Freshworks Inc. (FRSH - Get Rating) in San Mateo, Calif., is a software development company that offers software-as-a-service (SaaS) solutions. It provides customer experience (CX), IT service management (ITSM), customer relationship management (CRM), sales and marketing, and human resource (HR) management solutions.

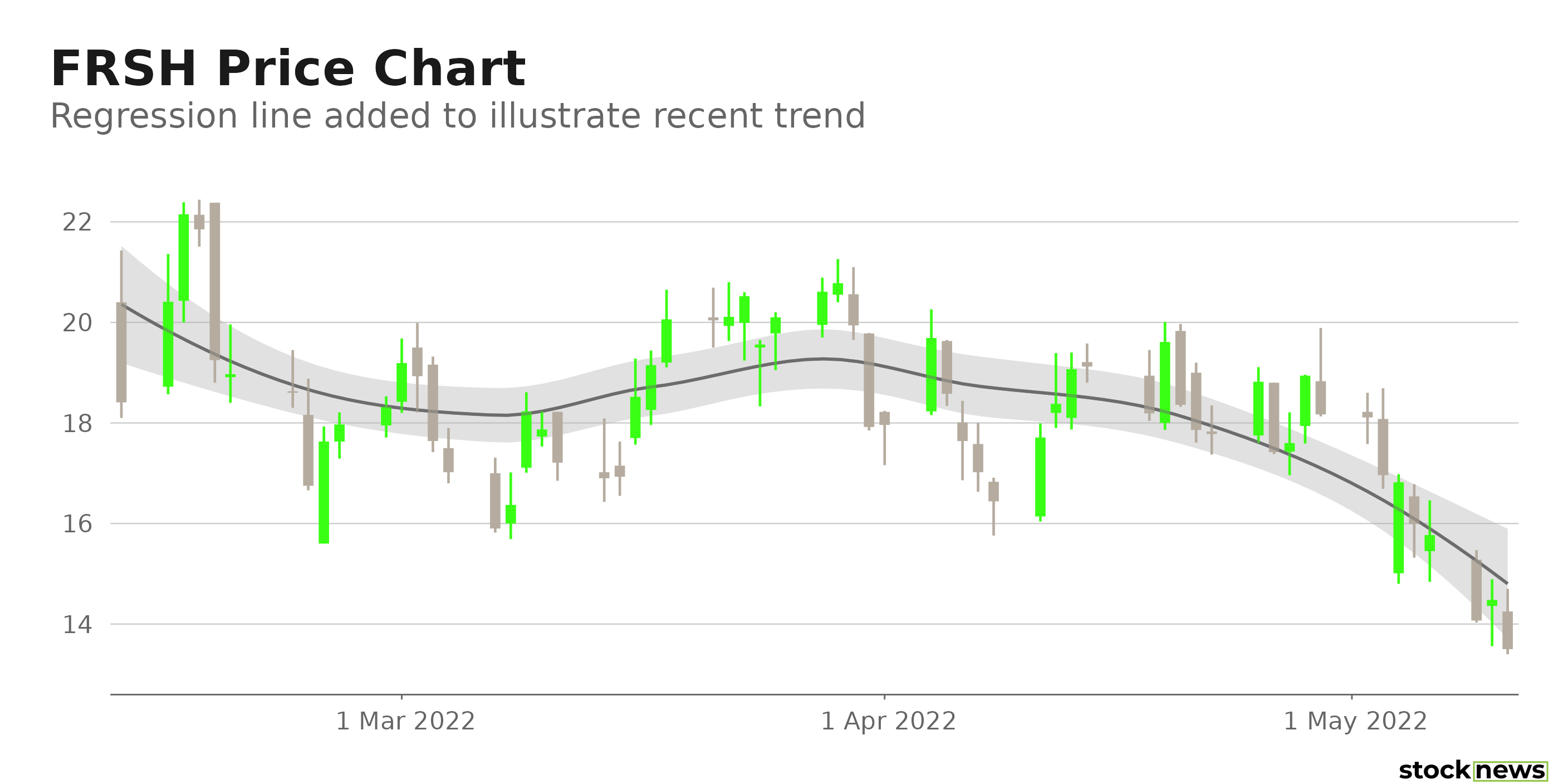

The company’s shares are down 48.6% in price year-to-date and 23.8% over the past month. In addition, closing yesterday’s trading session at $13.50, the stock is currently trading 73.7% below its 52-week high of $53.36, which it hit on Nov. 02, 2021.In its recent earnings report, the company posted a 115% net-dollar-based revenue retention, implying that current customers increased their spending by 15% on average compared to the previous year.

