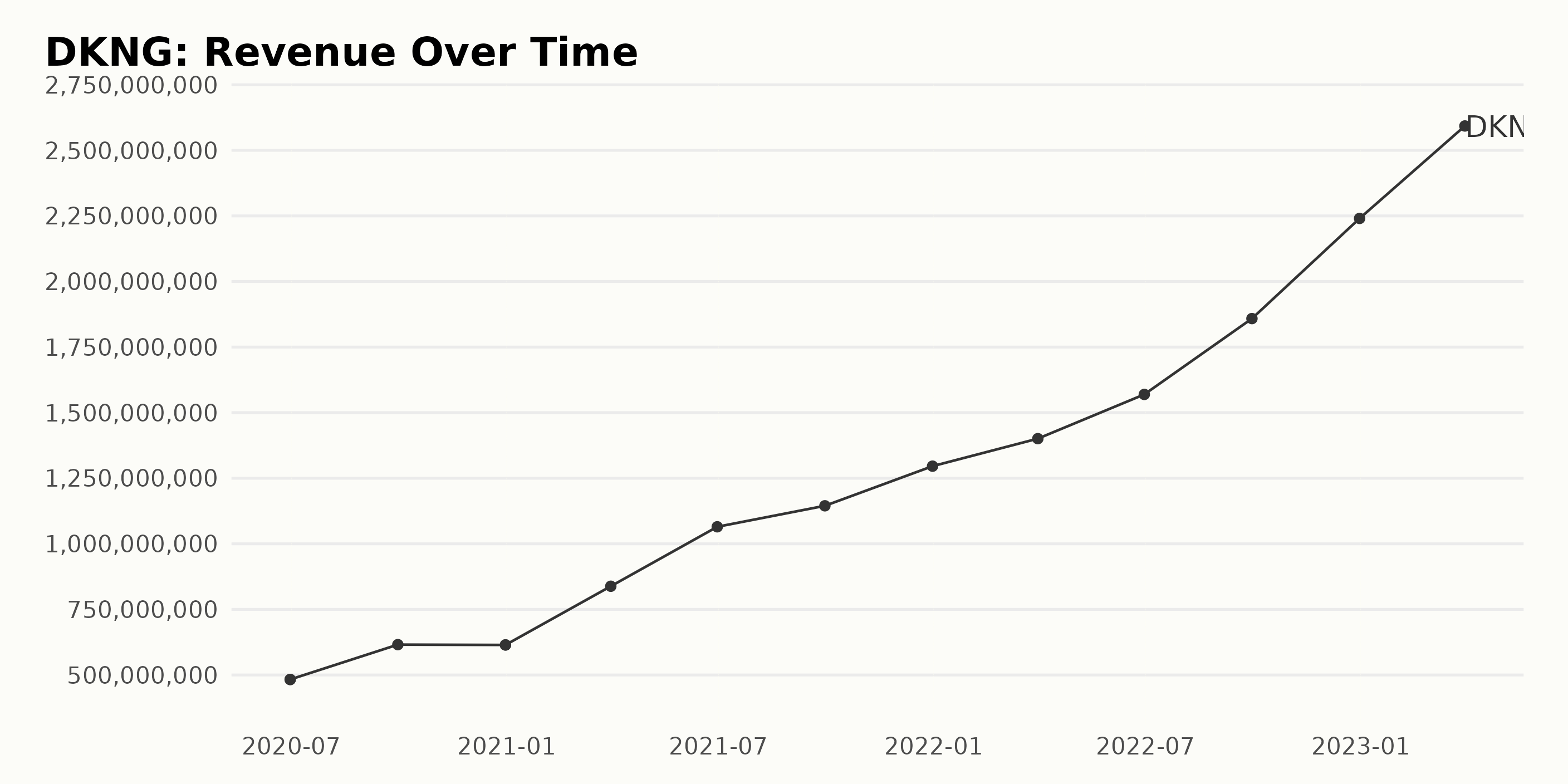

DKNG’s revenue has steadily increased since June 2020, when it was $482.88 million. By September 2021, this number had grown to $1.14 billion, and by March 2023, the most recent data point, it was $2.59 billion, an increase of 436% from the first value in the series.

