fuboTV Inc. (FUBO) is a live TV streaming platform providing live sports events, news, and entertainment content in Europe and the United States. The company’s platform allows customers to access content through streaming devices, as well as on Smart TVs, mobile phones, tablets, and computers.

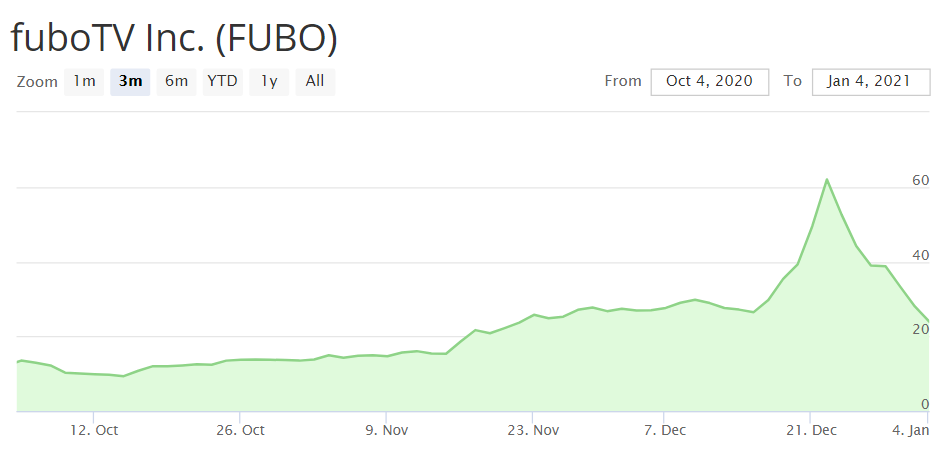

Shares of this leading sports-first live TV streaming platform plunged 45% last week after soaring more than 400% since the first week of October. This plunge can be attributed to the expiration of the lock-up agreement on December 30th amid the intensifying challenge of customer acquisition. Furthermore, the company’s notable gaps in programming after parting ways with WarnerMedia and letting go off networks like TNT and TBS have caused FUBO’s stocks to stumble last week.

Even though FUBO’s subscription grew in the last-reported quarter, its weak fundamentals and uncertainty about its potential to rebound based on several factors have led our proprietary rating system, POWR Ratings, to rate the stock as “Neutral.”

Here’s how our proprietary POWR Ratings system evaluates FUBO:

Trade Grade: B

FUBO is currently trading above its 200-day moving averages of $13.86. However, in just the past 5 trading days the stock has plunged more than 45%.

FUBO’s net revenue has increased 47% year-over-year to $61.20 million in the third quarter ended September 30, 2020. Its advertising has increased 153% from the year-ago value to $7.50 million, while subscription revenue has increased 64% from the prior-year quarter to $53.40 million over this period.

The company has recently launched its live TV streaming platform on Hisense Smart TVs with the VIDAA Smart operating system, giving consumers instant access to FUBO’s live sports and entertainment network. This will help FUBO witness a surge in subscription by providing the customer a more direct way of accessing the content they enjoy.

On December 11, FUBO added EPIX, a suite of premium entertainment networks, to its live TV streaming platform. This should further expand FUBO’s entertainment offering and provide greater value to its users.

Buy & Hold Grade: F

In terms of proximity to its 52-week high, which is a key factor that our Buy & Hold Grade takes into account, FUBO is poorly positioned. The stock is currently trading more than 55% below its 52-week high of $62.29, which it hit on December 22nd. This is primarily attributable to the expiration of a lock-up agreement in the company’s initial public offering in October. As of December 30th, approximately 88 million of its shares, which is more than triple the previous float, became eligible to be sold.

Peer Grade: D

FUBO is currently ranked #11 out of 15 stocks in the Entertainment – Sports & Theme Parks industry. Other popular stocks in this industry are Walt Disney Company (DIS), Live Nation Entertainment, Inc. (LYV) and Dover Motorsports, Inc. (DVD)

DIS, DVD, and LYV gained 25.3%, 22%, and 2.8% over the past year, respectively. This compares to FUBO’s 214.4% returns over this period.

Industry Rank: A

The Entertainment – Sports & Theme Parks industry is ranked #11 out of the 123 StockNews.com industries. The companies in this industry own and operate live sports streaming platforms, theme parks, hotels, vacation club properties, entertainment complexes, conference centers, campgrounds, golf courses, water parks, raceways, sports arenas, and other recreational facilities.

With the pandemic restricting movements of people and making social life difficult, the entertainment streaming platforms have witnessed an immense growth. Strict lockdown measures have boosted the media consumption significantly, thereby accelerating the growth of this industry. Amid growing fears surrounding a second strain of the virus and fresh lockdown measures, these platforms are expected to gain much more popularity in the upcoming months.

Overall POWR Rating: C (Neutral)

Despite reporting subscription and advertising revenue growth in its last reported quarter, FUBO is rated “Neutral” due to the expiration of a lock-up agreement and other factors as determined by the four components of our POWR Rating.

Bottom Line

While FUBO may witness some headwinds down the road, the favorable industry trend should help buoy the stock, if the company is able to maintain its financial performance in the current quarter.

Want More Great Investing Ideas?

9 “MUST OWN” Growth Stocks for 2021

The #1 CRITICAL Investment Lesson from 2020

7 Best ETFs for the NEXT Bull Market

FUBO shares were trading at $23.85 per share on Monday afternoon, down $4.15 (-14.82%). Year-to-date, FUBO has declined -14.82%, versus a -1.67% rise in the benchmark S&P 500 index during the same period.

About the Author: Imon Ghosh

Imon is an investment analyst and journalist with an enthusiasm for financial research and writing. She began her career at Kantar IMRB, a leading market research and consumer consulting organization. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| FUBO | Get Rating | Get Rating | Get Rating |