However, its free cash flow flipped from a $4.8 million inflow last year to a $1.8 million loss this year, causing a retreat in its share price. In addition, FRSH’s Director Johanna Flower sold 4,700 shares of the company’s stock on Tuesday, May 10. Also, JPMorgan analyst Mark Murphy has reduced the stock’s price objective to $23.00 from $38.00, while maintaining an Overweight rating.

Here is what could shape FRSH’s performance in the near term:

Poor Bottom line Performance

FRSH’s total revenue increased 42.3% year-over-year to $114.64 million for the three months ended March 31, 2022. However, its operating expenses increased 112.4% from its year-ago value to $139.37 million. Its operating loss grew significantly from the prior-year quarter to $47.12 million. The company’s net loss increased 1931.4% year-over-year to $49.06 million, and its loss per share came in at $0.18 over this period.

Poor Profitability

FRSH’s 0.46% trailing-12-months asset turnover ratio is 27.3% lower than the 0.63% industry average. Its $5.04 million trailing-12-months cash from operations is 94.1% lower than the $85.32 million industry average. Also, its trailing-12-months ROA, net income margin, and ROC are negative 17.2%, 58.9%, and 23%, respectively.

Premium Valuation

In terms of trailing-12-months Price/Cash Flow, the stock is currently trading at 761.48x, which is 4032.9% higher than the 18.4x industry average. Also, its 5.91x forward EV/Sales is 115.2% higher than the 2.75x industry average. Furthermore, FRSH’s 7.69x forward Price/Sales is 185.1% higher than the 2.70x industry average.

POWR Ratings Reflect Bleak Outlook

FRSH has an overall D rating, which equates to Sell in our proprietary POWR Ratings system. The POWR ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

Our proprietary rating system also evaluates each stock based on eight distinct categories. FRSH has a D grade for Value and Quality. Its higher-than-industry valuation is in sync with the Value grade. In addition, the company’s poor profitability is consistent with the Quality grade.

Among the 159 stocks in the F-rated Software – Application industry, FRSH is ranked #138.

Beyond what I have stated above, you can view FRSH ratings for Growth, Momentum, Stability, and Sentiment here.

Click here to check out our Software Industry Report for 2022

Bottom Line

FRSH’s poor bottom-line performance and rise in free cash outflow in its recent earnings release are concerning. Also, analysts expect its EPS to decline 25% next quarter (ending Sept. 30, 2022). In addition, it is currently trading significantly below its 50-day and 200-day moving averages of $18.01 and $21.94, respectively, indicating a downtrend. Furthermore, given its stretched valuation and poor profitability, we think the stock is best avoided now.

How Does Freshworks Inc. (FRSH) Stack Up Against its Peers?

While FRSH has an overall D rating, one might want to consider its industry peers, Commvault Systems Inc. (CVLT - Get Rating), Rimini Street Inc. (RMNI - Get Rating), and Enghouse Systems Limited (EGHSF - Get Rating), which have an overall A (Strong Buy) rating.

Want More Great Investing Ideas?

FRSH shares were unchanged in premarket trading Thursday. Year-to-date, FRSH has declined -48.59%, versus a -17.81% rise in the benchmark S&P 500 index during the same period.

About the Author: Pragya Pandey

Pragya is an equity research analyst and financial journalist with a passion for investing. In college she majored in finance and is currently pursuing the CFA program and is a Level II candidate. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| FRSH | Get Rating | Get Rating | Get Rating |

| CVLT | Get Rating | Get Rating | Get Rating |

| RMNI | Get Rating | Get Rating | Get Rating |

| EGHSF | Get Rating | Get Rating | Get Rating |