Amid the possibility of a recession, judicious investors seek reliable investment options that can weather the storm. To that end, The Coca-Cola Company (KO - Get Rating) is appealing, with its long-standing track record of stability and consistent dividend payments.

As one of the most recognized and trusted beverage companies worldwide, KO has maintained a remarkable 60-year streak of dividend hikes, making it a solid choice for those seeking steady income streams.

The company’s forward annual dividend of $1.84 per share translates to an attractive dividend yield of 3.08%. Furthermore, KO’s dividend payouts have consistently grown, with 3.4% and 3.5% over the past three and five years, respectively.

Despite the stock’s 7% decline over the past month, several factors suggest a potential upside. The company surpassed analysts’ expectations for its first-quarter earnings and revenue.

KO reiterated its organic revenue growth projection unchanged between 7% to 8% for the fiscal year 2023. Likewise, management kept the company’s comparable currency-neutral EPS (non-GAAP) growth expectation unchanged between 7% to 9%.

Let’s assess the trends of some of KO’s metrics to understand why it is a compelling investment choice now.

KO’s Steady Growth From June 2020 to March 2023

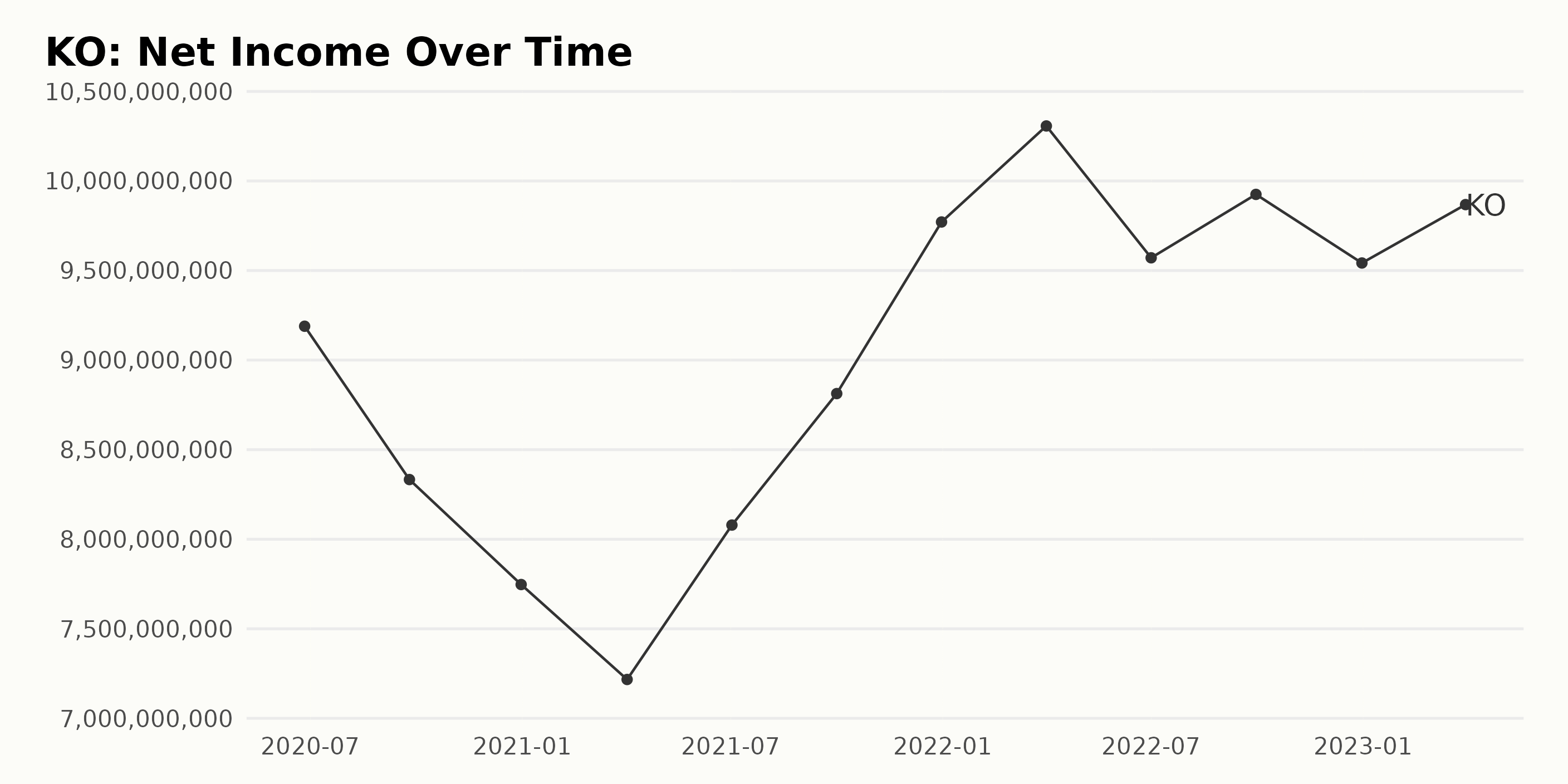

The series of KO’s net income from June 2020 to March 2023 showed some fluctuations, yet overall an increasing trend. The total growth rate was 6.6%, from $9.19 billion in June 2020 to $9.87 billion in December 2021.

