W.W. Grainger, Inc. (GWW - Get Rating) in Lake Forest, Ill., is a leading broad line distributor that sells maintenance, operating, and repair (MRO) products. It operates in two segments: High-Touch Solutions; and Endless Assortment. GWW sells more than two million MRO products through its High-Torch Solutions segment and more than 30 million products through its Endless Assortment segment.

The company has more than 4.5 million customers across North America, Japan, and the United Kingdom. Also, GWW has an ISS Governance QualityScore of 2, indicating low governance risk.

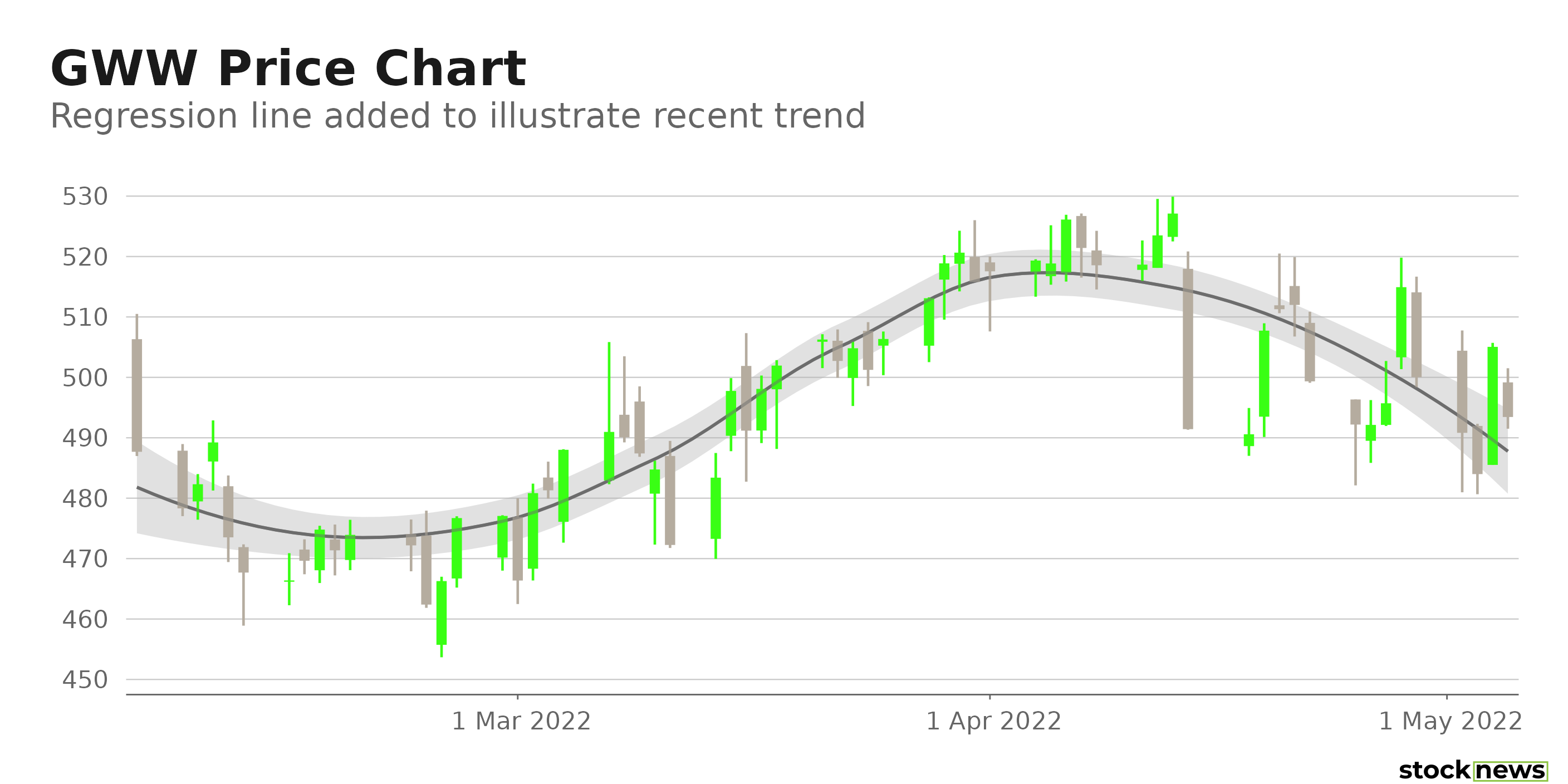

Shares of GWW have gained 10.7% over the past year and 5.3% over the past six months. Furthermore, the stock gained 4.5% in price intraday to close yesterday’s trading session at $505.05. GWW’s better-than-expected latest earnings report and recent dividend increase have caused the stock to outperform broader markets.