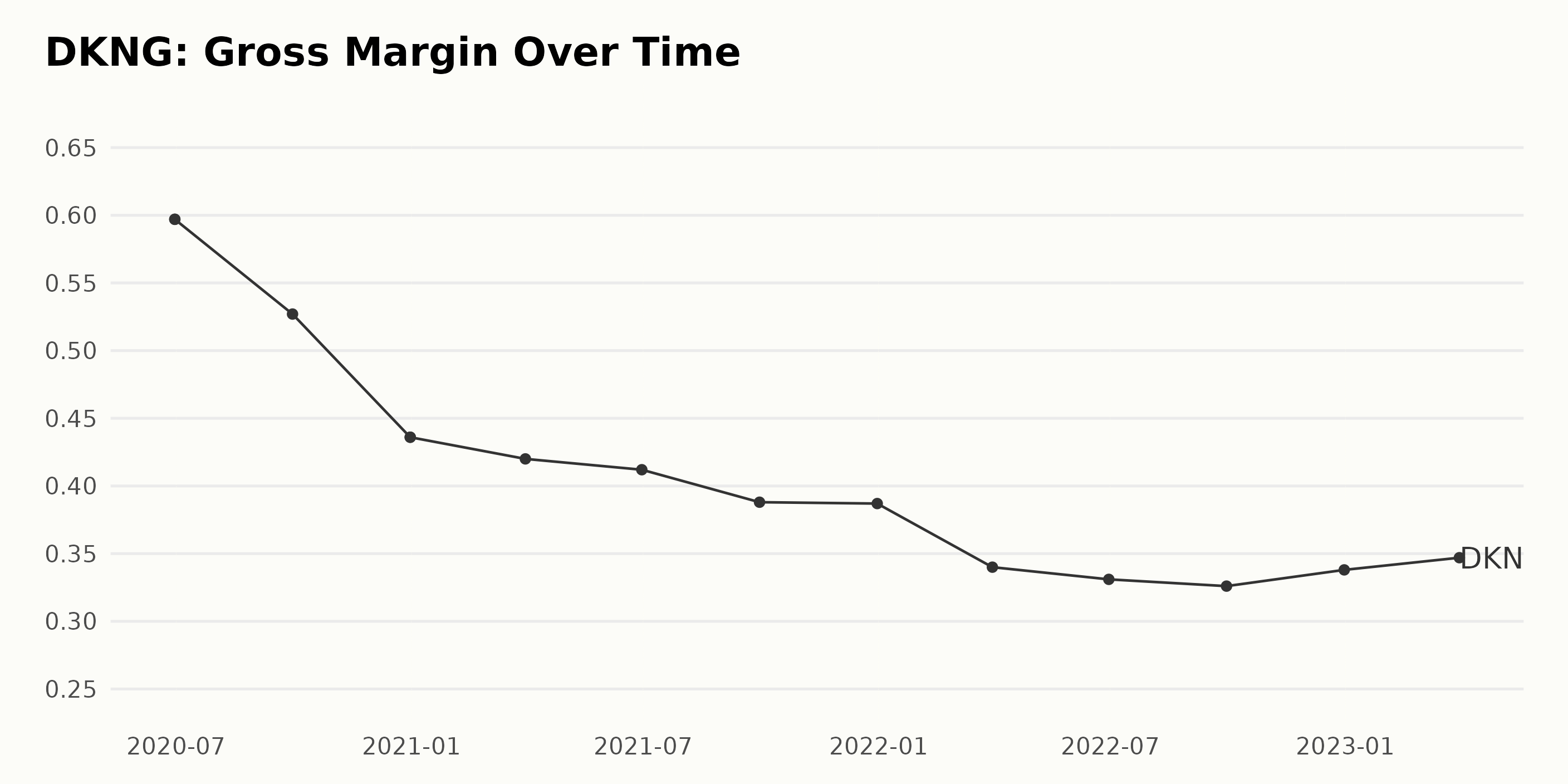

DKNG’s gross margin had generally decreased since June 2020, when it was 59.7%. This trend intensified in the third quarter of 2020, reaching a low of 33.1% in September 2022. However, more recently, the gross margin seems to have stabilized and reached 34.7% in March 2023. The gross margin has decreased by 8.3% over the last three years.