The latest data point in the series reported a net income of $9.87 billion in December 2021, followed by a slight decrease of $460 million, or 4.6%, to $9.57 billion in July 2022. Then, the net income increased by $364 million by September 2022 and rose to $10.31 billion in April 2023. The last reported value was $9.87 billion in March 2023.

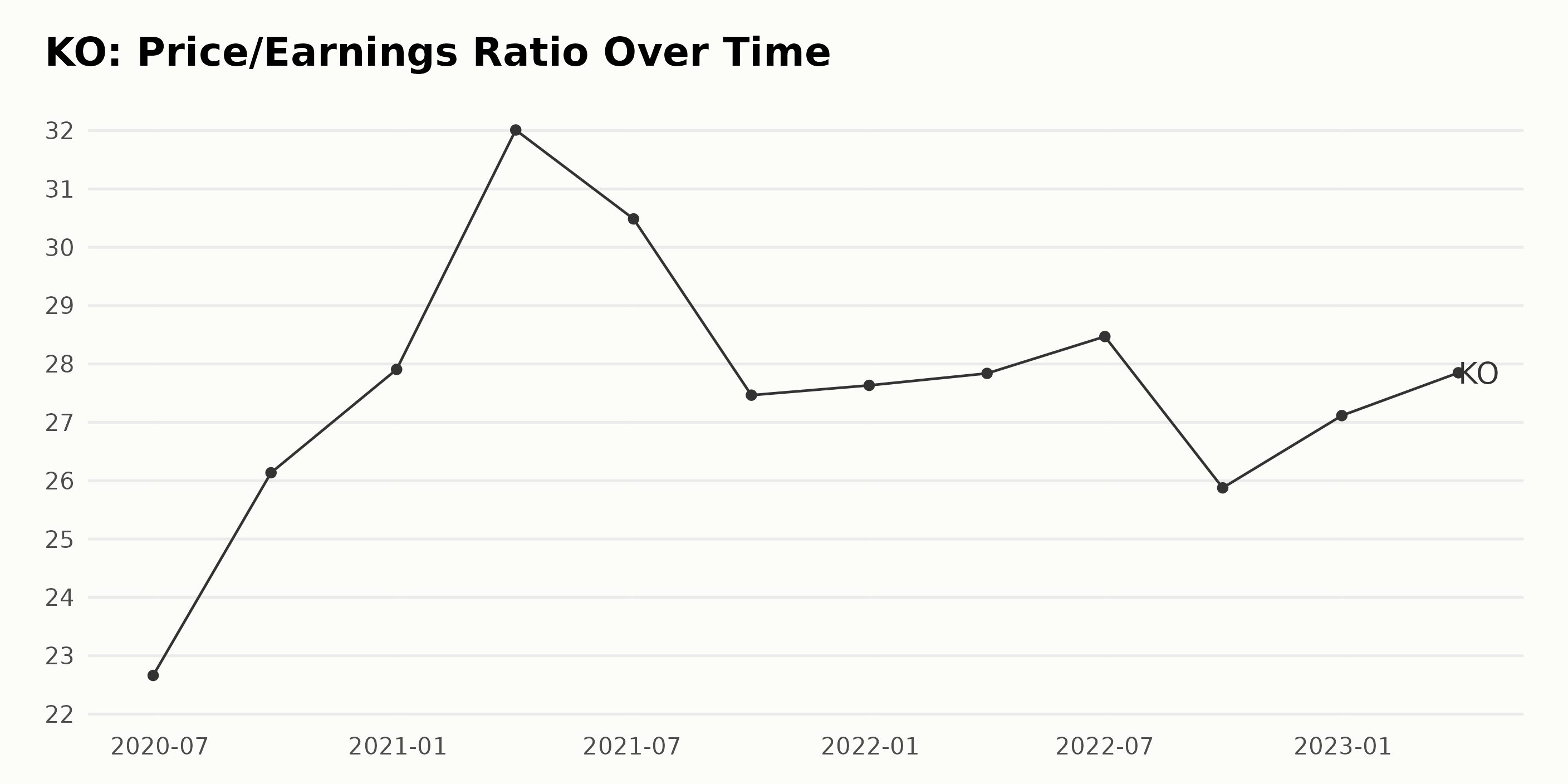

KO has experienced growing P/E ratio numbers from June 2020, with 22.7 up to a high of 32.0 in April 2021, before settling at 27.9 at the end of 2020. In 2021, the P/E ratio saw an overall decline before reaching 27.6 in December 2021 and then increasing slowly until March 2023 at 27.9. The recent data shows a slight increase, with the last value of 27.9 in March 2023. Overall, the P/E ratio of KO has grown by 23% from June 2020 to March 2023.