Here is what could shape GWW’s performance in the near term:

Robust Financials

GWW’s sales increased 18.2% year-over-year to $3.65 billion in its fiscal year 2022 first quarter, ended March 31, 2022. It surpassed the $3.50 billion consensus revenue estimate by 4.1%. Its gross margin increased 245 basis points from the same period last year to 37.9%. And its operating earnings came in at $534 million, up 49.2% from the prior-year quarter. Its net earnings and EPS improved 54% and 57.8%, respectively, from their year-ago values to $366 million and $7.07. The company beat the Street’s $6.12 EPS estimate by 15.5%. Also, its operating cash flow stood at $343 million, representing a 16.7% rise from the same period last year.

GWW Chairman and CEO DG Macpherson said, “The Grainger team performed extremely well in the first quarter, with strong financial results supported by a robust demand environment. We continued to execute against our key growth initiatives, drive operational excellence and strengthen our culture…Despite the ongoing inflationary and supply chain challenges, we are well positioned for a successful year.”

Impressive Shareholder Returns

In its fiscal first quarter, ended March 31, 2022, GWW returned $163 million to shareholders through dividends and share repurchases. This is aligned with the company’s aim to repurchase approximately $600 million -$800 million worth of outstanding shares in fiscal 2022.

In addition, GWW has increased its dividend payouts by 6% to $1.72 per share, payable on June 1, 2022. This aligns with the company’s capital allocation strategy and its goal of maximizing shareholder returns through periodic dividend increments and strategic investments in the business.

Higher-than-industry Profit Margins

GWW’s 36.88% trailing-12-month gross profit margin is 25.8% higher than the 29.31% industry average. Its trailing-12-month EBITDA and net income margin of 14.27% and 8.62%, respectively, compare with the 13.28% and 6.76% industry averages.

Also, GWW’s 60.1% trailing-12-month ROE is 317.8% higher than the 14.38% industry average. Its 22.83% and 16.75% respective ROTC and ROA are significantly higher than the 7.13% and 5.31% industry averages.

Consensus Rating and Price Target Indicate Potential Upside

Of the nine Wall Street analysts that rated GWW, five rated it Buy, one rated it Hold, and three rated it Sell. The 12-month median price target of $543.13 indicates a 7.5% potential upside from yesterday’s closing price of $505.05. The price targets range from a low of $450.00 to a high of $621.00.

POWR Ratings Reflect Rosy Prospects

GWW has an overall B rating, which translates to Buy in our proprietary POWR Ratings system. The POWR Ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

The stock has an A grade for Quality and a B for Momentum. GWW’s higher-than-industry profit margins justify the Quality grade. In addition, the stock is currently trading above its 50-day and 200-day moving averages of $499.30 and $471.19, respectively, indicating a golden-cross uptrend in sync with the Momentum grade.

Of the 91 stocks in the Industrial – Equipment industry, GWW is ranked #11.

Beyond what I have stated above, view GWW ratings for Growth, Sentiment, Stability, and Value here.

Click here to check out our Industrial Sector Report for 2022

Bottom Line

With declining GDP and aggressive central bank interest rate increases, the equity markets are expected to remain under pressure in the near term. As the economy heads toward a recession, investors have been focusing on high-yielding dividend stocks. GWW pays $6.88 in dividends annually, yielding 1.36% at the current price. Thus, we think GWW is an ideal investment bet.

How Does W.W. Grainger (GWW) Stack Up Against its Peers?

While GWW has a B rating in our proprietary rating system, one might want to consider looking at its industry peers, Preformed Line Products Company (PLPC - Get Rating), Standex International Corporation (SXI - Get Rating), and Hurco Companies, Inc. (HURC - Get Rating), which have an A (Strong Buy) rating.

Want More Great Investing Ideas?

GWW shares were trading at $492.14 per share on Thursday morning, down $12.91 (-2.56%). Year-to-date, GWW has declined -4.71%, versus a -11.54% rise in the benchmark S&P 500 index during the same period.

About the Author: Aditi Ganguly

Aditi is an experienced content developer and financial writer who is passionate about helping investors understand the do’s and don'ts of investing. She has a keen interest in the stock market and has a fundamental approach when analyzing equities. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| GWW | Get Rating | Get Rating | Get Rating |

| PLPC | Get Rating | Get Rating | Get Rating |

| HURC | Get Rating | Get Rating | Get Rating |

| SXI | Get Rating | Get Rating | Get Rating |