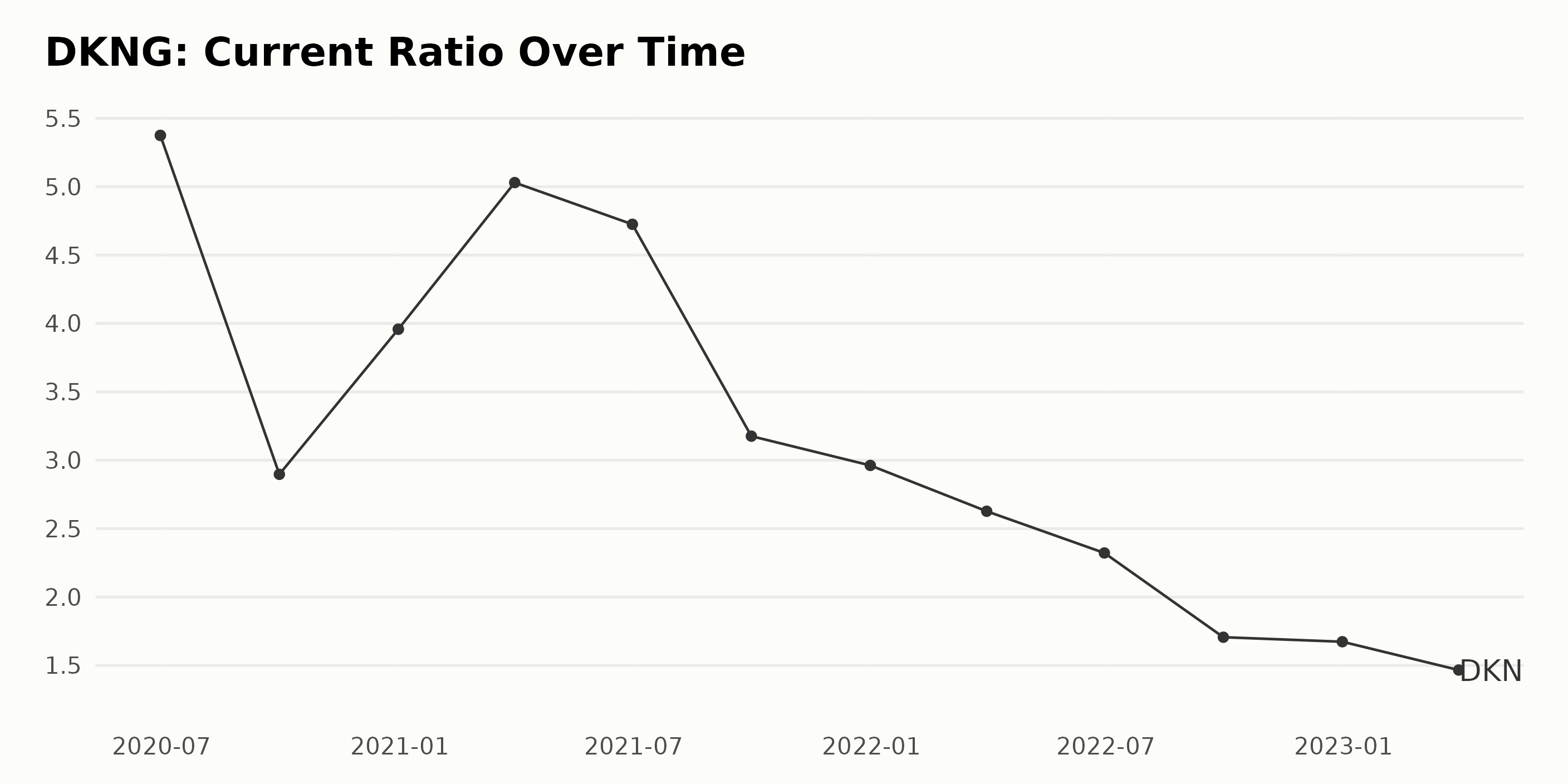

Its current ratio has been generally declining from June 2020 to March 2023, with some fluctuations. The most recent data indicates a current ratio of 1.47, a decrease of 70% since June 2020, when it was 5.38.