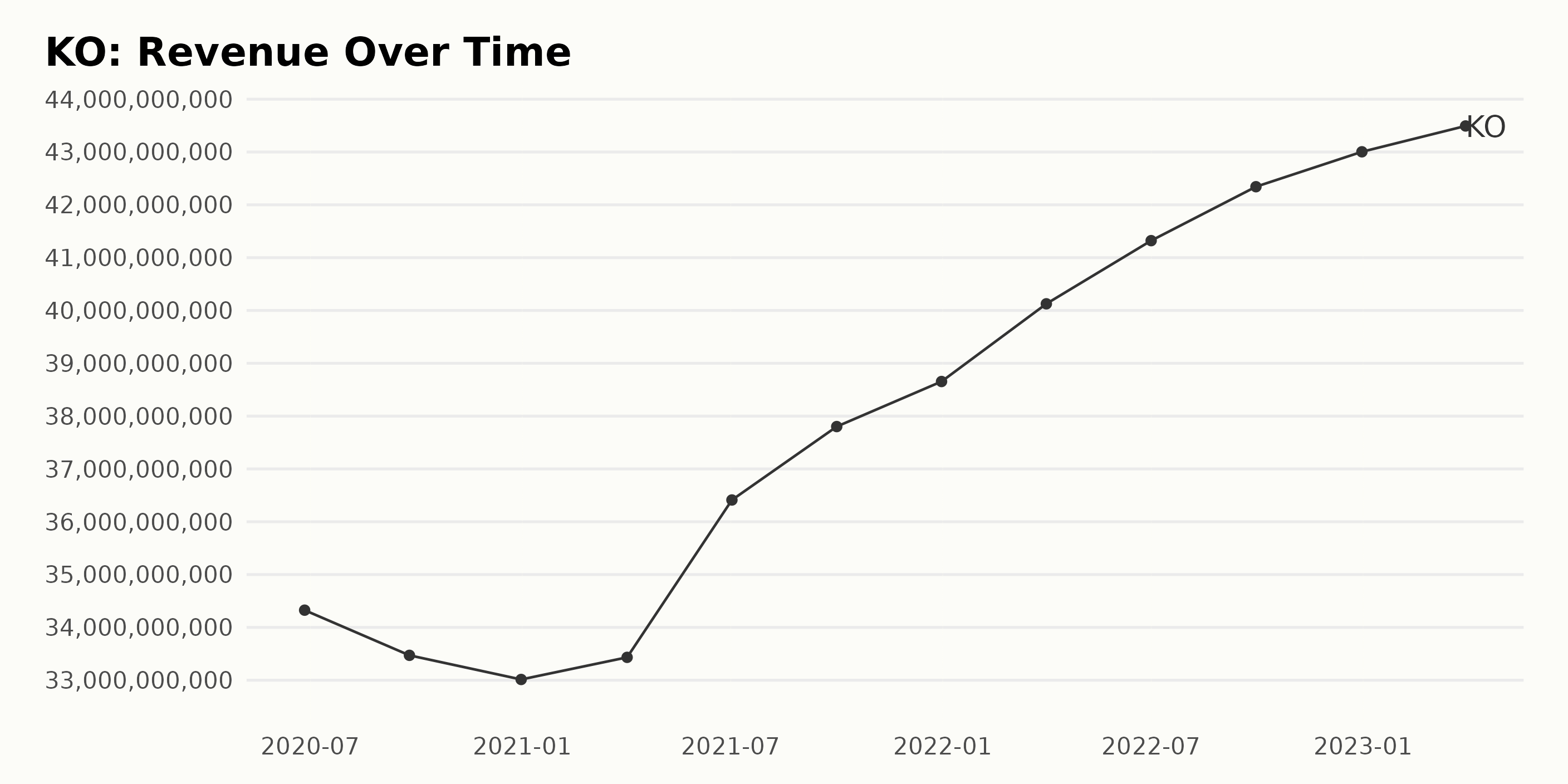

KO has seen a general overall trend of increasing revenues, fluctuating between $33.47 billion and $43.00 billion from June 26, 2020, until March 31, 2023. The most recent quarter showed an impressive increase of 10.2%, bringing the total revenue to $43.49 billion.

