Headquartered in Hong Kong, Integrated Media Technology Limited (IMTE - Get Rating) develops, sells, and distributes 3D autostereoscopic display (ASD) technology products and services in Hong Kong, China, Korea, Singapore, and Australia.

The stock surged more than 30% in price in December when the firm announced a plan to acquire a blockchain project. IMTE decided to “take over” a previously agreed-upon transaction with Hong Kong-based Joint Investment Limited. According to the terms of the agreement, Joint Investments and its former partners will develop a non-fungible token (NFT) trading platform based on blockchain technology.

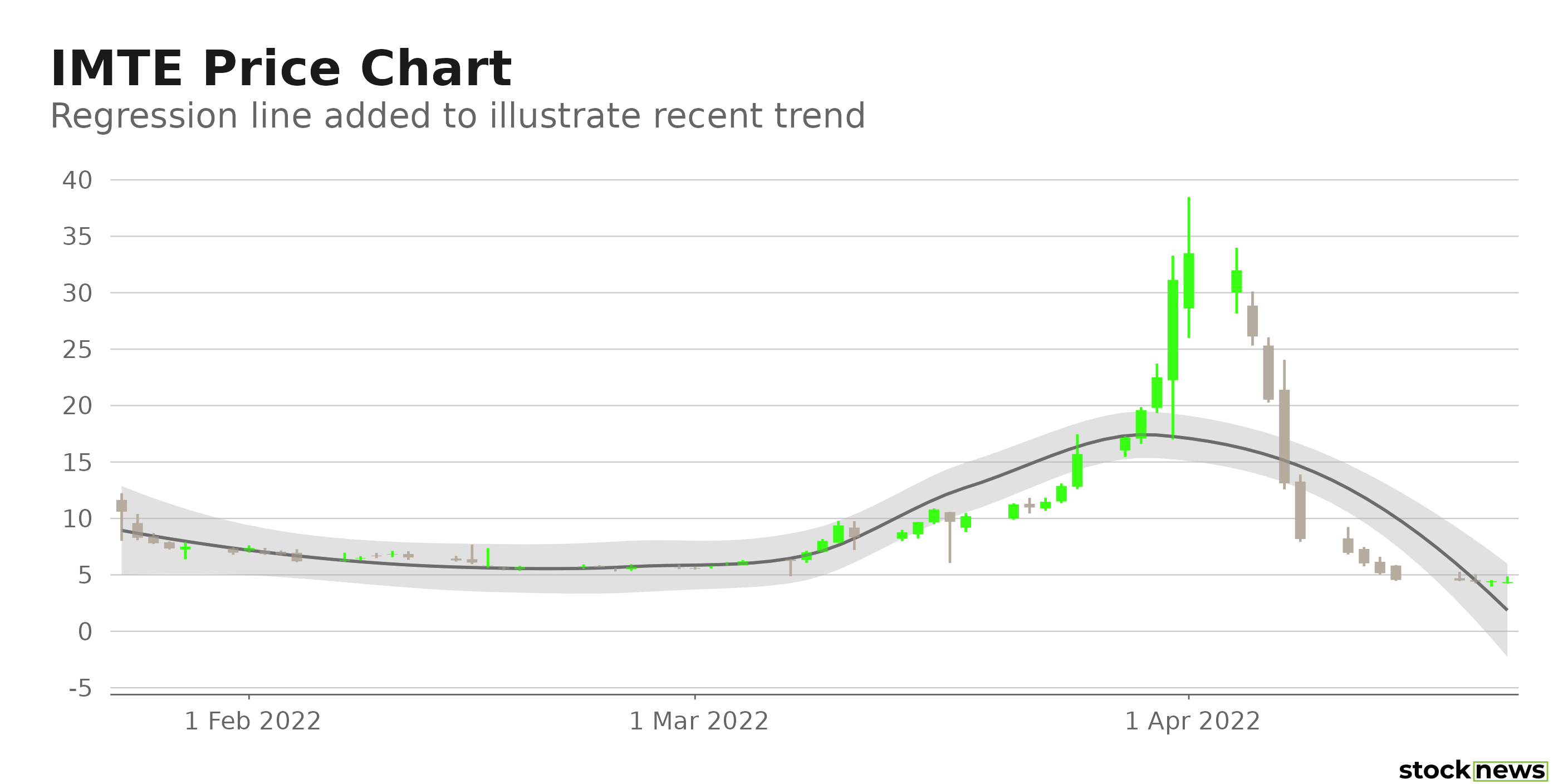

The stock is down 63.8% in price over the past three months and 61.2% over the past month to close yesterday’s trading session at $4.37. In addition, the stock is currently trading 88.6% below its 52-week high of $38.47, which it hit on April 01, 2022.

Here is what could shape IMTE’s performance in the near term:

Stretched Valuation

In terms of trailing-12-months Price/Sales, the stock is currently trading at 28.79x, which is 724.7% higher than the 3.49x industry average. Also, its 44.86x trailing-12-months EV/Sales is 1129.6% higher than the 3.65x industry average. Furthermore, IMTE’s 6.76x trailing-12-months Price/Book is 88% higher than the 3.58x industry average.

Poor Profitability

IMTE’s 0.09% trailing-12-months asset turnover ratio is 86.2% lower than the 0.63% industry average. Its trailing-12-months cash from operations stood at negative $5.45 million, versus the $90.61 million industry average. Also, its trailing-12-months ROA, gross profit margin, and ROC are negative 53.7%, 115.5%, and 32.4%, respectively.

POWR Ratings Reflect Bleak Outlook

IMTE has an overall F rating, which equates to a Strong Sell in our proprietary POWR Ratings system. The POWR ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

Our proprietary rating system also evaluates each stock based on eight distinct categories. IMTE has an F grade for Value, Stability, and Quality. The company’s higher-than-industry valuation is consistent with the Value grade. In addition, the stock’s 2.74 beta is in sync with the Stability grade. Also, IMTE’s poor profitability justifies the Quality grade.

Of the 48 stocks in the C-rated Technology – Electronics industry, IMTE is ranked #43.

Beyond what I have stated above, one can view IMTE ratings for Momentum, Quality, and Sentiment here.

Bottom Line

IMTE has posted losses for the past three years, yet it is trading at an expensive valuation given its near-term growth prospects. Furthermore, the stock is currently trading below its 50-day and 200-day moving average of $10.32 and $6.44, respectively, indicating bearish sentiment. Therefore, we believe the stock is best avoided now.

How Does Integrated Media Technology Limited (IMTE) Stack Up Against its Peers?

While IMTE has an overall F rating, one might want to consider its industry peers, Wayside Technology Group Inc. (WSTG - Get Rating) and Arrow Electronics Inc. (ARW - Get Rating), which have an overall A (Strong Buy) rating.

Want More Great Investing Ideas?

IMTE shares rose $0.23 (+5.26%) in premarket trading Friday. Year-to-date, IMTE has declined -2.24%, versus a -7.48% rise in the benchmark S&P 500 index during the same period.

About the Author: Pragya Pandey

Pragya is an equity research analyst and financial journalist with a passion for investing. In college she majored in finance and is currently pursuing the CFA program and is a Level II candidate. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| IMTE | Get Rating | Get Rating | Get Rating |

| WSTG | Get Rating | Get Rating | Get Rating |

| ARW | Get Rating | Get Rating | Get Rating |