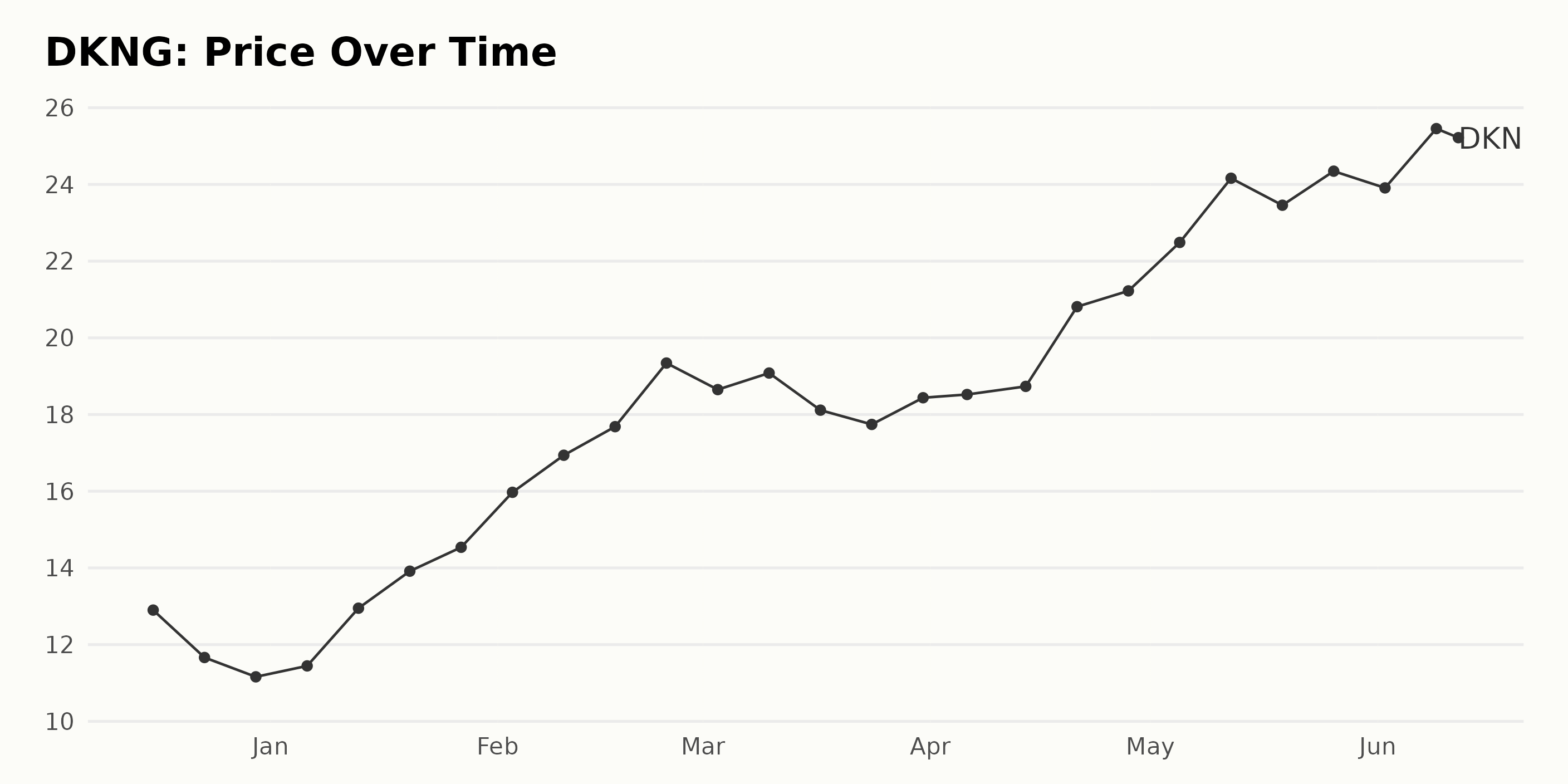

Significant Increase in Share Price: 92.4% in 6 Months

There is a clear trend of growth for the stock. From December 16, 2022, to June 9, 2023, the share price has risen from $13.22 to $25.46, an increase of 92.4%. The growth rate is accelerating; the earlier part of the data shows moderate increases, while the later part drastically increases at a significantly faster rate. Here is a chart of DKNG’s price over the past 180 days.