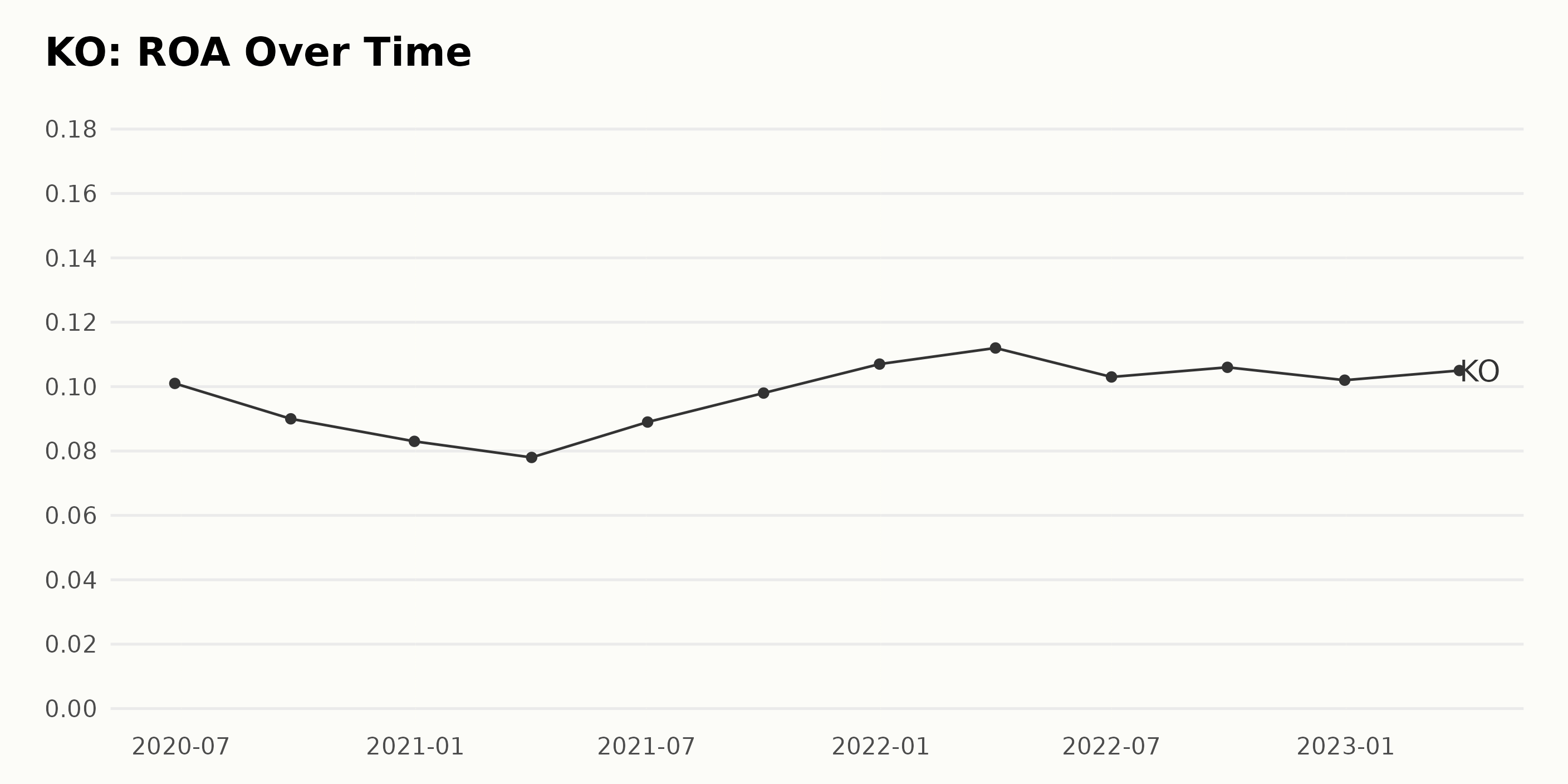

KO’s ROA has fluctuated over the last three years, increasing from 0.10 to 0.11 in April 2022 before declining to 0.10 by the end of December 2023. The most recent reported ROA is 0.11, a 6% increase from the first value in June 2020.

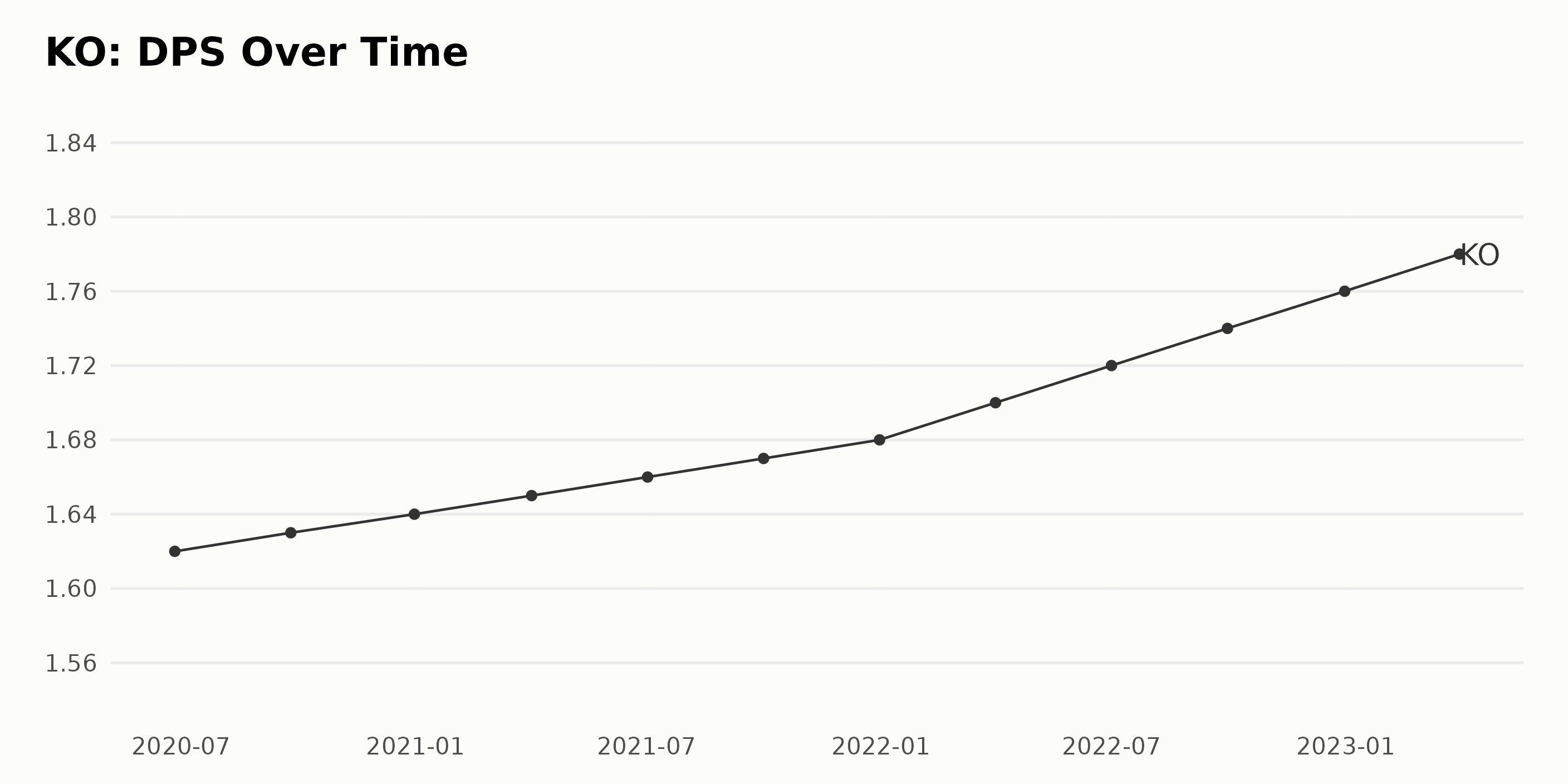

KO has had a steady upward trend in their dividend per share (DPS) from $1.62 on June 26, 2020, to $1.78 on March 31, 2023, with an overall 8.64% growth rate. The most notable fluctuation was from July 1, 2021, to October 1, 2022, when the DPS grew from $1.66 to $1.76, or a 6% growth rate.