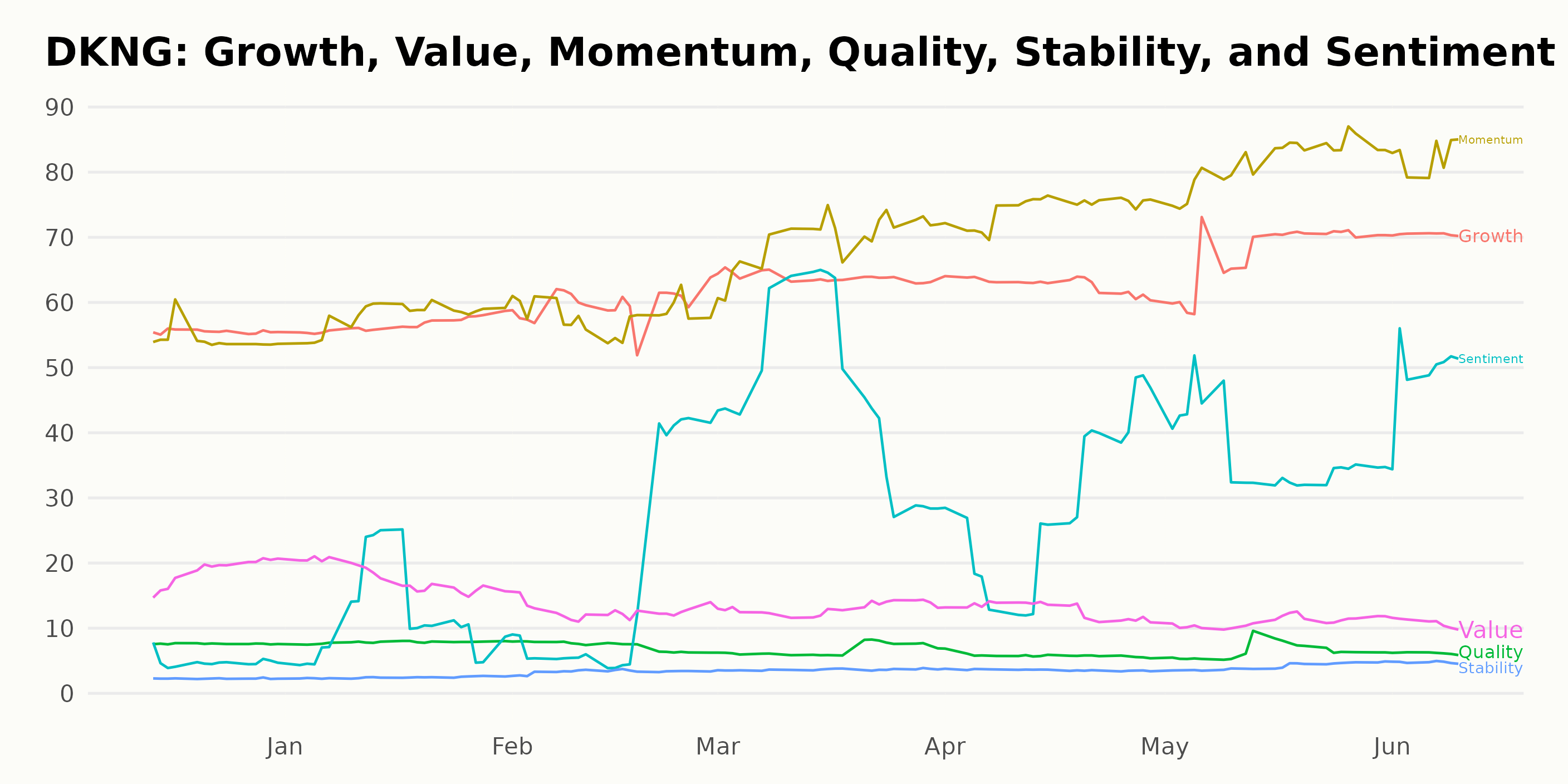

Unfavorable POWR Ratings

DKNG has an overall D rating, translating to a Sell in our POWR Ratings system. It is ranked #26 out of the 28 stocks in the Entertainment – Casinos/Gambling category. DKNG has an F grade in Stability and a D in Value and Quality.

Stocks to Consider Instead of DraftKings Inc. (DKNG)

Other stocks in the Entertainment – Casinos/Gambling sector that may be worth considering are International Game Technology (IGT), Boyd Gaming Corporation (BYD), and Monarch Casino & Resort Inc. (MCRI) — they have better POWR Ratings.

What To Do Next?

Get your hands on this special report with 3 low priced companies with tremendous upside potential even in today’s volatile markets:

3 Stocks to DOUBLE This Year >

Want More Great Investing Ideas?

DKNG shares were trading at $25.31 per share on Monday afternoon, up $0.37 (+1.48%). Year-to-date, DKNG has gained 122.21%, versus a 13.29% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| DKNG | Get Rating | Get Rating | Get Rating |

| IGT | Get Rating | Get Rating | Get Rating |

| BYD | Get Rating | Get Rating | Get Rating |

| MCRI | Get Rating | Get Rating | Get Rating |