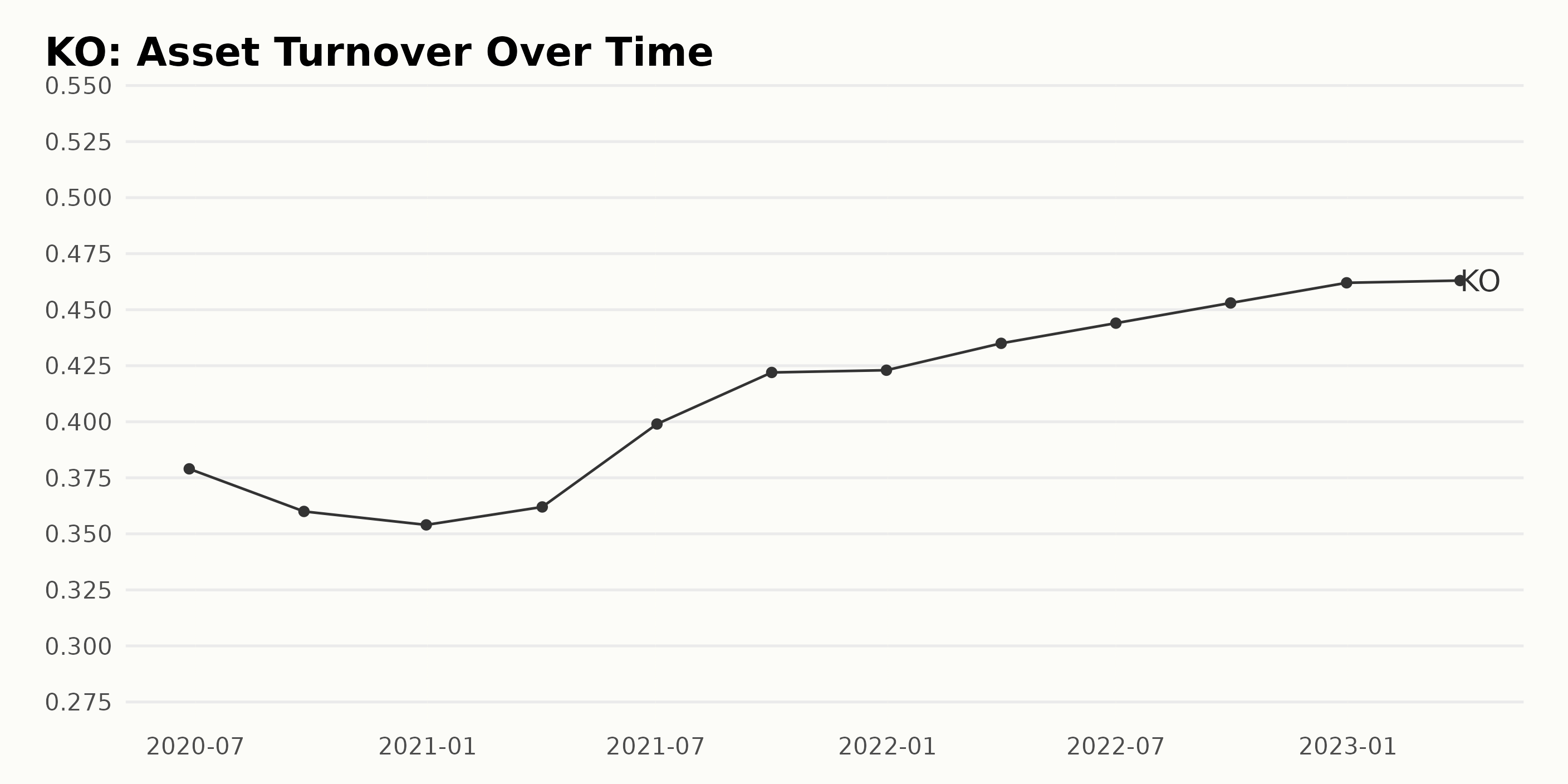

The asset turnover of KO has gradually increased from 0.379 in June 2020 to 0.463 in March 2023. The growth rate over this period is 21.3%. As of March 31, 2023, the most recent value was 0.463.

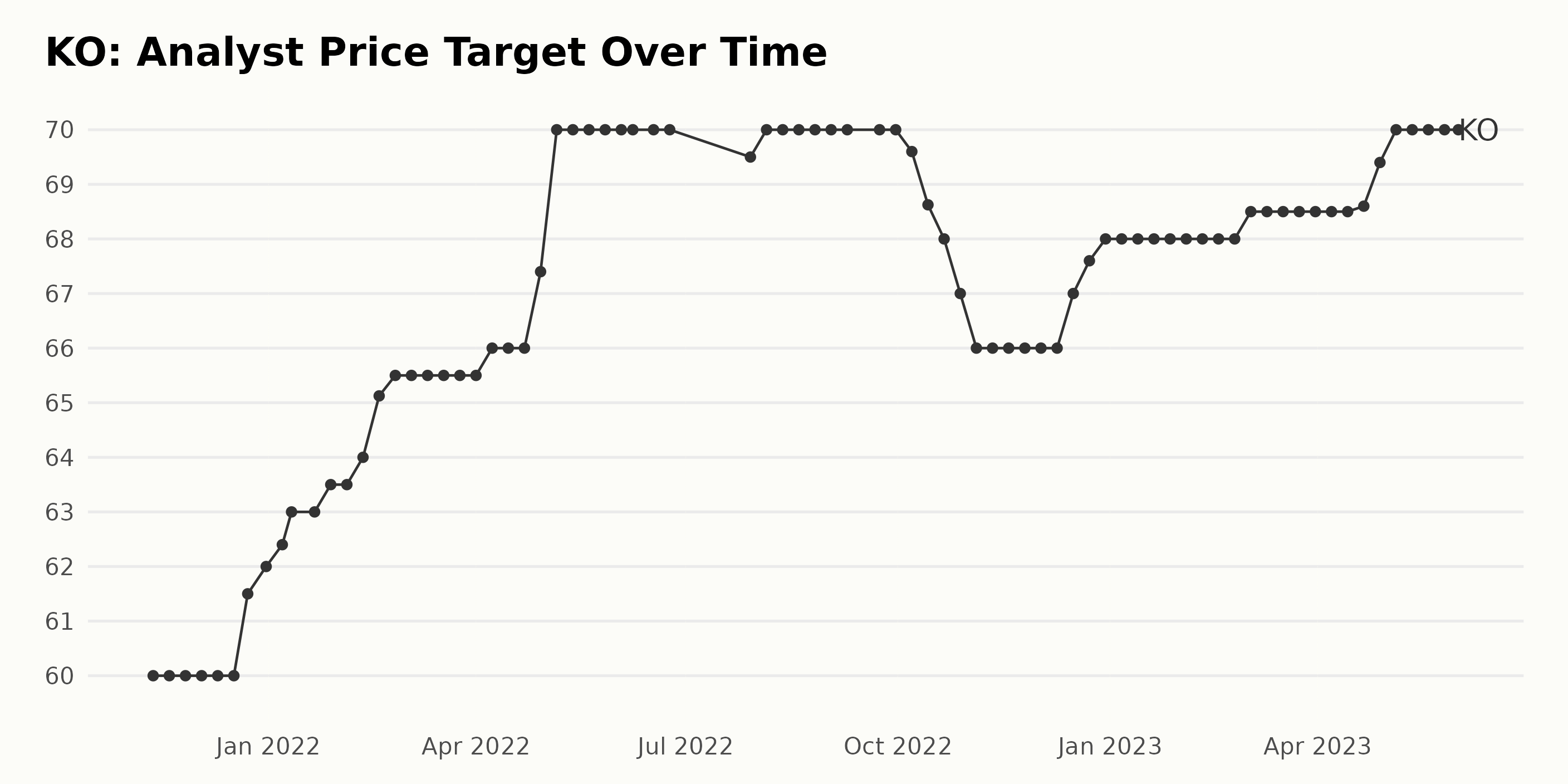

This series shows the analyst price target of KO. The price target has varied slightly throughout the series, ranging from a low of $60.00 in November 2021 to a high of $70.00 in May 2023. There has been a steady overall rise in the price target. The overall growth rate from the first observation to the last can be measured at 16.7%, with the price target increasing from $60.00 to $70.00.

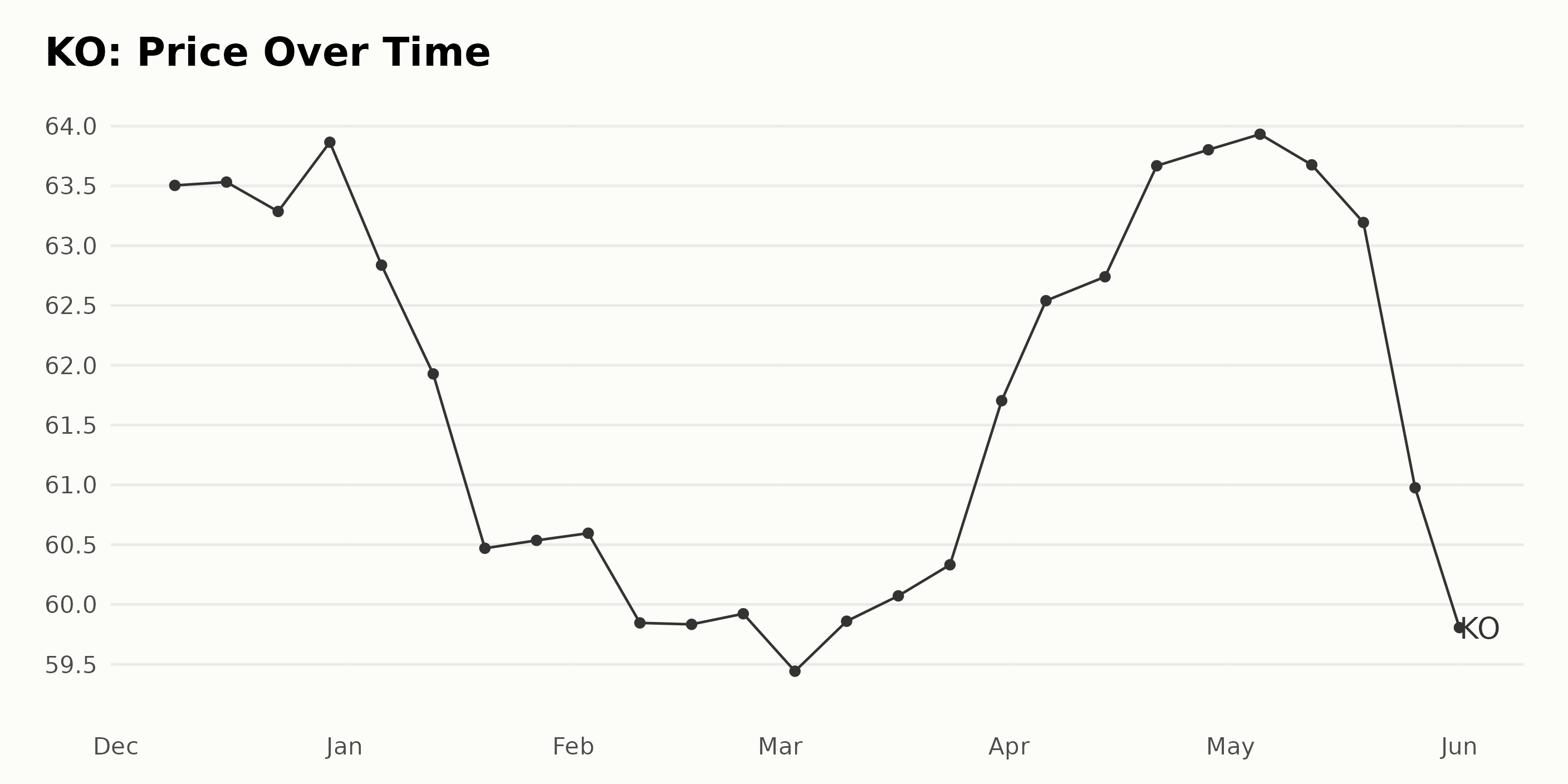

KO Share Price: 5.9% Decrease from December 2022 to June 2023

KO’s share price trend is generally downward from December 2022 to June 2023. Prices dropped from $63.50 to $59.81, a decrease of about 5.9%. However, the rate of decline accelerated from April to May 2023, with a more rapid decline from $63.68 to $60.97. Here is a chart of KO’s price over the past 180 days.

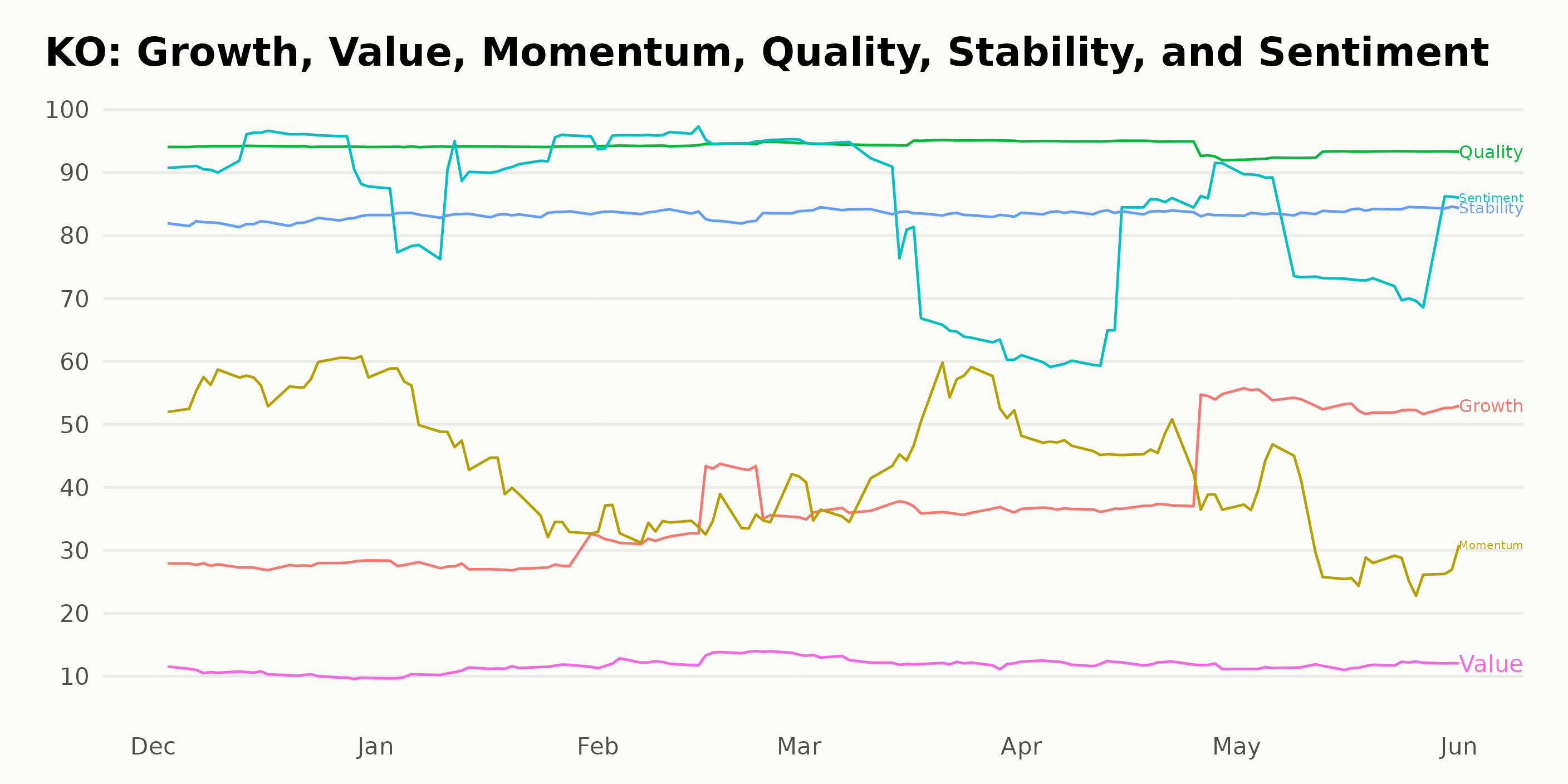

Coca-Cola Company: Quality, Sentiment, and Stability Ratings

The current POWR grade of KO is B. This grade has stayed consistent since December 2022 and has generally been around the middle of the ranking within the Beverages industry. The latest rank in the category for KO was 16 on June 1, 2023.

The three most noteworthy dimensions in the POWR Ratings for KO are Quality, Sentiment, and Stability. Quality has the highest rating of all dimensions, between 94 and 95. Sentiment scores increased from 89 in January to 95 in June, exhibiting a positive trend. Stability has consistently remained in the range of 82-84.

How Does Coca-Cola Company (KO) Stack Up Against Its Peers?

Other stocks in the Beverages sector that may be worth considering are Coca-Cola Consolidated, Inc. (COKE - Get Rating), Embotelladora Andina S.A. (AKO.B - Get Rating), and Coca-Cola Femsa S.A.B. de C.V. (KOF - Get Rating) — they have better POWR Ratings.

Discover 10 widely held stocks that our proprietary model shows have tremendous downside potential. Please make sure none of these “death trap” stocks are lurking in your portfolio:

Want More Great Investing Ideas?

KO shares were trading at $60.11 per share on Thursday afternoon, up $0.45 (+0.75%). Year-to-date, KO has declined -4.78%, versus a 10.97% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| KO | Get Rating | Get Rating | Get Rating |

| COKE | Get Rating | Get Rating | Get Rating |

| AKO.B | Get Rating | Get Rating | Get Rating |

| KOF | Get Rating | Get Rating | Get Rating |